How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

Figure Out Your Numbers

Find your most recent mortgage statement and write down these numbers.

Since mortgage interest is based on your outstanding principal balance and interest rate, every month a portion of your payment goes towards paying back the principal and any accrued interest.

Remember, your current principal balance is the remaining balance of what you borrowed, while the interest rate is what your lender charges for lending you money.

Once youve gotten your loan balance down to zero, the mortgage company releases the deed of the house and youre the rightful owner!

Recommended Reading: Reverse Mortgage On Condo

Todays Mortgage Refinance Rates

Theres good news if youve been considering a refinance because the average rates for 15-year fixed and 30-year fixed refinance loans decreased. If youve been considering a 10-year refinance loan, just know average rates also went down.

Take a look at todays refinance rates:

Compare national mortgage rates from various lenders .

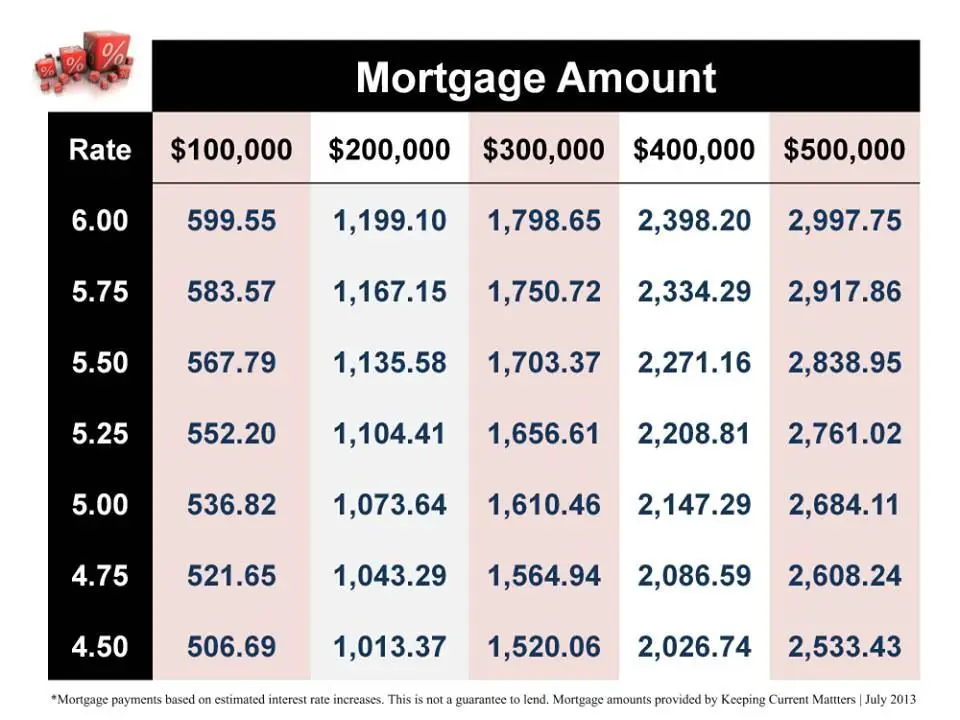

Monthly Payments On A $100000 Mortgage

At a 3% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $474.21 a month. Your payments on a 10-year mortgage might cost around $965.61 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest $555.83

Read Also: 10 Year Treasury Yield Mortgage Rates

Where Are Mortgage Rates Headed This Year

This year started off with mortgage rates surging to near prepandemic levels. A healthy economy and soaring inflation have helped to push rates up. At the same time, Omicron and the threat of other variants remain, and could mute the rise in mortgage rates in the future. The overall consensus is for rates to go up in 2022, and the decision by the Federal Reserve to reduce its bond purchases will contribute to that.

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

Recommended Reading: Requirements For Mortgage Approval

How Much Interest Do You Actually Pay Over The Life Of Your Home Loan

Interest is a major cost to factor into your home loan decisions. When repaying your home loan, not only do you have to repay the principal each month, but you also have to pay the interest charged on top of your balance.

Most borrowers have a loan term between 20 and 30 years. Even though home loan interest rates tend to be low, in comparison to credit cards and car loans, the total interest does add up over this time.

For example, on a 25 year $300,000 mortgage with a 3% interest rate, youâll pay about $126,790 in interest. That is a lot to spend on interest alone!

This is why itâs important to jump on opportunities to save money and reduce your interest rate. In this article weâll explain how interest is calculated, tell you how to pay less home loan interest, and show you how much you could save with a lower rate.

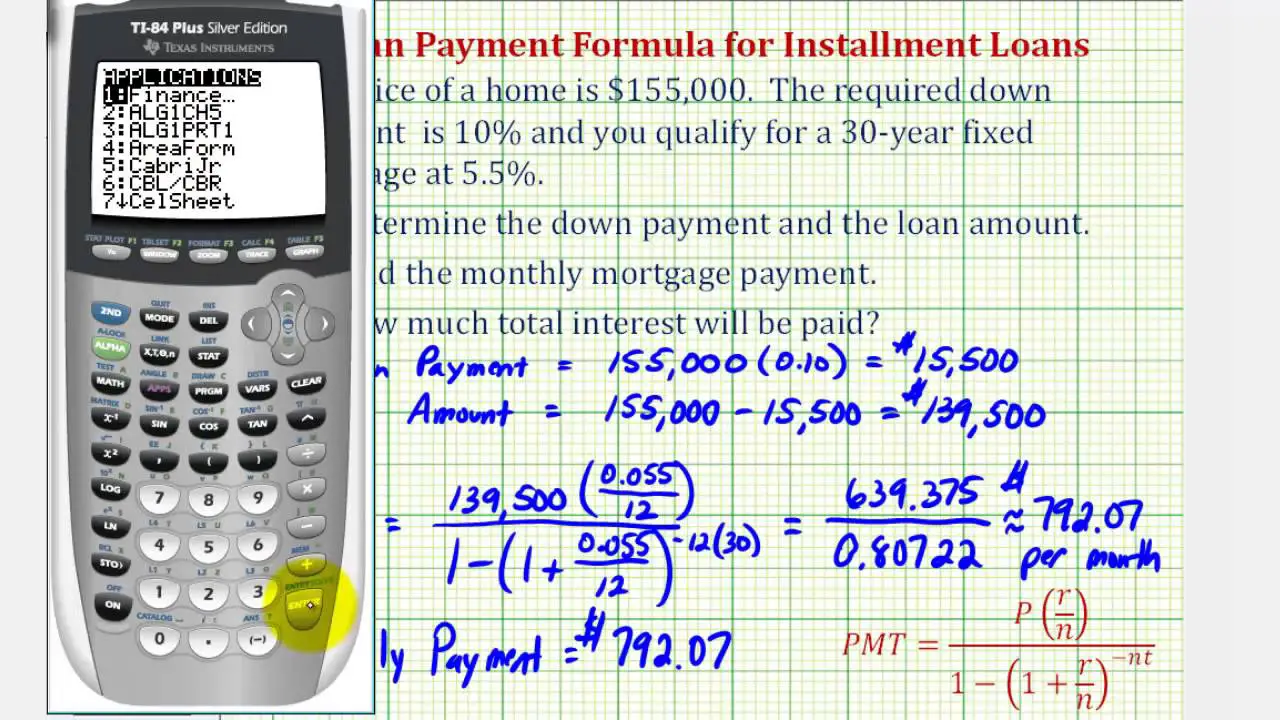

Calculate Annual Interest Amount

Lets say you took out a mortgage for $150,000 at a 4.25% interest rate for 30 years. How do you figure out how much youll pay in interest per year?

First, youre going to convert the annual interest rate percentage into a decimal interest rate. To do this divide the interest rate percentage by 100.

4.25% / 100 = 0.0425

In this example, 4.25% converts to 0.0425.

Now youre ready to calculate the annual mortgage interest amount.

Current Principal Balance x Mortgage Interest Rate = Annual Mortgage Interest Amount

This formula calculates the total interest on your mortgage per year.

Based on the example above:

- Current Principal Balance: $150,000

- Interest Rate: 4.25% or 0.0425

$150,000 x 0.0425 = $6,375 per year

In this example, youll pay $6,375 in interest for the year.

How about if your interest is 5% and you have a $350,000 loan. How much will your annual interest be then? If you calculated $17,500 a year thats correct!

- Current Principal Balance: $350,000

- Interest Rate: 5% or 0.05

$350,000 x 0.05 = $17,500 per year

Helpful Tip: Remember since the interest you pay is directly tied to the current balance, every month after making a payment, your principal goes down. That means that youll pay slightly less interest and more principal with each payment.

Read Also: Reverse Mortgage Manufactured Home

Does Owning A Home Help With Taxes

Taxes and Homeownership The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed. … Homeowners may deduct both mortgage interest and property tax payments as well as certain other expenses from their federal income tax if they itemize their deductions.

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Recommended Reading: Rocket Mortgage Conventional Loan

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

Also Check: Rocket Mortgage Requirements

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

How Much Interest Do You Pay On A $550000 Home Loan

As your loan size increases so does the total amount of interest youâll pay over your full loan term. You can see here that borrowers with a $550,000 loan amount could pay more than $450k in interest if theyâre not always on a competitive rate. That means paying over 80% of the total loan size again to your bank.

| Amount borrowed | Total interest paid over life of loan |

|---|---|

| $550,000 | |

| $453,320 |

You May Like: Monthly Mortgage On 1 Million

Which Factors Influence How Much Interest You Pay

As you can see from the maths above, the balance of your principal influences your interest, as does the annual rate you’re charged. Some home loans have what’s called a variable interest rate, which means that percentage can change based on factors such as the Reserve Bank’s cash rate. Other mortgages have one fixed rate for the life of the loan, while some people split their home loan to include both variable and fixed interest payments.The length of your mortgage will also influence the total amount of interest you’ll pay since interest is charged each year.The length of your loan affects how much you’ll pay in interest.One of the ways you can reduce the overall cost of the loan is by increasing your monthly payments above the minimum required. This can shorten the duration of the loan, meaning you will pay fewer years’ interest, and lower the interest faster by getting the balance down more rapidly.By plugging in different payment amounts on a home loan calculator, you can see the impact that adjusting your monthly instalments can have on your total interest costs. Some calculators also allow you to assess the effect of offsets, lump sum payments, extra repayments and different interest rates – all of which can affect the interest you’ll pay over the life of the mortgage. You could use this information to help you develop strategies to better manage your loan repayments and plan for mortgage refinancing if you choose to pursue this option.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

Recommended Reading: Rocket Mortgage Payment Options

What Do The Current Mortgage Rate Trends Mean For Homebuyers

As long as it makes sense for you to buy a home right now, the current mortgage rate trends shouldnt derail those plans. However, higher mortgage rates will drive up the cost of a home purchase and will impact how much house you can afford.

In 2022, the housing market is expected to moderate slightly, which is good for homebuyers. Although the market is expected to cold down a bit, it will remain strong for sellers. In general, experts believe home prices will continue to go up in 2022, but at a slower pace. And overall rates should still remain historically favorable.