Freddie Macs Weekly Mortgage Rate Survey

Below are Freddie Macs average mortgage rates, updated weekly every Thursday morning.

This should give you a decent idea of current mortgage rates, though as mentioned, theyre just averages and your rate may vary considerably depending on the many factors mentioned above.

The data is collected Monday through Wednesday, so they arent necessarily going to match up with todays mortgage rates if rates increased or fell from then until now. Consider this a starting point:

| Loan Program |

-Mortgage rates are currently trending UP–

* signifies a record low

Since 1971, Freddie Mac has conducted a weekly survey of consumer mortgage rates.

These are average home loan rates gathered from banks and lenders throughout the nation for conventional, conforming mortgages with an LTV ratio of 80 percent .

Note that these averages dont apply to government home loans like VA loans or an FHA mortgage.

The numbers are based on quotes offered to prime borrowers, those with high credit scores, meaning best-case pricing for the most part.

I believe the property type in the survey is for a one-unit primary residence as well, so expect a rate rise if its a vacation home or rental property, or multi-unit property.

Freddie uses HMDA data to establish regional weightings in five regions of the country, then aggregates that market data to compute a national average for their weekly rate update.

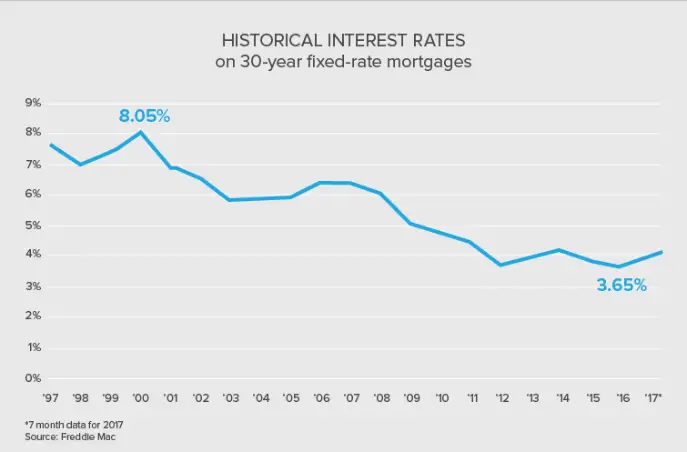

During the week ending January 7th, 2020, 30-year fixed mortgage rates hit new all-time lows.

Where Are Mortgage Rates Heading This Year

Mortgage rates sunk through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher.

In January 2021, rates briefly dropped to the lowest levels on record, but trended higher through the month and into February.

Looking ahead, experts believe interest rates will rise more in 2021, but modestly. Factors that could influence rates include how quickly the COVID-19 vaccines are distributed and when lawmakers can agree on another economic relief package. More vaccinations and stimulus from the government could lead to improved economic conditions, which would boost rates.

While mortgage rates are likely to rise this year, experts say the increase wonât happen overnight and it wonât be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance.

Factors that influence mortgage rates include:

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

Don’t Miss: Why Do You Need Mortgage Insurance

How And When Is My Price Determined

- Your price is determined by evaluating all the risk factors that are involved in your loan, and determining where you fit into our risk/price range.

- The Cooperative Bank of Cape Cod will give you an estimate of your risk-based pricing after we have done an initial evaluation of your credit history and a review of your proposed property.

- REMEMBER, however, that your risk-based pricing may change from this initial estimate if any of the risk factors discussed above change for example, if the appraised value of the property is determined to be different than the value used for your initial estimate or if your credit profile changes between the time of the initial estimate and closing.

- If you choose to lock a rate prior to the final risk assessment, you will be locked for the interest rate available at that time. Your actual price will be established based on where your final risk level fits into that particular interest rate range. Your final risk level is determined at time of closing, when there are no further changes to your credit profile or loan factors.

How Do Mortgage Points Work

Mortgage points, also known as discount points, are a form of prepaid interest. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to 1 percent of your total loan amount. For example, on a $100,000 loan, one point would be $1,000. Learn more about what mortgage points are and determine whether buying points is a good option for you.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

You May Like: How Much A Month Is A 500k Mortgage

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags that may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homeâs price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Donât settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youâve found the right rate, loan product and lender will help guarantee your mortgage rate wonât increase before you close on the loan.

Mortgage Rates: The Bottom Line

Mortgage rates are the number one issue when it comes to real estate financing. Sometimes that means processing fees are overlooked, fees that can substantially impact the real cost of mortgage loans. Why? Because different lenders make different deals.

To get the best deal, you have to understand the lenders rate sheet. Theres not just one rate. Every mortgage has combinations of points and rates. If you qualify for financing at 4.5 percent, you might also be able to get the same loan for 3.875 percent or 5.125 percent. In some cases, you might actually want the higher rate!

You May Like: How Much Mortgage Can I Get With 50k Salary

What Does This Mean To Mortgage Borrowers

While no one has a crystal ball, it is possible to theorize that if from where we are today, which is at 4.62% for a 30 year fixed rate loan, if there were four interest rate increases of approximately ¼% each over the next year, then we would end up with a 30 year fixed rate of 5.62%. Following is a chart illustrating the impact that would have on a persons monthly mortgage payment. Calculations are based on a loan amount of $238,700, which Experian reports as the average loan amount of a home loan in the United States based on the latest data available .

| Interest Rate |

| $1,374. 91 |

With a little bit of quick math you can see that a ¼% increase in interest rate on a $238,700 loan results in an increase of approximately $35 per month. If interest rates increase several times over a period of a year that can result in a persons monthly payment increasing by approximately $120.

How You And Your Property Affect Mortgage Rates

- That super low advertised mortgage rate sure looks good

- But be sure to check out the fine print

- You probably have to be an A+ borrower

- And you might need to pay discount points too

Also note that the par rate you see advertised on TV and the web often dont take into account any mortgage pricing adjustments or fees that could drive your actual interest up considerably.

Generally, a lender will showcase a mortgage rate that requires perfect credit, a 20% down payment, and is only available on an owner-occupied single-family home, as seen in my fictitious mortgage rate ad illustration above.

If your down payment or credit score isnt that high, or your home equity is low, your mortgage rate may creep higher as well.

Occupancy and property type will also drive rates higher, assuming its a second home, investment property, and/or a multi-unit property. So expect to pay more if thats the case.

If you do put less than 20% down, youll also have to factor in mortgage insurance, which if not explicitly charged, is usually built into the rate.

There are also loan amount restrictionspricing can change depending on if the home loan is conforming or jumbo. Typically, monthly payments are higher on the latter, all else being equal.

In other words, YOU and your property matter as well. A lot!

If youre a risky borrower, at least in the eyes of prospective mortgage lenders, your mortgage rate may not be as low as what you see advertised.

Read Also: What Is Loan Servicing In Mortgage

More On How To Maximize Total Wealth

The decision of whether to refinance your mortgage is multidimensional, especially if you account for maximizing total wealth. We believe it can be an oversimplification to focus on only one factor of savings . This approach doesnt take into account other variables in your financial picture that affect your total wealth over the course of the loan. Here are 6 other variables to account for when calculating total wealth:

1) Tax deduction of your closing costs and mortgage interestIn the tool, were assuming a current and future marginal tax rate of 28%. This is used to estimate the amount by which you can reduce your taxable income over the loan term.

2) Opportunity cost of investing your moneyIf you lower your monthly mortgage payment, you might choose to invest the difference in bonds or stocks. This can add up to a lot of money in the long run! We assume a post-tax investment yield of 3.5%. If you keep most of your savings in a bank account, decrease this to 0%. If you invest most of your savings in the stock market, increase it to 6%.

3) Cash flowIn the tool, we factor in one-time, out-of-pocket closing costs as well as the adjustment to your current monthly payment. Both of these affect your cash flow. If it will be difficult to absorb these adjustments, it may not make sense to refinance your mortgage even though it might save you money in the long run.

Real Estate Broker From Lake Oswego Or Summerlin Nv

Originally posted by :

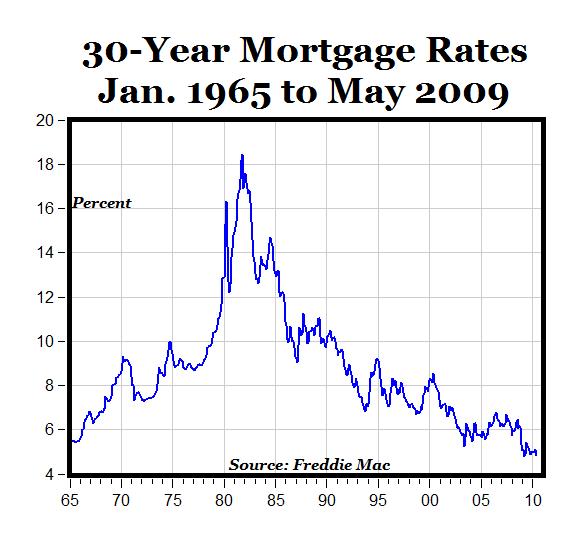

Well from a different perspective it is basically free money. Historically we are still well below average rates. My first mortgage was 12%.

One philosophy that applies here is the availability of money is more important than the cost of money.

what I find very unique right now Ned is the amount of HML or private money companies led by large hedgefunds investing in these HML companies have driven these private rates down to 10% apr or less.. so to only have about a 4% spread between bank money and HML is quite unique in my experience over the decades.. other than the high interest mid 80s anomaly.. the spread was usually 10% or so..

But for sure if a deal is stressed because 6% money only works and 7 or 8% money throws it out then those are some really tight spreads to be working with.. and one would not want to be signing up for 3 to 5 year call notes.

Don’t Miss: Can You Get A Conventional Mortgage On A Manufactured Home

Todays Mortgage Rates In The 5% To 5375% For Qualified Buyers

6 July 2009 ? Today the mortgage backed bonds opened up 6bps. Right now we are currently down 6bps. The Dow is down 67 however, and that is not really giving any steam to a rally for the bond market. The mortgage backed bonds are at a resistance level as we have seen the rates trend down the past week. Trading remains slow after the long holiday weekend. The Dow has been pressured lower over concerns for the overall global economy recovery. It took a long time for the economy to get to where we are currently at and it will be a slow long grind to recover as with any recession. Unemployment reached a 26 year high for the US, and in Europe they are not faring much better. I encourage all homeowner?s to review their mortgage rate to see if they can take advantage of the 30 year fixed mortgage rates. Again, with many variables in pricing a mortgage a consumer should be around the 5% to 5.375% range. Some of the issues that affect your mortgage rate are your loan to value of your home. Your credit score and the type of home . For first-time buyers the rates have been extremely stable and hopefully with the first-time buyer credit of $8,000 you can purchase an affordable home with almost the same payment as your rent!

Jumbo Fixed Rate Mortgage

| Term |

|---|

| 3.250% | $5,000 min |

1 This is a variable rate loan with thirty year term. Access to line of credit for first ten years followed by 20 year repayment period. The index is Prime Rate published on the last business day of the Wall Street Journal. Maximum loan amount cannot exceed 80% of the home’s current appraised value less any existing mortgage liens. $25.00 annual maintenance fee. Maximum Annual Percentage Rate is 18% and minimum rate will be equal to the initial rate on the loan. Other terms and conditions may apply. Rates subject to credit approval. Property insurance required. Offer subject to change without notice.

| Type |

|---|

*Rates are subject to approval

1 Annual Percentage Yield. 2,Annual Percentage Yield is available as of 03/24/20. Minimum deposit of $500 is required to open account. Penalties may be imposed for early withdrawal. Premium rates not eligible for this special. This is a limited time offer and may be withdrawn at any time. Rates subject to change at any time.

If you are 59 1/2 or older, you may change the term of your certificate once in a 12-month period . Fees could reduce earnings on account. There are no annual maintenance fees on IRA accounts. Share insurance is provided in excess of NCUA federal insurance by MSIC, a Massachusetts-chartered corporation not affiliated with the NCUA or the federal government.

Also Check: What Is Tip In Mortgage

How Will I Know If Mortgage Rates Are Going Up Or Down

- Heres a fairly simple way to guess the direction of mortgage rates

- Just look at the current yield on the 10-year Treasury and its recent trend

- If it goes up , expect mortgage rates to rise

- If it goes down , expect mortgage rates to drop

Typically, when bond rates go up, interest rates go up as well. And vice versa. Dont confuse this with bondprices, which have an inverse relationship with interest rates.

Investors turn to bonds as a safe investment when the economic outlook is poor. When purchases of bonds increase, the associated yield falls, and so do mortgage rates.

But when the economy is expected to do well, investors jump into stocks, forcing bond prices lower and pushing the yield higher.

Our Mortgage Rate Methodology

Moneyâs daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available for. Today, we are showing rates for Thursday, April 15. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

Don’t Miss: Can You Refinance Mortgage Without A Job