How Do Basis Points Affect Adjustable

If you have an adjustable-rate mortgage loan , also known as a floating mortgage, your interest rate is fixed during the introductory period . After the introductory period, your rate can go up or down every month, quarter, year or every few years. The rate will reset according to the terms of your loan.

Most ARMs have caps on how high or low the mortgage rate can go and how often it can change.

MoneyTermAdjustment Period

Its the period between mortgage rate changes. A 7/6 ARM has a 7-year introductory period. After the introductory period, the rate changes every 6 months.

Lets say youve found your dream home and a lender, and you take out a 5/1 ARM. A 5/1 ARM is a 30-year mortgage loan with a fixed rate for the first 5 years and an annually adjustable rate for the remaining 25 years.

Your $200,000 mortgage comes with an introductory 4.0% interest rate. For the first 5 years, your monthly mortgage payment, minus taxes, fees and insurance, will be $954.83.

After the 5-year intro period, lets say the interest rate rises by 25 basis points. Now your mortgage payment becomes $983.88. If it adjusts up 25 basis points a year after that, youll have an interest rate of 4.5% and a monthly loan payment of $1,013.37.

Should You Pay For Discount Points

There are two primary factors to weigh when considering whether or not to pay for discount points. The first involves the length of time that you expect to live in the house. In general, the longer you plan to stay, the bigger your savings if you purchase discount points. Consider the following example for a 30-year loan:

- On a $100,000 mortgage with an interest rate of 3%, your monthly payment for principal and interest is $421 per month.

- With the purchase of three discount points, your interest rate would be 2.75%, and your monthly payment would be $382 per month.

Calculate Your Payment And More

Buying mortgage points when you close can reduce the interest rate, which in turn reduces the monthly payment. But each point will cost 1 percent of your mortgage balance. This mortgage points calculator helps determine if you should pay for points or use the money to increase the down payment. Click on the “View Report” button to calculate the information.

Don’t Miss: Rocket Mortgage Qualifications

Mortgage Rates And The Federal Funds Rate

Here’s the good news. Mortgage rates are not directly tied to the federal funds rate. In other words, if your bank was offering a rate of 5% before the Fed’s rate hike, that doesn’t mean its rates will immediately shoot up to 5.5% after the announcement.

As mentioned before, the Fed has only raised rates by 0.25 percentage points up until now, but mortgage rates have risen by more than 2 percentage points over the past year. Clearly, the two don’t move in tandem 100% of the time.

Specifically, mortgage rates tend to be a bit more forward-looking, and are driven by market dynamics in addition to benchmark rates. Over long periods, mortgage rates and the federal funds rate tend to move in the same direction, but it is far from a one-to-one relationship.

How Do You Calculate Points On A Mortgage

So if your loan amount is $400,000, one mortgage point would be equal to $4,000. If they decide to charge two points, the cost would be $8,000. And so on.

If your loan amount is $100,000, its simply $1,000 per point. Its a really easy calculation. Just multiply the number of points times the loan amount.

If its one point, take a calculator and input .01 multiplied by the loan amount. If its 1.5 points, input .015 multiplied by the loan amount.

Using $300,000 as the loan amount in the above equation, wed come up with a cost of $3,000 and $4,500, respectively.

Assuming youre being charged less than a point, we have to consider basis points, which are one one-hundredth of a percentage point . Put another way, 100 basis points, or bps as theyre known, equals one percent.

For example, if youre only being charged half a point, or 50 basis points, youd calculate it by inputting 0.005 into a calculator and multiplying it by the loan amount.

Again, no basis points calculator needed here if you can manage basic math.

Using our loan amount of $100,000 example, a half point would equate to $500. If you were charged 25 basis points , itd be $250, and youd calculate it by entering 0.0025.

Dont get thrown off if the loan officer or lender uses basis points to describe what youre being charged. Its just a fancy way of saying a percentage of a point, and could actually be used to fool you.

Read Also: Rocket Mortgage Loan Requirements

Why Do We Have Basis Points

You may ask yourself why do we need to use basis points if they are the same as permyriads. Well, while these concepts are related, they are not exactly the same. The relation between a basis point and a permyriad is the same as between a percent and a percentage point. A basis point is equal to the value of a permyriad, but it is used when we speak about changes in percentage rates.

For example, let’s say that in some country the unemployment rate in 2017 was 6%. By 2018, this value had changed to 16%. You may want to say that the value has increased by 10%, but it is not quite clear whether you mean that it changed from 6% to 6.6% or from 6% to 16% .

To avoid this confusion, you can say it has increased by 1000 BPS. Then we know that you mean the second scenario, that is the increment by points, not by a percentage of a percentage. In this way, basis points help to eliminate ambiguity when talking about rate changes.

If you are confused about rate changes, take a look at our percentage of a percentage calculator or the percentage difference calculator.

How To Calculate Basis Point Conversions

To better understand the way the math works, let’s run through some quick story problems. I know that reminds you of math class. Dont worry. This wont be on the test.

Your Home Loan Expert tells you interest rates have moved up 10 basis points in the last 2 days. Whats the percent difference?

In order to convert from basis points to a percentage, you divide 10 by 100. If you dont have a calculator, just move the decimal two places to the left.

___ = 0.1%

Now lets say youre tracking the stock market and you read that the stock market is up 0.5% on the week. What would that be in terms of basis points?

In order to come to the answer, you multiply 0.5 by 100. You can also move the decimal point two places to the right.

0.5 × 100 = 50

Also Check: Bofa Home Loan Navigator

Why Do Investors And Analysts Use Bps

The main reasons investors use BPS points are:

- To describe incremental interest rate changes for securities and interest rate reporting.

- To avoid ambiguity and confusion when discussing relative and absolute interest rates, especially when the rate difference is less than 1 percent, but the amount has material importance. For example, when discussing an interest rate that has increased from 11% to 12%, some may use the absolute method stating there is a 1% increase in the interest rate, while some may use the relative method stating a 9.09% increase in in the interest rate. Using basis points eliminates this confusion by stating that there is an increase in the interest rate of 100 basis points.

Converting Basis Points To Percentage Points

Though basis points may seem complicated, converting a basis point to a percentage point is quite simple. If your lender told you that your interest rate would be decreased by 10 bps for making on-time payments, then the easiest way to convert that to a percentage point would be to divide the basis point amount by 100. In this case, 10 bps would be equal to 0.10 percent. Its an easy way to calculate the basis point change.

Conversely, if you want to determine the bps of a percentage point, then you can do so by either multiplying the percentage by 100 or simply moving the decimal point two places to the left. In this situation, .25% would equate to 25 bps.

Though a basis point may seem like a foreign term, if youve ever received a rate reduction or increase, its likely that the root of that fluctuation was based on a basis point. Next time you see a bps referenced, simply divide it by 100 and youll quickly find the percentage equivalent, allowing you to easily understand how it will impact your debt or investment.

Recommended Reading: Chase Recast Calculator

How Much Is A Mortgage Point

- Its just another way of saying 1% of the loan amount

- So for a $100,000 loan one point equals $1,000

- And for a $200,000 loan one point equals $2,000

- The higher the loan amount, the more expensive a point becomes

Wondering how mortgage points are calculated? Dont worry, its actually really easy. You dont even need a mortgage calculator! Or a so-called mortgage points calculator, whatever that is

When it comes down to it, a mortgage point is just a fancy way of saying a percentage point of the loan amount.

Essentially, when a mortgage broker or mortgage lender says theyre charging you one point, they simply mean 1% of your loan amount, whatever that might be.

Where Are Refinance Rates Headed

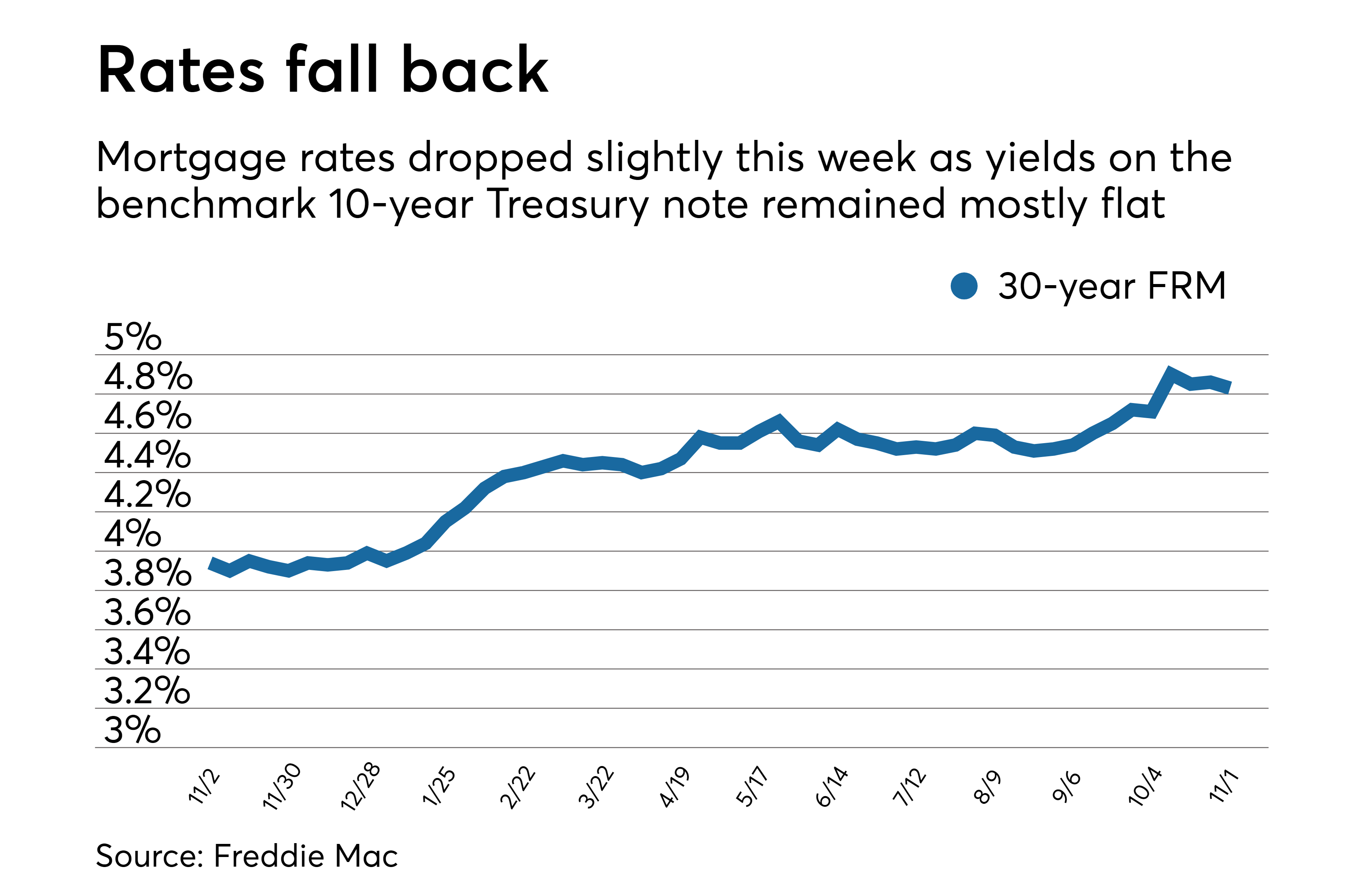

Since the beginning of the coronavirus pandemic in 2020, rates have been hovering around historic lows. But now rates are edging higher as the Federal Reserve acts to contain inflation.

Most experts predict rates will increase through 2022.

Until inflation peaks, mortgage rates wont either, says Greg McBride, CFA, Bankrate chief financial analyst.

To see where Bankrates panel of experts expect rates to go from here, check out our Rate Trend Index.

Want to see where rates are right now? See local mortgage rates.

Average mortgage ratesRecommended Reading: Can You Refinance A Mortgage Without A Job

Mortgage Rates Can Be Unpredictable

The key takeaway is that even though the Federal Reserve makes clearly-defined interest rate hikes, mortgage interest rates still move in an unpredictable manner governed by economic forces. Over time, however, the federal funds rate and the average mortgage rate tend to move in the same direction, so if the Fed continues to hike rates throughout 2022 as most experts are predicting, it could certainly put upward pressure on mortgage rates.

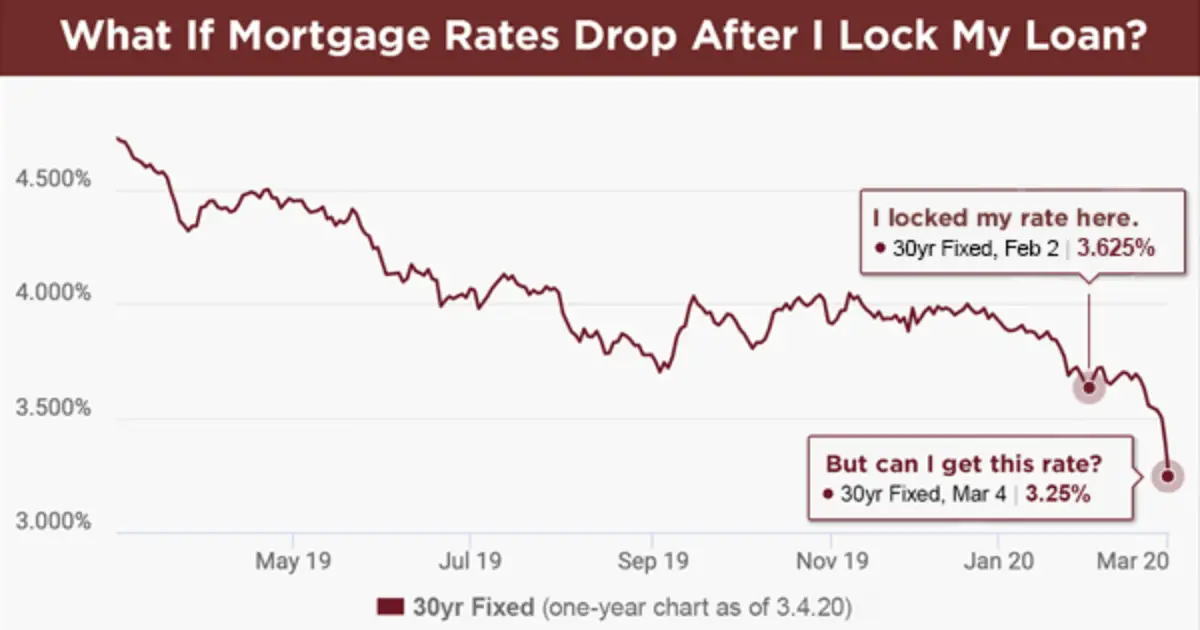

One smart move if you’re worried about Fed rate hikes making your home purchase even more expensive could be toapply for a mortgagenow and lock in your rate. Most lenders will let you lock in your rate for at least a month with no charge, and you may be able to lock yours in for several months for a modest fee, which could be well worth it for the peace of mind it brings.

Calculation Of Basis Point In Finance

Below are the examples to explain bps calculation.

Example #1

A Bank has cutdown Home loan lending rate by 25 basis point from 8.75%, so in this case, the new lending rate will be as follows:

Given:

- Rate Cut : 25

- 1 BP: 0.01%

So, Rate Cut in percentage will be

- Rate Cut = 0.01%*25

New Lending Rate will be

- New Lending Rate = 8.75% 0.25%

- New Lending Rate = 8.50 %.

Example #2

Adams purchased a short term fund that gave a return of 10% in a year on which the expense ratio is quoted as a 25 basis point. So, in this case, the net return on investment will be:

- Return from Fund = 10%

- Expense Ratio = 25 BPS = 25*0.01%= 0.25%

- Net Return from Fund= 10% -0.25% = 9.75%

Recommended Reading: Rocket Mortgage Launchpad

Mortgage Negotiation: Why Every Basis Point Counts

I just renewed our mortgage for the last time – ever.

We locked into a five year term and the house will be paid off well before it ends. Any move from here would be a downsize so it’s pretty safe to say the mortgage renewal ritual is over for me.

After 25 years of home ownership, there’s a lesson for younger homeowners that can get their homes paid off quicker and save tens of thousands of dollars: basis points really matter.

For those who don’t know, one hundred basis points equals 1 per cent. Banks talk to us about the cost of debt in percentages, but banks talks to other banks about debt in basis points.

That’s because our mortgages transcend our neighbourhood banks and enter the multi-trillion dollar global debt market where they are morphed with other mortgages and debt instruments. A difference of a few measly basis points between what lenders charge and what it costs them to borrow can translate into billions of dollars in profit.

That’s what the banker across the desk is thinking at mortgage renewal time, and that’s what you – the consumer — should be thinking too.

Negotiation basics

I took a pass and was contacted by another representative two weeks before the renewal date who, after I threatened to take my business to a mortgage broker, offered 3.09 per cent.

In this case, I was also informed that the penalty to be imposed by the bank for taking my mortgage elsewhere would outweigh any gains from a few basis points not true, but a good point. Touché.

How To Calculate Basis Points

1 basis point equals 0.01% or 1/100 of 1%, so if youre adding 25 basis points, move the decimal over to the left twice so it turns into 0.25%. Or if youre trying to figure out many BPS 0.45% is, move the decimal point over to the right twice and you get 45.

There’s also a metric around the price value of a basis point. This is intended to measure how much the price of the bond moves given a shift in interest rates. You can also use a basis point calculator to convert basis points into a percent or decimal. However, it’s also easy to do this yourself.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Should You Buy Points

If you can afford them, then the decision whether to pay points comes down to whether you will keep the mortgage past the “break-even point.”

The concept of the break-even point is simple: When the accumulated monthly savings equal the upfront fee, you’ve hit the break-even point. After that, you come out ahead. But if you sell the home or refinance the mortgage before hitting break-even, you lose money on the discount points you paid.

The break-even point varies, depending on loan size, interest rate and term. It’s usually more than just a few years. Once you guess how long you’ll live in the home, you can calculate when youll break even.

» MORE:‘Should I buy points?’ calculator

A Guide To Basis Points

Whether youre familiar with financial terminology or have never heard of the term basis point before, its a good idea to understand the basics of basis points they can affect your monthly mortgage payments. You may also want to know how they work in the context of interest rate changes when youre buying a home.

Heres what you need to know the basis point definition, how to calculate them and more.

Don’t Miss: What Does Gmfs Mortgage Stand For

Do Basis Points Affect The Mortgage Lending Process

Mortgage payments are impacted by your interest rate. If theres a 15-basis-point increase in mortgage rates, theres a corresponding rise in what your mortgage payment would be. If there is a decrease, your mortgage payment decreases.

If you would like a lower rate and you can make a lower payment in addition to your down payment, you can pay for mortgage points, which are prepaid interest. One point is equal to 1% of the loan amount, but you can buy them in increments down to 0.125 points.

On the other hand, if youre trying to lower closing costs, you can take a lender credit, which in effect is negative points. In exchange for the lender covering some of the closing cost, you pay a slightly higher rate.

How To Shop For A Mortgage

Comparing offers is critical to get the best deal on your mortgage. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher interest loan if the other aspects are favorable.

Also Check: Rocket Mortgage Vs Bank

How Mortgage Points Work

Mortgage points are used in the loan closing process and are included in closing costs. Origination points are mortgage points used to pay the lender for the creation of the loan itself whereas discount points are mortgage points used to buy down the interest rate of the mortgage.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Does Rocket Mortgage Service Their Own Loans