Compare To Other Loans

Standard loans like 30-year fixed-rate mortgages and 5-year auto loans are fully amortizing loans. With those loans, you pay down the loan balance slowly over the entire term of the loan.

With each monthly payment, a portion of the payment covers your interest costs, and the remainder goes toward reducing your loan balance. Your interest costs are at their highest in the early years, and most of the loan balance gets paid off in later years. You might even pay more in interest than you pay towards the principal in some months.

On the other hand, with a balloon mortgage, you pay mostly interest for a few years until you make a substantial payment to wipe out the remaining loan balance. Theres no gradual shift toward principal repayment.

The amount of time before your balloon is due varies, but five to seven years is a typical time frame.

Should I Consider A Balloon Loan

At the end of the day, though balloon loans arent commonplace anymore, they can be used in certain financial situations. Particularly as a seller, balloon payments can be an advantageous feature to include in a home loan. However, like any financial arrangement, this type of loan does come with its own advantages and disadvantages, so youll want to be sure to do your research before signing any legally-binding documents.

Contact Us for a Quote

How A Balloon Loan Differs From Conventional Loans

With a conventional mortgage, the loan term is the same length as the amortization schedule. Because of this, the entire mortgage gets paid off by the end of the loan.

Lets say youre making monthly payments of $1,300 for 30 years with a conventional mortgage. In the beginning, the majority of your payment will go toward interest, with the rest going toward your principal balance. Over time, as you pay down your loan balance, less of your payment will be applied to interest. Eventually, the majority of your payment will go toward principal. This is how you steadily pay down your mortgage over your loan term.

With a balloon mortgage, the loan term is shorter than the amortization schedule. A balloon mortgage offers the flexibility of low or no payments every month, but at the end of the term, the borrower has to pay the remaining loan balance in one large lump sum. So, instead of gradually paying off the loan over 15 or 30 years, you settle your balance all at once after a period of low or no payments.

Don’t Miss: 70000 Mortgage Over 30 Years

Key Takeaways For Balloon Payment

Balloon payments and mortgages have a commercial flair to them. Since it involves larger loan amounts and larger payments to be made, its not very uncommon for retail consumers to prefer to stay away from it.

With all its advantages and disadvantages, loans with balloon payments come with their own set of risks, and the same should be considered well in advance before going ahead with such a financial transaction.

Definitely, there is no question here to check whether balloon payments are good or bad, as it totally depends on the borrower and his finance obligations/requirements.

Balloon Mortgages: How They Work And If One Is Right For You

Balloon mortgages were far more common before the 2008-09 financial crisis. These days, most mortgages are 15- or 30-year loans with fixed interest rates. But balloon mortgages still exist.

In this article, we’ll take a closer look at what a balloon mortgage is, how it works, and what home buyers need to know about the pros, cons, and dangers of these loans.

Jump To

Read Also: What Does Gmfs Mortgage Stand For

Why Can Balloon Payments Be Risky

One of the most complex financial products on the market are balloon payment loans. For this reason, only eligible borrowers with stable income and significant cash on hand should use this kind of financing. Balloon payments are ideal for investors who want to free up capital or businesses that need financing immediately and have extremely reliable future cash inflows.

Unfortunately, this means that balloon loans arent ideal for the average borrower. This is because, as an average borrower, it is challenging to predict whether or not your future income will grow substantially. Instead, it is safer to take out a loan that is affordable based on your current income since it is steady and reliable.

If you like the structure of balloon payments, but cant afford it, a wise alternative is to make a bigger down payment upfront. Of course, youll need to wait until youve saved enough money to make the down payment you want. If youre not in a rush, this is an ideal option for the average borrower instead of using balloon payments.

What is a loan origination fee? Check out this article to learn more.

What Is A Balloon Payment Definition

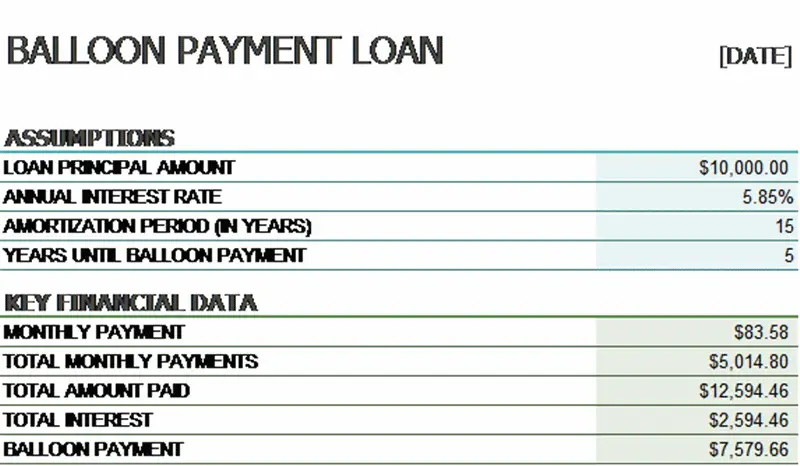

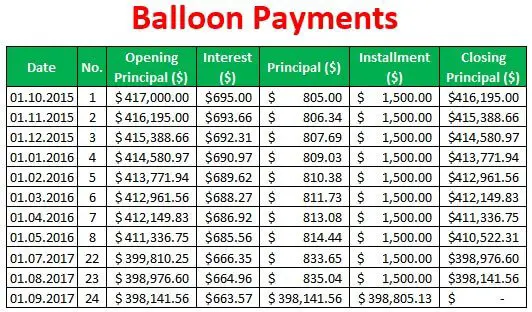

A balloon loan is a loan construction that typically has a relatively shortrepaymentterm and only a fraction of the loan’s principal balance is amortized over that period.

In other words, the fixed payments due monthly don’t cover the loan amount and the accruedinterest. Therefore, the borrower is required to make a large final payment at the end of the loan term, which refers to the balloon payment.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Borrow From Other Lenders

Another option is to investigate other funding sources. Could you qualify for a personal loan to help cover your balloon payment? Do you have friends and relatives who could loan you money. This isnt an ideal solution, but if your only alternative is defaulting on your mortgage, it could be worth considering.

Balloon Mortgages Vs Adjustable

- They are very different loan products that may both feature lower interest rates

- A balloon mortgage requires full payment at the end of a shortened loan term

- An ARM can simply adjust higher after the fixed-rate period ends

- But is still likely based on a 30-year loan term

A balloon mortgage differs from an adjustable-rate mortgage because full payment is required at the end of the shortened loan term.

With ARMs, the interest rate simply becomes adjustable after the initial fixed-rate period ends, but the loan isnt due in full immediately .

It continues to get paid down on a 30-year schedule, though mortgage payments can fluctuate up and down based on the variable interest rate.

In conclusion, be sure to compare all your options you may be surprised to find that a fixed-rate loan prices better to an ARM or a balloon mortgage, without all that risk!

Update: When the Qualified Mortgage rule was introduced by the Consumer Financial Protection Bureau , balloon mortgages were largely outlawed. That should give you an idea about what consumer advocates think about these types of loans.

Recommended Reading: Chase Recast

What To Do If You Cant Refinance

If you cant refinance, cant or wont sell your home and cant afford your balloon payment, what are your options? Your best move is probably to call your existing lender as soon as you realize that you cant cover your balloon payment. Your lender might offer to extend your existing loan for another few years before another balloon payment looms. That would give you more time to pay off some of what you owe and hopefully build positive equity in your home. You might then be able to refinance your loan.

Your lender might also allow you to refinance your loan on its own. You lender might see this as a better option than having to take your home through the foreclosure process. But what if your lender isnt willing to negotiate? Then you might face the unhappy prospect of losing your home to foreclosure.

Is A Balloon Mortgage Worth It

A mortgage with a balloon payment can help make homeownership more affordable to a borrower on a monthly basis, but it comes with huge risk.

If the borrower doesnt have enough cash to pay the balance, they could lose their home. While refinancing may avert this situation, it can be difficult to qualify. Typically to refinance, lenders look for a minimum amount of home equity, but if the balloon mortgage only required interest repayments, for example, the borrower would have little to no equity to draw from, and be left with few choices when the payment comes due.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

What You Need To Know

- A balloon mortgage lets you make low monthly payments over the life of the loan. At the end of loans term, you make one large payment for the outstanding loan balance

- Balloon mortgages come with three payment options: regular mortgage monthly payments that cover interest and principal, interest-only payments or no payments at all

- A balloon mortgage is best for borrowers who are interested in low living costs or dont plan on living in the home very long

What To Do If You Cant Afford Your Balloon Mortgage Payment

As noted, its unlikely youll be offered a balloon loan as a residential homebuyer, but it happens. If you cant afford the lump sum payment, you have two options to consider:

- Ask for an extension: Lenders may provide borrowers more time to pay back the loan, so its worth requesting an extension.

- Refinance your mortgage: You may be able to refinance your mortgage with different lending terms that dont involve a balloon payment at all, such as a conventional fixed rate mortgage or ARM.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

What Are 15 Year Balloons Used For

A 15-year balloon mortgage is a form of financing where the homeowner makes principal and interest payments for 15 years. Subsequently, at the conclusion of the 15 year term, they are required to pay the amount of money still owed. The 15 year has also become a preferred loan choice for a second mortgage in a piggyback agreement. Its become more and more common for borrowers that put less than 20% down to opt for piggyback options instead of purchasing mortgage insurance.

A piggyback can be a first mortgage for 80% of the homes value and a second mortgage for 5% to 20% of value, depending upon how much the borrower puts down as a payment. In some cases the second mortgage is an adjustable rate however an increasingly common option is the 15 year balloon.

What Is A Balloon Mortgage

A balloon payment mortgage is a short-term home loan with low monthly payments where the bulk of the loan is due at the end of the loan period.

Unlike a typical mortgage, the balance of a balloon mortgage isnt designed to fully amortize reduce to $0 through debt payments throughout the loan payment term. Instead, the borrower pays the majority of the loan off in one lump-sum payment at the end of the term.

Read Also: Rocket Mortgage Conventional Loan

Mortgages With Extra Long Terms

As you saw above, balloon loans can resemble traditional mortgages that you pay off early in a lump sum. The only way to get the monthly payments even lower is to reduce the amount of principal paid each month. Assuming you still pay some principal, the balloon mortgage still resembles a longer-term mortgage you pay off early, but it now resembles a mortgage with an unusually long term.

So why not see if you can just arrange a fully amortized mortgage with such a long term? If you can arrange a mortgage with a 40 or 50 year term, that could reduce the the monthly payment just as much as the balloon-payment arrangement.

Since a loan with this longer term will not pass the qualified-mortgage test, youll probably pay a higher interest rate than you would for a traditional 15- or 30-year mortgage. And, since the loans amortized over a longer period, youll pay more in interest even if you land the same APR.

A Balloon Payment Could Mean Low Monthly Payments

One type of mortgage loan is a balloon mortgage. Its called a balloon mortgage because theres a large, potentially very large, payment due at the end. Prior to that, monthly payments may be smaller than those for more common types of home loans. This depends on the loan term, however. Monthly payments for a 20-year balloon loan will be lower than those those for a 20-year standard mortgage, almost certainly, but balloon loan terms tend to be shorter than this, and standard mortgage terms may be longer.

So it isnt the case that every balloon mortgage will have lower monthly payments than every traditional mortgage. Still, lowering monthly payments is what motivates most borrowers to consider mortgages with balloon payments. Low monthly payments are balloon loans main selling feature.

Read Also: Chase Mortgage Recast Fee

Why Would You Get A Balloon Payment Mortgage

Lets start with the obvious reason why you would opt for a balloon mortgage. Perhaps youre in the market for a home but dont intend to stay in the property for 10-plus years. Or maybe you want to spend the next few years saving as much money as possible for your forever home.

So who would most benefit from a balloon mortgage? Well, this type of loan may cross your mind if you see yourself earning significantly more income in the future. Balloon mortgages are also viable options for borrowers expecting to receive a windfall of cash, whether its from the sale of another property or an inheritance.

Balloon Loans For Business

The balloon mortgage is used often by businesses in the construction industry as a way to obtain short-term financing for construction projects without offering collateral. In this case, they are generally short-term loans that have higher interest rates than conventional collateralized business loans.

The construction company might take out a loan for a year or 18 months and then refinance with a lower-rate mortgage, using the newly built structure as collateral.

Recommended Reading: Rocket Mortgage Qualifications

What Is A Balloon Payment And How Does It Work

A balloon payment is a lump sum paid at the end of a loan’s term that is significantly larger than all of the payments made before it. On installment loans without a balloon option, a series of fixed payments are made to pay down the loan’s balance. Balloon payments allow borrowers to reduce that fixed payment amount in exchange for making a larger payment at the end of the loan’s term. In general, these loans are good for borrowers who have excellent credit and a substantial income.

Risks Of Balloon Mortgages

The balloon mortgage can be a risky proposition.

First of all, the homeowner has little or no equity in the house and is counting on selling it or refinancing it for at least the amount of the balloon payment. In a slow or declining real estate market, that might not be possible. Even if it is, thats not a great alternative for the homeowner, who had intended to sell the house and move on.

If the real estate market goes sour, then the borrower could be in real trouble. In a worst-case scenario, the lender may or may not agree to extend the deadline on the balloon payment or otherwise change the terms of the loan.

Defaulting on a balloon mortgageas with any mortgagehas serious consequences: The home may be foreclosed upon, and the borrowers credit score will suffer a major hit.

Refinancing the loan may be difficult, too. Because the borrower has built up less equity in the home than they would have with a regular mortgage, they may seem like a less creditworthy prospect to lenders.

A balloon mortgage has its risks for lenders as well. Because that final payment is such a big amount, the odds are greater that the borrower wont be able to make it and that the lender will have to foreclose on the property. Also, because the monthly payments are lower, lenders dont get as significant a cash stream from the loan.

You May Like: Reverse Mortgage On Condo

Tips On Saving For A Home

- Before you even consider buying a home, you should know what you can afford to spend on one. SmartAssets home affordability calculator can help provide some insights to this elusive question. All you need to know to use it is your marital status, your household income, the size of your down payment, how much you pay per month towards debts and where you want to live.

- Have further financial questions? SmartAsset can help. So many people reached out to us looking for tax and long-term financial planning help, we started our own matching service to help you find a financial advisor. The SmartAdvisor matching tool can help you find a person to work with to meet your needs. First youll answer a series of questions about your situation and goals. Then the program will narrow down your options from thousands of advisors to up to three fiduciaries who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

Pros And Cons Of A Balloon Mortgage

Your balloon mortgage loan might have seemed like a good idea when you first applied for it. Maybe it meant that your monthly mortgage payments have been lower so they fit into your budget. But now your mortgage balloon payment is due and you cant afford to make it. Before you start panicking, its important to keep in mind that you do have some options.

Read Also: Does Rocket Mortgage Service Their Own Loans