Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Read Also: What Is An Investment Mortgage

Don’t Forget About Other Expenses

While interest on a mortgage can be a significant expense, and finding ways to lower your rate can save a lot of money, don’t forget about the other expenses that can come with buying a home. These may include closing costs, insurance premiums, taxes and fees. Understanding all of these, along with the interest rate, can help you determine if you can afford to buy a home.

Which Factors Influence How Much Interest You Pay

As you can see from the maths above, the balance of your principal influences your interest, as does the annual rate youâre charged. Some home loans have whatâs called a variable interest rate, which means that percentage can change based on factors such as the Reserve Bankâs cash rate. Other mortgages have one fixed rate for the life of the loan, while some people split their home loan to include both variable and fixed interest payments.The length of your mortgage will also influence the total amount of interest youâll pay since interest is charged each year.The length of your loan affects how much youâll pay in interest.One of the ways you can reduce the overall cost of the loan is by increasing your monthly payments above the minimum required. This can shorten the duration of the loan, meaning you will pay fewer yearsâ interest, and lower the interest faster by getting the balance down more rapidly.By plugging in different payment amounts on a home loan calculator, you can see the impact that adjusting your monthly instalments can have on your total interest costs. Some calculators also allow you to assess the effect of offsets, lump sum payments, extra repayments and different interest rates â all of which can affect the interest youâll pay over the life of the mortgage. You could use this information to help you develop strategies to better manage your loan repayments and plan for mortgage refinancing if you choose to pursue this option.

Recommended Reading: Is Rocket Mortgage And Quicken Loans The Same

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

How Do Mortgage Points Work With Arm Loans

Mortgage points on an adjustable-rate mortgage work like points for a fixed-rate mortgage, but most ARMs adjust at five years or seven years, so its even more important to know the breakeven point before buying points.

Factor in the likelihood that youll eventually refinance that adjustable rate because you may not have the loan long enough to benefit from the lower rate you secured by paying points, says McBride.

Because the points only apply to the fixed period of an ARM, most adjustable-rate borrowers do not use them, according to U.S. Bank.

Also Check: How Much Mortgage Can I Afford With 60k Salary

Student Loan Interest Paid In A Lifetime: $599407

The average public university student borrows $30,030 to attain a bachelor’s degree. Because average interest rates vary widely depending on the type of student loan you have, we used federal loan data since these loans make up about 92% of all student loans.

For the purposes of our calculation, we used this year’s fixed federal interest rate for direct subsidized and unsubsidized loans for undergraduate students, which was 3.73%.

At this rate, using Bankrate’s student loan calculator, we found that the average student loan borrower on a standard 10-year repayment plan will pay $5,994.07 in interest alone over the course of 10 years.

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

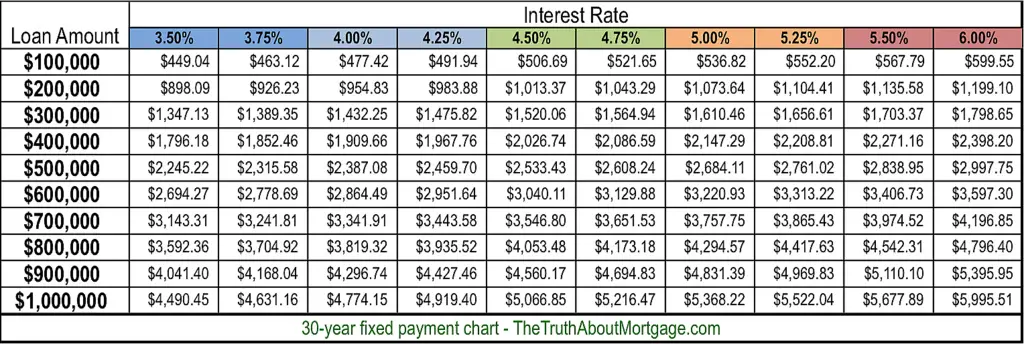

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

You May Like: Can You Get A Mortgage With A Fair Credit Score

Mortgage Interest Payment Calculator Tools

One way to find out how much interest you’ll owe in a given month, over the life of the mortgage or during other time periods is to use a mortgage interest payment calculator, such as the mortgage and interest calculator provided by Nerdwallet. These are computer programs that you can find on numerous financial news and information sites. Some mortgage lenders may also provide one on their websites.

To use one of these tools, follow the instructions to enter your current mortgage principal amount and annual interest rate. Find these numbers in your mortgage documentation. Then, follow the instructions to calculate your monthly, annual or lifetime interest payments.

If you’re putting any confidential information into a mortgage amortization calculator, make sure that you trust the organization running it and that you’re confident that you don’t have any malware on your device. Only enter the data in a secure place where nobody is looking over your shoulder.

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

-

Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

-

Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

Look for a lower interest rate. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Read Also: How Much Should You Pay A Mortgage Broker

How Much Income Do I Need To Buy A $400k Home

This answer isnt just about your income. Your interest rate and your plans for a down payment play an important role. For example, if youre planning to secure an FHA loan and put down 3.5 percent on a $400,000 home, youll need to earn just over $102,000 per year for a 30-year mortgage with a 5 percent interest rate.

If youre sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Read Also: Can You Pay Off Mortgage Early Without Penalty

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Why Should I Use A Mortgage Calculator

Don’t Miss: Why Are Mortgage Rates Going Down

Do You Pay Less Interest If You Pay Your Mortgage Twice A Month

Yes, ultimately, paying half of your current monthly principal and interest payment every two weeks will help a) reduce the interest paid and b) the time it takes to pay off the loan.

This payment schedule is known in the trade as a bi-weekly payment option. The reason you pay a reduced amount of interest when making biweekly mortgage payments is simply related to an imperfect calendar, which creates an extra monthly mortgage payment each year.

This strategy essentially forces the borrower to make an extra mortgage payment each year 13, not 12. These extra mortgage payments, over time, save several years and tens of thousands of dollars, depending on the loan size leaving you debt-free sooner.

The following examples clarify the concept of bi-weekly payments. Note, it is important to confirm that your mortgage lender accepts biweekly payments if you wish to pay off your mortgage with an extra mortgage payment.

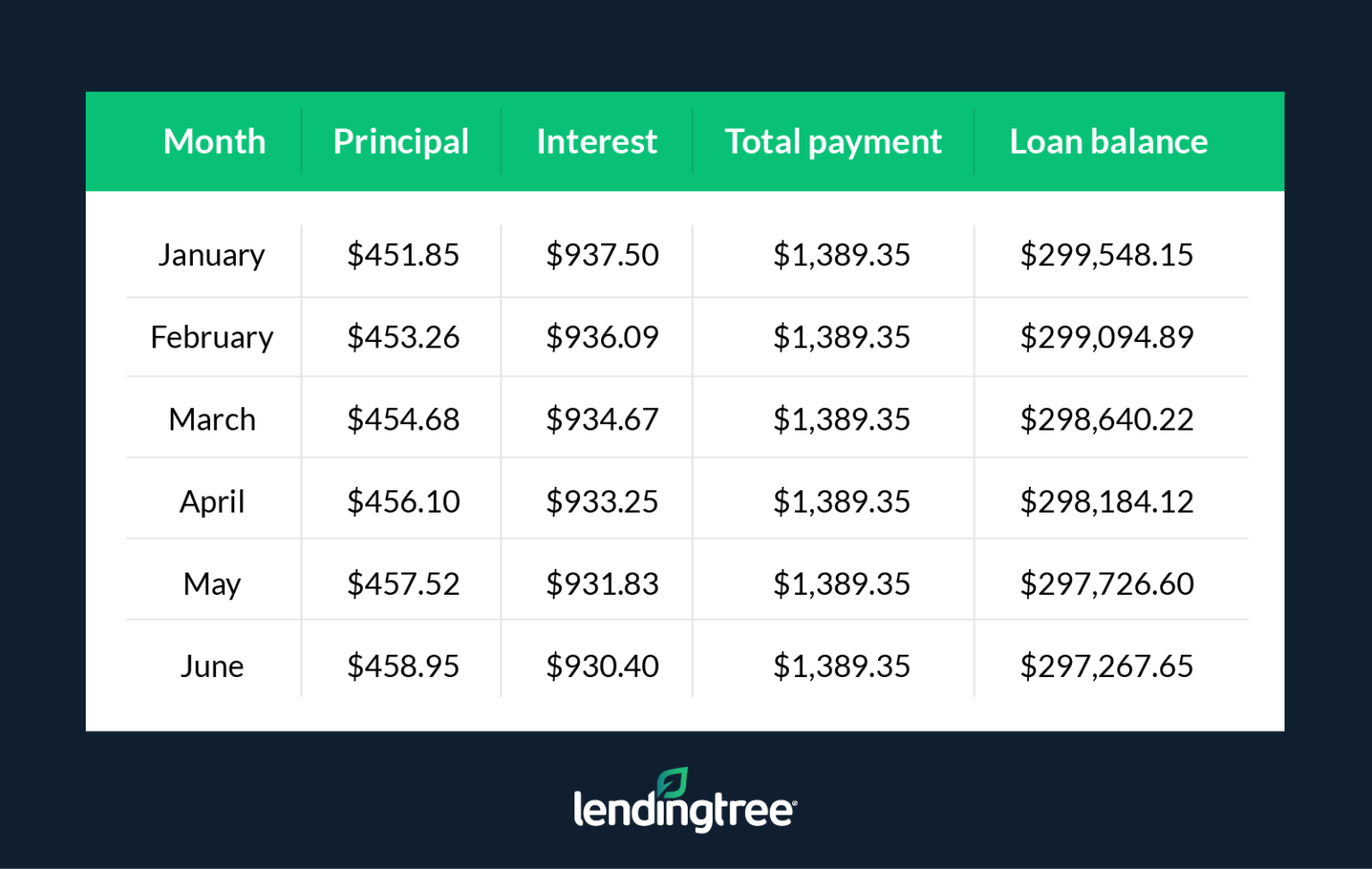

For both scenarios, note that you currently have a $275,000 mortgage on your home with a fixed interest rate of 4.5%. Your monthly principal and interest payment for this fixed-rate mortgage is $1,393.38 per month.

Scenario #1 Pay the mortgage over the 30-year term, with twelve payments each year.

This requires a total interest payment of $226,616.80 over the life of the loan. This is calculated as follows

- Total payments $1,393.38 12 30 = $501,616.80.

- Interest Paid equals total payments minus original principal balance or $501,616.80 $275,000 = $226,616.80

Monthly Interest Rate Calculation Example

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. Youll need to convert from percentage to decimal format to complete these steps.

Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

Want a spreadsheet with this example filled in for you? See the free Monthly Interest Example spreadsheet, and make a copy of the sheet to use with your own numbers. The example above is the simplest way to calculate monthly interest rates and costs for a single month.

You can calculate interest for months, days, years, or any other period. Whatever period you choose, the rate you use in calculations is called the periodic interest rate. Youll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product.

You can use the same interest rate calculation concept with other time periods:

You May Like: What Should Your Credit Score Be For A Mortgage

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Read Also: How Much Would A 70000 Mortgage Cost

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Don’t Miss: What Does It Mean Refinance Mortgage