British Columbia Mortgage Calculator

Getting a mortgage in British Columbia is no small commitment – it will probably be the biggest financial commitment you ever make. Thats why a mortgage calculator for your province is crucial – it lets you figure out exactly how much your mortgage will cost you ahead of time.

Of course, a BC mortgage calculator is just the beginning – its important you understand what affects the price of your mortgage. Thats why weve laid out the costs of getting a mortgage in BC below. Each of these elements has already been included in the mortgage calculator above.

How Much Is Closing Cost On A 400k House

closing costspricepriceclosing costsprice400k closing costspriceclosing costs

. Also, how much are closing costs on a $400 000 house?

A general rule of thumb is to budget approximately 1 ½ to 2% of the value of the home as your closing costs. For example a $400,000 home would expect to have closing costs of about $6,000 to $8,000. Budget more for buying a new home from a builder.

Additionally, how much are closing costs on a 500k house? How to Negotiate Closing Costs on a House

| Closing Costs as % of Home Price | $100,000 |

|---|---|

| $40,000 |

Then, how do I calculate my closing costs?

Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So, if your home cost $150,000, you might pay between $3,000 and $7,500 in closing costs. On average, buyers pay roughly $3,700 in closing fees, according to a recent survey.

How much are closing costs on a 350k house?

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can’t typically be borrowed because that would raise the buyer’s loan ratios to a point where they might no longer qualify.

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Don’t Miss: How Does Rocket Mortgage Work

Choosing The Right Mortgage With Mortgage Choice

Choosing a home loan is like selecting a fine wine: it suits your palate, handpicked for you and gets better over time. A Mortgage Choice broker knows which home loan is right for you.Use our tool to get your free quote and find out how much you could borrow in minutes or speak to you local broker for expert advice.

Why You Need A Good Credit Score For A Mortgage

In order to qualify for a mortgage, you have to show the lender how your credit score stands. Your credit score is based on how well you handle managing debt and how much of it you have outstanding at any given time. You can request a free credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228.

Its important that these numbers are good in order to get approved for a mortgage so make sure there are no late payments on your credit report and that youre paying off any balances as soon as possible.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Where To Get A $400000 Mortgage

Shopping around for your mortgage is critical if you want to get the lowest interest rate. To do this, youll either need to apply to several mortgage lenders directly.

Once you have a few loan estimates in hand, you can compare the costs of each lender one by one. Make sure to look at the APR, origination fee, mortgage points, and the total cash youll need to bring to closing.

From there, you can choose the best offer, proceed with the lenders full application, and provide any financial documentation they might require.

You can also use Credible to shop all of our partner lenders at once. Credible can ease the process and allow you to receive and compare multiple prequalified rates faster. Our process is entirely online, and it only takes a few minutes.

Dont Overextend Your Budget

When you buy a more costly home like a 500k mortgage or 600k mortgage, banks and real estate agents make more money.

Most of the time, banks pre-approve you for the maximum amount that you can afford. Your budget will be stretched to its limits right out of the gate.

Its critical to ensure that youre happy with your monthly payment and the amount of money youll have after purchasing a house.

Every major purchase should begin with a carefully-constructed budget, which should include your debt, income and assets. You should include how much you need to bring to the table in order for this purchase to make sense.

First-time homebuyers often have more debt than they do income, which makes it necessary to start with a bare bones plan of how the money will be spent on housing and other expenses before jumping into homeownership. Having a plan to get out of debt is often necessary.

Youll also want to realistically assess costs associated with homeownership. For example, how much will it cost to maintain your home?

Make sure you have enough available monthly income so that your mortgage payments, property insurance, taxes and homeowners association fees are manageable.

To get a clear picture of what you can afford and how much you have available for a downpayment, view SmartAssets downpayment calculator in minutes to determine your monthly payment using a mortgage calculator.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you won’t be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, you’ll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

Land Transfer Tax In British Columbia

The land transfer tax in British Columbia is calculated as a percentage of the houses value, estimated using its purchase price. The LTTs marginal tax rate varies from 1.0% to 2.0% of the propertys value depending on its purchase price. See Ratehub.cas British Columbia land transfer tax pagefor more information on tax rates and calculations.

Recommended Reading: What Does Gmfs Mortgage Stand For

Do You Have A Suitable Mortgage Deposit

You are more likely to be accepted for a £400,000 mortgage if you have saved a substantial deposit towards the cost of your new home. Most lenders ask for at least 10% of the purchase price, but the more you can put towards the purchase, the better your mortgage terms will be. This is because the Loan to Value ratio will be lower, so there will be less risk to the bank or building society.

The Homebuying Process: Step

Buying a house is likely to be the biggest financial commitment that you will make for your entire life, and while the experience can be both exciting and nerve-wracking, its important to get it right in order to avoid excessive extra costs in the future. Dont buy a home without reading this.

When its your first time buying it can be a little overwhelming, with lots of unknowns, legal wranglings, and lists of things to do in order to get the keys to your first home.

A few essentials youll want to do straight off include:

- Check your credit and strengthen your credit score

- Find out how much you might be able to borrow

- Save for down payment, closing costs

- Build a healthy savings account

- Get preapproved for a mortgage

- Start speaking to realtors and finding one you like and is recommended

- Find suitable mortgage lenders

- Buy a house you like

Luckily, when youre ready to make your first move, weve got this extremely thorough home buying guide to walk you through the must-dos of your first purchase.

You May Like: Rocket Mortgage Payment Options

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

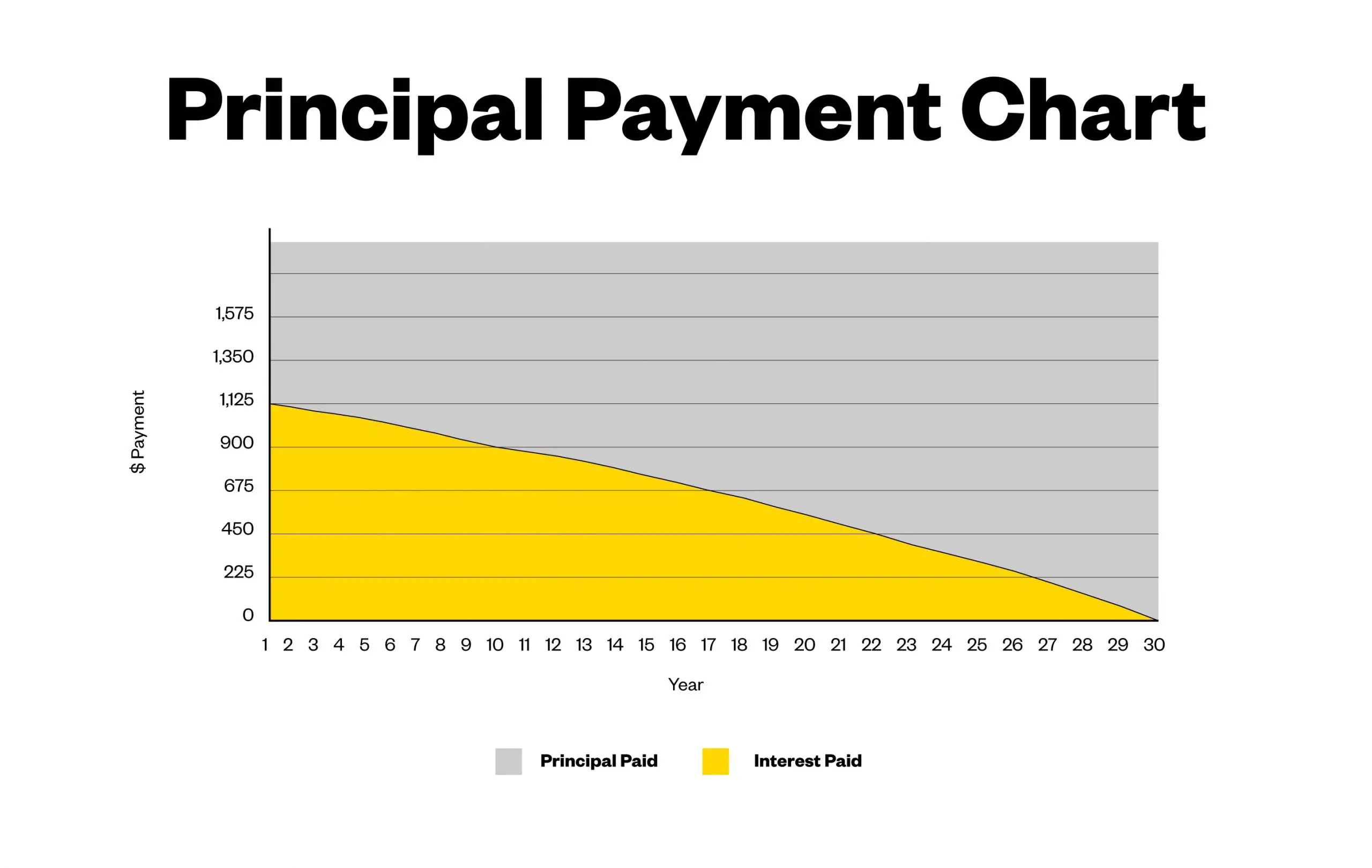

Whats The Amortization Schedule For A $400000 Mortgage

When you take out a fixed-rate mortgage, your total monthly principal and interest payment doesnt change for the life of the loan. But the amount of your payment that goes toward principal versus interest does change. This is known as an amortization schedule.

At the beginning of your loan, the amount going toward interest will be far higher than the amount going toward the principal. The situation slowly reverses over the course of the mortgage. By the end, youll be paying more in principal than interest.

The first year of an amortization schedule for a 30-year, $400,000 mortgage with a 4% APR would look like this :

- Beginning balance: $400,000

- Monthly interest: $1,333.33

- End-of-year balance: $393,553.66

Note that at the end of the year, your loan balance is reduced only by the portion of your monthly payment that went toward the principal. The interest portion doesnt reduce your loan balance.

- Beginning balance: $22,427.84

- Monthly interest: $74.76

- Ending balance: $0

On a 15-year mortgage, the amortization schedule works similarly but youll be paying the principal down much faster and paying much less in interest.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

How Does The Property Type Affect My Repayments

Buy-to-let properties

If your £400,000 mortgage is for a buy-to-let investment, there are several things to consider as different rules apply than with residential mortgages.

Many lenders will require a larger deposit, typically 25%+. Some also have minimum income requirements, and affordability is based not only on the borrowers income, but the BTLs forecast rental income. Many want evidence that rent generated through letting covers the mortgage payments by 125-130%.

Visit our dedicated BTL page for more information on this.

Second homes

Many lenders consider you higher risk if you already own a home and are looking to take out a mortgage on another. This is because if you fall into financial difficulty, lenders assume that youll prioritise repayments for your main place of residence.

Youll likely need to put down a larger deposit for a second home, there may be high minimum income requirements, and more extensive checks around your affordability.

Non-standard construction types

Some providers will not lend on properties that deviate from the standard construction type, such as listed buildings, unique properties or those with thatched roofs, etc. Other lenders will consider but will deem them higher risk and offer less favourable rates.

Nevertheless, some lenders are happy to consider a wider range of property types. Read more at our non-standard property section here.

Also Check: Can I Get A Reverse Mortgage On A Condo

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Recommended Reading: Mortgage Recast Calculator Chase

What Are The Monthly Repayments On A 400000 Mortgage

Lots of customers approach us to find out how much they can expect to repay for a mortgage of a particular size.

This article is based specifically on £400k mortgages, what factors lenders consider before authorising a mortgage of this size, and how much approximately the monthly repayments on a £400k mortgage will cost you.

The experts can give the right advice, even if youve been declined or have a bad credit history.

The following topics are covered below…

The Income Needed To Qualify For A $400k Mortgage

Unfortunately, there’s no magic bullet for determining the exact income needed for a $400K mortgage. However, we can generate an estimate based on some basic calculations.

Most mortgage lenders follow the 43% rule, which stipulates that all of the bills you pay each month including your mortgage, taxes, insurance premiums, credit card payments, and utilities should total less than 43% of your total annual income.

Essentially, banks wont consider borrowers with a debt-to-income ratio or DTI above 43%.

In order to calculate how much you can afford to pay each month, you’ll need to know:

Although these considerations can vary widely, we can make a broad-scale estimate to roughly determine the income needed to qualify for a $400K mortgage.

For example, if you make a $55,600 downpayment on a $400K house and qualify for a 4.25% 30-year mortgage, your minimum monthly income should be $8,178 .

According to this calculation, a prospective homebuyer looking to purchase a $400K house should make roughly $100,000 a year. Again, this number may vary with other considerations such as budget limitations, other loan obligations, and the details of your mortgage. However, it should hopefully serve as a working estimate.

Don’t Miss: Reverse Mortgage For Mobile Homes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads