Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

How Do You Calculate Mortgage Factor

CalculatingMortgagemortgagemortgagecalculate

. Similarly, you may ask, how do you calculate loan factor?

Multiply the amount you need to borrow by thefactor rate. If you’re borrowing $100,000 and thefactor rate is 1.18 for a term of 12 months, you’ll need torepay a total of $118,000. The factor rate iscalculated by dividing the financing cost by the loanamount.

Also Know, how do you calculate amortization factor? To calculate amortization, start by dividing theloan’s interest rate by 12 to find the monthly interest rate. Then,multiply the monthly interest rate by the principal amount to findthe first month’s interest. Next, subtract the first month’sinterest from the monthly payment to find the principal paymentamount.

Similarly, you may ask, how do you calculate a mortgage payment formula?

Equation for mortgage payments

What is the loan factor?

Definition of Loan Factor. Loan Factormeans, with respect to each Loan, the amount set forth as apercentage in the Loan Terms Schedule with respect to suchLoan, which fully amortizes the Loan over theRepayment Period applicable to such Loan in equal periodicinstallments at the Basic Rate.

Money Factormoney factorMoney factor

Astika De Goñi

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

If You Should Rent Vs Own A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment, as opposed to giving your money to a landlord. As an owner, you also gain the ability to paint your living room any color your desire.

However, theres a mathematical piece to this as well. You have to know how much you need for a down payment, and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage, because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. However, not every situation is the same.

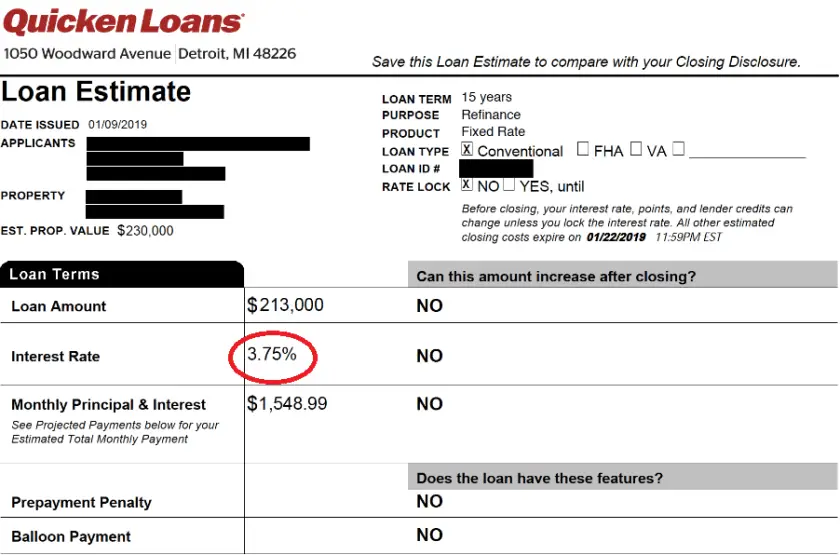

Like this estimate?

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Read Also: Rocket Mortgage Loan Types

Why Mortgage Lenders Require A Down Payment

Very few mortgage programs allow 100-percent, or zero-down, financing . Thats because a down payment on a home reduces the risk to the lender in several ways:

- Homeowners with their own money invested are less likely to default on their mortgages.

- If the lender has to foreclose and sell the property, its not on the hook for the entire purchase price, which can limit its potential losses if the home is sold for less than the remaining mortgage balance.

- Saving a down payment requires discipline and budgeting. This can help set up borrowers to be successful homeowners.

There are two government-backed loans that require no down payment: VA loans for service members and veterans and USDA loans for eligible buyers in rural areas.

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

Read Also: 10 Year Treasury Vs Mortgage Rates

Conventional Down Payment Requirements

Most conventional loans allow for a smaller down payment thanks to the backing of Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy loans from mortgage lenders.

To compensate for the risk of this low down payment, however, the borrower is required to pay for private mortgage insurance, or PMI, when they put less than 20 percent down.

With PMI, you can borrow up to 97 percent of the homes purchase price in other words, put just 3 percent down. Some property types, like duplexes, condominiums or manufactured houses, require at least 5 percent down.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Don’t Miss: Rocket Mortgage Loan Requirements

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?

What It Means For Consumers

Calculating your monthly payments can help you figure out whether you can afford to use a loan or credit card to finance a purchase. It helps to take the time to consider how the loan payments and interest add to your monthly bills. Once you calculate your payments, add them to your monthly expenses and see whether it reduces your ability to pay necessary and living expenses.

If you need the loan to finance a necessary item, prioritize your debts to try and pay the ones that cost you the most as early as possible. As long as there’s no prepayment penalty, you can save money by paying extra each month or making large lump-sum payments.

It helps to talk to your lender before you begin making extra or lump-sum payments. Different lenders might increase or decrease your monthly payments if you change your payment amount. Knowing in advance can save you some headaches down the road.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

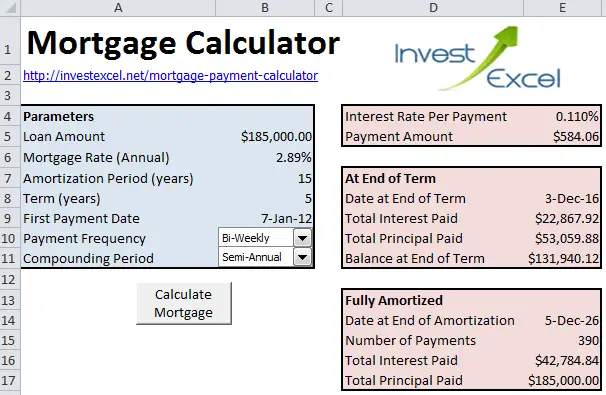

How Do I Use Excel To Calculate Mortgage Payments

CalculatepaymentfigurepaymortgageformulaPMTformulaPMT

Virna Lambea

Derivation of Mortgage Loan Payment Formula

Domingas Rebelo

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Recommended Reading: Recasting Mortgage Chase

What Is A Mortgage Balance

A mortgage balance is the amount owed at a particular moment in time during the mortgage loan term.

Here’s an example:

Mrs. Davis finances a home by taking out a fixed-rate $150,000.00 mortgage at 4% interest with a 30-year term. She has agreed to make payments of $900 per month. At this point in time, the mortgage balance is $150,000.00.

Mrs. Davis pays her mortgage for 10 years, and checks her mortgage balance using the Mortgage Balance Calculator. She knows that she has been paying every month for 10 years, so she enters 120 as the number of payments into the calculator, along with the rest of the required variables. She finds her mortgage balance at this point in time to be $91,100.05.

While Mrs. Davis was able to use the Mortgage Balance Calculator in our example, there are some things to keep in mind . . .

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

You May Like: Mortgage Recast Calculator Chase

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Recommended Reading: Reverse Mortgage Manufactured Home

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.