The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

What Will My Home Loan Repayments Be

A Mortgage Repayment Calculator can give you all the information youll need when working out how to calculate home loan repayments, and it will do it in a way that makes sense and is easy to understand. Once you have found a loan type and kind you think may be suitable, simply enter the relevant information into the calculator below. Not only will you be able to discover what your repayments may be, but youll also find out how much overall interest you will pay over the loan term. If you have chosen principal and interest repayments a Mortgage Repayment Calculator will show you how much of each repayment will be made up of both. Youll notice at the start, your home loan repayments will be made up mostly of interest, something that will decrease over the loan term. Thats a way a bank or lender can manage risk, in case you default on your home loan.

Buy What You Can Afford

There are other considerations that you may need to take into account such as the cost of living. The cost of living varies state by state, if you buy a house, do you need to cut costs on your other expenses, such as eating out?The most important thing to remember is to buy what you can afford as costs can add up quickly. If you are not sure what kind of house you can afford, always take the conservative route and buy a house that you are 100% sure that you can afford.Every family is different, it is hard to calculate exactly how much you can afford based on your income. However, you can use our home affordability calculator to get a general sense of what kind of house you can afford.

Also Check: Chase Recast

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

How Do I Pay For Cmhc Insurance

Your lender is theparty responsible for paying CMHC insurance costs, but in the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan. This will slightly increase your monthly or bi-weekly payments. In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum. Only in a few exceptional cases will the lender pay for your mortgage insurance.

Read Also: Can I Get A Reverse Mortgage On A Condo

Sell And Split The Proceeds

If neither you or your ex-spouse has an attachment to the property or the capital to buy each other out, it’s often best to sell. That way, you can split the proceeds and enjoy a cleaner split.

Even if you don’t want to sell, if you can’t agree on how to split up the house, the court may order you to sell it. This is especially common in a community property state, where it’s the law to split everything 50/50.

An experienced real estate agent can help you and your ex-spouse get the most from your home and sell fast so you can put this chapter of your life behind you.

If selling is your best option, Clever can connect you with agents from well-known brokerages like Century 21 and Coldwell Banker. They’ll help you through every step of the sales process.

How To Figure Mortgage Interest On Your Home Loan

Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow. Her expertise has appeared in the New York Times, Washington Post, CBS Evening News, and HGTV’s House Hunters.

All homeowners should know how to figure mortgage interest. Whether you are financing the purchase of a home or refinancing your existing mortgage loan with a new loan, you will prepay interest.

How much interest is prepaid will determine when you want your first regular payment to begin. Many borrowers prefer to make a mortgage payment on the first of every month. Some prefer the 15th. Sometimes, lenders will choose that payment date for you, so if you have a preference, ask.

You May Like: Does Getting Pre Approved Hurt Your Credit

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

You May Like: Will Mortgage Pre Approval Hurt Credit Score

How Is A Home Buyout Calculated In A Divorce

To buy out your exâs equity, you need to figure out how much they have.

Start by getting your home appraised with the help of a professional appraiser. This will give you a very accurate estimate of the homeâs fair market value that you and your lawyer can use in your calculations. For estimating purposes, a site like Zillow can give you a general estimate, but this won’t be exact.

Once youâve determined the value of your home, subtract the amount you owe on your mortgage from your homeâs value and divide the result by two. This will tell you how much equity each of you probably has. Letâs look at an example tomake this clearer.

| Home’s appraised value | |

| Equity for each spouse | $100,000 |

To determine how much you must pay to buy out the house, add your ex’s equity to the amount you still owe on your mortgage.

Using the same example, youâd need to pay $300,000 to buy out your exâs equity and take ownership of the house.

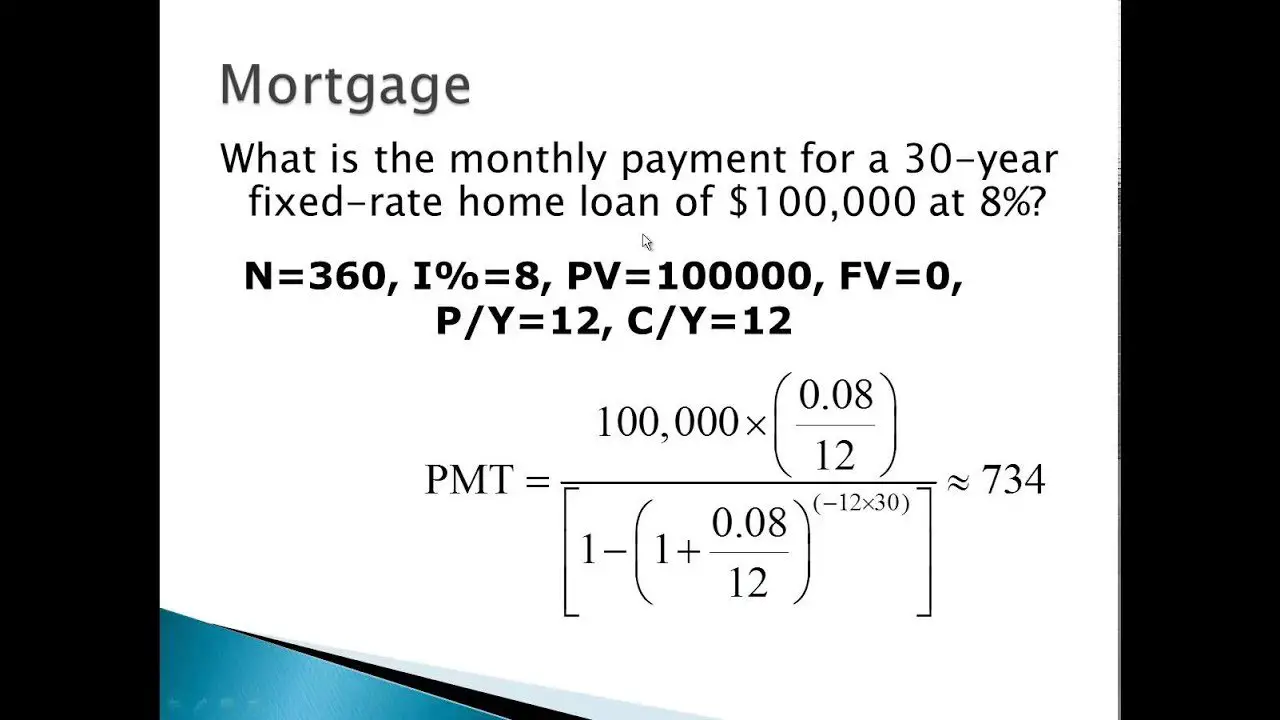

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

You May Like: Reverse Mortgage Mobile Home

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Fees And Taxes In Quebec

The land transfer tax in Quebec is a percentage of the homes purchase price or the homes value as evaluated by the municipality. Depending on the homes value, the percentage ranges from 0.5 to 1.5 percent, or 0.5 to 2.0 percent in Montreal. For more information, see Ratehub.cas Quebec Land Transfer Tax page.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Also Check: Are Discount Points Worth It

Should I Save For A 20% Down Payment

If you can afford it, making a down payment of 20% or more will allow you to avoid having to pay for mortgage default insurance, and it can give you more flexibility in your financing options.

Making a down payment of less than 20% will limit your housing options in certain cities, such asVancouvers housing marketand Toronto where the average price of a home is approaching $1 million. If you require a longer amortization period, you will also need a down payment of 20% or greater.

In addition to a down payment, there are alsoclosing costs that you will need to pay upfront. These costs, such as land transfer tax, legal fees, and moving expenses, can add up to thousands of dollars.

If you are a professional real estate investor, however, you may want to minimize your down payment in order to maximize your return. You can find the potential return of your real-estate investment using ourcap rate calculator.

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

Read Also: Does Rocket Mortgage Service Their Own Loans

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.