Some Basic Rules Of Thumb To Live By

While there is certainly this debate about paying off the mortgage vs. investing I do think there are some rules of thumb that I try to live by.

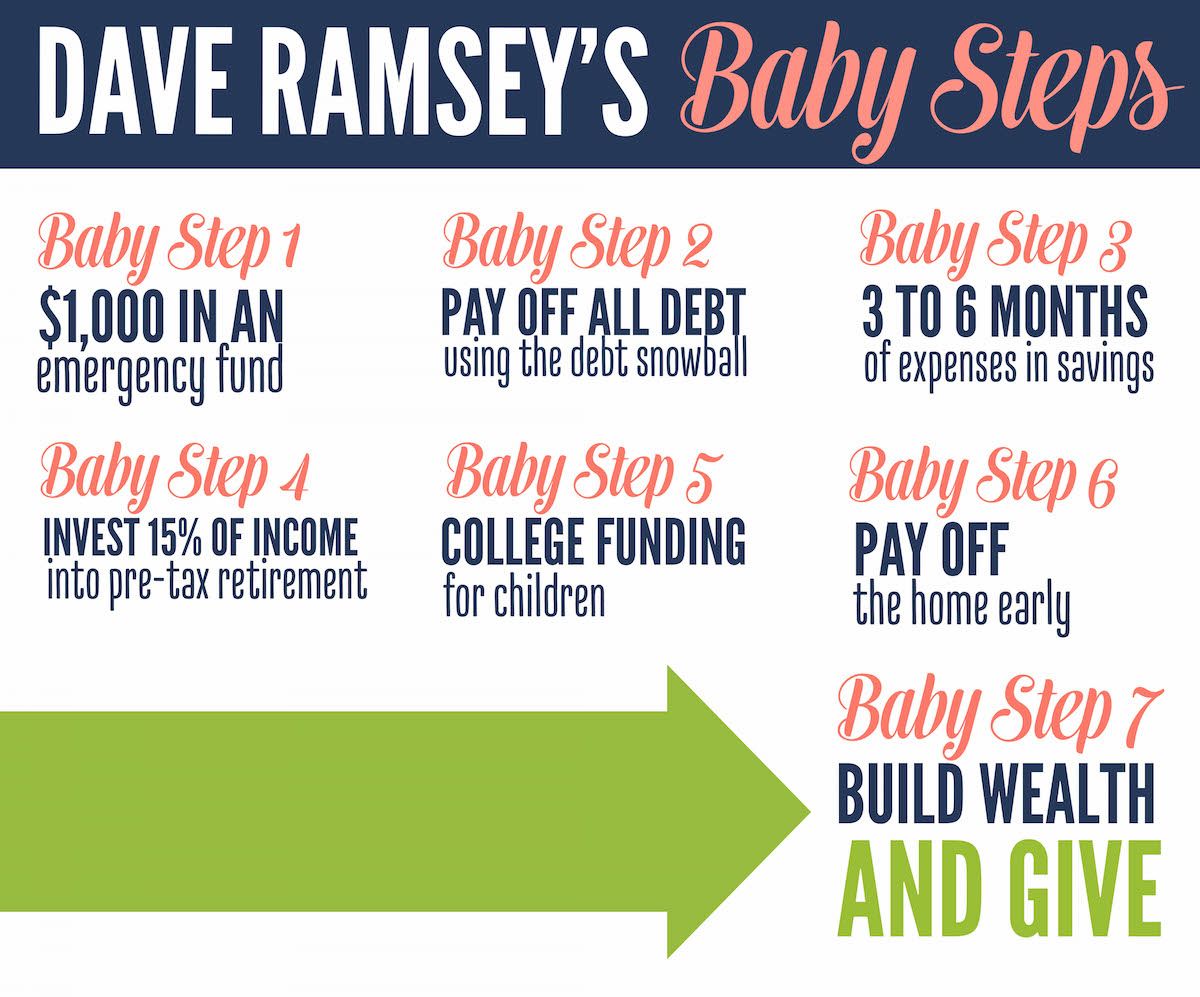

First, pay off your debt before you retire. Even though I dont pay a lot of extra money on our mortgage I do believe in having ALL of your debt paid off before you retire. It will just provide your peace of mind as you move into your retirement years.

Second, save at least 15% of your income no matter what. If there is a choice between saving for retirement, saving for a house, and/or paying off the mortgage I will always err on the side of saving for retirement. Your house is an illiquid asset and unless you sell it it wont help you much in retirement if you dont have any savings. So if I have to choose I would dedicate myself to saving more for retirement, even if that means I would rent rather than own a house.

Third, dont buy more house than you can afford. I think a lot of us certainly want the dream home/McMansion that we see on TV but getting into our dream home can be a stretch for a lot of people. I would personally advise people to buy a much more modest house than try to stretch the budget to get into a bigger and better house. Buying a modest house, paying it off quickly, and then using that house to get into your dream home would probably be a better strategy.

What Does Dave Ramsey Say About Buying A House

For starters, a house payment should never cost more than 25% of your take- home pay. That includes principal, interest, property taxes, homeowners insurance and, depending on your situation, it also includes private mortgage insurance and homeowners association fees.

Here’s How Big Dave Ramsey Says Your Emergency Fund Should Be

by Christy Bieber | Updated July 17, 2021 – First published on July 4, 2021

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Should you listen to Ramsey’s advice?

Every single person experiences an emergency at some point in their life — and some may even experience them relatively often. That’s why saving money in an emergency fund is one of the best steps that you can take to reduce financial worries and lessen the likelihood of ending up in debt.

An emergency could be anything from a job loss to an unexpected car repair, and it can turn into a financial disaster if you don’t have the money saved to handle it. But how big should your emergency fund be so that you are prepared for life’s costly surprises?

The answer to that question varies, but financial guru Dave Ramsey recommends starting with $1,000 before moving on to an even bigger emergency fund. Keep reading to learn more and to see if you should listen to Ramsey’s advice.

You May Like: Chase Recast Mortgage

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

The Dave Ramsey Budget: Is It Realistic

Home> Debt Help Advice> The Dave Ramsey Budget: Is it Realistic?

Dave Ramsey, the silky voiced straight-arrow with 13 million radio listeners built an eight-figure media empire on the gospel of financial modesty rooted in self-reliance.

He preaches daily against the devil known as debt and says one of the best ways to rid yourself of this demon is to live on the Dave Ramsey budget, which he calls zero-based. Should you take Dave Ramseys advice on budgeting? Lets get a better understanding of how his system works.

Don’t Miss: Recast Mortgage Chase

Save For Your Down Payment

As you consider how much house you can afford, its crucial to think about your goals for the down payment on your home. Although Dave Ramsey says the best option is to have a 100% down payment, that isnt a feasible option for most home buyers. Therefore, its wise to save at least 10% or, if possible, 20% of your new homes cost. If you meet the 20% threshold, youll no longer be required to carry private mortgage insurance.

If you cant afford to make a large down payment, your mortgage may be affected in a few different ways:

- You may not qualify for certain types of home loans

- You will have to pay for Private Mortgage Insurance with a down payment under 20%

- Your loans interest rate may go up

You can still buy a home with a down payment of less than 20% of your homes price. However, you may end up with a higher interest rate and additional monthly costs, such as monthly mortgage insurance.

Here’s Why Warren Buffett Is Right And Dave Ramsey Is Wrong About Mortgages

by Christy Bieber | Published on Jan. 9, 2022

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The billionaire investor understands one key factor about mortgage loans that Dave Ramsey doesn’t.

Also Check: Chase Recast Calculator

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Why Do I Need A Budget

No matter what your financial situation you need a budget.

Budgeting is the financial roadmap for your life.

You need a budget:

- If you are trying to pay off credit card debt or pay off any debt for that matter!

- If you are trying to cut back on spending money.

- If your living expenses are out of control and you need a better way to manage them.

- If you need help trying to figure out how to best spend your paycheck every month.

- If you want help tracking your bills.

I could probably list another 20 reasons off the top of my head you get the picture.

Budgeting helps to ensure you reach your financial goals!

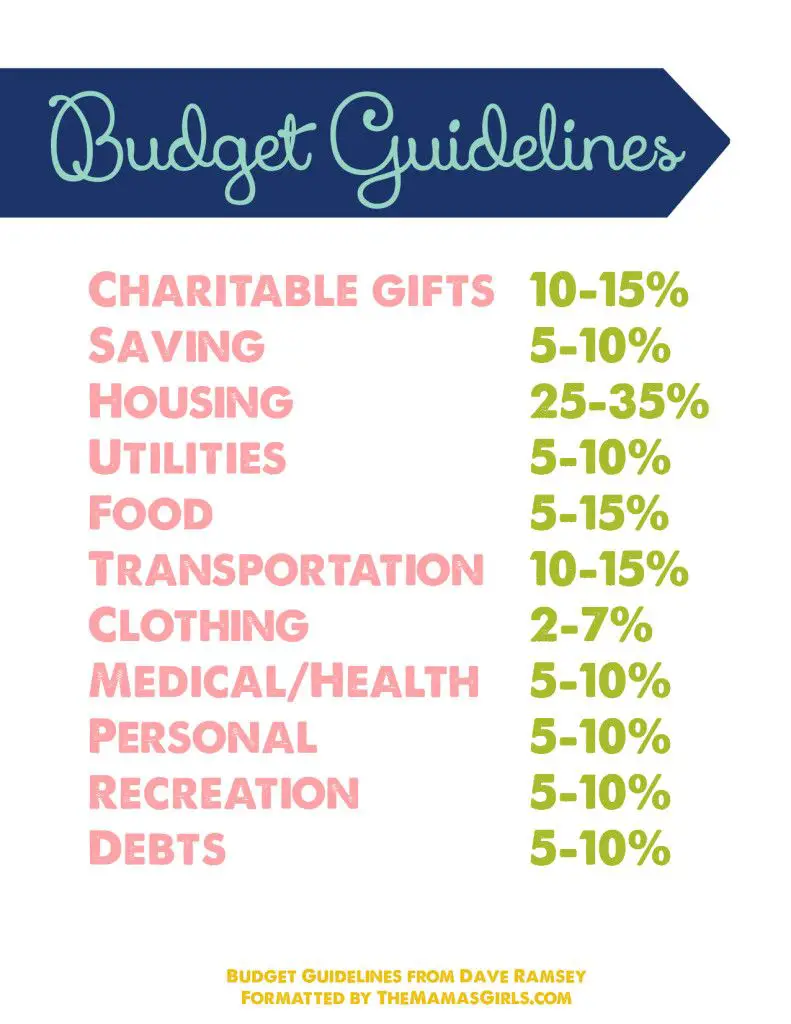

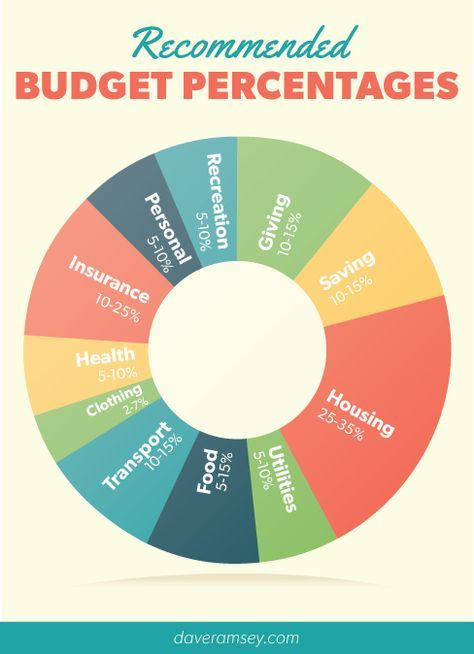

So, lets see what Dave recommends for your household budgeting percentages.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Determine Your Maximum Mortgage Payment

You will likely qualify for a mortgage that takes up as much as 43% of your gross income. However, if you go that high on your mortgage payment, you may end up feeling broke at the end of the month. And you need to make sure you account for other expenses like groceries and dining out with friends.

Financial advisors generally suggest not exceeding 28% of your monthly income when it comes to your house payment. In fact, the lower the percentage of your monthly income you can find, the better.

However, different factors provide exceptions to this rule. For example, if youre a small business owner with more disposable income than appears on paper, you may be more comfortable with a higher mortgage-to-income ratio.

More conservative advisors, like Dave Ramsey, suggest keeping your home payment, including property taxes and insurance,below 25% of your gross monthly income.

No matter what ratio you settle on, remember that you dont want to put financial pressure on yourself. Be financially wise and dont go house poor.

An example for reference: Your gross monthly household income is $10,000. If you want to have an income-to-mortgage ratio of 28%, your monthly house payment should be no more than $2,800.

How Much Should I Spend On An Engagement Ring

Financial rule of thumb: One months pay

Analysis: This advice works as a rule of thumb meaning that its widely applicable. But if your income is very low, spending the equivalent one months pay might have severe consequences on your ability to take care of your everyday expenses. You should never buy something even something as important as an engagement ring that puts your financial stability in jeopardy.

If thats the case for you, take the time to explore lower-cost options that are still meaningful. In Europe, for example, its common for even wealthy couples to have simple gold-band or silver-band rings with inscriptions on the inside, as opposed to expensive diamonds. Similarly, they often opt for less expensive gems that have a personal connection think of birth stones, or the state gem of the place where you and your loved one first met.

If youre a Dave Ramsey fan, three articles youll enjoy on The Ways to Wealth are:

Read Also: Rocket Mortgage Conventional Loan

What Happens When You Qualify For A Loan

To begin the mortgage process, youll need to meet with a lender and be prepared to provide proof of:

- Where you work

- Your assets

- How much you plan to put down on your home

Its likely your lender will approve you for more money than you should borrow. Just because you qualify for a big loan doesn’t mean you can afford it!

A good lender will clearly explain your mortgage options and answer all your questions so you feel confident in your decision. If they dont, find a new lender. A mortgage is a huge financial commitment, and you should never sign up for something you dont understand!

If youre ready to get prequalified for a mortgage loan, we recommend talking with Churchill Mortgage.

How Does Dave Ramseys View On Credit Score Affect Home Buying

Dave Ramsey, just like some other personal finance experts advocate being debt-free. However, a major demerit to being debt-free is that your credit score will eventually turn zero. But this leaves you in a situation where youll find it difficult to prove to mortgage lenders that youre creditworthy.

Rather than opting for a mortgage, Dave Ramsey suggests that you opt for Manual Underwriting. Manual Underwriting is a physical investigation of your capacity to pay off your debt. Its used to verify your capacity to handle the debt youre about to take on. Some of the information youll have to present include a history of rental payments and proof of income.

To get a mortgage via manual underwriting can be pretty tricky as you cant just visit the bank and come out with the money you need. Here are some things that youll have to come along with:

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Exceptions To The Rule

While mathematically, you are better off not paying off your mortgage early, in the real world you have to consider other factors besides math.

For example, what if you dont have the discipline to invest your money? Or, what if you invest it every month but keep cashing out to buy a new car or finance your Starbucks addiction? In that case, putting the money towards your mortgage makes sense as an investment vehicle.

Or, what if you have low risk tolerance? The reality is that while, over the long term, the stock market will go up, there is no guarantee for any particular year. If a 20% drop in the market will make it hard for you to sleep at night, then the potential reward may not be worth the risk. If you have a risk averse personality, the emotional security of having a paid-off house may be worth any lost opportunity costs.

Bottom line, you need to make the decision that is best for you. While Ive laid out the mathematical reasons why youre better off not rapidly paying down your mortgage, in the real world there are other factors to consider. The most important thing is that you think for yourself so that you can make the decision that is best for you.

**************************

If youve found this article helpful, consider joining Medium. Youll be able to read a wide variety of content from many talented authors. Its only $5 a month, making it a great value. This link will lead you to my landing pagewhere you can sign up. Thanks for the support!

Consult A Pro To Find The Right Home

Finding a home on your own takes time and energy. Instead, you choose to rely on the expertise of real estate professionals who can help you find the perfect home and negotiate the price on your behalf, so you can be confident youre getting the best deal possible.

Ramseys nationwide Endorsed Local Provider network can help you find a local real estate professional you can trust. The ELPs in the network promise to help you save time and money, so you wont have to worry about being pressured into buying a home that doesnt fit your budget.

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

S To Buying A Home That Won’t Bust Your Budget

5 Minute Read | January 06, 2022

Its easy to feel overwhelmed by all the decisions that go into buying a new home. Brand-new or existing? Cottage or McMansion? Fixer-upper or move-in ready? City or country? After all, a home is a big purchase, and you want it to be a blessing for many years to come.

But one question holds the key to home-buying success: How much home can you afford?

Lucky for you, you dont need a degree in rocket science to find the answer. You just need to know how to budget. Here are five steps to help you create your own home-buying budget.

Test To Find Out What You Can Afford

Before you buy, it is a good idea to go for a test run with the increased costs of homeownership.

One thing you can do is take 30% of your expected mortgage and interest payment and add it back on. So, if your expected mortgage and interest payment is $1,100, add $330 so that your total estimated monthly costs are $1,430.

Then, consider the difference between what you pay now for your rental and the estimated cost. If you pay $850 in rent now, it means that you will pay an extra $580. Can you afford that much house?

Lets find out with a real savings test. Next, open a high yield bank account. Put that extra $580 in the account every single month. Do this for at least four months.

Are you having difficulty making the new payment? If so, you might not be ready to purchase a home. The higher costs may exceed your ability to pay for them.

Before you buy a home, you need to make sure that you are truly ready to shoulder the costs. Otherwise, you will be house poor and will strain your monthly cash flow. You could end up in a worse position than if you continued to rent.

Recommended Reading: Reverse Mortgage For Condominiums

Can I Afford To Rent A House

Most of the time, houses are going to cost more to rent than an apartment . But if youre looking to split your rent costs by having roommates, then renting a house could be a great option. A three-bedroom house with a monthly rent of $1,900 will only run you about $630if its split three ways. Thats honestly going to be cheaper than a one-bedroom apartment in most cities.

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

Don’t Miss: Rocket Mortgage Payment Options

Dave Ramsey Retirement Calculator

How much money do you need to retire? In Daves R:IQ retirement calculator, youll describe your retirement plans and your current financial progress. Then the calculator will do some fancy math to figure out how big of a nest egg youll need. It will also break down how much you have to invest every month to make your dreams a reality.

Summary: Household Budget Percentages

We all know that personal budgeting gets a bad rap. But if you want to improve your financial situation or need money ASAP, its one of the most important things you can do.

Budgets tell your money where to go. Done right, they give you more freedom with your personal finances, not less.

Thats because they give you the power to decide ahead of time whats important for you. A good budget will help you better allocate your money towards both your short-term and long-term goals, help you identify areas where you can cut wasteful and unnecessary spending, and help ensure youre saving and investing for a stable and prosperous future.

Read Also: Mortgage Recast Calculator Chase