Why Does So Little Of My Mortgage Payment Go To Principal

The smaller the mortgage principal, the less interest charged. This occurs because the homeowner has paid money towards the principal amountreducing itand the new interest payment is calculated on the lower principal amount. Towards the end of the mortgage, the payments will be primarily principal repayments.

Thereof, what percentage of mortgage payment goes to principal?

Traditional 30-Year LoansOver the life of a $200,000, 30-year mortgage at 5 percent, you’ll pay 360 monthly payments of $1,073.64 each, totaling $386,511.57. In other words, you’ll pay $186,511.57 in interest to borrow $200,000. The amount of your first payment that’ll go to principal is just $240.31.

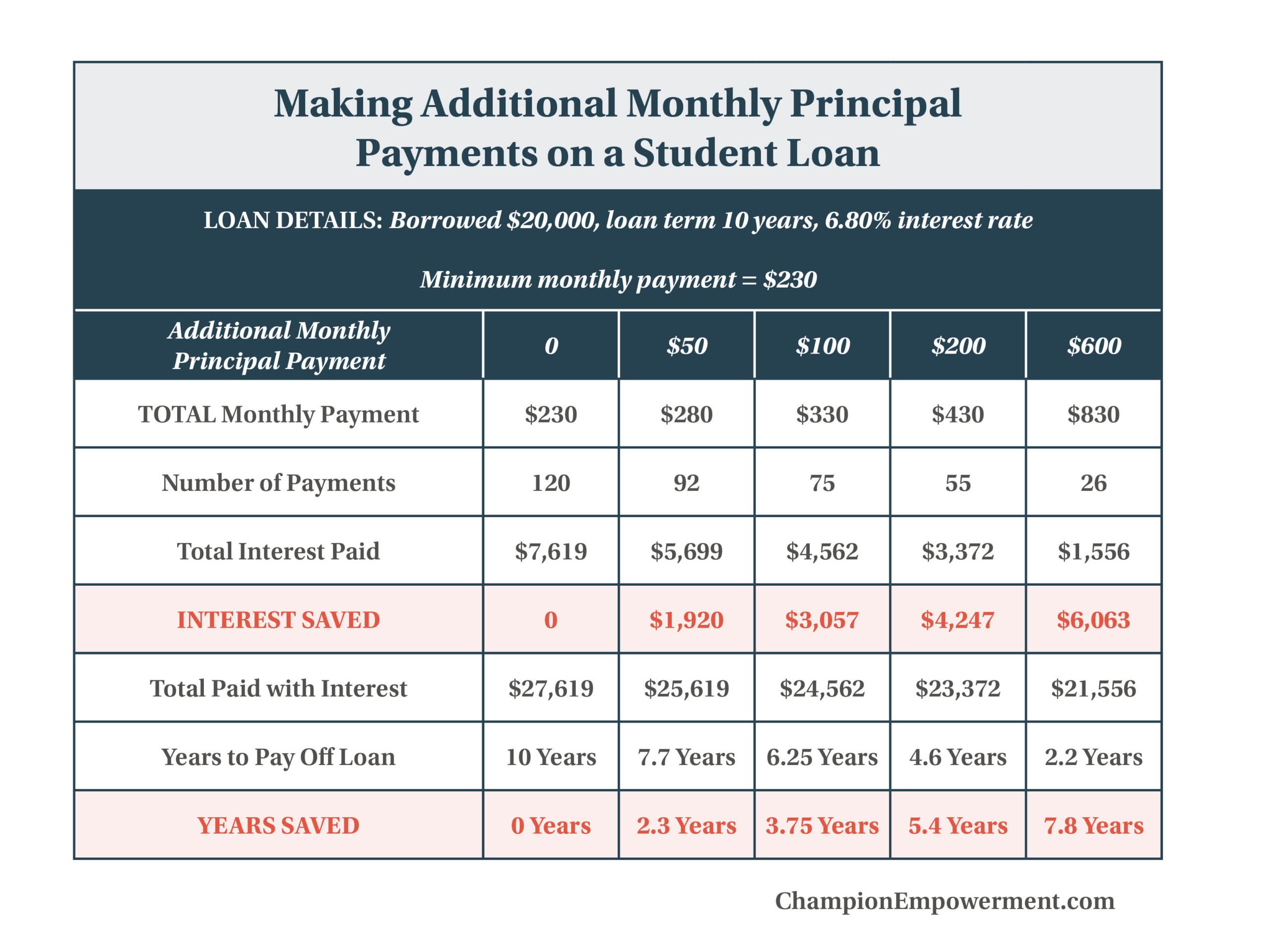

One may also ask, is it smart to pay extra principal on mortgage? Making additional principal payments will also shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you’ll have fewer total payments to make, in-turn leading to more savings.

Similarly, it is asked, why does so much of my mortgage payment Go to interest?

In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower.

Do large principal payments reduce monthly payments?

You May Like Also

Rising House Prices Encourage Speculation

Governments, banks and homeowners all benefit from rising house prices. Most localities depend upon real estate prices to raise property tax revenue. There is an in-built self-interest to see higher home appraisal. In the end, supply and demand will determine the price for a home.

As the American government helped strengthen the banking system, there was more access to capital. This fueled speculation by some who thought they could buy a house and “flip it” in five years to make a profit. This led to higher prices. In 2008, the sub-prime mortgage crisis destroyed this speculative bubble.

In the United States, any individual can look up any address on web sites, like “Zillow.com”. This freedom of information has created a very robust housing market.

Other countries do not permit housing prices to be freely advertized. In many African nations, it is difficult simply to get a map, let alone real estate valuations. This has created a more restricted housing market.

Round Up Your Mortgage Payments

Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term. So if you cant afford an extra mortgage payment, round up your scheduled payments to the nearest $100 amount instead. This small move pays off in a big way.

To illustrate, if you have a mortgage payment of $1,140 and make an extra principal payment of $60 each month . In this example, youll shorten your mortgage term by three years.

Read Also: What Does Conforming Mean In A Mortgage

Imagine Being Able To Pay Off A Loan Faster Than The Set Term It May Seem Like A Dream But It Can Be Possible If You Can Make And Your Lender Accepts Principal

Principal-only payments are a way to potentially shorten the length of a loan and save on interest. If your lender allows it, you can make additional payments directly toward the amount of money you borrowed the principal which can help you pay off your loan faster.

Lets take a closer look at how you can make principal-only payments, the benefits of doing so and things to consider before you send extra payments to your lender.

Are There Other Ways To Save On Interest

Yes! Consider applying any extra funds at the end of the month toward your loan balance. Even paying an extra $50 or $100 a month allows you to pay off your mortgage faster.

Another idea is to refinance to a 15-year mortgage. Though your payments will be a bit higher, your overall savings will be greater. The shorter loan term also means that youll pay off your home loan in a fraction of the time.

Recommended Reading: Is Biweekly Mortgage Payments A Good Idea

Choose Accelerated Weekly Or Accelerated Biweekly Payments

If you switch to an accelerated weekly payment schedule, you’ll increase your mortgage payments from 12 to 52 payments annually a payment every week instead of monthly, and one extra monthly payment every year.

If you switch to an accelerated biweekly payment schedule, youll increase your mortgage payments from 12 to 26 annually a payment every 2 weeks instead of monthly, and one extra monthly payment every year.

Loan Calculator Paying Extra On Principal

Making extra payments on your mortgage can drastically reduce the number of years on the loan . . . and can save you a tremendous amount of interest. How much interest can you save with an extra payment every month? Take a look . . .

| Initial Loan Amount | |||

|---|---|---|---|

| $100 | |||

| SAVINGS | Save $30,580 in interest. You will pay off your mortgage 8 years and 8 months early. | Save $37,069 in interest. You will pay off your mortgage 5 years and 2 months early. | Save $39,937 in interest. You will pay off your mortgage 3 years and 8 months early. |

If youre thinking about refinancing your mortgage to a lower interest rate or decreasing the length of the mortgage, you might be wondering if it would be better to make an extra payment instead of going through the refinance process. The extra payoff calculator will estimate the time you can payoff the mortgage starting with your present balance.

This calculator will not accept partial months. For example, 26 years and 1 month. Please use whole numbers.

|

|

Also Check: Is 5.375 A Good Mortgage Rate

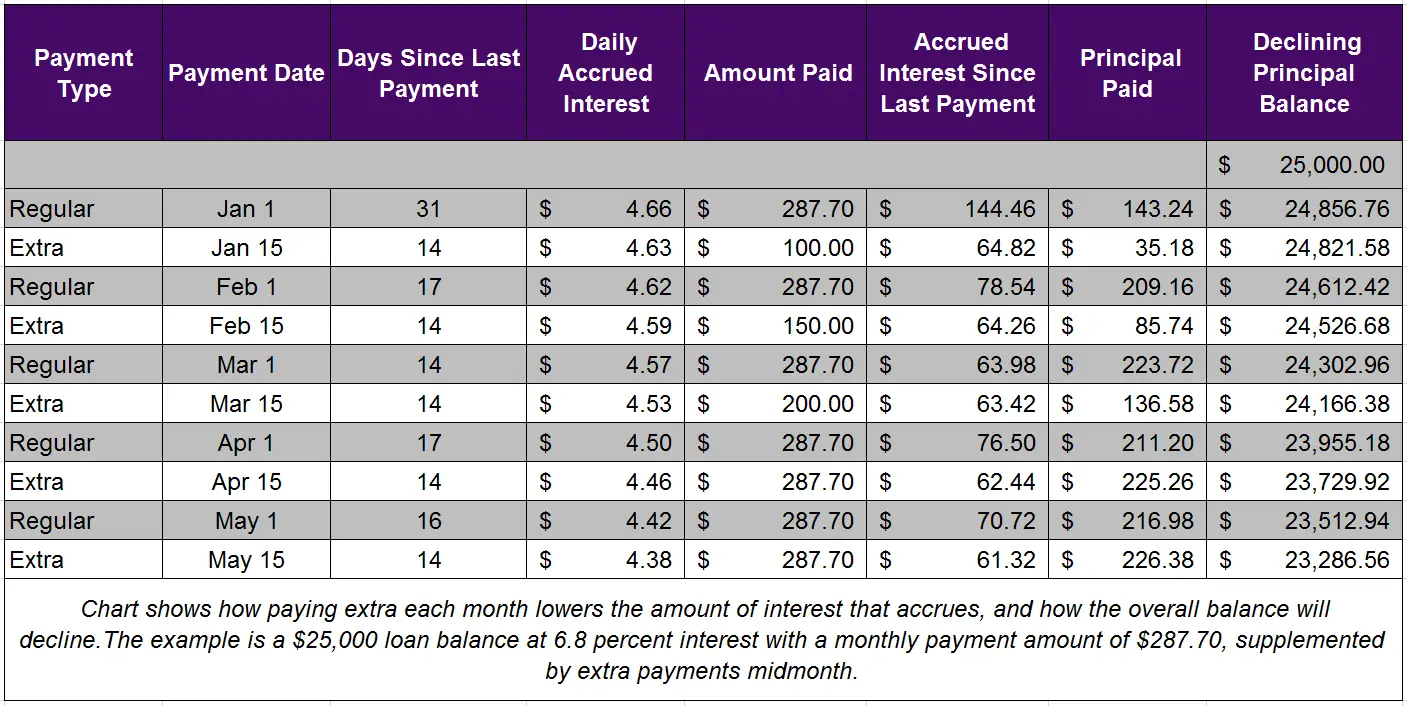

How To Avoid Risk When Making Extra Principal Payments On Your Mortgage

If you are making extra principal payments on your mortgage, heres a simple way to avoid the risk of your bank not applying your payments properly: check your remaining loan balance before you make an extra principal payment. If you dont know how to get this information, we have a short video on where to find it. Then, on your next statement, make sure that your remaining loan balance has decreased by the same amount as your extra payment plus the principal you paid in your monthly mortgage payment. For example, if your remaining loan balance is $100,000, and you pay $2,000 as an extra principal payment, make sure your loan balance decreases by $2,000 plus the principal you paid in your monthly mortgage payment. For example, if you current monthly mortgage payment is $2,400, and $1,800 of it is your interest payment and $600 is your principal payment, make sure that your remaining loan balance at your very next statement is $97,400.

Dont delay! Errors in the way that payments are applied are then amortized and can cost you even more money over time as you may end of paying interest on the amount that you intended to go to paying down your loan balance. Its essential that you pay attention to your remaining loan balance to avoid this risk.

How The Extra And Lump Sum Calculator Works

Your Mortgages Extra and Lump Sum Calculator will ask you to provide a few important pieces of information for it to perform its number-crunch.

This information will include the principal amount from the home loan, the annual interest rate, additional repayment amount each month when additional repayments will start, and any lump sum payment to be made throughout the life of the loan.

To help you understand how extra and lump sum payments can impact the total amount you will need to repay on your home loan, here is an example provided by the calculator.

Lets say you have an $800,000 home loan with a 4.5% interest rate p.a. over a 30-year loan term.

Additional repayments will be made on top of your standard monthly repayment of $100 each month. An extra $10,000 will be contributed in the sixth month of your loan term.

From this information, the calculator shows that your 30-year loan term will reduce by two years and two months, and youd save a total of $62.438 in interest – a huge amount considering the small outlay.

You May Like: How To Get A Cheap Mortgage Rate

Put Your Windfall On The Mortgage

If you receive a work bonus, an inheritance or other lump sum, you could consider putting some of this into your home loan. It might be tempting to book a holiday. But in the long run, reducing your loan period will probably be more relaxing.

As with any large sum, you may wish to consult your financial adviser or accountant before you decide where to put the money.

Mistake #: Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

You May Like: What Is A Future Advance Mortgage

Should I Refinance Or Just Pay Extra

With mortgage interest rates near record lows, refinancing your current mortgage might seem like a no-brainer. Millions of homeowners could lower their monthly payments and save on long-term interest.

But what if you already have an ultra-low rate? Or youre nearly done paying off your home loan?

In some cases, starting your mortgage over with a refinance wont make sense. Luckily, you can still save on interest and potentially pay off your home early by paying extra toward your mortgage.

Heres how to choose the right strategy.

Extra Mortgage Payments Vs Investing

Assume you have a 30-year mortgage of $150,000 with a fixed 4.5% interest rate. You’ll pay $123,609 in interest over the life of the loan, assuming you make only the minimum payment of $760 each month. Pay $948 a month$188 moreand youll pay off the mortgage in 20 years, and youd save $46,000 in interest.

Now, lets say you invested that extra $188 every month instead, and you averaged a 7% annual return. In 20 years, youd have earned $51,000$5,000 ahead of the sum you saved in intereston the funds you contributed. Keep on depositing that monthly $188, though, for 10 more years, and youd end up with $153,420 in earnings.

So while it may not make a huge difference over the short term, over the long term, youll likely come out far ahead by investing in your retirement account.

Don’t Miss: What Required To Refinance A Mortgage

Investing The Cash Instead

If you have excess cash burning a hole in your pocket, consider the opportunity cost of paying down your mortgage early instead of using the funds to invest elsewhere. While you will save on a portion of the interest expense, you may be better off investing the money instead, especially if your interest rate is low.

Consider your interest expense relative to your long-term return expectations. If a homebuyer can get a 30-year fixed mortgage for 2.85% and their long-term assumption for investment returns is 6%, theyre using leverage to achieve a better financial outcome. After all, you won’t enjoy the benefits of paying down your mortgage early until you’re living debt-free, but the average buyer only lives in the house for 10 years.

Mistake #: Not Putting Extra Payments Towards The Loan Principal

Throwing in an extra $500 or $1,000 every month wont necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money youre paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

If youre writing separate checks for extra principal payments, you can make a note of that on the memo line. If you pay your mortgage bill online, you might want to find out whether the lender will let you include a note specifying how additional payments should be used.

Don’t Miss: Can You Refinance Your Mortgage

Mistake #: Not Considering All Of Your Options

It can be very tempting if you come into some extra money to put that toward paying your mortgage off ahead of time. However, getting out of debt a little bit earlier may not be the most remunerative choice to make. To illustrate this, lets look at an example.

Lets say youre considering making a one-time payment of $20,000 toward your mortgage principal. Your original loan amount was $200,000, youre 20 years into a 30-year term, and your interest rate is 4%. Paying down $20,000 of the principal in one go could save you roughly $8,300 in interest and allow you to pay it off completely 2.5 years sooner.

That sounds great, but consider an alternative. If you invested that money in an index fund that represents the S& P 500, which averages a rate of return on 9.8%, you could earn $30,900 in interest over those same 10 years. Even a more conservative projection of your rate of return, say 4%, would net you $12,500 in interest.

Everyones financial situation is unique, and its very possible that the notion of being out of debt is so important to you that its worth a less than optimal use of your money. The important thing is to consider all of your options before concluding that paying off your mortgage earlier is the best path for you.

Should You Make Extra Mortgage Payments

This sounds like a great idea, right? For some people, it is. In many cases, however, while its a good option, it may not be the best. Thats because theres an opportunity cost involved: if you pay extra money toward your principal, you cant use that money for anything else.

To further illustrate the point, lets take a look at a few areas that, depending on your situation, may be better uses of your money than paying down mortgage principal early.

Your rainy-day fund. Emergencies can put an enormous strain on your budget if you dont have anything set aside to pay for them. Its ideal to have somewhere between three to six months worth of your household take-home pay set aside to help you deal with the unexpected. Build up your emergency fund in a savings or money market account before paying extra on your mortgage.

Your 401. If your employer offers any kind of match on your contributions to your 401, ensuring youre getting the full match amount is an absolute must. In most cases, youll earn much more from your 401 contributions in the long run than you would save by paying extra on your principal. Even if you dont have a 401 available to you, there are plenty of investment options out there that can provide a better rate of return than what you might save on your mortgage interest.

Under the right circumstances, paying extra principal can result in considerable savings, and can allow you to pay off your mortgage well ahead of schedule.

Read Also: How Much Is Mortgage On 1 Million

How Much Will You Save By Making Extra Payments

The amount you can save by making extra mortgage payments is one of the first things you need to figure out as that number will enable you to compare it to other options. Lets take a look at how much you could save on interest over the life of a 30-year, $200,000 loan with a 3.5% interest rate if you paid $50, $100 and $250 extra each month.

| Extra Monthly Payments | |

| $43,638 | 9 years, 7 months |

Just paying an extra $50 per month will shave 2 years and 7 months off the loan and will save you over $12,000 in the long run. If you can up your payments by $250, the savings increase to over $40,000 while the loan term gets cut down by almost a third.The savings can be substantial. Use a mortgage calculator to figure out your estimated savings. Then, compare that to the savings or returns you can get by investing the same money elsewhere.

Two Benefits Of Making Extra Mortgage Payments

As you may know, making extra payments on your mortgage does NOT lower your monthly payment. Additional payments to the principal just help to shorten the length of the loan . Of course, paying additional principal does, in fact, save money since youd effectively shorten the loan term and stop making payments sooner than if you were to make the minimum payment. However, that only happens after a certain period of time.

If you have an extra mortgage payment plan that will end your mortgage within a timeframe that lets you enjoy five years or longer of mortgage-free living, that makes more sense, says Sullivan.

So what is the effect of paying extra principal on a mortgage?

Recommended Reading: Who Should You Get A Mortgage From