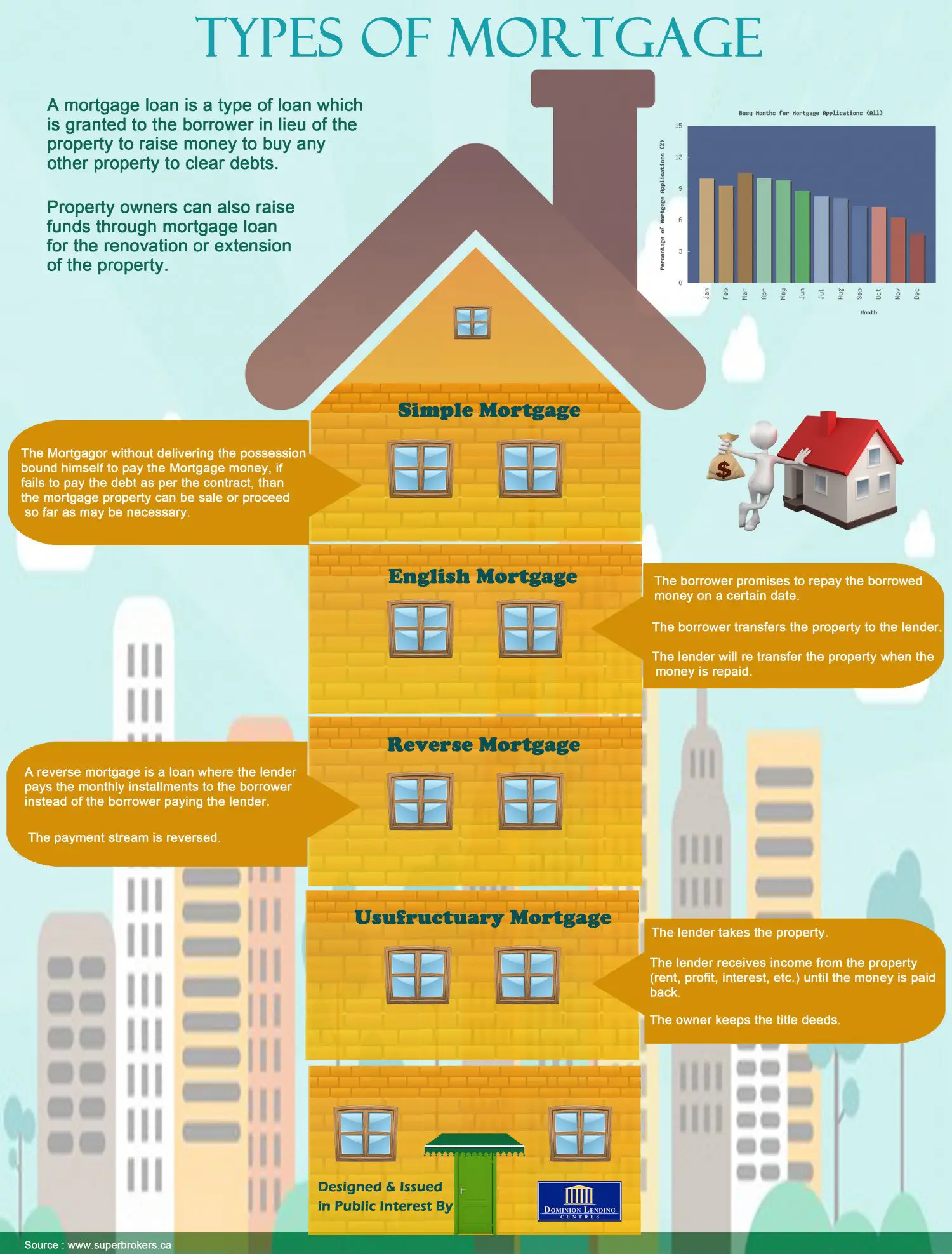

What Types Of Mortgage Loans Are Available

There are 3 types of home loans:

The type of interest rate determines the classification.

Additionally, most mortgages are 30 or 15 years loans, although 25, 20 and 10 year loans are available.

The advantages of a short term loan are less interest charged and higher payments, whereas a long term loan will require more interest although he payments will be lower. Because of this, a 15 year mortgage may have less than half the interest costs of a 30 year mortgage.

The following are the most common and easily accessed types of home loans.

A quick snapshot:

- Conventional Mortgage fixed rate, most common type of home loan

- Adjustable Rate Loan rate fluctuates, best for short term home ownership

- FHA Home Loans ideal for first time home buyer, 3.5% down payment

- USDA Loans very low interest rate, no down payment

- VA Loans no down payment, no PMI for military veterans

- Jumbo Loans for higher priced homes

Competitive Home Loans From Central Bank

Our lending professionals at Central Bank know your market like the back of their hand and are here to help as much as youd like! We provide competitive rates across mortgage types, and our application process is simple and easy so you can get into your home with as little friction as possible. Browse our full range of home loan options below.

Contact us if you have any questions about our loan programs or general rates, or stop by any Central Bank location to get started with your mortgage today. You can also apply for a home loan online.

Types Of Mortgage Loans For Buyers And Refinancers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Many types of mortgage loans exist, and they are designed to appeal to a wide range of borrowers’ needs.

For each type of mortgage listed below, youll see its advantages and the kind of borrower it’s best for. This page concludes with a glossary of terms describing different types of mortgage loans.

Also Check: How To Become A Mortgage Broker In Fl

One Year Traditional Arms

A mortgage loan in which the interest rate changes based on a specific schedule after a fixed period at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

Second Mortgages: Home Equity Loans And Helocs

A second mortgage is a different type of mortgage loan that allows you to borrow against the equity youve built in your home over time. Similar to a first mortgage, which is the loan you use to buy a home, a second mortgage is secured by your home. However, a second mortgage takes a subordinate position to a first mortgage, which means its repaid after a first mortgage in a foreclosure sale.

Both home equity loans and home equity lines of credit are types of second mortgages. A home equity loan is a lump-sum amount. It typically comes with a fixed interest rate and is repaid in fixed installments over a set term. A HELOC is a revolving credit line with a variable rate that works similarly to a credit card. The funds can be used, repaid and reused as long as access to the credit line is open.

Key features:

|

Can be used to purchase or refinance a home Can be used by homeowners without a first mortgage in some cases |

Rates and qualification requirements are more stringent than for first mortgages |

Ideal for: Borrowers who want to use their existing equity to fund other financial goals.

Also Check: Can You Use 1099 As Proof Of Income For Mortgage

What Else Should I Think About Before I Take Out A Mortgage

Youll need to consider more than just your loan type when youre shopping for a mortgage.

Your loan term is an important factor as well. Loans typically range from 15- to 20- and 30-year terms but other lengths may be available depending on your lender.

Keep in mind that shorter-term loans tend to have higher monthly payments , but you can save thousands in interest over the life of the loan. Another consideration is that interest rates on shorter-term loans may be lower.

Depending on your situation, you may also consider a specialty loan like a construction loan or home renovation loan. Construction loans are generally short-term loans used to finance the building of a new house, or renovating an existing one, then convert to a traditional mortgage once the build phase is complete. A home renovation loan, like Fannie Maes HomeStyle® Renovation Mortgage, allows you to borrow enough money to buy a home and fix it up before you move in.

Choose The One That Best Suits Your Financial Situation

Borrowed money can be used for many purposes, from funding a new business to buying your fiancée an engagement ring. But with all of the different types of loans out there, which is bestand for which purpose? Below are the most common types of loans and how they work.

You May Like: What Income Is Considered For Mortgage

Rising Rates And Your Arm

Adjustable-rate mortgages generally have a very attractive introductory rate. But after a specified time, the rate changes according to the terms of the loan. Here’s how to strategize if you have an ARM and rates are rising. And if you’re considering one of these loans, we’re here to help you think through how you would toggle between the financial plus of a low initial rate and the potential hit of rising mortgage rates down the road.

Interest Rates And The Housing Market

Mortgage rates affect how much you need to pay on your mortgage. They can also change the housing market as a whole. Understanding how these causes and effects work will help you search for the best deal for a new home or decide whether it’s time to refinance your current place. Learn which rates and indexes to watch to make a sound decision about your next step.

Read Also: What Is 10 Over 30 Mortgage

What Is A Mortgage Broker

A mortgage broker works as an intermediary between you and lenders. In other words, mortgage brokers dont control the borrowing guidelines, timeline or final loan approval. Brokers are licensed professionals who collect your mortgage application and qualifying documentation, and can counsel you on items to address in your credit report and with your finances to strengthen your approval chances. Many mortgage brokers work for an independent mortgage company so they can shop multiple lenders on your behalf, helping you find the best possible rate and deal. Mortgage brokers are typically paid by the lender after a loan closes sometimes the borrower pays the brokers commission up front at closing.

A Home Equity Loan Is Better If:

- You want a fixed-rate payment: Your monthly payment will never change even if interest rates rise.

- You want one lump sum of money: You receive the entire loan upfront with a home equity loan.

- You know the exact amount of money you need: If you know the amount you need and don’t expect it to change, a home equity loan likely makes more sense than a HELOC.

Recommended Reading: Can A Mortgage Loan Be Used For Renovations

Examples Of Mortgage Rates

How much that mortgage will cost starts with the interest rate, you’re charged. Knowing the going rate will help you figure out how much you can afford to borrowand keep you from accidentally agreeing to a loan that is higher than it should be for its terms and your credit score.

The example mortgage rates below are hypothetical and are for informational purposes only. Loans above a certain threshold may have different loan terms, and products used in our calculations may not be available in all states. Loan rates used do not include amounts for taxes or insurance premiums. Individual lenders terms will apply.

Health Professions Student Loans

Specialized student loans exist for students studying specific areas of medicine such as nursing, dentistry, optometry, sports medicine, or veterinary medicine. Each loan has its own requirements about accepted areas of study and financial need.

Learn more about medical education loans from the Health Resources and Services Administration , a part of the U.S. Department of Health and Human Services.

Despite your financial standing or field of study, you can find an education loan that suits your needs. It can help you and your family to fund your higher education and reduce the financial burden of school.

Don’t Miss: What Is Current Mortgage Refinance Rate

What Is A Construction Mortgage Loan

This type of mortgage loan involves buying land on which to build a house. These loans typically come with much shorter terms than other loans, at a maximum term of one year. Rather than the borrower receiving the loan all at once, the lender will pay out the money as the work on the home construction progresses. Rates are also higher for this mortgage loan type than for others.

There are two types of construction loans construction-to-permanent loans and construction-only loans.

All Loans Arent Created Equal If You Need To Borrow Money First Youll Want To Decide Which Type Of Loan Is Right For Your Situation

As you begin comparing loans, youll find that your credit is often an important factor. It helps determine your approval and loan terms, including interest rate.

To help you get started, well review eight types of loans and their advantages. Well also discuss things you should watch out for as you make your decision.

Recommended Reading: Is It Worth It To Recast A Mortgage

Things To Watch Out For

FHA loans can be more expensive than other types of home loans because the cost of the federal governments guarantee is passed on to you. The FHA requires you to pay for mortgage insurance on all loans through its program. This is paid in two ways an upfront payment made as part of the closing costs and a monthly insurance premium.

The upfront mortgage premium is 1.75% of the loan amount . The monthly premium is typically 0.85% of the loan per year, or $1,700 annually for a mortgage of $200,000. Unlike with conventional loans, youll have to go through a complicated process to cancel mortgage insurance on an FHA loan.

Different Types Of Fha Mortgage Loans

FHA loans remain one of the most popular loan programs available today for first-time home buyers and move-up buyers alike.

Today we are going to discuss the latest requirements for FHA loans. This post will cover different types of FHA mortgage loan programs like standard FHA purchase loan, FHA 203 , FHA streamline refinance, FHA cash-out refinance.

Recommended Reading: How To Sell A Mobile Home With A Mortgage

Still Confused Talk To A Loan Officer

The calculations above are really just ballpark estimates. To really know the percentage of your income that should go toward your mortgage, you also have to factor in how much debt you have and what your goals are. For example, if youre looking to start a family, you might need to put away more money for diapers, childcare and tuition savings than youre currently considering.

At Movement Mortgage, well discuss your particular citation and look at everything including your liquid assets and credit score in order to pre-approve you for a loan you can handle.

Do You Have To Pay Back The Stafford Loan

Yes, you are required to repay your Stafford loan, plus interest. You can make payments on your Stafford Loan while you are in school, and you will have a grace period of six months after you graduate or leave school before you are required to begin making payments. There are a variety of repayment options available for Stafford Loans, including standard, extended, graduated, and income-based repayment plans. Your monthly payment will be based on the repayment plan you choose, as well as the amount you borrowed and the interest rate on your loan.

Recommended Reading: What To Know Before Applying For A Mortgage

United States Department Of Agriculture Loans

Backed by the U.S. Department of Agriculture, USDA loans help low- to moderate-income buyers in designated rural and suburban areas. While it might seem to be only for farmland on the surface, USDA loans can buy primary residences for qualified applicants.

Borrowers looking to buy a home in areas designated as eligible by the USDA need to meet strict income limits. These limits are specific to the locality where youre buying a home. Buyers under the USDA program typically dont qualify for mortgages from other sources. USDA loans are available from a wide variety of local and online lenders and, in some cases, directly from the USDA itself for some low-income applicants.

The USDA doesnt set minimum credit score guidelines. Borrowers with a score of 640 or higher are said to experience a more streamlined loan process. Down payments can be as low as 0%, but, as with an FHA or conventional mortgage, buyers will have to pay PMI if they put down less than 20%.

What Should You Do If You Want To Return A Financed Vehicle In Canada

Your first step is to get in touch with your lender or dealer to see if returning your vehicle is even a possibility. Depending on your exact situation, they may be willing to work with you to come up with an arrangement to help you with your financial issues.

Lenders may be open to working with you if youve lost your job, had your work hours reduced, or can no longer work because of a health issue. In these cases, your lender may suggest an affordable repayment plan that works for both of you. If youve been making timely payments up to this point, you may be in a better position to ask for some help.

What Kind Of Financial Assistance Can Your Lender Offer?

- The lender may allow you to skip a payment or two and tack these deferred payments onto the end of the loan term to give you some relief for a short period of time.

- They may agree to extend the term to give you more time to pay the loan off and reduce the monthly payments.

These suggestions only make sense if youre experiencing temporary financial troubles. Otherwise, if your financial woes will be long-lasting, these short-term measures will be of no value. Instead, you may need to voluntarily surrender the car or take steps to sell it.

Additional Reading

You May Like: Is 4.5 A Good Mortgage Rate

How Your Mortgage Payments Are Calculated

Mortgage lenders use factors to determine your regular payment amount. When you make a mortgage payment, your money goes toward the interest and principal. The principal is the amount you borrowed from the lender to cover the cost of your home purchase. The interest is the fee you pay the lender for the loan. If you agree to optional mortgage insurance, the lender adds the insurance charges to your mortgage payment.

Refinance Your Car Loan

You may be able to refinance your car loan to help save you money. Refinancing involves taking out a new loan and replacing your old one. The new loan will ideally have a lower interest rate to help make the loan more affordable.

Or, you could refinance into a loan with a longer term to give you more time to repay the loan and keep your monthly payments lower. Keep in mind, however, that a longer loan term will likely mean youre paying more in interest overall.

Recommended Reading: Which Way Are Mortgage Rates Trending

Cons Of Conventional Loans

- Minimum FICO score of 620 or higher often required

- Higher down payment than some government loans

- Must have a debt-to-income ratio of no more than 43 percent

- Likely need to pay PMI if your down payment is less than 20 percent of the sales price

- Significant documentation required to verify income, assets, down payment and employment

Not All Mortgage Products Are Created Equal

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

Unless you can buy your home entirely in cash, finding the right property is only half the battle. The other half is choosing the best type of mortgage. Youll likely be paying back your mortgage over a long period of time, so its important to find a loan that meets your needs and budget. When you borrow money from a lender, youre making a legal agreement to repay that loan over a set amount of time .

Recommended Reading: What Would The Payment Be On A 100 000 Mortgage