Budgeting Guide For Mortgage Repayments

When budgeting for your mortgage repayments, it is recommended that you include the following:

- The monthly repayment amount determined by the mortgage repayment calculator

- Additional costs incurred by the mortgage

- Monthly homeowners insurance estimates

- Fixed expenses such as debt payments , childcare, memberships and services

- Monthly discretionary spending such as groceries, travel, clothing, entertainment, etc.

Balance this total against your net monthly income.

Be sure to also consider additional costs that are likely to occur during the term of your mortgage, such as:

- Home repairs or upgrades

How Often Can I Skip Mortgage Payments

| Lender |

|---|

| – |

RBC lets you make a mortgage prepayment that is up to the amount of your regular mortgage payment during your regular payment date. The minimum amount for Double-Up payments is $100, and goes up to 100% of your regular payment amount. The Double-Up payment is used to pay your mortgage principal balance.

Scotiabanks Match-a-Payment allows you to double your regular mortgage payment for any payment. You’ll also be able to increase your mortgage payment by up to 15% once per year.

You can choose to increase your regular TD mortgage payments by up to 100% once every calendar year, up until the increase is equivalent to 100% of your regular mortgage payment. This allows you to double your regular payments.

BMO allows you to increase your regular mortgage payments by up to 20% once per calendar year, or up to 10% for BMO Smart Fixed Mortgages.

You can double your mortgage payments or increase it up to 100% at any time with CIBC.

National Bank lets you make an additional payment on top of your regular payment, which can be up to 100% of your regular payment amount, on each of your regular payment dates.

How Much Interest Will I Pay On My Mortgage

The exact amount of interest youll pay depends on the mortgage rate youre on. This can change over time. For example, you might be locked into a low mortgage rate for a time, but if interest rates rise during this period, you could end up paying a higher mortgage interest rate when you come to remortgage, or if you move onto your lenders standard variable rate.

Our mortgage calculator shows you how much you would pay each month and over your mortgage term, assuming the rate remains the same over the mortgage term. If your mortgage rate changes, you can use the calculator again to show what your payments would be on your new rate, as well as the total amount youll pay over the mortgage term.

You can see the impact paying a higher or lower interest rate would have on your mortgage payments by using our interest rate calculator.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

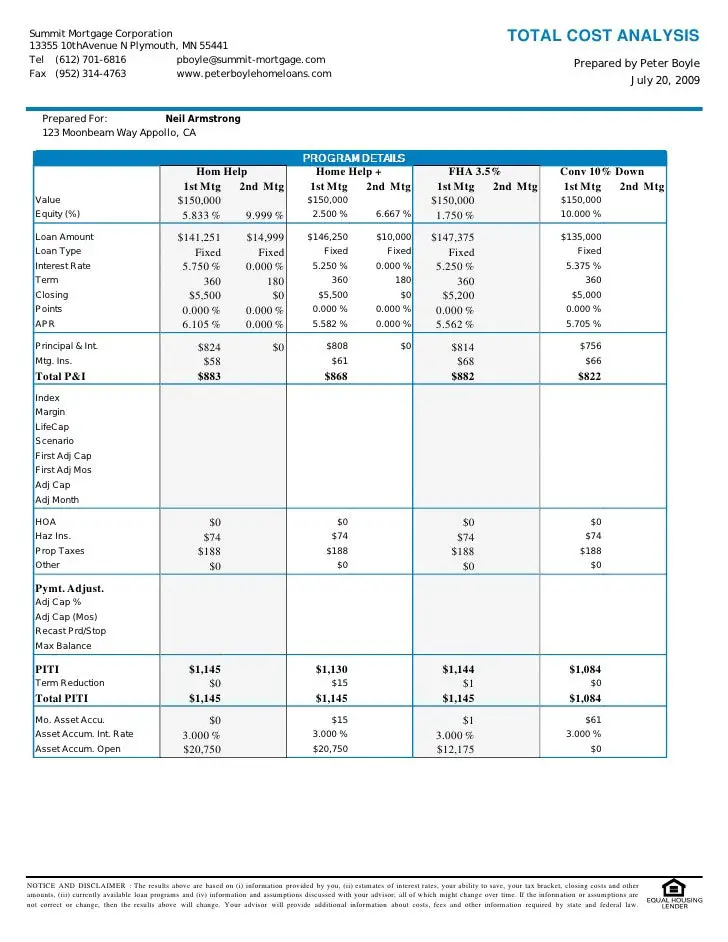

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

You May Like: Chase Recast Mortgage

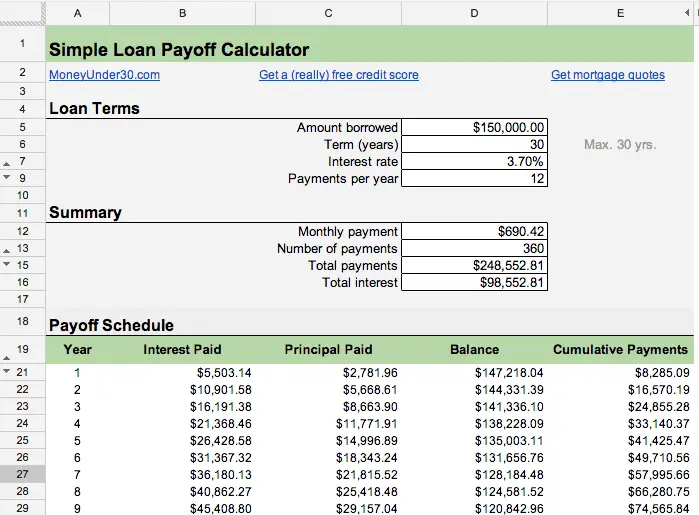

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

A Sample Maximum Affordability Calculation

Let’s look at an example where your gross annual income is $75,000. You’re buying a home with annual property taxes of $3,600, monthly heating costs are $200 and, since you’re buying a house, there are no condo fees. In addition to your housing expenses, you have a monthly car loan at $300 and must make minimum monthly payments of $250 on your credit card debt. You have $20,000 saved up for a down payment.

Example Parameters

÷ 12 months in the year

= Max monthly mortgage payment: $1,450

Since both your GDS and TDS ratios must be less than or equal to the maximum, the largest mortgage payment you can afford is $1,450. Though your GDS suggests you can afford $1,500, at that monthly payment, your TDS will be over 40% and therefore $1,450 is the maximum payment that ensures both debt service ratios fall within the allowable range.

With a monthly mortgage payment of $1,450 per month, you can afford a $300,000 mortgage with a 5-year fixed interest rate of 3.28% and an amortization period of 25 years. Finally you must ensure you have the minimum down payment of 5%. Since $20,000 / $300,000 = 6.67% you can satisfy the minimum down payment requirement.

After calculating your GDS ratio, TDS ratio and down payment percent, you can determine your maximum affordability at $300,000. Since your TDS ratio is limiting your affordability, you could try paying off some of your credit card or car debt to increase your maximum affordability.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

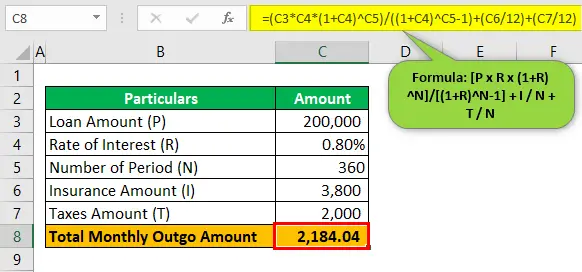

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

How Much Is A 150000 Mortgage A Month Final Thoughts

When considering what mortgage amount to apply for ask an expert to assist you. Affording the repayments each month comfortably should be a number one priority.

If youre ready to take the leap, were ready to help you with your first time buyer mortgage application.

As a first time buyer, its natural to have a lot of questions. Ask away, one of our friendly advisors would love to talk things through with you.

Call us today on 01925 906 210 or complete our quick and easy First Time Buyer Mortgage Application.

Consolidate Today!

Read Also: Rocket Mortgage Loan Requirements

Should I Choose A Fixed Or Variable Rate

A variable rate lets you benefit from decreases in market interest rates, but it will cost you more if interest rates rise. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future.

Of course, its not possible to exactly predict future interest rates, but a2001 studyfound that variable interest rates outperform fixed interest rates up to 90% of the time between 1950 and 2000. If youre comfortable with taking on risk, a variable mortgage rate can result in a lower lifetime mortgage cost.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

How Much Deposit Is Needed

Mortgage lending is based on how much you want to borrow in relation to the value of the property. This is known as the loan-to-value ratio.

If you put down a £15,000 deposit on a property worth £150,000, then you own 10% outright and need to borrow 90%. This means your LTV ratio is 90%.

The current minimum deposit is 5% or 95% LTV for residential mortgages. So for a mortgage on a £150,000 home, youll need to raise at least £7.5K for a deposit.

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

What Is A Fixed Rate Mortgage

Fixed rate mortgages allow you to benefit from a set interest rate for an extended period of time. You can find fixed rate mortgages with high street banks for 2,3,5 or 10 years.

Securing an interest rate could help you know exactly how much you have to pay each month for the first few years of your mortgage. However, it is impossible to predict how interest rates will behave, and it is possible that the best interest rate today may not continue to be as competitive throughout your fixed rate period.

Why Use A Mortgage Repayment Calculator

Understanding roughly how much your monthly repayments will be is a crucial step in budgeting for a new mortgage. Taking out a mortgage at the upper end of your affordability may at first seem like a good idea but depending on the type of mortgage you decide to go for, mortgage rate increases could see you saddled with repayments that you cant afford. Instead, its best to opt for mortgage repayments that you can comfortably afford even if this means borrowing slightly less.

You May Like: Can You Refinance A Mortgage Without A Job

What Is The Total Amount Repayable

When you take out a mortgage, you agree to pay the principal and interest over an agreed term. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your mortgage, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Estimate your monthly repayments on a £150,000 mortgage at a 4% fixed interest with our total amount repayable schedule over 15 and 30 years.

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Don’t Miss: Chase Mortgage Recast

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Repayment Or Interest Only

An interest only mortgage typically has some of the lowest minimal monthly mortgage repayments in the market, as you are only paying the interest on the mortgage. It should be noted that you cannot own the property at the end of the term through an interest only mortgage.

Repayment mortgages generally have higher monthly mortgage repayments. This is because you are paying both the capital and interest on a mortgage. Repayment mortgages may be a good option for you if you want to ultimately own the property outright.

Don’t Miss: Reverse Mortgage Manufactured Home

How Does The Interest Rate Affect The Cost Of My Mortgage

Your regular mortgage payments include both principal payments and interest payments. Having a higher interest rate will increase the amount of interest that you will pay on your mortgage. This increases your regular mortgage payments, and makes your mortgage more expensive by increasing its total cost. On the other hand, having a lower mortgage interest rate will reduce your cost of borrowing, which can save you thousands of dollars.

Important Questions To Ask Yourself Before You Put In An Offer

If the answer to any of these is I dont know then speaking to a mortgage advisor might be a really good first step for you, and its not as stressful as you may think.

With the right advice and the perfect lender, you could have your £150 000 mortgage-in-principle in no time, ready to start looking for your dream home.

Also Check: How Does Rocket Mortgage Work