Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car-and have a little fun now and then. You also need to be prepared for emergencies as well.

Your mortgage specialist will help you make sure you have money left over to pay for the necessities of life, as well as some of your lifestyle choices. The following calculations are used by most lenders as a guide to help determine the maximum you should spend on housing costs and overall debt levels:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, then you have a few options.

You and your mortgage specialist may also need to factor in expenses or changes that you know are on the horizon. Maybe you’ll need to replace your car within the next year. Or if you’re expecting your first baby you may need to consider the impact of a maternity or paternity leave on your budget in addition to expenses related to having a baby.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Documentation Required To Get Pre

To get a full pre-approval, youll need to be prepared to provide the following documentation:

- Pay stubs Youll need to provide your most recent pay stub, which must show your year-to-date earnings. Youll need a pay stub for each job you have, and for each person applying for the pre-approval.

- W2s Many mortgage lenders will require your W-2 for at least the most recent calendar year. However, some lenders may require them for the past two years.

- Completed, signed income tax returns Youll need to provide these if youre self-employed, or have substantial real estate, investment, or partnership income. They should include all pages of IRS Form 1040, including schedules.

- Asset statements For bank accounts or taxable investment accounts, youll need to provide statements covering the most recent two months, or the most recent quarter. For retirement accounts, youll need to provide something similar.

- Gift information If some or all your down payment will come from a gift, youll need to provide the amount of the gift, when it will be available, who the donor will be, and what their source of funds for the gift will be. The lender will likely request that the donor complete a formal mortgage gift letter, that will request specific details.

- This can usually be satisfied by providing your drivers license. In some cases, the lender may request a copy of your Social Security card. These documents will be requested to verify your identity for federal compliance purposes.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

How Secure Is Your Income

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

How Debttoincome Ratio Affects Your Mortgage

Why is DTI key to your mortgage loan amount? Because the more you spend on debt obligations, the less money you have leftover for your monthly mortgage payment.

Some types of loans allow higher DTIs than others. But, with most mortgages, lenders will want you to have a DTI of 43% or less.

For example, say you have a monthly gross income of $5,000. You already pay $1,000 per month on existing debts. How much mortgage can you afford?

- Max DTI: 43%

- Existing debts: $1,000

- Max home expenses: $1,150

Now you know you can only afford a new home if the total monthly payment comes out to $1,150 or less.

Remember to include property taxes, homeowners insurance, and private mortgage insurance when estimating your monthly mortgage payment.

Depending on your lender, a DTI above 43% may be allowed.

On some conforming conventional loans, Fannie Mae and Freddie Mac set their maximum DTIs at 45% to 50%. And its possible to get an FHA loan or VA loan with up to a 50% DTI.

However, youll likely need compensating factors to make up for the high DTI like a big down payment or a great credit score.

Also Check: How Much Is Mortgage On 1 Million

Our Take: Somewhere In Between

Not everybody is as debt-averse as Ramseyand following his one-size-fits-all advice has risks. You just have to remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

Another reader put it this way:

- Your mortgage payment should be equal to one weeks paycheck.

- Your mortgage payment plus all other debt should be no greater than two weeks paycheck.

Thats on the conservative side, too. One weeks paycheck is about 23% of your monthly income.

If I had to set a rule, it would be this:

- Aim to keep your mortgage payment at or below 28% of your pretax monthly income.

- Aim to keep your total debt payments at or below 40% of your pretax monthly income. Note that 40% should be a maximum. We recommend an even better goal is to keep total debt to a third, or 33%.

As some commenters have pointed out, while it may be possible to buy a decent home in a small midwestern town for $100,000 , workers in New York or San Francisco will need to spend five times that amount just to get a hole in the wall. Yes, people tend to earn more in these high-cost-of-living areas, but not that much more. Does it mean they shouldnt buy a home? Not necessarily. Theyll simply have to make trade-offs to buy in those areas.

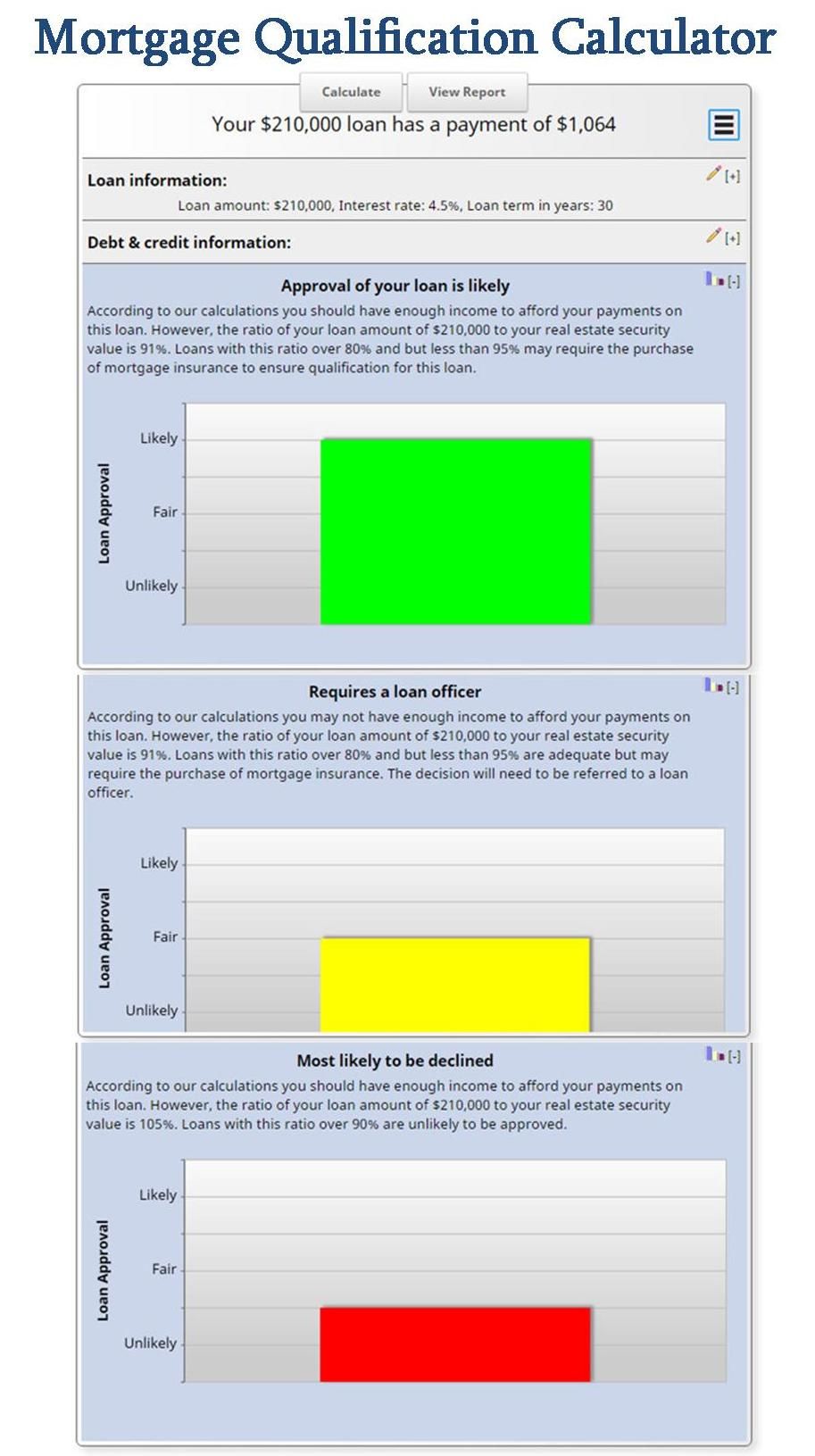

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Don’t Miss: Does Getting Pre Approved Hurt Your Credit

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

You May Like: Can You Refinance A Mortgage Without A Job

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

Notes On Using The Mortgage Income Calculator

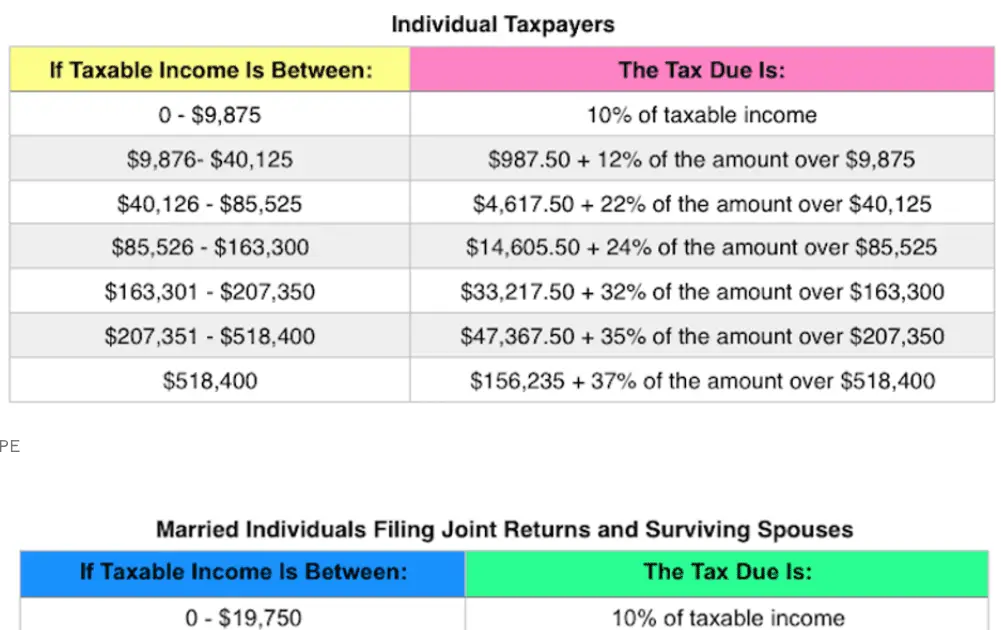

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Also Check: Rocket Mortgage Launchpad

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

How Your Income And Debt Affect Your Mortgage

Mortgage lenders dont just want to know your salary. They want to know how much discretionary income you have the amount left over after your fixed expenses are taken care of.

Thats why income for mortgage qualifying is always viewed in the context of your debt to income ratio or DTI.

If you have any existing debt like a car payment, student loans, or a credit card payment lenders will subtract those costs from your monthy income before calculating how large a mortgage payment you qualify for.

The more debt you have, the less youll be approved to borrow for a mortgage.

Conversely, if you keep your debt low, you might be able to borrow as much as 6 times your salary for a mortgage. Heres how.

Also Check: Rocket Mortgage Vs Bank

Guidelines For An Affordable Mortgage

Everybody wants an affordable mortgage that leaves them enough money each month to enjoy life to the fullest while paying off their home.

The following tips will help you acquire an affordable mortgage:

1. Keep Monthly Costs Below 42% of Your Income: Keep all credit cards, loans, home insurance costs, bank obligations, mortgage principal, and interest lower than 42% of your gross income.

2. Understand the Benefits of 5% Down Payments: If you have 5% to put down on a property, some lenders will give you mortgages with no closing costs. However, you must make sure you can truly afford this deposit. First-time homebuyers who cant afford a large down payment but would otherwise qualify for a home loan may be eligible for a 3% down payment mortgage.

3. Plan Ahead for Future Maintenance: Consider monthly maintenance costs and factor these into your budget.

4. Dont Be Greedy: Loan approvals arent always perfect for your circumstances. Weigh your financial situation before agreeing to something that you cant afford.

5. Factor in all Expenses: Remember to work out moving expenses, home inspections, appraisal fees, utilities, furniture, and temporary storage.

Buying a new home is an exciting process. However, you must do the math and figure out what percentage of income will be saved for your mortgage while still living comfortably. Luckily, we can help. If youre buying a new home, we can help get you pre-approved and funded for a super-fast loan.

How Lenders Assess What You Can Afford

Mortgage lenders base their decisions on whats known as the loan-to-income ratio the amount you want to borrow divided by how much you earn.

The most you can borrow is usually capped at four-and-a-half times your annual income

Have you had mortgage advice?

You can get advice directly from a lender who will discuss their own products, or from a broker wholl be able to look at mortgages from a range of providers.

Read Mortgage advice: should you use a mortgage adviser? for details of where to get advice.

Also Check: What Does Rocket Mortgage Do

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.