Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Can Closing Costs Be Included In A Va Loan

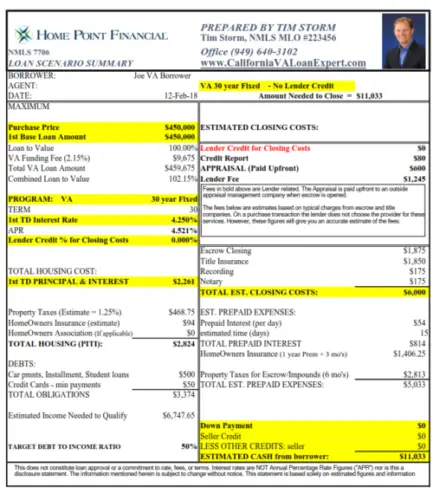

If youre an eligible veteran, service member or surviving spouse, a VA loan can help you purchase or refinance a home with low upfront costs. However, low costs dont necessarily mean no costs. Like other types of home loans, VA loan borrowers will have to pay fees known as closing costs to lenders for processing their loan.

Fortunately, VA loan borrowers have options to reduce the amount they pay out of pocket. In this article, well answer what VA loan closing costs are and if closing costs can be included in a VA loan.

Prepaid Daily Interest Charges

You prepay interest on your loan from the day your loan closes to the end of the month. For example, if you close on the 15th of the month, then you prepay 15 days of interest in advance. If your loan funds at the end of the month, this charge will be small. Basically, if you close near the start of the month and you have a big loan amount, then the charge may be substantial.

Read Also: How Accurate Are Mortgage Affordability Calculators

What Are The Benefits Of An Fha Home Loan

FHA loans are a type of non-conforming loan available through private lenders. They are government-insured loans designed with low- and moderate-income wage earners in mind. Essentially, FHA loans are an option for borrowers who might not qualify for a conventional loan. They typically require only 3.5% down and are available even to those with past credit problems and lower credit scores.

FHA loans are also designed with some debt-to-income ratio limit flexibility, and can be manually underwritten. That means the decision to approve isnt left to an algorithm borrowers have an opportunity to explain why their credit problems are behind them to a human being.

Next, lets take a look at what your closing costs are comprised of with an FHA loan, and some strategies for reducing them

How Else Can I Avoid Paying Closing Costs

As we mentioned above, you can usually roll closing costs into your mortgage only when you refinance.

But there are other ways to reduce your closing costs when buying a home.

The first is asking your mortgage lender to waive some or all of your upfront fees. They might agree, but theyll charge you a higher interest rate in return. This is known as a lender credit.

You might also ask your seller to cover some of your closing costs. Known as a seller concession, this is more likely in a buyers market than a sellers market.

USDA borrowers can roll closing costs into their USDA loan if the appraised value is higher than the purchase price. More on that here.

Recommended Reading: How Does A Construction Mortgage Work

Pros And Cons Of Financing Your Closing Costs

When youre buying a home, one of the things you have to factor into your budget are closing costs. Typically, homebuyers spend between 2% and 5% of the purchase price on these expenses. If you agree to finance your closing costs, youll pay less money up front. Before making that move, however, its best to weigh the advantages and disadvantages of taking that route. If you want additional expert guidance, use SmartAssets financial advisor matching tool to pair up with a financial professional who can help you with your real estate needs.

Check out our closing costs calculator.

First Off What Are Closing Costs

Lets make sure we define closing costs before explaining how they can be paid. Closing costs are kind of like taxes, for lack of a better term. Lets say youre at the store looking to buy a shirt. The shirt may be fifteen dollars, but when you check out, youll probably end up paying sixteen or seventeen dollars. Why? Because there are closing costs associated with the purchase in this case, wed refer to them as taxes. Closing costs are just like a sales tax. When you go to get a mortgage, there are certain unavoidable costs associated with approving and processing your loan, such as origination fees, points, taxes, insurance, title fees, and appraisal fees, to name a few.

Also Check: How To Check Credit Score For Mortgage

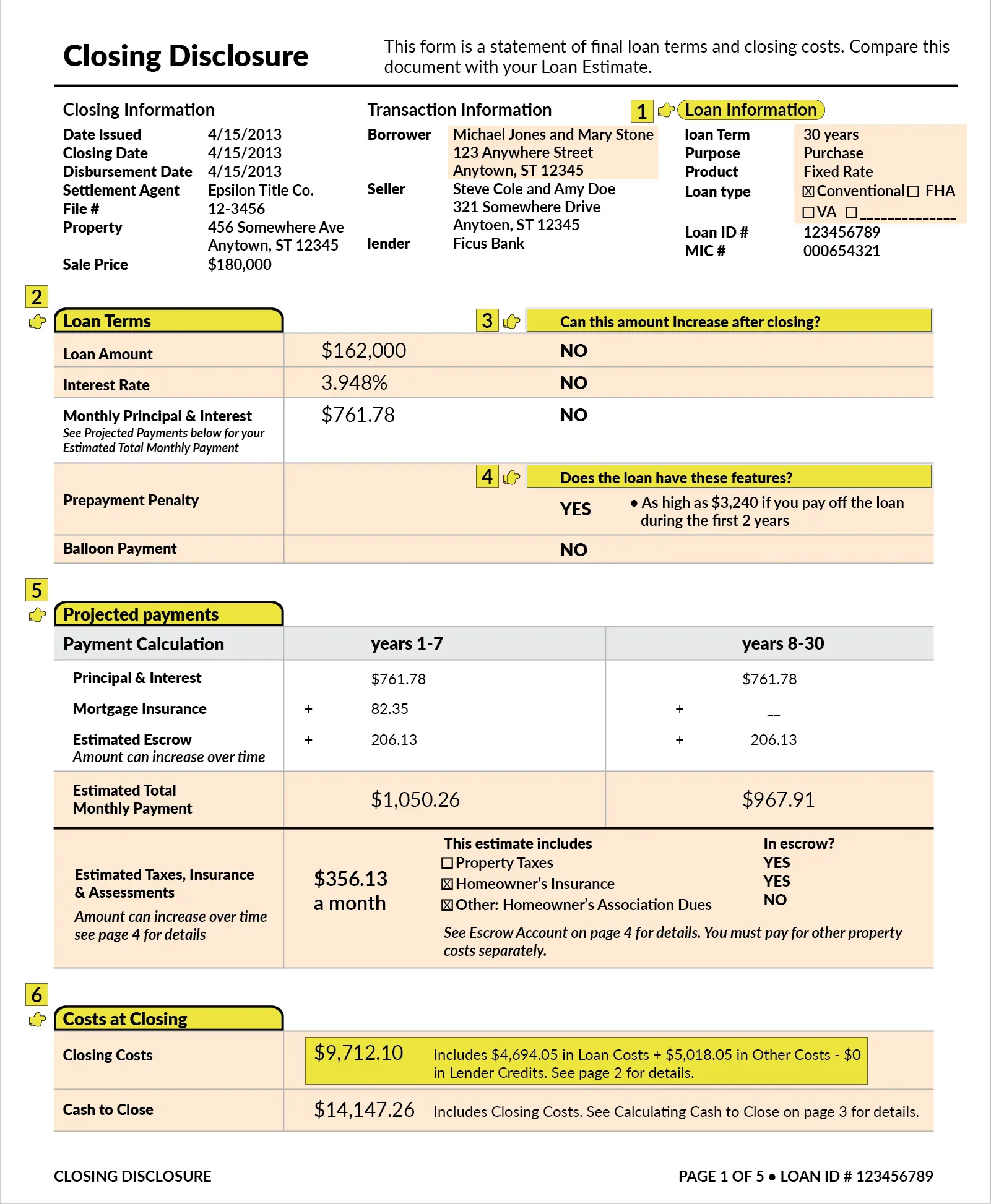

Compare The Loan Estimate And Closing Disclosure Forms

When you get your initial loan estimate, review it with a fine-tooth comb. If youre unsure about what a fee entails or why its being charged, ask the lender to clarify. A lender who cant explain a fee or pushes back when queried should be a red flag.

Likewise, if you notice new fees or see noticeable increases in certain closing fees, ask your lender to walk you through the details. Its not uncommon for closing costs to fluctuate from preapproval to closing, but big jumps or surprising additions could impact your ability to close.

Be wary of a lender adding on unnecessary junk fees that duplicate existing ones or that havent been disclosed in advance.

How Do You Reduce Closing Costs

Although closing costs can be significant, there are some things you can do to lower them. First, its important to understand that different lenders will have different closing costs. Some will be higher than others, and some lenders will charge more fees than other lenders.

Also, if you are a first-time home buyer, you may qualify for a grant to help you with this expense. Its worth your time to research your options to see whats available before you apply for a mortgage.

Finally, as previously mentioned, you may be able to negotiate the closing costs with the seller. This may not always work, of course, especially if there is a strong real estate market where you are buying a home. If a seller has multiple offers, for example, he or she will most likely go with the highest offer and probably wont be interested in helping out with the closing costs.

Read Also: What Kind Of Mortgage Loans Are There

So What Are All Of These Itemized Closing Costs

Excellent question. After all, Loan Estimates and Closing Disclosures are 35 pages long and theyre an alphabet soup of fees, taxes, and jargon thats only familiar to people in the real estate industry. Whats more, there are different tax and insurance regulations from state to state, and some use different terms for the same types of charges. The kind and number of itemized fees you could see on a LE or CD can also vary dramatically. For this reason, its challenging to find a detailed list that explains what each and every one of these fees mean.

Page 2 of your LE or CD divides all your closing fees into two categories: Loan Costs, and Other Costs. Loan Costs are charges for services provided to the lender so that they can accurately process the loan. Other Costs include taxes, prepaid costs, initial escrow payments, and other itemized costs.

At the end of this article we explain the most common closing fees and charges. Theyre broken down into the same sections as your LE or CD so you can easily follow along.

- If theres a fee on your loan estimate thats not listed below, your loan consultant or processing expert will be able to explain it for you.

- If you need more information about the itemized fees on your Closing Disclosure, your closing expert can help you.

Better Mortgage is committed to eliminating unnecessary fees wherever possible and not passing on costs to our customers. Youll see how our Loan Estimates compare when you start the process.

Origination And Underwriting Fees

It takes a lot of time and resources to collect, evaluate, and verify an applicants financial information. The lender will also have to order a home appraisal, order the final loan documents, and make sure all laws and regulations are followed. The origination and underwriting fees cover all of the work involved in processing the mortgage.

Don’t Miss: What Is Mortgage Interest Deduction

When Are Closing Costs Due

Most closing costs are due on the day of closing, which is the point in time when the title of the property is transferred from the seller to the buyer. Money is typically wired to the receiving parties upon closing, or the buyer will bring a cashiers check to the closing appointment.

However, there are some closing costs paid before closing day, such as inspections, certifications or land surveys. Home inspections are usually completed within a week of your offer being accepted and are paid for at the time of service. Not all deals require an inspection. Its usually up to the buyer if they want to add an inspection contingency.

If you are getting a flood zone certification or land survey, youll also pay for these at the time of service, though sometimes the cost is shared with the seller.

Note: Earnest money is not technically considered a closing cost , but it plays an important role in your total payment on closing day. Its typical to make an earnest money deposit when you put an offer in on a home. The average amount ranges between 1% to 3% of the offer price and its deposited into a third-party account to show the seller that youre a serious buyer. Its held there until closing day when it is applied to your down payment amount.

What’s The Right Call For You

No matter how much you end up spending on closing costs, think about the best way to pay those fees. If you can afford the extra money at closing, you may decide to just fork it over and be done. But if you’d rather keep more money in savings, you may want to roll closing costs into your mortgage instead. This holds especially true if you’re buying a home that needs a lot of work. You may need that money in the near term to get it into better shape.

You May Like: What Would The Payment Be On A 100 000 Mortgage

Can You Finance Closing Costs Into Your Usda Home Loan

Yes, there are a couple approaches to this. One is to essentially build the costs into your purchase offer and ask for a seller credit. While far less common, in some cases it might be possible to roll the closing costs on top of the loan. If the home appraises for a higher value than the purchase price, your lender could increase your loan amount to cover your closing costs.

What Is A Wrap Around Mortgage

In a wrap around mortgage, the seller doesnt pay off their loan. Instead, they leave it open, and issue a new loan to the buyer that wraps around the original loan.

On the buyers side, the loan looks like any other type of seller financing. The seller provides them a loan, typically at a higher interest rate than conventional mortgages, and the buyer has a certain number of years to refinance or otherwise pay off the loan in full.

The difference from a traditional seller-financed mortgage lies on the sellers side. Rather than pay off their existing mortgage and lend the entire new loan amount to the buyer, they leave their original mortgage open, and only lend the buyer the difference between the two.

And in so doing, they typically earn an interest spread, charging higher interest to the buyer than what they themselves pay to their lender. The new loan gets recorded on title in second lien position, after the original mortgage.

However, the new loan is not a second mortgage. The borrower pays interest on the full loan amount, not just the difference between the old mortgage balance and the new one.

Sound complicated? Its not as complex as it sounds, and best illustrated with an example.

Don’t Miss: Is The Payoff Amount On A Mortgage Less Than Balance

Can Anyone Qualify For A No Closing Cost Mortgage

No. Home buyers applying for a conventional mortgage typically need a minimum 740 credit score but, depending on market conditions, those same borrowers may be able to get a no closing costs mortgage with a 700 minimum credit score.

Borrowers applying for an FHA loan preferably need a 680 credit score to qualify for a no closing cost loan. However, depending on market conditions, FHA borrowers may qualify with a 640 score.

The Bottom Line: Closing Costs Are An Inevitable Expense Of Getting A Mortgage

No matter what type of mortgage you ultimately choose, closing costs will be a factor of your home buying experience. Because FHA closing costs include the upfront MIP, an FHA loan can have average closing costs on the higher end of the typical 3% 6% range. That doesnt diminish in any way the value of getting an FHA mortgage, with its low down payment, lower interest rates and flexible underwriting.

Ready to apply for your FHA or conventional loan? Apply online now and find the best option for you.

Lower your monthly payments fast.

Apply for an FHA Streamline Refinance and start saving sooner.

You May Like: How Long For A Mortgage Pre Approval

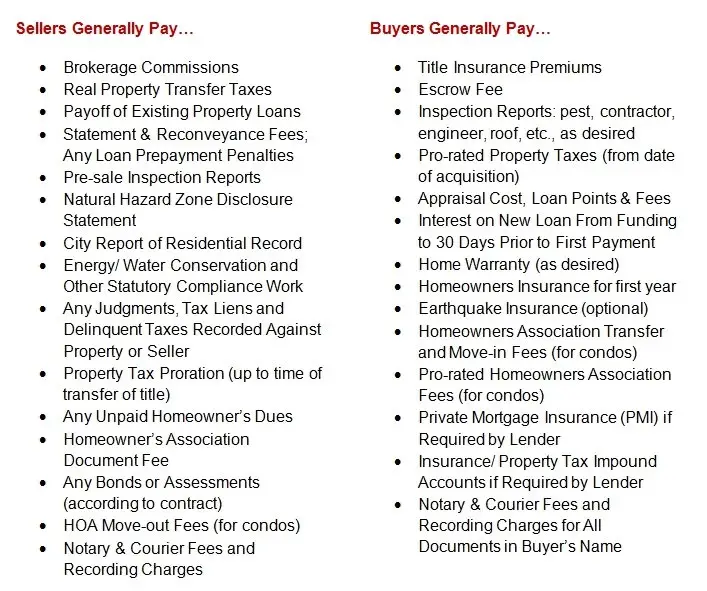

Closing Costs For Sellers

Sellers usually pay buyer and listing real estate agent commissions, transfer fees and their own real estate attorney costs. Local rules vary by location, however, and many items can be negotiated by contract.

Heres a list of the most common closing costs for sellers.

- Agent commission

- Attorneys fees

Can You Roll Closing Costs Into The Mortgage

In simple terms, yes you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage youre getting. If you choose to roll your closing costs into your mortgage, youll have to pay interest on those costs over the life of your loan. This essentially means that youll be paying much more for these costs than you would paying for them upfront.

Don’t Miss: Are Mortgage Rates Going To Rise

Is Rolling Closing Costs Into Your Loan The Same Thing As A No

If you roll your closing costs into your mortgage, this may be known as a no-closing-cost loan. But its not the only type of no-cost refinance.

Often when lenders advertise no-cost or zero-cost mortgages they are referring to a different arrangement, which involves the lender paying your closing costs in exchange for a higher interest rate. This is technically called a lender credit.

A lender credit means the mortgage company will cover part or all of your closing costs. In return, you will pay a slightly higher interest rate over the duration of the loan.

The downside is youll pay a larger monthly payment for the long haul. And youll likely pay significantly more interest overall. Even a slight rate increase can add up to thousands of dollars when stretched across 30 years.

However, the idea is that you dont have to come up with as much cash upfront. This can be helpful when you are also having to come up with a large down payment.

The Cost To Refinance A Mortgage

Refinancing isnt free youll have to pay closing costs but there are ways you can pay less for your new loan.

Edited byChris JenningsUpdated November 29, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

Refinancing your mortgage can help you save money in the long run, as well as lower your monthly payment. However, before you move forward, its important to consider the costs of refinancing and how to avoid or lower some of these fees.

Heres a closer look at the cost to refinance a home loan:

You May Like: Chase Recast Calculator

You May Like: Can I Afford A Second Mortgage

What Are Closing Costs

Closing costs are the expenses that you pay when you close on the purchase of a home or other property. These costs include application fees, attorneyâs fees and discount points, if applicable. With real estate sales commissions and taxes included, total real estate closing costs can approach 15% of a propertyâs purchase price.

While these costs can be substantial, the seller pays a number of these fees, such as the real estate commission, which can account for about 6% of the purchase price. Some closing costs, however, are the responsibility of the buyer.

Buying: When Do You Pay Closing Costs And Down Payment

If youre a new homebuyer, youll pay your closing costs and the balance of your down payment on the day you sign your final loan documents.

The amount of the down payment is decided by you and your loan consultant. Its a common misconception that down payments should be 20% of a homes purchase price, for borrowers with great credit and a steady income, its possible to buy a home with as little as 3% down. Each lender has its own criteria for the array of mortgages they offer, and theyll walk you through the minimum down payment needed for the loan you qualify for. The down payment amount is typically based on the cost of the home, your assets, your credit history, and more.

Once a seller has accepted an offer on the home you love, the seller will usually need you to make an earnest money deposit. These funds are held in escrow during the loan application process. When the loan is approved and the closing documents are signed, the earnest money deposit will be applied to your down payment or closing costs.

Don’t Miss: How To Borrow Money From Your Mortgage