About Negative Points And Fractional Points

Negative discount points are an option a lender may offer to reduce closing costs. They work just opposite of positive discount points instead of paying money to receive a lower rate, you are essentially given money in return for a higher rate.

These are often a feature of “no closing cost” mortgages, where the borrower accepts a higher rate in return for not having to pay closing costs up front. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Fractional points are commonly used by lenders to round off a rate to a standard figure, such as 4.75 percent, rather than something like 4.813 percent. Mortgage rates are typically priced in steps of one-eighth of a percent, like 4.5, 4.625, 4.75, 4.875 percent, etc., but the actual pricing is more precise than that. So lenders may charge or credit a fractional point, like 0.413 points or 1.274 points to produce a conventional figure for the mortgage rate.

How To Choose Between Points Or Credits

As with a lot of decisions during the mortgage process, the right choice depends on your personal situation. In this case, it largely depends on one of the first questions your Mortgage Expert will ask you:

How long do you intend on keeping the property that youre purchasing or refinancing?

Like a lot of financial choices, theres a break-even point at the heart of this issue. Most Americans will sell, refinance, or otherwise close within 6 years.

This can change on a case-to-case basis and choosing credits versus points depend on how long you plan on keeping the loan. If youre like most Americans and dont plan on keeping the loan for a long time, credits might make more sense. The upfront savings will outweigh any potential savings down the road. If you know that you will keep the loan for a longer period of time, points might make more sense. Your monthly payment will be higher but the long-term savings will outweigh the cost of points upfront.

Keep in mind that you can also choose the par rate, which is the lowest rate option that comes with no points. If youre unsure about your future plans this might make the most sense.

In addition to time, another factor to think about is how much cash youre comfortable paying upfront. Remember, points mean more money at closing, credits mean less.

Below are three different situations with the same loan amount, and why you might opt for points, credits, or neither with your rate.

Comparing Mortgage Loan Offers

Understanding how points work is just one important factor in your decision. Its also important to know how they work when comparing loan rates. Thats because if two lenders offer you the same interest rate but one is charging a point and the other isnt, the lender that isnt charging the point is offering a better deal.

While youre loan shopping, if two lenders offer you a fixed-rate loan of $200,000 at 4.25%, but one is charging a point for that rate, youd be paying an extra $2,000 upfront with that lender to get the same rate from the other lender for free. Thats why its so important to comparison shop carefully and understand loan terms before you decide on a lenders offer.

You May Like: Mortgage Rates Based On 10 Year Treasury

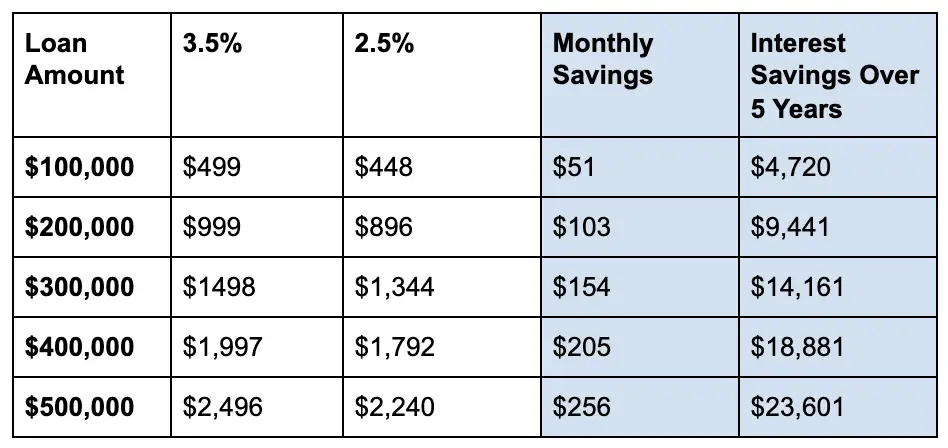

How A 1% Difference In Your Mortgage Rate Affects How Much You Pay

In this example, lets say youre looking to take out a home loan for $200,000. If you get a 30-year mortgage and you put down a 20% down payment of $40,000, youll have a $160,000 mortgage.

If you only put down 10%, youll have a $180,000 mortgage. The following table shows you how much youll pay both per month and over the life of the loan in each scenario.

| Mortgage Rate | |

|---|---|

| $912* | $148,332 |

*Payment amounts shown do not include private mortgage insurance , which may be required on loans with down payments of less than 20%. The actual monthly payment may be higher.

This calculation does also not include property taxes, which could raise the cost substantially if you live in a high-tax area.

In this example, a 1% difference in mortgage rate results in a monthly payment thats close to $100 higher. But the real difference is how much more youll pay in interest over 30 yearsmore than $33,000! And just think, if you lived in the 1980s when the highest mortgage rate was 18%, youd be paying thousands a month just in interest!

What Are Mortgage Points And How Much Do They Cost

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

One discount point costs 1% of your home loan amount. For example, if you take out a mortgage for $100,000, one point will cost you $1,000. Purchasing a point means youre prepaying the interest to have a smaller monthly payment.

Points are paid at closing, so your lender will calculate the cost of any points you agree to purchase and add those charges to your other closing costs.

You might have also heard the term mortgage origination points. This refers to the origination fees paid to your mortgage lender for the processing and assessment of your loan. Sometimes you can negotiate these charges with your loan officer, depending on your credit score and down payment.

For each discount point you buy, your interest rate will be reduced by a set percentage point. The per-point discount youll receive varies by lender, but you can generally expect to get a .25% interest rate reduction for each point you buy. Most mortgage lenders cap the number of points you can buy, and most allow you to purchase a fraction of a point. Generally, points can be purchased in increments down to eighths, or 0.125%.

If you choose not to buy mortgage points, your interest rate will remain at 4.125%. Over 30 years, without paying down the loan early, the cost of the loan, with interest, is $348,947.70.

Also Check: Rocket Mortgage Launchpad

Evenly Distributed Interest Rate Reductions

In some circumstances, a buyer may choose to purchase enough discount points to reduce their interest rate evenly over the life of the loan. By obtaining a buydown loan, the buyer pays an even larger sum upfront that prevents their interest rate and thus their monthly mortgage payments from ever increasing.

Using the same example as above, the buyer would be expected to pay a monthly mortgage payment of $2,147.29 for a zero-point loan, which is a loan without any discount points applied. If the buyer decides theyd rather buy down the mortgage and pay 4% interest throughout the loans term, their payments would look like this:

|

$2,851.50 |

Because the buyer would be lowering their interest payments for the entire life of the loan instead of just 2 or 3 years the total cost of the buydown would be higher. These buydowns usually cost around $16,000 – $20,000 and save buyers somewhere around $85,550 but they only make sense for buyers who intend to stay in the home for more than 5 years or so.

Great news! Rates are still low in 2021.

Missed your chance for historically low mortgage rates in 2020? Act now!

When Should You Pay Points On A Mortgage

Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and, in turn, your monthly payments. A single mortgage point equals 1% of your mortgage amount. So if you take out a $200,000 mortgage, a point is equal to $2,000. By doing this, youll pay more now, but youll be reducing your long-term costs. Like any financial decision, this isnt necessarily a good move for everyone, though. As you decide if paying for mortgage points makes sense for you, speak with a local financial advisor about how a home loan can affect your long-term financial plan.

Read Also: 10 Year Treasury Vs Mortgage Rates

Are There Limits On Buydowns

If youre interested in a mortgage buydown, you should consult a lender, as some restrictions apply. Buydowns are only eligible when purchasing or refinancing principal residences and second homes. Typically, buyers must qualify for the standard interest rate of the zero-point loan to be able to buy down a mortgage.

How Points And Credits Are Calculated

Points are calculated as a percentage of the total loan amount, with 1 point equal to 1%.

Every lender has a specific pricing structure, which is why different lenders offer the same rates at different prices.

At Better Mortgage, transparency is key to us, which is why points and credits are displayed in actual dollar values when you view your personalized rate options in your Better Mortgage account. Positive numbers in your points/credits column represent points , and negative numbers represent lender credits .

Also Check: Monthly Mortgage On 1 Million

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

How Much Is A Mortgage Point

One point equals 1% of your loan amount. For example, one point on a $300,000 loan would cost you $3,000. Any points you find listed on Page 2, Section A of your loan estimate or closing disclosure must buy you a lower interest rate by law, according to the Consumer Financial Protection Bureau .

Shopping for the lowest rate for the mortgage points you pay is especially important. Lenders set their own interest rate pricing structures, so make sure you collect at least three to five rate quotes to compare.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

When Discount Points Are Worth It

Katherine Alves, executive vice president of Homeowners First Mortgage, says you want to ensure that purchasing discount points will result in a financial advantage.

To do so, you need to calculate the cost versus savings over time. This is done by comparing rates with no points to a loan with points and reviewing the overall annual savings in the monthly payment, recommends Alves.

Then, you need to decide if you are going to remain in your home or the current mortgage loan long enough to recoup the costs of your discount points, she explains. This is known as the breakeven point.

Take a look at an example.

Assume a borrower named Steve purchases a home and takes out a 30year mortgage for $400,000. Hes offered a 3.25% fixed interest rate.

- If Steve purchased one discount point a $4,000 upfront cost he would save about $108 on each monthly payment

- It would take Steve 37 months to reach his breakeven point and recoup the $4,000 he paid upfront

If Steve held onto the loan over its full 30year term, he would save around $35,000 overall in interest by purchasing that single discount point, Killinger says.

Here, the assumption is that Steve will stay put in his home and not refinance or sell until more than three years have passed. In this case, paying for a discount would be well worth it.

You May Like: Reverse Mortgage On Condo

Should You Pay For Discount Points

There are two primary factors to weigh when considering whether or not to pay for discount points. The first involves the length of time that you expect to live in the house. In general, the longer you plan to stay, the bigger your savings if you purchase discount points. Consider the following example for a 30-year loan:

- On a $100,000 mortgage with an interest rate of 3%, your monthly payment for principal and interest is $421 per month.

- With the purchase of three discount points, your interest rate would be 2.75%, and your monthly payment would be $382 per month.

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

You May Like: Bofa Home Loan Navigator

Those Who Dont Plan On Owning The Home Longer Than The Recovery Period

The takeaway from the example above is that if you expect to be in the home less than 9.5 years, paying discount points to lower the rate wont make financial sense.

At least thats the case if you will need to pay the discount points yourself. If theyll be paid by the seller or by a gift from a family member, taking the discount will absolutely be worth doing.

Otherwise, it will only make sense if you expect to be in the home for longer than the recovery period.

Key Facts About Mortgage Points

The terms around buying mortgage points can vary significantly from lender to lender so consider the following carefully.

-

The lender and marketplace determine the interest rate reduction you receive for purchasing points so its never fixed.

-

Mortgage points and origination fees are not the same things. Mortgage or discount points are fees paid in addition to origination fees.

-

You can potentially receive a tax benefit from purchasing mortgage points. Make sure to contact a tax professional to learn how buying points could affect your tax situation.

-

Mortgage points for adjustable-rate mortgages usually provide a discount on the loans interest rate only during the initial fixed-rate period. Calculate the break-even point to determine if you can recoup what you paid for in points before the fixed-rate period expires.

-

Crunch the numbers if youre on the fence on whether to put a 20% down payment or buying mortgage points. If you choose to make a lower down payment, you may be required to carry private mortgage insurance so factor this additional cost because it could offset the interest savings earned from purchasing points.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Mortgage Points: What Are They And Are They Worth It

Mortgage points can lower the interest rate you pay on your mortgage loan, as well as your monthly payment.

Edited byChris JenningsUpdated October 29, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Mortgage points, also called discount points, are an option for homebuyers looking for the lowest interest rate on their loan. They offer a trade-off: Pay an extra fee at closing and get a lower rate over the course of your loan term.

Heres what you need to know about mortgage points:

How Buydowns Are Structured

Since buydowns are negotiated, they can be arranged in a variety of ways. In addition to buydowns over the life of the loan, common structures that lenders use are the 3-2-1 buydown and the 2-1 buydown. However, regardless of the structure, the principles are the same.

The buyer, seller or builder will pay the lender the difference between the standard interest rate and the lowered rate through points at closing. The buyer will benefit from the reduced interest rate until the buydown expires, usually after a few years. Not all buydowns expire. If it does, the buyer will have to pay the standard interest rate for the remainder of the term, which will cause their monthly mortgage payments to increase.

Also Check: Rocket Mortgage Vs Bank

Are Mortgage Points Worth It

Though money paid on discount points could be invested in the stock market to generate a higher return than the amount saved by paying for the points, the average homeowner’s fear of getting into a mortgage they can’t afford outweighs the potential benefit they may accrue if they managed to select the right investment. In many cases, paying off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. Though most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.