Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Which Is Right For You

It might be appealing to stretch your payments out over 30 years if you’re concerned about your monthly cash flow, and you might not be approved for a 15-year mortgage in any event. Lenders approve your loan application based in part on your ability to repay it. They compare your monthly income to your monthly debt payments. This is your debt-to-income ratio, and it might disqualify you for a 15-year loan.

-

You’ll get a lower interest rate and pay less interest overall over the life of the loan.

-

You’ll build equity in your property more quickly.

-

Your mortgage is less likely to be underwater if you’re forced to sell.

-

Your monthly payments will be higher because you’re squeezing all that principal into a shorter term.

-

Making higher mortgage payments might prevent you from saving for things like retirement or emergencies.

-

You’ll be at risk of default and foreclosure if life throws you a curveball that prevents you from meeting your higher monthly payments, such as a job loss or illness.

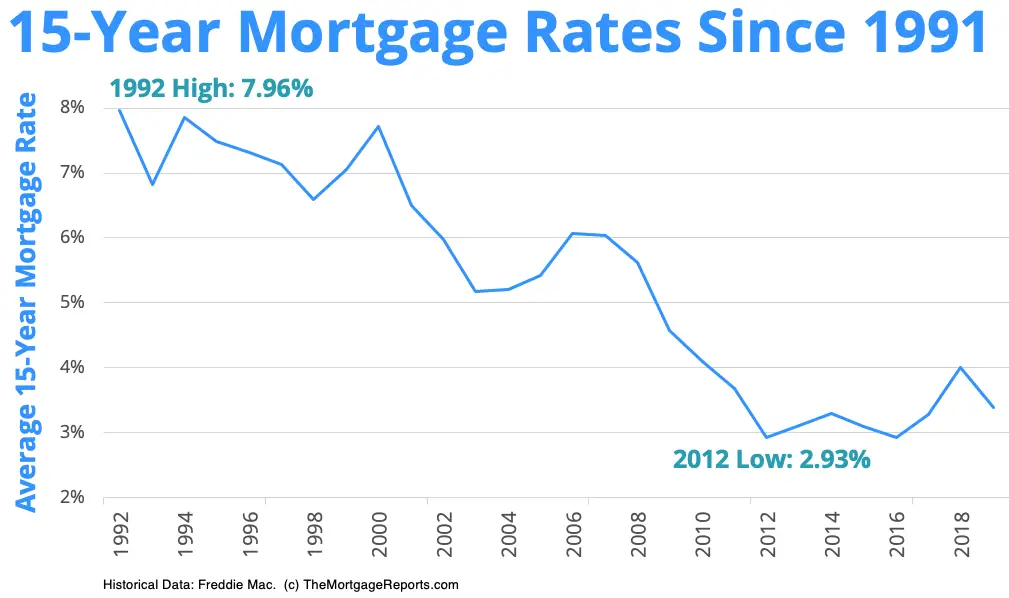

The graph below illustrates the difference in principal and interest rates in 15-year and 30-year mortgages.

Other, less-noticeable differences are also significant.

How Do 30year Mortgage Rates Compare To Other Loan Types

Todays 30year mortgage rates like all current rates are lower than theyve been in most of U.S. history.

Even so, 30year mortgage rates often look higher than other rates youll see advertised.

You can generally find lower mortgage interest rates if you opt for:

- A shorter-termloan Shorterterm home loans have lower rates than 30year FRMs because investors dont hold the risk of carrying your debt for as long. However these loans have much higher payments, since youre repaying the same amount of money over a shorter time period

- An adjustable-rate mortgage Adjustablerate mortgages have a fixed interest rate for the first few years. Then, the rate can change with the market. These loans typically offer lower introductory rates than 30year loans. But that rate could rise later on, so you lower mortgage payment is not guaranteed to continue

Despite their slightly higher rates, most borrowers opt for a 30year fixed mortgage over a 15year FRM or an adjustablerate mortgage.

The stability and predictability that come with fixed rates and low payments are hard to beat.

You May Like: Are Discount Points Worth It

Someone Moving In Less Than 10 Years

A 30year term with a fixed rate buys you security and predictability over three decades. But suppose you dont need all that time, because you know youll be moving on in ten years or fewer.

In this case, you might be better off with an adjustablerate mortgage .

Adjustablerate mortgages typically come in 3 forms: the 5/1, 7/1, and 10/1 ARM. All have 30year terms, but the first number refers to the amount of time your interest rate is fixed.

If youre certain youll be moving before that fixedrate period ends, you could opt for an ARM and enjoy the introductory rate it offers which is usually significantly lower than 30year mortgage rates.

There Are Other Ways To Pay Down Your Mortgage Faster

If your goal is to pay down your mortgage faster, you can do that with a 30-year loan by simply making extra payments whenever youre able. If you make enough extra payments over your loan term, you can easily shave off time from your loan, even as much as 15 years.

The catch with this strategy is that youll still pay a somewhat higher interest rate on the 30-year mortgage compared to a 15-year note.

If you do make extra payments, make sure you indicate that these payments are to go toward your loan principal. Your Caliber Loan Consultant can show you how to do that.

Recommended Reading: Reverse Mortgage Manufactured Home

How To Get A Low 15

If you want to lower the cost of homeownership, you can start by finding a way to lower your mortgage rate. The higher your mortgage rate, the more interest youll pay over the life of your home loan. Thats why its important to compare mortgage rates before committing to working with a specific lender.

The homebuyers who qualify for the lowest mortgage rates tend to have good credit scores. According to the FICO scoring model, youll likely need to have a credit score of at least 740 if you want access to the best rates. Of course, the exact credit score youll need to qualify for a 15-year fixed-rate mortgage will depend on the mortgage lender you choose to work with.

If your credit score isnt as high as it could be, it might be a good idea to work on improving your credit before you apply for a mortgage. Eliminating debt, paying bills every month on time and in full and keeping your below 30% are all things you can do to boost your credit score and put you in the best position to get a favorable mortgage rate.

While its possible to qualify for a mortgage with a low credit score , itll be more challenging and could result in a high interest rate. If this is your situation, your best bet might be to go for an FHA loan or a USDA loan. The former is designed for first-time homebuyers, while the latter is built for those buying a home in a rural area.

Considerations Before Choosing A 15

The 15-year mortgage can provide enormous long-term savings to a homeowner as compared to other, longer-term loan products. However, the program wont be for everyone.

Most notably, the monthly payments on a 15-year mortgage are considerably higher than the payments on a comparable 30-year loan.

At todays rates, the payment on a 15-year loan is 50% higher than a 30-year.

An increase such as this can be a budget-breaker to some households and, it can be harder to qualify for a mortgage with higher payments because of debt-to-income requirements put forth by a lender.

Therefore, before selecting a 15-year mortgage to finance your next home, make sure the monthly payment is a manageable one and, be sure to check with your lender.

This mortgage calculator can help you compare payments.

If you find 15-year fixed-rate mortgage payment to be too high for your comfort, but you still want the benefits of having a 15-year loan, theres another path you can take.

As a homeowner, theres no rule against refinancing and, with mortgage rates low, its an excellent time to consider any low-rate product not just the 15-year fixed.

To copy the benefits of a 15-year loan, do the following:

Youll also remain in control of your repayment schedule. If theres ever a month you dont want to send extra monies to the bank, you dont have to.

Read Also: Can You Do A Reverse Mortgage On A Condo

Alternative Options For 15

The major drawback of the 15-yr mortgage loan is that youre locked into a higher payment. If for any reason, money becomes tight, the higher mortgage payment can be a real burden.

However, you could opt for a 30 year fixed rate mortgage and pay an additional amount each month to pay off the loan in 15 years while not being locked into that higher payment. On a $160,000 loan, the 30-yr mortgage payment would be roughly $850 per month.

Monthly Payments Are Higher On 15

- Expect a mortgage payment that is 1.5X a comparable 30-year fixed

- Not a bad deal considering the loan is paid off in half the time

- Just make sure you can afford it before you commit to it

- Since there wont be an option to make smaller payments once youre locked in

While the lower interest rate is certainly appealing, know that the 15-year fixed-rate mortgage comes with a higher monthly mortgage payment because you have 15 fewer years to pay it off.

Ultimately, when you have less time, higher payments are required to extinguish the balance.

If we consider a $200,000 loan amount, which isnt necessarily that large, the monthly mortgage payment would be $470.69 higher on the 15-year mortgage because its paid off in half the amount of time.

So despite the lower interest rate on the 15-year fixed, the monthly payment is still significantly higher, about 56% more expensive.

Take a look at the numbers below, using those Freddie Mac average mortgage rates:

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Is It Cheaper To Pay Off A 30

Some people get a 30-year mortgage, thinking theyll pay it off in 15 years. If you did that, your 30-year mortgage would be cheaper because youd save yourself 15 years of interest payments.

But doing that is really no different than choosing a 15-year mortgage in the first placebesides that choosing to make those extra payments would be up to you.

Good intentions aside, this rarely happens. Why? Because life happens instead. You might decide to keep that extra payment and take a vacation. Or maybe its time to upgrade your kitchen. What about a new wardrobe? Whatever it is, theres always a reason to spend that money somewhere else.

When you have a 15-year mortgage from the beginning, you wont be tempted to use that money for something else. Youve got built-in accountability to get your house paid off fast!

The Main Downsides Of A 30

The most obvious disadvantage of a 30-year mortgage is that itll take twice as long for you to own your home outright, which means a longer duration until you have financial freedom from your housing payment.

But Nicole Rueth, producing branch manager at Fairway Mortgage in Denver, also points out that the lower monthly payment of a 30-year mortgage comes at an additional cost, with 30-year mortgages carrying higher interest rates. Combined with the longer term, that results in paying much more in total interest over the life of your mortgage.

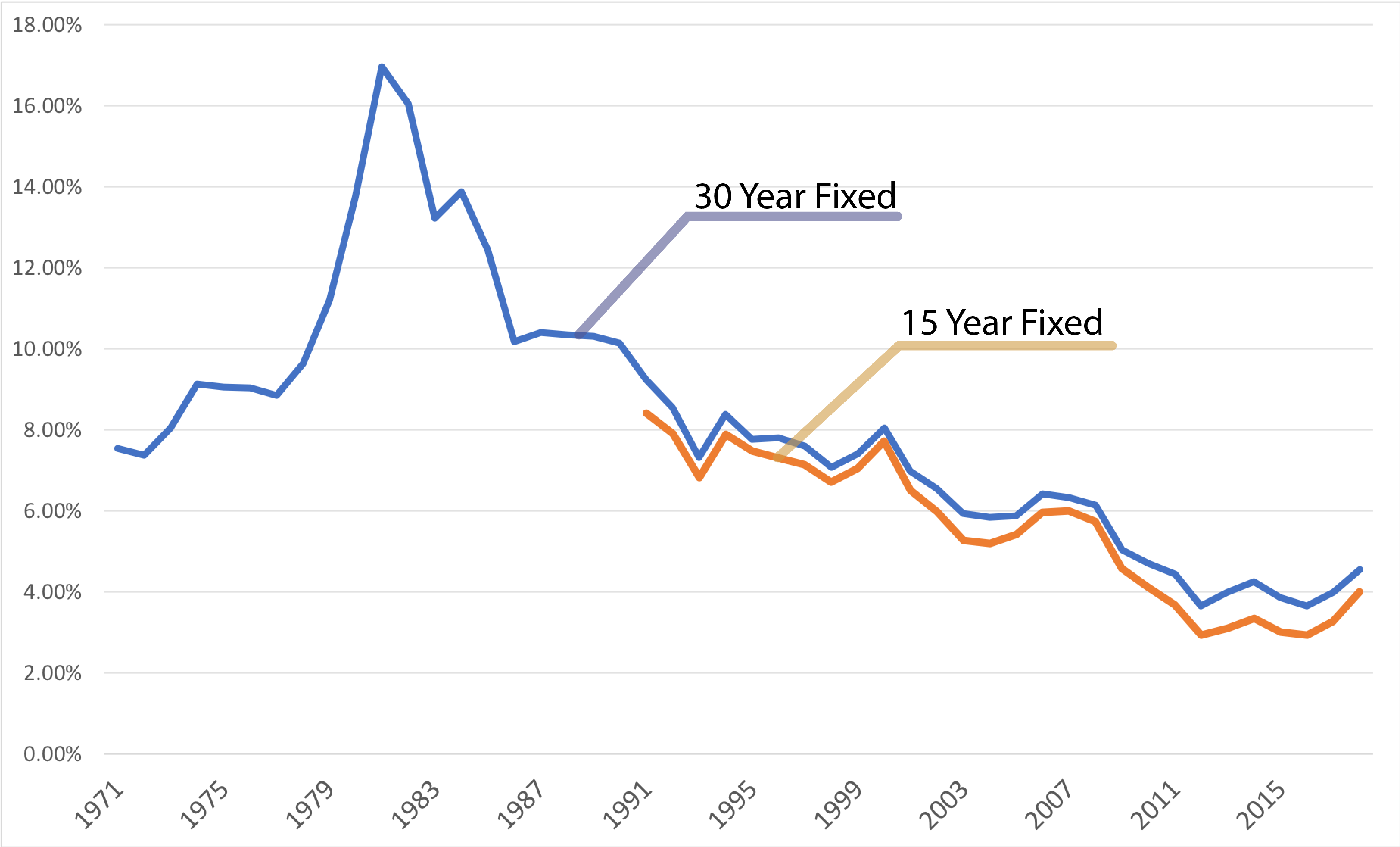

According to a recent Bankrate mortgage survey, average interest rates on a 30-year fixed-rate mortgage are currently 3.05%, which is near a record low. But in the same survey, the average rate on 15-year mortgages was just 2.45%.

That means youre paying 0.6% more for a 30-year mortgage, which may not sound like a lot. But on a $200,000 home with a 20% down payment, youll pay a total of $31,358 in interest over the entire length of a 15-year mortgage at 2.45%, while the same home with a 30-year mortgage at 3.05% ends up costing a much higher $84,399 in total interest.

Read Also: Who Is Rocket Mortgage Owned By

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Drawbacks Of Refinancing Into A 15

Having all your money tied up in your home can be risky. Many financial experts recommend having at least three to six months of emergency savings set aside in case you lose your job or cannot work for extended periods.

You may not want to refinance if it will negatively impact your monthly cash flow. Thats especially true in the uncertain financial climate were currently in. You have to make sure you can continue to make payments or you could risk losing your house, cautions William Stack, a financial advisor with Stack Financial Services LLC in Salem, Missouri.

Instead of refinancing a mortgage, you could contribute more money toward a 401 plan or an IRA account or beef up your emergency savings fund. The latter approach helps you avoid revolving credit card balances from month to month and incurring more debt at a higher interest rate.

I believe that if youre not maxing out any available employer match to your retirement plan, its a mistake to accelerate your mortgage payments by shifting to a 15-year mortgage, says Allison Bishop, CPA, a financial coach in Portland, Maine. Youre giving up a 100-percent return on your investment in favor of something more like a 3 to 4 percent return. Its also smarter to put that extra money toward paying down higher-interest credit card debt if you have it.

Recommended Reading: Will Mortgage Pre Approval Hurt Credit Score

How Does A 15

A 15-year fixed-rate mortgage offers a generic, structured plan for financing a home: You get a mortgage for a set term at a set interest rate, and lenders require a down paymentusually between 520%.

The only thing that varies within fixed-rate mortgages is the length of the mortgage term. You can stretch your monthly payments anywhere from 10 to 50 years, but the two most common term options are the 15-year and 30-year fixed-rate mortgages.

There are two basic components to every fixed-rate mortgage loan: the principal and the interest.

- The principal is the amount you borrow to purchase your home.

- The interest is the amount you pay to compensate the lender for taking the risk of lending that money to you.

So, in order to borrow money, you have to spend more money. But if you opt for a 15-year fixed mortgage, there is a silver lining: Youll have fewer interest payments!

They Have Lower Interest Rates Than Most Mortgage Loans

On average, 15-year fixed-rate mortgages come with lower rates than just about any other type of mortgage loan. Thats because, with a 15-year loan, theres less risk for the lender. The longer the term, the higher the risk that the loan wont be repaid.

With a 15-year mortgage, you can usually get an interest rate between 0.25% to 1% lower than with a 30-year mortgage. That might not seem like much, but the lower interest rate will save you thousands of dollars in the long run. More on that below.

And by choosing a 15-year fixed rate conventional loan, you also wont get hit with the fees that come with government-backed loans like a VA loan or an FHA loan.

Don’t Miss: Who Is Rocket Mortgage Owned By

Reason #: A Mortgage Wont Stop You From Building Equity In The House

Everyone wants to build equity. Its the main financial reason for owning a house. You can use the equity to help pay for college, weddings and even retirement. Mortgages are bad, many people say, because the bigger the mortgage, the lower your equity.

But think about it differently. Say you buy a house for $300,000 and you get a $250,000, 30-year, 3% mortgage. Your down payment is your starting equity, and you want that equity to grow, grow, grow.

But this thinking fails to acknowledge that this is not the only way you will build equity in your house. Thats because your house is likely to grow in value over the next 20 years. If that house rises in value at the rate of 3% per year, it will be worth $541,833 in 20 years! Youll have nearly a quarter-million dollars in new equity even if your principal balance never declines!

Get Todays Mortgage Rates

Current mortgage rates are at their lowest levels in more than a year. Its an excellent time to consider a refinance especially if youre considering the 15-year fixed-rate mortgage.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Popular Articles

Resources

Don’t Miss: Who Is Rocket Mortgage Owned By