Rates In The 2s Are Now Reality

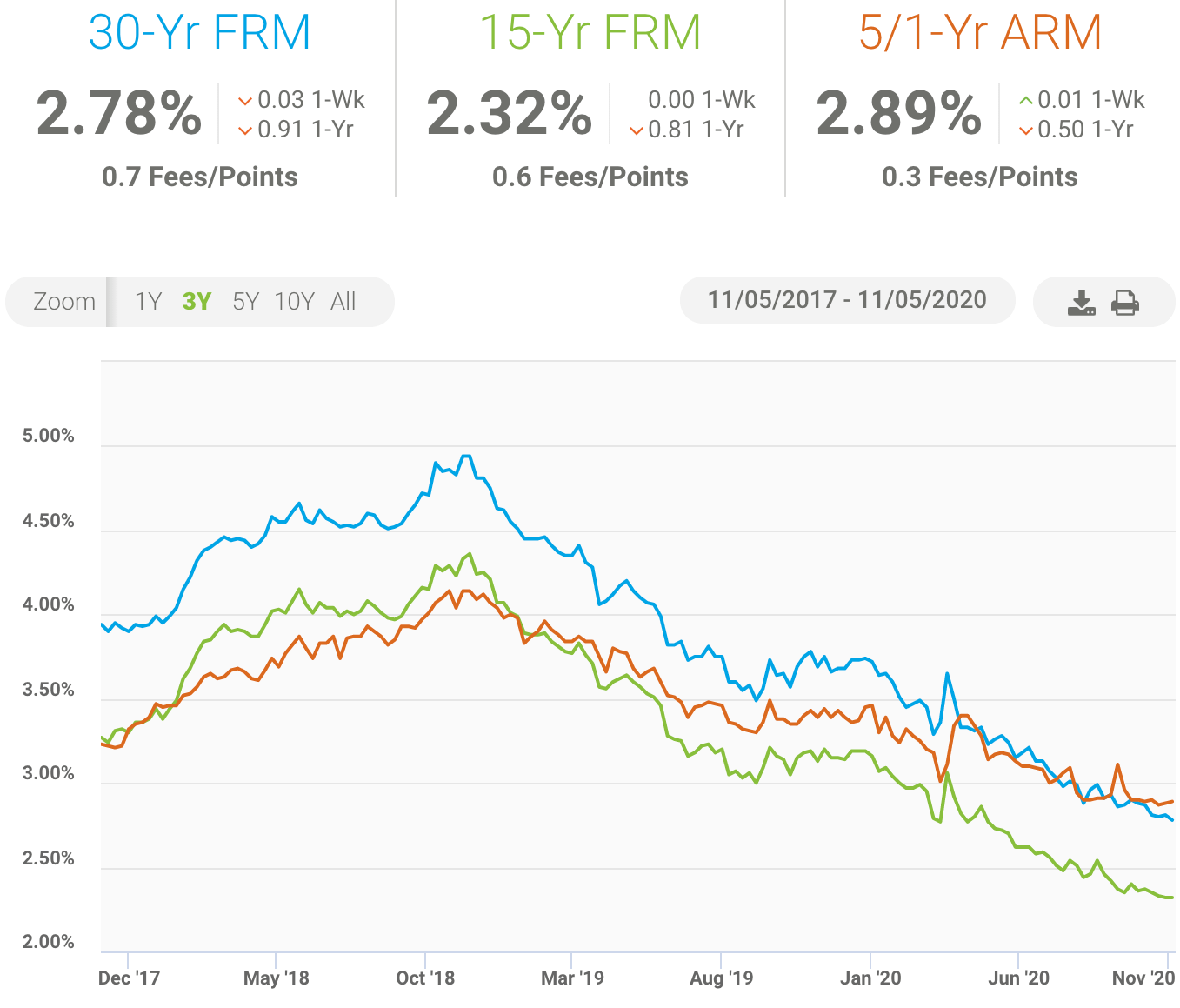

Mortgage rates in the 2s are here. And were not talking about a onetime instance of 2.99%, either.

Were talking about real, 30year, fixedrate mortgages starting at 2.5% from multiple lenders.

Of course, not everyone will find rates so low. As always, your mortgage rate depends on the strength of your application and which lenders you shop with.

For those with strong credit and a willingness to shop around, however, rates in the 2s could be a real possibility.

Comparing 5/5 Arm And 5/1 Arm Loans

A 5/1 ARM is another type of adjustable-rate mortgage. Similar to the 5/5 ARM, the mortgage rate on a 5/1 ARM is fixed for the first five years of the loan. The rate then adjusts annually thereafter, which differs from the rate adjustments on a 5/5 ARM that happens once every five years.

Both 5/5 ARMs and 5/1 ARMs have 30-year payoff schedules and rate adjustment caps. However, the two loan types have some key differences, including their initial interest rates. Lets look at an example, using LendingTrees home loan calculator. The assumptions here are a $200,000 loan with a 30-year repayment term.

| 5/1 ARM | ||

| Monthly payment | $854.03 | $790.24 |

As of this writing, the typical 5/1 ARM rate was about 3.10%, according to Freddie Macs Primary Mortgage Market Survey. A quick online search of mortgage lenders offering 5/5 ARMs had rates around or slightly below 2.5%. This 60-percentage-point difference in rates could save you more than $60 on your monthly mortgage payment during the first five years of your loan.

At What Point Does It Make Sense To Refinance

With these low rates, we recommend that you start seriously considering a refinance if your current rate is above 3.5%.

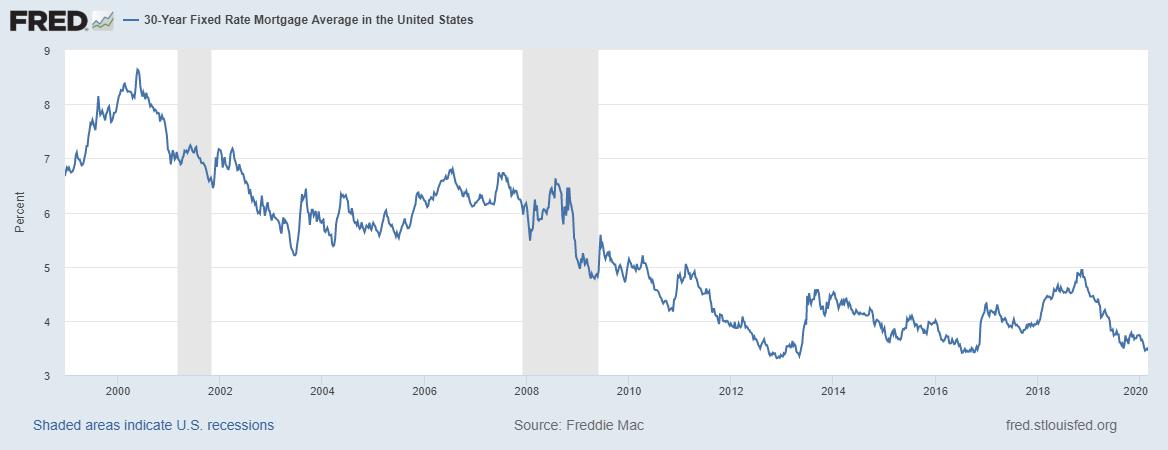

The market rates have shifted, notably, from even what they were at the beginning of 2020. As much as everyone has been introduced to new and unexpected changes over the past few months, mortgage rates have experienced tremendous downward pressure. This results in the lower mortgage rates that youre probably hearing about.

If your rate is above 3.5%, this is the point where you need someone you can trust to review your mortgage and determine if it indeed makes sense to refinance. As always, each situation is unique and, in some cases, it may not make sense to refinance upon further review.

We also encourage prospective refinancers to talk to us first. Let us help you prior to making any major moves to pay off other debt or close out accounts that may significantly affect your credit score. With our guidance, we can help you navigate the refinance process and answer any questions that you may have.

Don’t Miss: Which Is Better 30 Or 15 Year Mortgage

Bottom Line: When To Refinance A Mortgage

The best time to refinance your mortgage depends on your financial situation and what makes sense for you. Make sure refinancing is the right step to meet your needs, whether its saving money, changing your terms, or raising funds. Take the time to compare offers, lender fees, and closing costs. Calculate your break-even point. If everything lines up, refinancing your mortgage may be the right next move for you.

Looking for a mortgage refi lender? You could be paying less for your mortgage with Laurel Road. Learn more about Mortgage Refinancing with Laurel Road here.

In providing this information, neither Laurel Road nor KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Roads Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.

You Want Cash For Something Important

Want some extra cash, stat? If youve built up equity in your home and could use some extra money for other priorities, such as a long-awaited home renovation, or even an unexpected financial emergency, refinancing with a cash-out refi can help you free up some funds. With a cash-out refi, you take out a larger mortgage than your current one and keep the difference in cash. For example, if your home is worth $400,000 and you have a $200,000 balance on your current mortgage, you could take out a new mortgage for $300,000 and keep the $100,000 difference. And remember, most lenders require you to maintain at least 20 percent equity in your home in a cash-out refinance, so make sure the math works after you figure in closing costs. In the example above, you would still have 25% equity in your home.

Now that you know more about some of the different scenarios where refinancing makes sense, lets look at how the refinancing process actually works.

Recommended Reading: What Income Can Be Used To Qualify For A Mortgage

Is A 5/1 Arm Loan Right For You

Assuming market conditions with a decent spread between fixed and adjustable rates, it can make sense to get an adjustable rate mortgage, particularly if you know you plan to be out of the house by the time the rate would adjust. This is because the upfront interest rates can be lower than anything you would get for a fixed rate under normal circumstances.

If market conditions change and theres more of a difference between adjustable rates and fixed-rate mortgages, the lower rate on an ARM can help provide you financial flexibility. In addition, as we saw earlier, you can pay down quite a bit of principal by taking the payment savings in the initial years and putting it back toward the balance.

If you plan on being in your house for a long time, its probably best to take a look at a fixed-rate mortgage. This will provide you with long-term payment certainty.

/1 Arm Loan Pros And Cons

Adjustable rate mortgages have their benefits, but theyre not right for everyone. Although there is a fixed-rate portion of the loan that may make it more attractive than a truly variable-rate mortgage, its important to realize that the potential for future upward adjustment means that there is less certainty than you would get with a fixed-rate mortgage. In understanding the differences between adjustable rate and fixed-rate mortgages, it helps to take a look at the pros and cons of ARMs.

Don’t Miss: What Is Mortgage Insurance Vs Homeowners Insurance

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

Shop At A Mix Of Financial Institutions

Your finances are in order, and you know what type of loan you want. Now its time to shop around for a mortgage.

This is likely going to be the biggest purchase of your life its not a bad idea to go to two or three financial institutions, Morse says. Rates can fluctuate daily and even from hour to hour, he adds, so take that into account while shopping. You might want to shop on different days to get a mix of options.

Start with your bank or credit union, as they may offer you a better rate simply for having an existing banking relationship with them. Make sure youre also checking other credit unions, national banks, and local or regional banks.

From one lender to the next, you may see different promotional rates, fees, interest rates and offers for discount points. For example, Morse says his credit union doesnt charge an application fee, which saves about $500. Fortunately, lenders must provide you with a standard Loan Estimate, which makes it easier for you to compare loans.

Heads up: Shopping for a mortgage will add a hard inquiry to your credit reports, which may temporarily lower your scores. Try to limit your shopping to a 45-day window, as multiple credit inquiries from mortgage lenders within this time frame may be treated as just one.

Also Check: How Long After Bankruptcy Can You Get A Mortgage

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Variable Mortgage Vs Fixed: How Variable Offers More Flexibility And Lower Penalties Than Fixed

Closely related to lowering risk as seen in the last point, the lower penalties and increased flexibility built into a variable rate mortgage are a cornerstone of a variable rate.

When looking at a variable vs fixed mortgage, it should be taken into account that, especially during the first 3 years of a fixed rate mortgage, the penalty to break the mortgage can be extremely high.

As a mortgage broker for over 11 years, I have seen many individuals faced with massive interest rate differential penalties, when breaking their mortgage for any number of reasons:

- Moving

- Refinancing to pull out equity

- Switching into a lower rate

- Family changes

- Many more

This trend was especially the case in 2020 as many who are in a fixed-rate mortgage in the mid to high 2% range were faced with cost-prohibitive penalties in the $10,000s to break their higher-rate mortgage. This was not the case for those in a variable rate mortgage, and this kind of flexibility could certainly come into play in 2022-2023 as rates may threaten to increae.

While a discussion of penalty details is beyond the scope of this article, the point is that most variable rate mortgages will only ever charge 3 months interest penalty if you end up breaking the mortgage. The 3 month interest penalty is far lower often to the tune of thousands of dollars lower than comparable fixed rate mortgage penalties.

The variable rate mortgage is, in many cases, the right financial tool to help accommodate these changes.

Don’t Miss: How Do I Qualify For A Zero Down Mortgage

What Are The Pros And Cons Of Variable Rates

Variable mortgage rates expose you to changes in interest rates and, thus, in your mortgage payments. If market rates fluctuate, you will be charged the difference in interest applied to your mortgage principal. Further, if your mortgage payments are structured so you pay a fixed amount every month â with rate changes altering the interest and principal portions â then your mortgage payment schedule may also be affected.

On the other hand, variable mortgage rates have proven to be less expensive compared to fixed rates when examined historically, and they particularly make sense in falling interest rate environments.

Is 5 Years The Best Variable Term Length

Not necessarily. Variable rates are offered on mortgages of different term lengths, though generally 3 or 5 years. 5-year variable-rate mortgages typically have lower interest rates, which is obviously a big positive, but there are other factors that might make a 3-year variable rate a better option.

The 3-year term is sensible if you foresee breaking your mortgage within a few years â if you were to upgrade or sell your home, for instance. Opting for a 3-year term over a 5-year term could save you a considerable amount in penalty costs.

Another point to consider is a variable rateâs relationship to prime: if you believe discounts to prime will become more favourable in the short-term, committing to a 3-year over a 5-year mortgage rate is also a sound strategy.

You May Like: How To Remove Pmi From Your Fha Mortgage

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wonât be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

How To Qualify For The Lowest Mortgage Rate

Comparing home loan offers is a great way to get the lowest rate.

The mortgage rate youll qualify for depends on a number of factors lenders consider when assessing how likely you are to repay your home loan. Your credit score impacts your mortgage rate. And your loan-to-value ratio matters, so having a larger down payment is better for your mortgage rate.

But banks will look at your situation differently. So you can provide the same documentation to three different banks, and get offers with three different mortgage rates and fees that vary just as much.

At NextAdvisor were firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. We do not cover every offer on the market. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors.

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Well see you in your inbox soon.

Read Also: Does My Husband Have To Be On The Mortgage

What Is A 5/5 Arm

A 5/5 ARM is an adjustable-rate mortgage that has a fixed mortgage rate for the first five years of a 30-year loan term. After that, the mortgage rate becomes variable and adjusts every five years.

The rate adjustments on 5/5 ARMs are tied to a benchmark interest rate called an index, such as the LIBOR or the 1-Year Constant Maturity Treasury Index. Theres also a margin, which is a set number of percentage points that a lender adds to the index to determine your mortgage rate. For example, if the index is 2.5% and the margin is 2%, your rate at that time would be 4.5%.

Like most adjustable-rate mortgages, 5/5 ARMs may have a lifetime rate adjustment maximum. Usually, rates cant increase by more than five percentage points over the life of the loan, though the exact cap varies by lender. So, if you have a 5-year ARM with an initial 4.5% interest rate and a lifetime cap of 5%, the maximum interest rate your lender could ever charge you is 9.5%.

ARM loans also often come with adjustment caps that limit how much the interest rate can increase each time it adjusts. For example, a 5/5 ARM may have a 2% periodic adjustment cap, so if your existing rate is 4.5%, the rate cant increase to more than 6.5% at the next five-year mark.

The benchmark interest rate could also decrease, in which case your mortgage rate would also drop. If interest rates fall, youd lock in a lower rate for at least the next five years.

Timing A Fixed Rate Lock

The points mentioned so far mainly apply to the period where you are in a variable rate.

While many will choose to remain in a variable rate for the entire term, one of the fundamentals of a variable rate is the ability to lock into a fixed rate and I believe that there will be a best time to make this transition.

For example, if interest rates remain at ultra-low levels for the next two years, and then threaten to increase at this point it would be a good time to switch to a fixed rate. Why?

The idea behind timing the market is to prolong the time spent in an ultra-low rate mortgage. If you wait until rates are ready to go up then you may have provided yourself with another year or two of ultra-low rates. As of August 2021, rates are predicted to start increasing in late 2022 or early 2023.

Read Also: How Much Mortgage 200k Salary

You Want To Shorten Your Overall Term

Alternatively, if you want to pay off your mortgage sooner, you could refinance to shorten your term length. This may result in higher monthly payments, but itll help you meet your goal of home ownership sooner. You could also increase your monthly payments on your existing mortgage but if you do, contact your mortgage servicer to make sure your extra payments are applied correctly. Also, check your mortgage terms to see if you might incur any penalties if you end up of paying off your mortgage early.