Remove Mortgage Insurance Payments

If you took out a conventional loan with PMI, or a government-backed FHA or USDA loan with a mortgage insurance premium , removing the insurance can lower your monthly mortgage payments.

With a conventional loan, the PMI will be automatically removed when you’re scheduled to reach 22% equitymeaning the principal balance is at 78% of the home’s original value. However, you can request to cancel PMI earlierwhen you reach 20% equity.

If you’re over 20% equity because your home’s value has increased, you may need to pay for a new appraisal and then request to cancel your PMI based on the current balance and value. Alternatively, you could refinance the loan and may qualify for a PMI-free mortgage.

For borrowers who took out an FHA loan after June 2013, the MIP will be removed after 11 years if you put at least 10% down. If you put less down with an FHA loan, or have a USDA loan, the only way to remove the MIP payments is to refinance with a different loan that doesn’t require mortgage insurance.

Apply For A Mortgage Loan Modification

If youre experiencing long-term financial hardship, then asking for a loan modification might help lower your mortgage payments. Your lender might restructure your loan by extending the loan term, reducing your interest rate, or reducing your principal balance.

Tip:

Find Out: What to Do If You Fall Behind on Mortgage Payments

Dispute Your Property Tax Bill

If your home loan includes an escrow account, property taxes may make up a noticeable chunk of your monthly mortgage payment. As a homeowner, you can appeal a tax assessment with your local, county or regional tax board. Common reasons to appeal are errors in square footage, zoning or amenities.

Consult with a tax attorney to learn the deadlines for a property tax appeal. Ask about property tax exemptions if youre a senior or have a disability, you may be eligible for one.

Recommended Reading: What Are Basis Points In Mortgage

Simple Ways To Reduce A Mortgage Payment

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Its often said that your mortgage payment should be no more than 28% of your gross monthly pay. A really conservative take is that your payment should be no more than 25% of net monthly pay.

In any case, here are suggestions to make your payments more palatable. A lower mortgage payment could mean lower blood pressure, not to mention the ability to pay down other debt, build investments, and have a healthy emergency fund.

Remove Private Mortgage Insurance

You might also be able to lower your mortgage payment without refinancing. Eliminating private mortgage insurance , which protects the lender, can help lower your monthly payments.

You might be paying PMI if your down payment was less than 20% on a conventional loan, or have an FHA loan or USDA backed loan which both require PMI throughout the life of the loan. Either way, you might be able to ditch that PMI.

Heres how to get rid of PMI:

- Conventional loan: Contact your lender. PMI should automatically fall off once you have 22% equity in your home. But you might be able to ask your lender to remove PMI when youre scheduled to hit 80% LTV. This could happen earlier than anticipated if your home value has increased substantially.

- FHA or USDA loan: Youll need to refinance into a conventional loan, then ask your lender to drop PMI when you have 20% equity .

Read On: How to Get Rid of Private Mortgage Insurance

You May Like: Is Nationwide A Good Mortgage Lender

Pay Extra On Your Mortgage

Unlike a credit card, your mortgage probably has a set monthly payment of principal and interest. Paying more than the required amount one month does not mean you will have a lower payment amount the next. However, paying extra on your mortgage each month could help you pay off your mortgage faster and eliminate monthly mortgage payments sooner. For example, paying extra principal each month could help you pay off a 30-year mortgage in 27 years and save you from needing to make 36 monthly payments.

Benefits Of Paying Mortgage Off Early

Many people struggle when deciding whether to pay off their mortgage or build up savings, but in the long run, the benefits of getting free from that mortgage really shine through. For one, having one debt paid off means being able to handle any short-term debts such as credit cards. You also end up saving money if you pay off your mortgage earlier, avoiding additional interest that would have otherwise accrued. Your financial stability is bolstered by cutting out these future payments and also by your ability to better endure turbulent housing market conditions.1

Read Also: What Experian Credit Score Do I Need For A Mortgage

Take A Mortgage Payment Holiday

During the pandemic in 2020, the government instructed lenders to grant a payment holiday of up to six months to anyone that asked for one. There were many affected by the lockdowns and the impact was far reaching meaning that people needed help with their finances. This scheme came to an end last year however, payment holidays have always been available for those that ask.

If you are keen to take a payment holiday, you need to speak to your lender and see if they will offer you this facility. Use the money that you save as a buffer for the coming months. Lenders are required to do whatever they can to help customers through difficult financial periods.

The downsides of a mortgage payment holiday are that it will show on your credit file meaning that it could impact future lending. It should only be used as a last resort and only if you are confident you will not be making any future loan or mortgage applications.

How To Lower Payments On A Mortgage For New Borrowers

New borrowers have a little more flexibility in trying to lower their mortgage payments because they still have a clean slate. Starting out strong and having a plan from the beginning will ensure that your monthly mortgage payments will never spiral out of control. Here are some things you can do as a new borrower to make sure that your EMIs stay affordable.

Recommended Reading: Do Credit Unions Give Better Mortgage Rates

How To Lower Your Monthly Mortgage Payment

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Money is tight, and youre looking for expenses to cut. Your mortgage payment is the biggest bite out of your paycheck, so that seems like a logical place to start.

Here are some options that may help you lower your monthly mortgage payment and important considerations about each one.

How to lower your mortgage payments

Seek Professional Mortgage Advice

If you arent sure which is right for you, and would like to explore all of your mortgage offers, you should take the advice of professionals. The Brookfield Finance team have access to the whole mortgage market and have years of experience in helping people find the best financial solutions to suit their needs. Contact us today on 01934 756717 to discover how we can help you.

Get in Touch

You May Like: What’s The Going Mortgage Interest Rate

Managing Your Savings And Expenses

Regardless of where you are in your journey to becoming a homeowner, Monarch Money is here to help.

Still building a down payment? Use our budgeting tool to manage and automate your savings. Already own a home? Use our platform to manage and stay on top of the many expenses associated with homeownership, from your mortgage payment to your homeowners insurance premiums, property taxes, HOA fees, and more.

Natalie Taylor, CFP®, BFA

How Biweekly Mortgage Payments Can Save You Money

With a traditional repayment plan, you’d pay once a month, meaning you’d make a total of 12 payments over the course of one year. With a biweekly repayment plan, you’d pay every two weeks, meaning you’ll end up making 26 payments over the 52 weeks in a year.

For example, lets say you have a $400,000, 30-year mortgage with a 4% interest rate. By paying monthly, you’ll pay $1,910 per month or $22,920 over one year. With a biweekly plan, you’ll pay $955 every two weeks, which totals $24,826 throughout the year.

Here’s the difference in total interest you’ll pay on that $400,000 mortgage, depending on your repayment schedule. With monthly payments, you’ll pay $287,478.03 in interest over the entire 30 years. However if you switch to biweekly payments, you’ll pay $242,371.40 in interest and will shorten your repayment period to just 26 years. Your net savings would be $43,809.11 and four years off the mortgage if you paid on biweekly.

To get started with this type of repayment plan, talk to your lender about enrolling in biweekly payments. Note that some lenders do charge borrowers to do this, so make sure you ask about any associated fees and weigh those against the potential savings. You’ll also want to check with your mortgage lender to see if they charge any prepayment fees or penalties.

Read Also: Can You Write Off Mortgage Payments

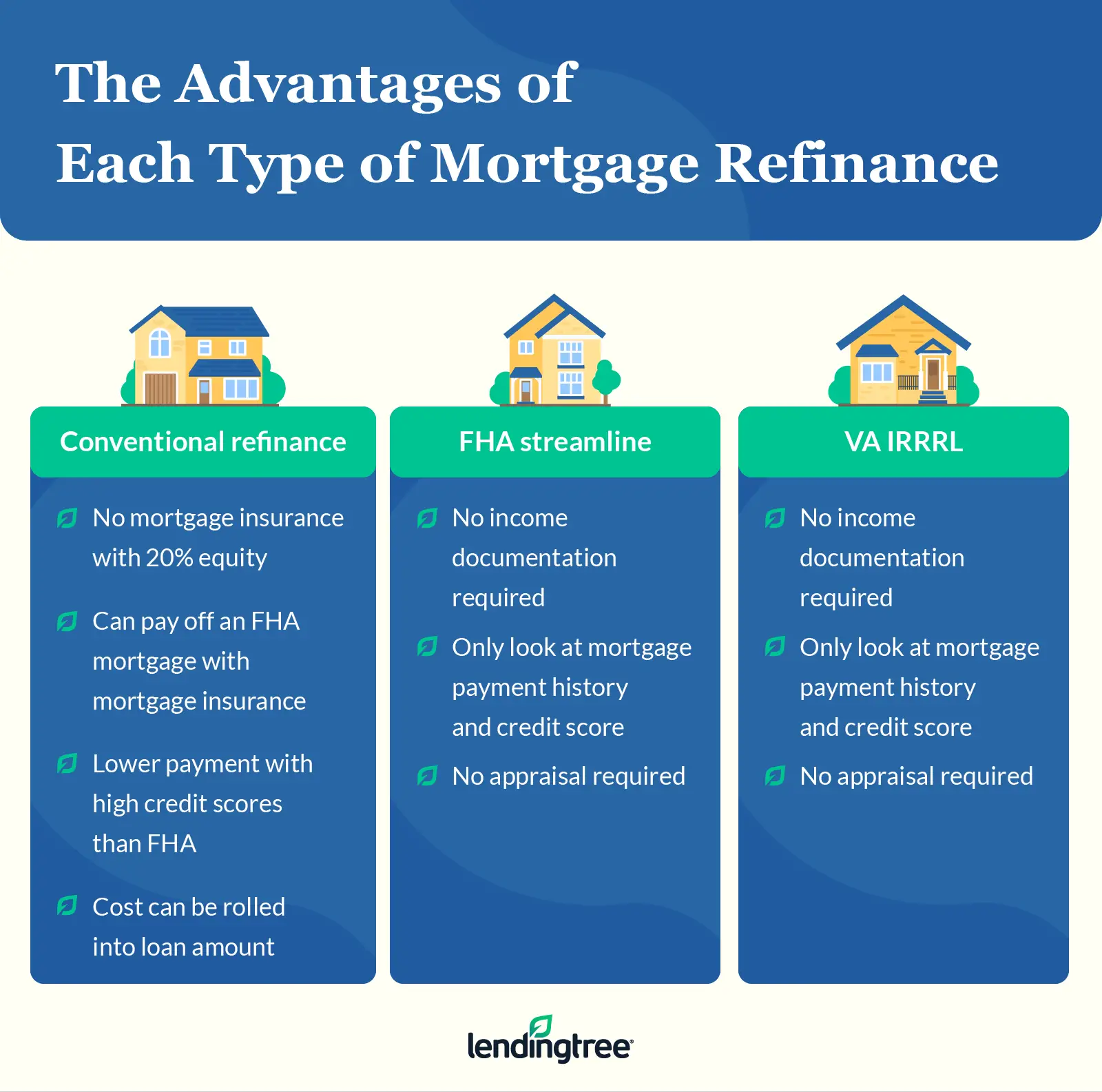

Refinance To Get Rid Of Mortgage Insurance

If you made less than a 20% down payment on a conventional loan or took out an FHA loan, youre likely paying for mortgage insurance. You could easily be paying hundreds of dollars monthly toward mortgage insurance premiums, depending on the amount you put down and your credit score when you bought your home.

The good news is you can get rid of or reduce your monthly mortgage insurance cost with these refinance tips:

Refinance your conventional mortgage. If home values in your area are on the rise and you have a conventional mortgage, you may be able to remove or at least lower your monthly private mortgage insurance premium. If you have at least 20% equity, you wont need PMI at all. Even if you dont, your mortgage premium will drop based on how much equity you have now compared to when you bought your home.

Refinance an FHA loan to a conventional mortgage. The most effective way to stop paying FHA mortgage insurance is to refinance your FHA loan to a conventional loan. However, check your credit scores first conventional mortgages require higher credit scores than FHA loans.

Refinance and pay down your principal. A little extra cash may help you pay your balance down to 80% of your homes value and avoid mortgage insurance altogether on a conventional loan.

Refinance To A Longer Loan Term

Another way to lower your mortgage payment is to refinance to a longer loan term. For example, if you have 20 years left on your mortgage and you refinance to a new 30-year mortgage, your monthly payments might go down.

However it is important to understand that doing this could increase the total amount you pay in interest over the life of your loan. Thats because you are paying back the money you own over a longer period of time. In this case, lowering your mortgage payment does not mean you are “saving money.”

If you are a current Freedom Mortgage customer, we can often help you keep your loan term the same when you refinance your home. That means we might be able to offer you a lower interest rate without adding years to the term of your new mortgage.

Also Check: When Can I Apply For A Mortgage

Extend To A Longer Term

Note that in the above example, part of the reason for the lower mortgage payment is that youve refinanced into another 30-year loan. Thats because the longer you have to repay the loan, the lower your monthly payment will be. The flip side of this is that youll pay more interest overall for the longer repayment period.

See How Bc Interest Rates Affect Total Cost

Plug a few different interest rates into the calculator and youll quickly see how a few percentage points can have a huge impact on a borrowers mortgage costs.

BC mortgage rates have been on the rise lately, and are expected to keep climbing. Inflation is still more than three times the 2 percent rate the Bank of Canada is targeting, so theyll almost certainly be hiking the overnight rate again before the years out. Theres a high probability that the next rate decision, planned for December 2022, will boost variable rates by at least another 0.5 percent.

Some analysts expect national variable mortgage rates to increase to 5.55% before the end of 2022, and fixed rates to hit 5.30%. Factoring in the mortgage stress test, that could mean qualifying at a rate in excess of 7%, which is going to be a stretch for many homebuyers in many markets. If buyers can lock in at a lower rate, they should strongly consider it.

Recommended Reading: How 10 Year Treasury Affect Mortgage Rates

Shop For A New Homeowners Insurance Rate

Your mortgage payment isnt just on the loan itself, as there are often other costs included, like your homeowner’s insurance. If you have an escrow account to pay your homeowners insurance and property taxes, youll pay 1/12th of the annual insurance premium with your monthly payment.

Consider shopping around for cheaper home insurance. You may even consider doing this annually, as many insurance agents offer lower premiums to new clients to bring in more business.

Ask For A Lower Interest Rate On Your Credit Cards

A lot of people dont know that the APR that goes into calculating their interest rate is variable, which means it can change from time to time, Boothe said. However, obtaining a lower interest rate means more of your payment can be applied to principal and youll be charged less interest, helping to pay down the debt faster.

Odds of getting a lower interest rate increase if youve had your card for a while and have a great payment history and/or have seen a recent boost in your credit score.

Its important to clarify when asking for a lower interest rate whether the new rate will apply to previous and/or new purchases and note whether its promotional . A simple yet effective script is, Hi my name is X. Ive been a customer for X years and Im calling to see whether I qualify for a lower interest rate.’

Also Check: How Long To Get A Mortgage Pre Approval

Payment Reduction Refinance Plan

Why do you ask? Well, I believe as do many experts, that rates will drop quickly after inflation is under control. They are likely to drop into the fives or even the fours. When that happens, I will contact my clients and do a payment reduction refinance with no lender fees. The amount of this seller subsidy account that has not been used will be applied to your loan balance which will help lower your payments again.

If you are ready to begin your home buying process, I am here to help. Mortgages Made Easy is my moto. I will make it fast and easy for you. Most people will only need a few documents to get pre-approved. You can start your process now online or over the phone at 945-1066.

My goal is to have you join the hundreds of other buyers that I have helped and I want to make sure I provide you the best rates, the lowest fees and the best service possible so you will leave me a great . Happy House Hunting!

Richard Woodward

Your Local, 5-Star Rated Mortgage Lender

Voice/Text: 945-1066

Nexa Mortgage NMLS# 1660690

7820 Hague Ct Plano, TX 75025

Licensed by the Texas Department of Savings and Mortgage Lending Mortgage Banker Registration. Nexa Mortgage is an Equal Housing Lender. This is not an offer of credit or commitment to lend. Loans are subject to buyer and property qualifications. Rates and fees are subject to change without notice.

What Does Your Monthly Mortgage Payment Include

A mortgage payment is how you pay back your home loan. When you take out a mortgage, your lender will give you a breakdown of what will be included in your monthly mortgage payment. Generally, it comprises four key components:

- Principal: This is the original amount of money you borrow to buy a house. The principal is part of your monthly payments and paid off over the life of your loan. Once you buy a home and start making payments, you reduce your loan amount each month.

- Interest: When you take out any loan, lenders charge interest in exchange for the amount borrowed. Interest is typically expressed as a percentage of the principal, which is paid down over the loan term. Many factors go into determining interest rates, including your credit history, debt-to-income ratio, loan amount and the length of the loan.

- Taxes: When you buy a house, you must pay property taxes regardless of your location. The property tax bill youll pay is dependent on your local tax rates and the value of your property, which can change from year to year. Typically, each state has its own taxation system.

- Insurance: The last component of your mortgage payment is insurance. There are two primary types: homeowners insurance and private mortgage insurance .

Also Check: Can You Do A Reverse Mortgage While In Chapter 13