Comparing A $2000 Monthly Payment Frequency

| Payment Frequency | |

|---|---|

| $500 | $26,000 |

Monthly, semi-monthly, bi-weekly, and weekly all add up to the same amount paid per year, at $24,000 per year. For accelerated payments, youre paying an extra $2,000 per year, equivalent to an extra monthly mortgage payment. This extra mortgage payment will pay down your mortgage principal faster, meaning that youll be able to pay off your mortgage quicker.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Selecting between them lets you easily compare how it can affect your mortgage payment, and the amortization schedule below the Canada mortgage calculator will also reflect the payment frequency.

What Is The Monthly Payment On A $500 000 Mortgage

Monthly payments on a $500,000 mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $2,387.08 a month, while a 15-year might cost $3,698.44 a month.

How long does it take to fully pay off a home mortgage?

Some people pay off their debt over 15 years others take 30 years. There’s no right way or wrong way to pay a mortgage you just have to decide what makes the most sense for you. While the two most common mortgages are 15-year and 30-year plans, less common types are 10-year, 20-year, and 25-year mortgages.

How long does it take to pay off a 400 000 House?

Monthly payments for a $400,000 mortgage

On a $400,000 mortgage with an annual percentage rate of 3%, your monthly payment would be $1,686 for a 30-year loan and $2,762 for a 15-year one.

How much do you have to make a year to afford a $800 000 house?

For homes in the $800,000 range, which is in the medium-high range for most housing markets, DollarTimes’s calculator recommends buyers bring in $119,371 before tax, assuming a 30-year loan with a 3.25% interest rate.

What Should I Consider Before Applying For A $400000 Mortgage

Its important to fully understand the costs of a mortgage before applying for one. Before applying for a $400,000 mortgage, make sure youve figured out how much you have saved for a down payment on a home. This will help you determine what loans you may be eligible for. Different loan programs have different requirements. Also determine what payment amount fits comfortably in your monthly budget.

You can use a site like Credible to quickly gauge what mortgage interest rates you may qualify for, helping you determine how much you can afford.

As you compare loan offers from different lenders, be sure to ask about things like fees and prepayment penalties. A prepayment penalty is a fee you pay if you pay off your mortgage early, which can make it difficult to refinance down the line. Some lenders also charge an origination or underwriting fee, which can be steep.

You May Like: Chase Recast Mortgage

Join Our Newsletter To Stay Connected

Copyright 2021 Mortgage Choice Pty Ltd | ABN 57 009 161 979 | Australian Credit Licence 382869 | FinChoice Pty Limited | ABN 97 158 645 624 | AFSL 422854 | Head Office: Level 10, 100 Pacific Highway, North Sydney NSW 2060 | Mortgage Choice is owned and operated by ASX-listed REA Group Ltd

Legal disclaimer and information.

*Note: the home loan with the lowest current interest rate is not necessarily the most suitable for your circumstances, you may not qualify for that particular product, and not all products are available in all states and territories.

#The comparison rate provided is based on a loan amount of $150,000 and a term of 25 years. WARNING: This Comparison Rate applies only to the example or examples given. Different amounts and terms will result in different Comparison Rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the Comparison Rate but may influence the cost of the loan.

~Not all brokers or advisers offer the products of all lenders or solution providers.

What Mortgages Does Cmhc Insurance Not Cover

TheCMHC has eligibility requirementsthat limit the type of mortgages that can be insured.

CMHC insurance will not cover homes with a cost of $1 million or more.

Mortgages with an amortization period greater than 25 years are also not eligible for CMHC insurance.

You can still get CMHC insurance for mortgages with a down payment larger than 20%.

Don’t Miss: Chase Mortgage Recast Fee

Your Down Payment Influences The Home Price You Can Afford

Because the minimum down payment in Canada is 5%, this benchmark is used to determine your maximum affordability. Ignoring your income and debt levels, you can infer your maximum purchase price based on the size of your down payment. Because the minimum down payment is a sliding scale, the calculation depends on whether your down payment is more or less than $25,000.

If your down payment is $25,000 or less, your maximum home price would be: down payment amount / 5%. For example, if you have saved $25,000 for your down payment, the maximum home price you could afford would be $25,000 / 5% = $500,000.

If your down payment is $25,001 or more, the calculation is a bit more complex. You can find your maximum purchase price using: down payment amount – $25,000 / 10% + $500,000. For example, if you have saved $40,000 for your down payment, the maximum home price you could afford would be $40,000 – $25,000 = $15,000 / 10% = $150,000 + $500,000 = $650,000.

Naturally, as your affordability is also a function of your income and debt levels, you should visit our mortgage affordability calculator for a more detailed analysis.

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

What Can I Expect To Pay For A Mortgage On A 400000 Property

If youre wondering how much your monthly mortgage repayments would be on a £400k mortgage, unfortunately there is no one size fits all response. The cost of a £400k mortgage can vary drastically case-by-case, and lender-by-lender.

All mortgage providers have their own eligibility criteria as well as different views on how your individual circumstances affect the interest rate youre offered, and therefore how much your monthly repayments will be.

Recommended Reading: Reverse Mortgage On Condo

How Accelerated Mortgage Payments Work

Accelerated mortgage payments are the payment frequency options that will allow you to pay off your mortgage faster and save you potentially thousands in mortgage interest costs.

With accelerated bi-weekly payments, you’ll still make a payment every 14 days , which adds up to 26 bi-weekly payments in a year. The part that makes it accelerated is that instead of calculating how much an equivalent monthly mortgage payment would add up to in a year, and then simply dividing it by 26 bi-weekly payments, accelerated bi-weekly payments does the opposite.

To find your accelerated bi-weekly payment amount, you’ll divide the monthly mortgage payment by two. Note that there are 12 monthly payments in a year, but bi-weekly payments are equivalent to 13 monthly payments. By not adjusting for the extra monthly payment by taking the total annual amount of a monthly payment frequency, an accelerated bi-weekly frequency gives you an extra monthly payment every year. This pays off your mortgage faster, and shortens your amortization period.

The same calculation is used for accelerated weekly payments. To find your accelerated weekly payment amount, you’ll divide a monthly mortgage payment by four.

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

Read Also: What Does Gmfs Mortgage Stand For

What Income Do You Need For A $400k

Start here to compare mortgage rates

Coverage and rates tailored to fit your needs

Lower rates

Compare multiple quotes and choose the most economical one

Reputable providers

We work in a network of trusted providers

Owning a home is a dream for many. However, purchasing one is a complex process. From making an offer to negotiating closing costs, the financial aspects of home-buying can be frustrating for even the savviest shopper.

What We’ll Cover

However, one thing that shouldn’t feel challenging should be figuring out the income you need to qualify for a mortgage. If youre looking for a jumbo loan between $400K and $500K, read on to learn more.

How Much Is The Average Mortgage

Asked by: Bernice Leuschke

Read our editorial standards. The average mortgage payment is $1,275 on 30-year fixed mortgage, and $1,751 on a 15-year fixed mortgage. However, a more accurate measure of what the typical American spends on their mortgage each month would be a median: $1,556 in 2018, according to the US Census Bureau.

$1,487$400,000$1,275 on a 30-year fixed mortgageover $1,500 per month38 related questions found

Recommended Reading: Reverse Mortgage Manufactured Home

What Are The Typical Repayments On A 400000 Mortgage

The amount you have to pay towards your £400,000 mortgage on a monthly basis will depend on three points:

- The type of mortgage you have applied for, ie whether youve opted for a repayment or interest-only mortgage

- The interest rate thats being applied to your repayments by the bank or building society

- The length of your mortgage term 30 years on average

If you are considering an interest-only mortgage the lender will require proof of a credible repayment strategy.

There are a multitude of £400,000 mortgage calculators available on the web. These use your mortgage product type, your preferred terms and current interest rates to help you determine whether or not you can afford the fees that will be incurred on a mortgage of this size.

Our mortgage calculator will be able to give you an idea of what your monthly payments might be for a home loan of £400,000.

What Is The Minimum Down Payment Required In Canada

The minimum down payment in Canada depends on the purchase price of the home:

- If the purchase price is less than $500,000, the minimum down payment is 5%.

- If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

- If the purchase price is $1,000,000 or more, the minimum down payment is 20%.

Mortgage default insurance, commonly referred to as CMHC insurance, protects the lender in the event the borrower defaults on the mortgage. It is required on all mortgages with down payments of less than 20%, which are known as high-ratio mortgages. A conventional mortgage, on the other hand, is one where the down payment is 20% or higher.

According to a recent TD Canada Trust Home Buyers Report1, 30% of homebuyers plan to or have at least a 20% down payment, the point at which mortgage default insurance is no longer required.

Recommended Reading: Chase Recast Calculator

How Does The Interest Rate Affect The Cost Of My Mortgage

Your regular mortgage payments include both principal payments and interest payments. Having a higher interest rate will increase the amount of interest that you will pay on your mortgage. This increases your regular mortgage payments, and makes your mortgage more expensive by increasing its total cost. On the other hand, having a lower mortgage interest rate will reduce your cost of borrowing, which can save you thousands of dollars.

Fha Loan Limits In 2021

The Federal Housing Administration regulates the maximum amount of mortgage loans that can be awarded to potential homebuyers. These loans are based on the median price of homes in specific counties and cities, with maximum loan amounts set at 115% of area median house prices.

In 2021, these loan limits will reach a maximum value of $822,375 in high-cost areas. This increase is due to the rise in home values over the past year.

While the value of $822,375 represents the national loan “ceiling” or the highest loan amount that an applicant can receive, the loan “floor” or minimum possible loan has also increased to $356,362.

This means that, depending on what your salary is and where you’re looking to buy a home, you may easily qualify for a $400K or even $500K mortgage.

Because the FHA loan limits are based on the median home value in a given county or city, a jumbo loan may be well within your reach.

For more information, check out this resource about FHA Loan Limits By State to identify the FHA loan limits in your county. The information will help you make a more informed decision about choosing a home location and qualifying for a jumbo loan.

You May Like: What Information Do You Need To Prequalify For A Mortgage

How Much Income Do I Need To Afford A $400000 Mortgage

As a general rule of thumb, you want to keep your monthly mortgage payment to 28% of your gross monthly income or less. But theres some flexibility here. Most lenders evaluate whats known as a debt-to-income ratio when considering you for a mortgage.

To calculate this ratio, take all your monthly debt payments and divide it by your monthly income. The limit for many loans is 43%. Say you make $75,000 per year, or $6,250 per month. If you have a monthly car loan payment of $200, a student loan payment of $300, and youre considering a mortgage with a $2,000 monthly payment, that gives you a debt-to-income ratio of 40% .

If your payment on a $400,000 mortgage is $2,200 after your escrow payment is factored in, that means youll need an annual income of about $94,000 to keep it within 28%. But with no other debt, you may qualify with an income as low as $61,395.

As you can see, many factors determine how much you can afford to pay for a house, so its important to do your due diligence before applying for a $400,000 mortgage.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate is guaranteed to remain unchanged for the length of your mortgage term.

- A variable interest rate can change during your mortgage term. This will not affect your mortgage payment for the duration of the term, but adjusts what percentage of your payment goes to paying off the mortgage principal.

Read Also: 10 Year Treasury Vs Mortgage Rates

What Is The Upfront Mip For Fha Loans

Category: Loans 1. Up-Front Mortgage Insurance Definition Investopedia Up-front mortgage insurance is an insurance premium that is collected, typically on Federal Housing Administration loans, at the time the loan is FHA collects a one-time Up Front Mortgage Insurance Premium and an annual insurance premium which

What Is The Maximum Student Loan Amount For Lifetime

Category: Loans 1. Subsidized and Unsubsidized Loans | Federal Student Aid The $65,500 subsidized aggregate loan limit for graduate or professional students includes subsidized loans that a graduate or professional student may have $138,500 subsidized/unsubsidized total for graduate or professional students The graduate aggregate limit includes all federal loans

Read Also: How Does Rocket Mortgage Work

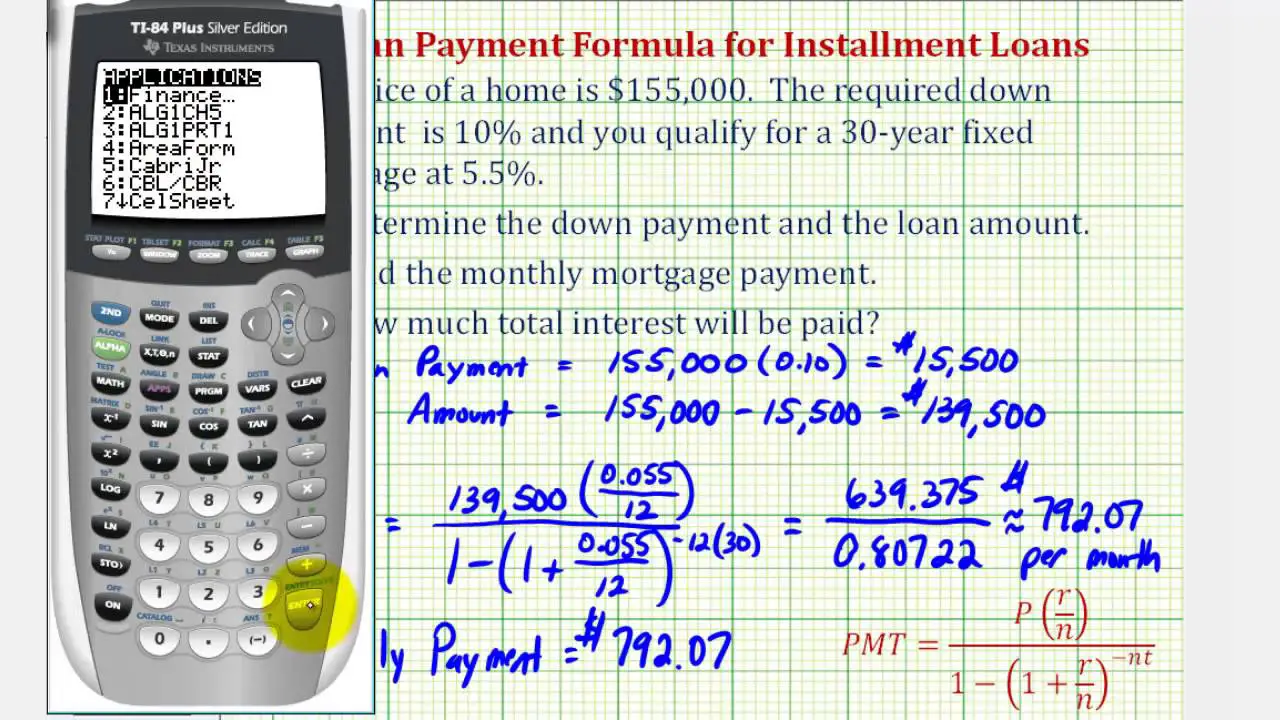

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

Can I Lower My Monthly Payment

If you want to lower your monthly payment on a $400,000 mortgage, you have several options.

- Increase your loan term. The longer your mortgage, the lower your monthly payment will be. If you have a 15-year mortgage, refinancing to a 30-year mortgage will give you considerably lower monthly payments.

- Get a better interest rate. Improving your credit score will lower the interest rate youre offered, which will decrease your monthly payment. You may also be able to reduce your interest rate by taking mortgage points.

- Get rid of PMI. If youre taking out a conventional loan, youll need to pay private mortgage insurance, or PMI, if you make a down payment of less than 20%. PMI is included in your escrow amount in your monthly payment. Once you reach 20% equity in your property, youre able to drop PMI, lowering your monthly payment. You can get there faster by making extra principal payments, refinancing, or asking your lender to reappraise your property if values have gone up.