How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

How To Find Your Lowest Mortgage Rate

Mortgage rates are highly personal. Factors like your credit score and debt-to-income ratio will have a big impact on the rate you get.

That means the company with the lowest average rates wont always be the cheapest lender for everyone.

For example: Among the 40 mortgage lenders in our study, Freedom Mortgage had the lowest average mortgage rate in 2020, at just 2.92% for a 30-year loan.

But average rates tell only part of the story. Overall, Freedom Mortgage rates ranged from under 2% to over 6%. So some people got much lower rates than others.

To find your best deal, you have to request rate quotes from more than one company and compare offers.

Bank Of America Customer Service Reviews

Bank of America has an overall above-average reputation for customer service, according to J.D. Powers 2020 customer satisfaction survey.

Mortgage-related complaints at major lenders

Company |

| 860/1,000 |

Bank of America mortgage complaints

In 2019, Bank of America received 245 official complaints from mortgage customers. To put that in perspective, Bank of America underwrote a total of 466,552 mortgage loans in 2019. So it received approximately one complaint for every 2,000 mortgage customers.

Thats a higher number of complaints than many other big-name mortgage lenders, but still fairly low overall.

Also Check: Can I Get A Mortgage With A Fair Credit Score

What Could Be Improved

No USDA loan

Bank of America Mortgage doesn’t offer USDA loans. USDA loans are mortgages insured by the U.S. Department of Agriculture for low and moderate income borrowers, usually in rural areas. A key benefit is that there is no down payment requirement. If you want a zero-down mortgage from Bank of America, you’ll have to pursue down payment assistance and home buyer grants through other channels, which can be more work on your part.

Non-qualified mortgage loans

If you don’t qualify for a traditional mortgage, you might have a hard time finding a loan to suit your needs. Bank of America might not be able to help you, for instance, if you’re self-employed and need to qualify on bank statements or profit-and-loss statements. You also need to look elsewhere if you want to buy an investment property relying on the rental income you expect it to generate.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Recommended Reading: How Does A Reverse Mortgage Work When The Owner Dies

What Is A Discount Point

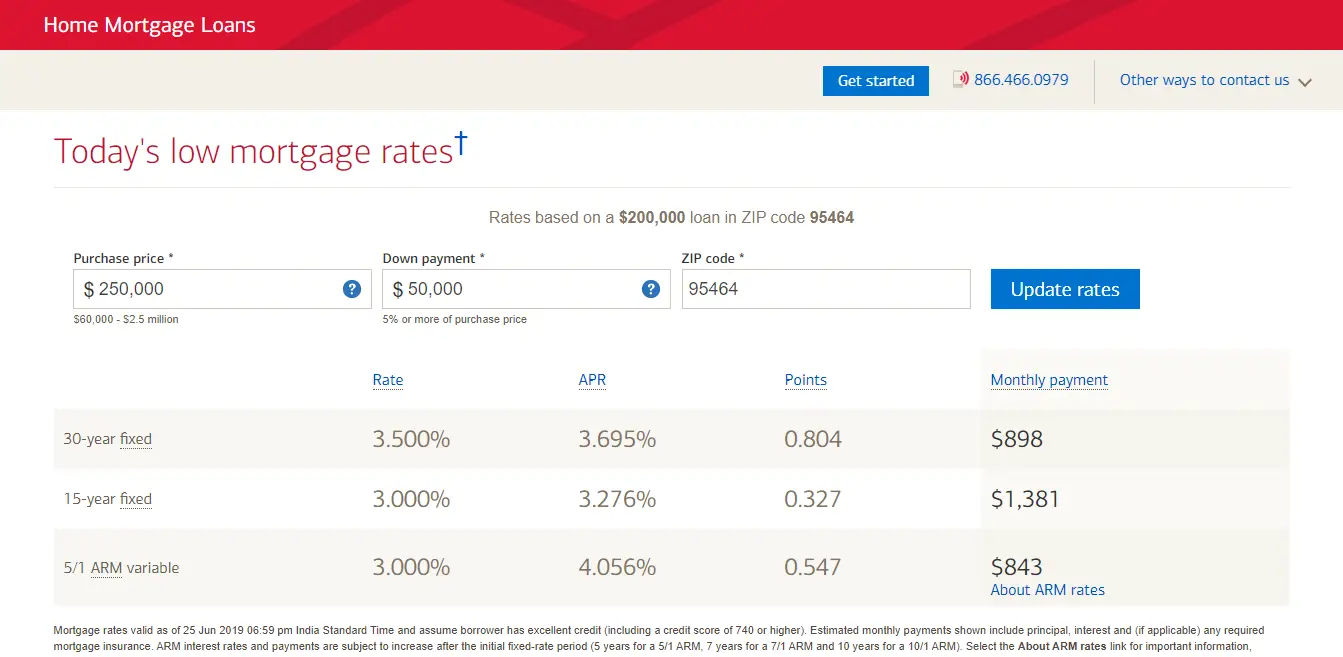

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Best Mortgage Rates Faq

What are todays mortgage rates?

Between 2019 and 2021, mortgage dropped from over 4 percent to below 2 percent. Currently, mortgage rates are hovering near 3 percent for the best borrowers. Thats incredibly low compared to the historical average of about 8 percent for a 30-year fixed-rate mortgage .

Whats a good mortgage rate?

Historically speaking, anything below 4 percent is a very good mortgage rate. In todays market, the best rates might be in the high 2 percent or low 3 percent range. Remember that the lowest mortgage rates go to borrowers with strong credit, few debts, and at least 20 percent down payment.

Who has the best mortgage rates?

In our analysis of 40 top lenders, the ones with the best mortgage rates on average were Freedom Mortgage, Better Mortgage, Citibank, Guild Mortgage Company, and American Financial Network. These rankings are based on 30-year mortgage rates from 2020 Your own best mortgage rate could easily come from a different lender, which is why its important to compare personalized offers before choosing a lender.

How do I compare current mortgage rates? What is the best mortgage loan type for me?How do I choose a mortgage lender?How is your mortgage interest rate determined?Does my down payment affect my rate?Are jumbo mortgage rates higher?Whats better, a fixed-rate mortgage or adjustable-rate mortgage?Whats better, a 30-year mortgage or a 15-year mortgage?

Recommended Reading: How To Get The Best Interest Rate On A Mortgage

Which Mortgage Lender Has The Lowest Closing Costs

Closing costs are around 2-5% of the loan amount on average. Thats over $4,000 on a $200,000 loan a considerable amount of cash.

Just like mortgage rates, you can shop around for the lowest closing costs to minimize your out-of-pocket fees.

Heres how the top mortgage lenders compare for total loan costs, according to 2020 data from HMDA.

| Mortgage Lender | |

| 1.79% | $4,481 |

When youre shopping around, note that some closing costs cannot be negotiated because theyre set by third parties .

But lenders do have wiggle room when it comes to setting their own fees. So if you get multiple offers, you might have some leverage to negotiate your costs down.

Some homebuyers even get the seller to cover some or all of their closing costs. But thats not a guarantee, so you should still plan ahead for these expenses.

Equation For Mortgage Payments

M = P

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

This formula can help you crunch the numbers to see how much house you can afford. Using our mortgage calculator can take the work out of it for you and help you decide whether youre putting enough money down or if you can or should adjust your loan term. Its always a good idea to rate-shop with several lenders to ensure youre getting the best deal available.

Recommended Reading: Is Total Mortgage A Good Company

Understand Your Mortgage Options

You may be able to get a lower interest rate on your loan if you make a large down payment, since you borrow a smaller percentage of the propertys value. Loans available for vacation homes tend to be more conservative than those for primary residences, and you may need a down payment of 20 percent or more, especially if you need a jumbo loan.

Generally, lenders also want your debt to represent no more than 36 percent of your monthly pre-tax income. This percentage is your debt-to-income ratio.

A professional loan officer can help you better understand the costs of purchasing a second home and the available loan options. You can also be prequalified or preapproved for a loan before you start looking at properties.

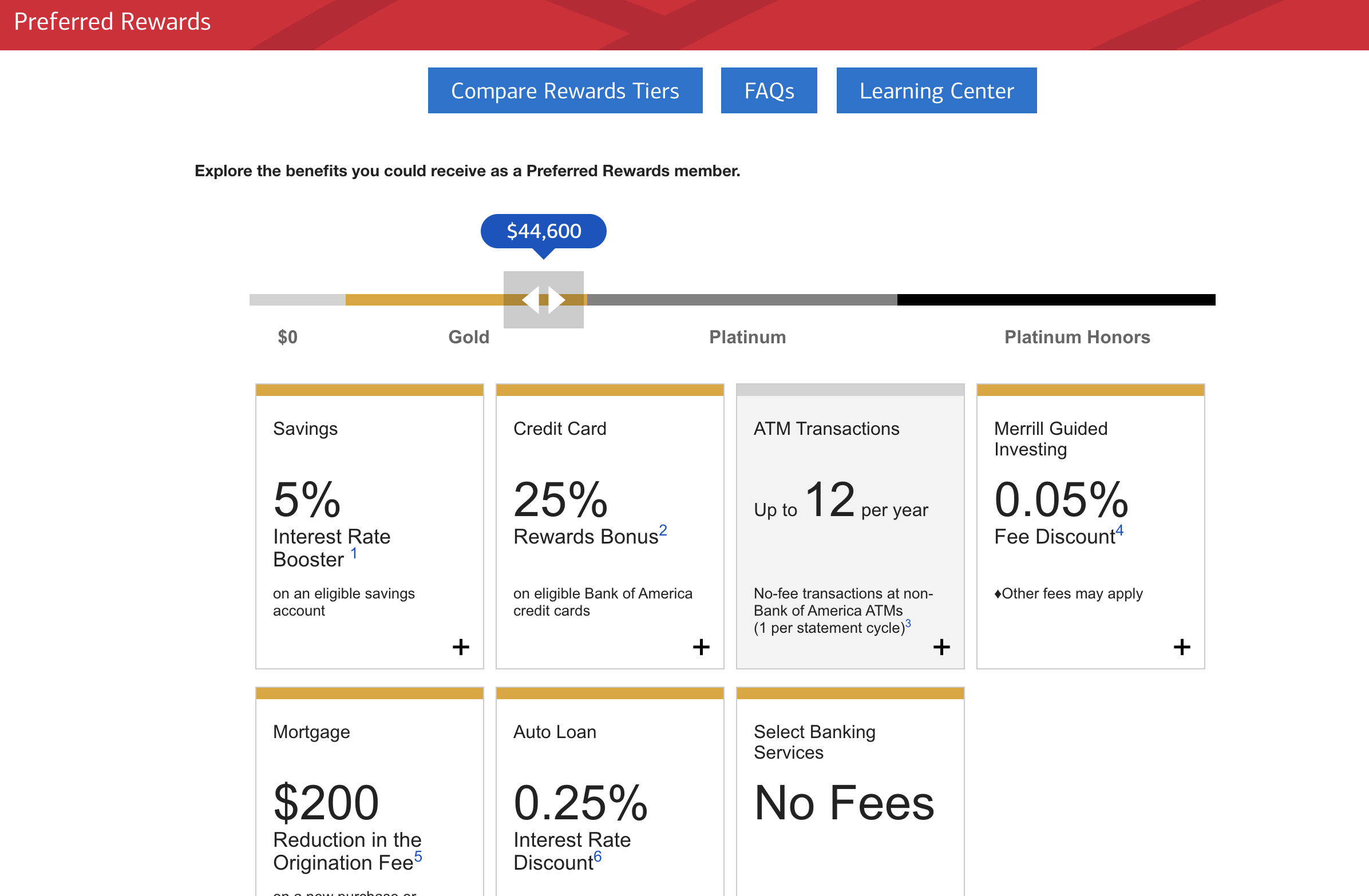

Your lender looks at your current financial situation and the property you want to purchase and advises you on your eligibility for different types of loans. If you are a Bank of America client, you may be eligible for a reduction in your mortgage origination fee through the Preferred Rewards program.

Buying a second home can be complicated and may take some time, but with forethought, preparation and some help from experts, you can make an informed decision that’s appropriate for your situation.

How To Qualify For A Bank Of America Mortgage

Like most lenders, Bank of America offers a wide selection of loans, each of which has different qualifying requirements. In general, aim for a credit score of at least 600 and a debt-to-income ratio no higher than 43%.

Bank of America does have programs with more flexible guidelines if you have a higher DTI or a low credit score, but youll get the best rates and terms when you prove you can comfortably afford the loan and have a solid payment history on your other debts.

In addition to managing your credit score and debt-to-income ratio, you should try to have the following:

- Stable income and employment for the last 2 years

- Proof of assets for your down payment and closing costs

- Proof of reserves

- No recent delinquencies or public records

Recommended Reading: Are All Mortgage Rates The Same

Bank Of America Mortgage Rates And Fees

If youre already a Bank of America customer, you may qualify for a reduction of up to $600 in the mortgage lender origination fee.

One of the most important considerations when choosing a mortgage lender is understanding what the loan will cost. In order to provide consumers with a general sense of what a lender might charge, NerdWallet scores lenders on two factors regarding fees and mortgage rates:

-

A lender’s average origination fee compared with the median of all lenders reporting under the Home Mortgage Disclosure Act. Bank of America earns 4 out of 5 stars on this factor.

-

A lender’s offered mortgage rates compared with the best available on comparable loans. Bank of America earns 5 out of 5 stars on this factor.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

You can decide to buy discount points a fee paid with your closing costs to reduce your mortgage rate.

Deciding whether to pay higher upfront fees is a matter of considering how long you plan to live in your home and how much cash you have to apply toward closing costs when you sign the loan paperwork.

How Bank Of America Shines

If youre thinking about buying or refinancing a home, Bank of America could be a good choice if:

- Youre more comfortable doing business with an established, major bank

- Youd like the flexibility of applying online or working with a loan officer in person, over the phone, or by video conference

- Youre an existing B of A customer who would benefit from having much of your application pre-filled and potentially qualify for a discount on origination fees

Also Check: How Much Mortgage Can I Afford On 200k Salary

Loandepot Vs Bank Of America Mortgage

LoanDepot is a cross between an online lender and an in-person lender. Most of the lending process is completed online, but you can visit one of their 200 branches throughout the country if you want in-person support.

LoanDepot offers a package deal to save you money. If you use a real estate agent, they matched you with and use all LoanDepot services, including homeowners insurance and title services, youll save up to $6,000 on your loan.

> > More: LoanDepot Mortgage Review

Do You Already Own A Home And Want To Refinance

Refinancing your mortgage can be a good financial move if you lock in a lower rate. However, there are upfront costs associated with refinancing, such as appraisals, underwriting fees and taxes, so youll want to be sure the savings outpace the refinance price tag in a reasonable amount of time, say 18 to 24 months.

While mortgage rates have risen from the record lows of late 2020 and early 2021, they remain at historically low levels. That means millions of homeowners still could save by refinancing. Reducing your rate isnt the only reason to refinance. Its also possible to tap into your home equity to pay for home renovations. Or, if you want to pay down your mortgage more quickly, you can shorten your term to 20, 15 or even 10 years. And because home values have risen sharply, its possible that a refinance could free you from paying for private mortgage insurance.

For more information, visit Bankrates mortgage refinancing hub. Learn more about refinance rates.

Check out Bankrates guide to paying for repairs and 203 mortgages for more information.

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

Don’t Miss: What Is Rocket Mortgage Interest Rate

Bank Of America Mortgage Online Convenience

Bank of Americas digital mortgage experience allows many borrowers to apply, get pre-qualified or preapproved and lock their interest rate online through its website or mobile app. If youre already a banking customer, the digital application will auto-populate with your contact information and financial data, reducing the time it takes to apply. If you prefer to apply over the phone or in person at a Bank of America branch, those options exist as well.

Bank of Americas Home Loan Navigator portal helps borrowers stay plugged in throughout the lending process. You can upload documents, download loan disclosures, track the progress of your loan and e-sign required paperwork.

Current Mortgage Rates: Today’s Interest Rates

Rate, points and APR may be adjusted based on several factors including, but not limited to, state of property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value and your credit score. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Don’t Miss: What Is Tip In Mortgage

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Read Also: How To Lower My Mortgage