Low Down Payment Insured Mortgage

Most lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages-as low as 5%. Low down payment mortgages must be insured to cover potential default of payment as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you

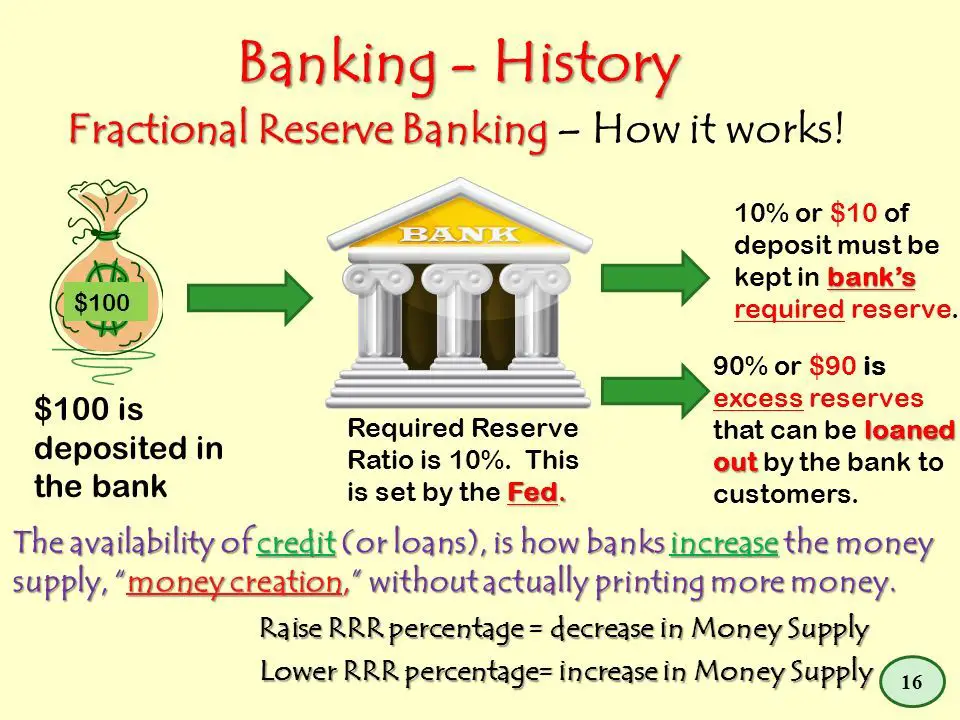

Cautions About The Money Multiplier

The money multiplier will depend on the proportion of reserves that banks are required to hold by the Federal Reserve Bank. Additionally, a bank can also choose to hold extra reserves. Banks may decide to vary how much they hold in reserves for two reasons: macroeconomic conditions and government rules. When an economy is in recession, banks are likely to hold a higher proportion of reserves because they fear that loans are less likely to be repaid when the economy is slow. The Federal Reserve may also raise or lower the required reserves held by banks as a policy move to affect the quantity of money in an economy, as Monetary Policy and Bank Regulation will discuss.

The process of how banks create money shows how the quantity of money in an economy is closely linked to the quantity of lending or credit in the economy. Indeed, all of the money in the economy, except for the original reserves, is a result of bank loans that are re-deposited and loaned out, again, and again.

Watch a video of Jem Bendell discussing The Money Myth.

Avoiding Mortgage Broker Fees

Whether you choose to use a broker or not, getting multiple mortgage quotes is likely to translate to actual savings. According to a 2018 Freddie Mac report, borrowers save an average of $3,000 over the life of the loan by getting at least five quotes from lenders.

So for borrowers who don’t have the time or ability to research loan options independently, the savings delivered by obtaining a range of estimates from a mortgage broker can help offset the broker’s fees. But if a broker’s commission comes out to more than $3,000, you may want to consider switching to someone with a different fee structure.

For example, a broker that charges a 2% rate on a $250,000 loan would receive $5,000, but a broker charging a 1% rate would only receive $2,500. Of course, this is only an average and every case will be different, but calling around to multiple brokers could mean that you’d retain more of your savings from finding the right loan. Borrowers could also elect to bypass the broker entirely.

Many online resources enable home buyers to research loan options themselves and avoid paying mortgage broker fees. Mortgages are not one-size-fits-all, and a borrower’s circumstances can help narrow their search. For example, some lenders specialize in working with first-time home buyers, while borrowers with little saved for a down payment may want to compare lenders that offer FHA loans.

Recommended Reading: Bofa Home Loan Navigator

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Saving Money With A Larger Down Payment

It’s to your advantage to put down as much money as you can because interest costs for a smaller mortgage are lower-adding up to significant savings over the long run.

The table below shows how an average homeowner can save more than $25,000 in interest costs on a $100,000 home by making a down payment of 25% versus the minimum down payment of 5%.

| Down Payment % |

|---|

Also Check: Monthly Mortgage On 1 Million

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Don’t Miss: Does Rocket Mortgage Sell Their Loans

How To Negotiate The Best Mortgage Rate

When you shop for a home loan, compare offers from different competing lenders. There isnt usually much to be gained by working over an individual loan officer and trying to beat a better deal out of him or her.

However, lenders are rarely allowed to reduce your fees slightly under certain conditions. They may be allowed to do so in order to compete with another lenders pricing, if they have a policy in place that meets guidelines established by the Consumer Financial Protection Bureau.

Second, any discount cant be taken from the loan officer commission, except to defray certain unexpected increases in estimated settlement costs.

Fortunately, these days its easy to get a fistful of quotes online without putting on your boxing gloves.

How To Get A Mortgage

Getting a mortgage can be a daunting prospect, particularly if you’re a first time buyer, but there’s lots of information available and helpful tools you can use along the way.

The first place most people start is a mortgage calculator. This helps you get a quick indication of how much you may be able to borrow and gives you an idea of what different borrowing amounts and terms might cost you.

You also need to consider a mortgage deposit at this point. You’ll need a deposit of at least 5% of the purchase price to be potentially eligible for one of our mortgages. However, the higher your deposit, the less money you will need to borrow, so you may also want consider a 90% LTV mortgage or higher

Once you’re house-hunting, or looking to remortgage, the next step is to get an Agreement in Principle. This is a personalised indication of what a bank may be able to lend to you. It can be used with sellers and estate agents to demonstrate you may be in a financial position to purchase a property.

Also Check: Rocket Mortgage Payment Options

Lenders Mortgage Insurance Explained

So what is LMI? Basically, it protects lenders in the event of borrowers defaulting on their loans. Think of a $400,000 house. If a bank lends you $360,000, and you repay $40,000 but then fall prey to financial woes and cant make your repayments, the bank is then $320,000 out of pocket. Worst case scenario, a bank may need to seize your house but they may only be able to sell it for $310,000. Theyd still be ten grand out of pocket. And, thats not even accounting for the interest they would have expected on such a loan.

Hence, . You can pay it upfront or include it as part of the loan. So, borrowing $367,000 instead of $360,000 . At this point, its important to remember that borrowing a higher amount not only means repaying that higher amount but also repaying a higher amount of interest. For example, paying interest on $367,000 at 5%, is obviously more than paying interest on $360,000 at 5%.

Now, it is possible to sidestep purchasing mortgage insurance by having someone act as a guarantor for the loan. This is basically where another person puts their property up as additional security for a loan. The most common example of this is a parent putting their property up as security for their son or daughters loan.

How Do Reverse Mortgages Work

When you have a regular mortgage, you pay the lender every month to buy your home over time. In a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. The money you get usually is tax-free. Generally, you dont have to pay back the money for as long as you live in your home. When you die, sell your home, or move out, you, your spouse, or your estate would repay the loan. Sometimes that means selling the home to get money to repay the loan.

There are three kinds of reverse mortgages: single purpose reverse mortgages offered by some state and local government agencies, as well as non-profits proprietary reverse mortgages private loans and federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages .

Also Check: 10 Year Treasury Vs Mortgage Rates

Mortgage Down Payment Options

From a low down payment mortgage to using your Registered Retirement Savings Plan as a source of funds, buying a home has never been easier.

The down payment is that portion of the purchase price you furnish yourself. The balance is obtained from a financial institution in the form of a mortgage. The amount of the down payment should be determined well before you start house hunting.

Using The Money Multiplier Formula

Using the money multiplier for the example in this text:

Step 1. In the case of Singleton Bank, for whom the reserve requirement is 10% , the money multiplier is 1 divided by .10, which is equal to 10.

Step 2. We have identified that the excess reserves are $9 million, so, using the formula we can determine the total change in the M1 money supply:

Step 3. Thus, we can say that, in this example, the total quantity of money generated in this economy after all rounds of lending are completed will be $90 million.

Read Also: Chase Recast Calculator

The Money Multiplier And A Multi

In a system with multiple banks, the initial excess reserve amount that Singleton Bank decided to lend to Hanks Auto Supply was deposited into Frist National Bank, which is free to loan out $8.1 million. If all banks loan out their excess reserves, the money supply will expand. In a multi-bank system, the amount of money that the system can create is found by using the money multiplier. The money multiplier tells us by how many times a loan will be multiplied as it is spent in the economy and then re-deposited in other banks.

Fortunately, a formula exists for calculating the total of these many rounds of lending in a banking system. The money multiplier formula is:

The money multiplier is then multiplied by the change in excess reserves to determine the total amount of M1 money supply created in the banking system. See the Work it Out feature to walk through the multiplier calculation.

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

You May Like: Can You Refinance A Mortgage Without A Job

How Much House Can I Afford

5-min read

So, youre thinking of buying your first home. Thats exciting. As you begin your house hunting adventure, do your homework and figure out how much you can comfortably afford.

Lets look at three key factors before you start shopping: your monthly mortgage payment, closing costs and ongoing expenses.

How Much Do Mortgage Brokers Make

Mortgage broker commissions vary between banks and individual brokers. However, a typical range might be 0.5% to 1.2% of your full mortgage amount. The exact percentage will also depend on the term and type of the mortgage.

For example, if your mortgage was $500,000 and your broker was paid a 1% commission, they would receive $5,000. This amount is paid by the lender, so youâll never see the bill.

Generally, lenders will pay brokers an upfront commission when a borrower signs their mortgage contract, but there are other commissions they may pay as well. There are two other common commission structures trailer and renewal fees.

Trailer fees are paid to brokers over time, for as long as the borrower stays with the lender. This will normally be paid in exchange for a lower upfront commission. These fees are intended to disincentivize brokers from recommending regular lender switching, which isnât always good for borrowers.

Renewal fees are paid to the original broker whenever a borrower renews their mortgage with a lender. While this might increase the likelihood of a broker recommending you renew with your current lender, a broker would also get paid if you were to renew with a new lender. Itâs always a good idea to compare rates at renewal time, regardless of how your broker gets paid.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Summary Of Current Mortgage Rates

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Is A Mortgage

A mortgage is a way of borrowing money to buy or refinance a property. These loans are generally repaid over relatively long periods, often 25 years or more, to spread out the large cost of buying a home.

- Mortgages are generally available from banks and other financial institutions, known as ‘lenders’. These lenders charge ‘interest’ and sometimes other fees, on top of the amount borrowed.

- The lender will also secure or guarantee the repayment of the loan, interest and fees by placing a ‘charge’ or ‘security’ on the title to property. This would allow the lender to sell the property in the event that the mortgage cannot be repaid.

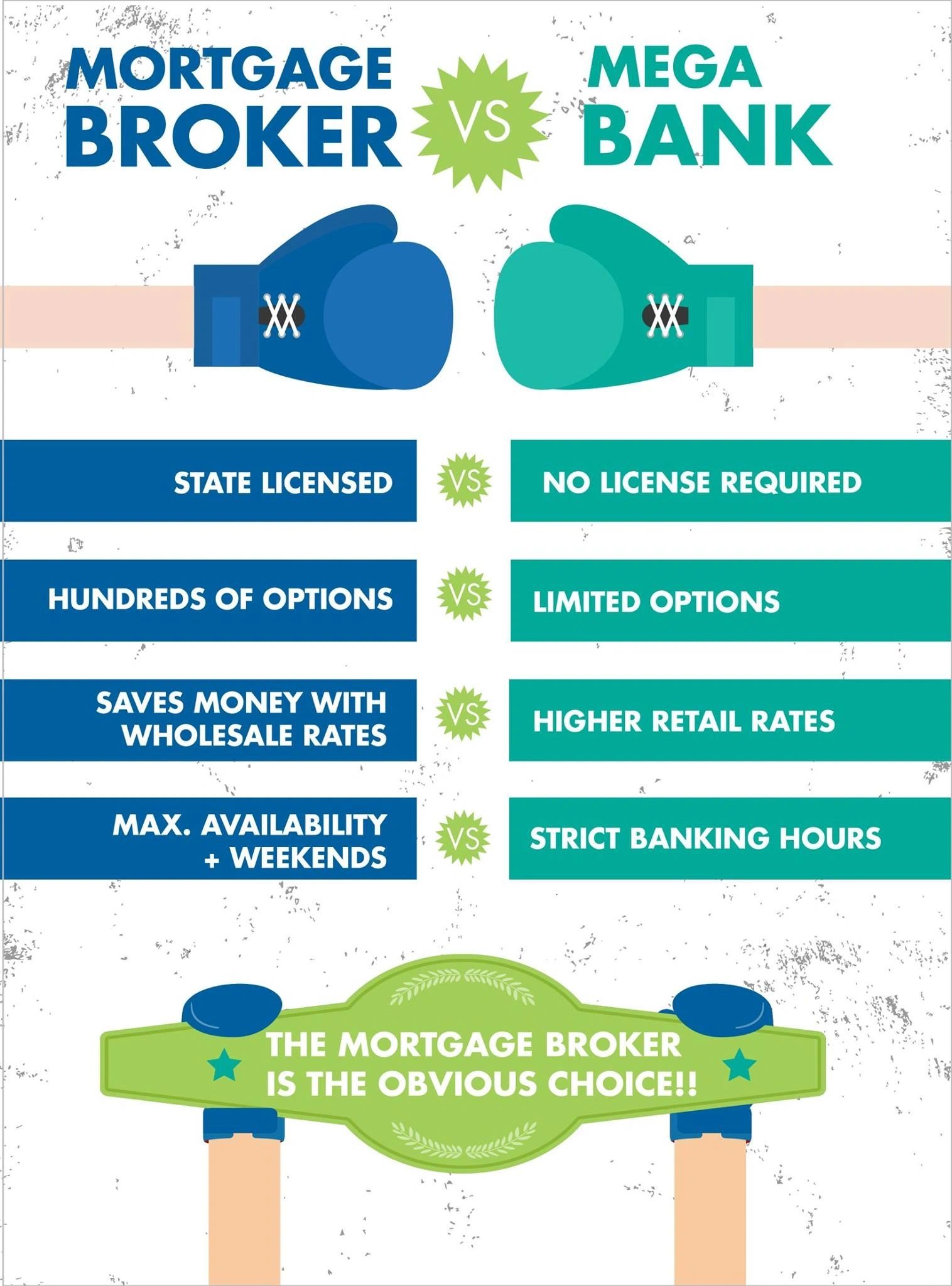

Is It Better To Get A Mortgage From A Bank Or A Broker

There are pros and cons to using both mortgage brokers and to getting a mortgage from a bank directly. Generally, we recommend you compare rates from a range of both mortgage brokers and mortgage providers, in order to get a better understanding of whatâs available to you.

Here are some of the differences between getting a mortgage through a broker vs going to a lender directly:

| Broker |

Read Also: Mortgage Rates Based On 10 Year Treasury