Refinance To A Lower Rate

Homeowners can save money by refinancing to a lower rate, or by converting an adjustable rate mortgage into a fixed rate which remains locked for the life of the loan. If you would make higher payments if forced to, but would otherwise struggle to make the higher payments then it may make sense to opt for a 15-year mortgage rather than a 30-year loan. The shorter duration loan will typically have a lower interest rate & since the loan will be paid off faster you’ll spend far less on interest. For your convenience, here are current rates in your local area.

One thing to note about refinancing is there are some fixed costs in setting up a new mortgage even for streamlined refinancing. If you will live in your home for many years then locking in a lower rate makes a lot of sense, but if you plan on moving in the next few years it may not be worth the cost of refinancing unless you needed to get cash out or had another reason to set up the new loan. In cases where a homeowner needs a small sum of money a HELOC may be a superior option to refinancing the entire mortgage.

When Balancing Early Mortgage Repayment And Other Financial Responsibilities Works

You should have a robust household emergency fund before you think about paying extra cash toward your mortgage. An unexpected auto bill, medical expense or other cost can upset your budget if you dont have any liquid cash.

While its possible to take cash out of your home equity with a refinance, this process takes time, which you may not have in an emergency. Make sure you have plenty of money set aside for emergencies before you put any extra toward your mortgage loan.

You may also want to put off paying off your mortgage if you have another big expense coming up. Your priority should be putting money into your 401 or IRA. You might also want to consider diverting your extra money into a childs college fund or into savings for an upcoming vacation or wedding.

Theres no point in paying off your mortgage if it means going back into debt in the future.

See how much cash you could get from your home.

Apply online with Rocket Mortgage® to see your options.

Recast Your Mortgage Instead Of Refinancing

Mortgage recasting is different from refinancing because you get to keep your existing loan.

You just pay a lump sum toward the principal, and the bank will adjust your payoff schedule to reflect the new balance. This will result in a shorter loan term.

One major benefit to recasting is that the fees are significantly lower than refinancing.

Typically, mortgage recasting fees are just a few hundred dollars. Refinance closing costs, by comparison, are usually a few thousand.

Plus, if you already have a low interest rate, you get to keep it when you recast your mortgage. If you have a higher interest rate, refinancing might be a better option.

Check with your lender or servicer if you like this option. Not all companies will allow a mortgage recast.

Recommended Reading: Can You Refinance A Mortgage Without A Job

When Does A Prepayment Chargeopens A Popup Apply

Prepayment charges may apply when you prepay your mortgage balance before the maturity dateOpens a popup. and you:

- Renew, refinance or pay off your mortgage mid-term

- Prepay more than your annual prepayment privilege amount

- Refinance your mortgage and choose a new term

- Transfer your mortgage to another lender

How Much Will I Pay

As might be expected, prepayment penalty costs vary. However, there are some typical models for determining penalty cost:

- Percentage of remaining loan balance: Here they assign a small percentage, such as 2%, of the outstanding principal as a penalty fee if the payoff is made within the first 2 or 3 years of the loan term.

- X number of months interest: Here you just pay a total of a certain number of months interest, such as 6 months.

- Fixed amount: With this, the lender writes in a set figure, such as $3,000, for paying off a loan within the first year.

- Sliding scale based on mortgage length: This is the most common model an example is a sequential 2/1 prepayment penalty over the first 2 years of the loan. If the mortgage is paid off during year 1, the penalty is 2% of the outstanding principal balance, and if the mortgage is paid off during year 2, then the penalty is 1% of the outstanding principal balance.

Want to have some fun with math? Heres how it looks when we use a model of a typical mortgage and interest rate. We used a hypothetical $200,000 loan.

You May Like: How Does Rocket Mortgage Work

Make One Extra Mortgage Payment Per Year

Many homeowners choose to make one extra payment per year to pay off their mortgage faster.

One of the easiest ways to make an extra payment each year is to pay half your mortgage payment every other week instead of paying the full amount once a month. This is known as biweekly payments.

When you make biweekly instead of monthly payments, you end up adding one extra payment each year.

However, you cant simply start making a payment every two weeks. Your loan servicer could be confused about getting irregular, partial payments. Talk to your loan servicer first to arrange this plan.

You could also simply make a 13th payment at the end of the year. But this method requires coming up with a lump sum of cash. Some homeowners like to time their extra payment with their tax return or with a yearly bonus at work.

However you arrange it, making an extra payment each year is a great way to pay off a mortgage early.

As an example, if you took out a mortgage for $200,000 on a 30year term at 4.5%, your principal and interest payment would be about $1,000 per month.

Paying one extra payment of $1,000 per year would shave 4½ years off your 30year term. That saves you over $28,500 in interest if you see the loan through to the end.

Paying down your mortgage balance quickly has other advantages, too.

The Right Of Rescission

Most reverse mortgages come with the right of rescission. With this cancellation right, borrowers have three business days after signing their reverse mortgage closing paperwork if they want to cancel the transaction with no penalty. The lender cancels all mortgage documents and returns all fees, closing costs, and unused funds within 20 days.

You May Like: Who Is Rocket Mortgage Owned By

Recap Of Ways To Pay Off Your Mortgage Faster

If you decide you want to pay off your mortgage early, ask your mortgage lender about:

Whatever you choose, make sure youve weighed all your options to find the best use for your hardearned cash.

What Are The Advantages Of Making Extra Payments Versus Refinancing

One advantage of paying off your mortgage early instead of refinancing is you don’t have to pay closing costs. The money you might spend on these costs goes to paying down your mortgage principal instead.

Another advantage is you aren’t committed to paying more each month. Sometimes when homeowners refinance, they shorten the loan term. This can save money, but it can also increase your minimum monthly payment. When you decide to make extra payments on your current mortgage, you can pay as much or as little extra as you want each month – including nothing extra at all.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

How Extra Mortgage Payments Work

Real estate attorney Rajeh Saadeh explains the concept behind accelerated payments:

Say you have a 30year mortgage. You can make additional payments applied to your principal at the time your mortgage payment is normally due, or earlier.

Or you can do so at more frequent intervals during the year, he says.

Any time you pay extra on your mortgage, you need to indicate to your lender that the money should go toward loan principal not interest.

That will reduce your loans term and enable you to pay off your loan more quickly, Saadeh explains.

But you dont want any extra payments to go toward your loans interest that wont reduce your principal owed or shorten the life of your loan.

Make sure your lender or servicer is applying any extra money toward principal as its first priority. Otherwise, youll need to indicate that your extra payments should be applied that way.

Prepayment Penalty: What It Is And How To Avoid It

7-minute read

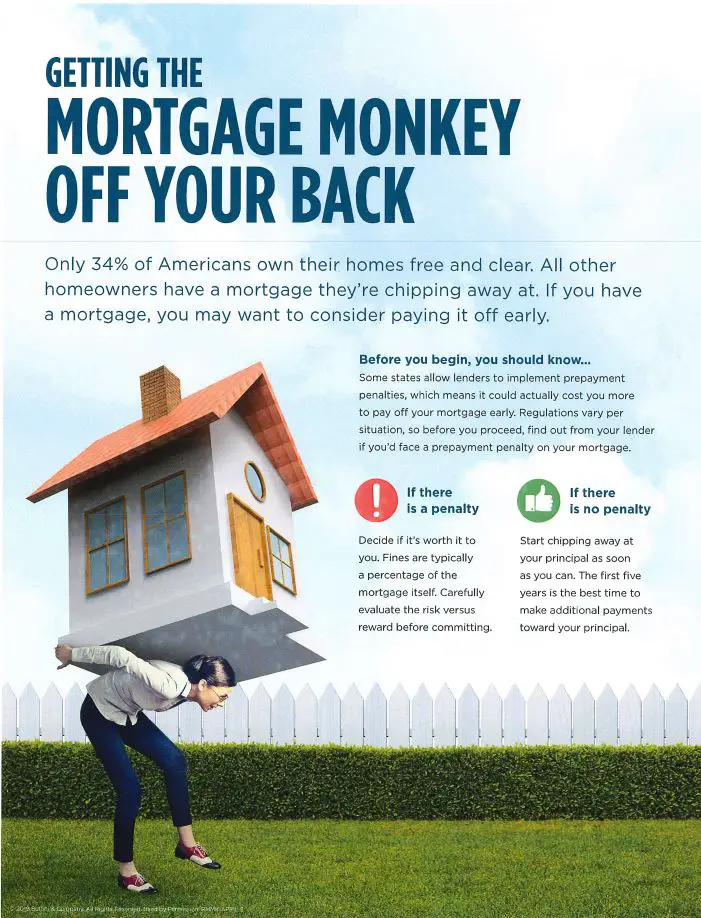

The phrase prepayment penalty is likely making you curious. After all, why would you be penalized for prepaying something, which almost always is a benefit to the entity being paid? Well, thats the thing about mortgage loans: Many of them surprisingly come with prepayment penalties, which limits your flexibility and can take a bite out of your wallet just for trying to do the right thing for your finances.

So when youre looking at home loans and trying to decide what is the best type of mortgage for you, this is a feature you should be aware of, as prepayment penalties are sometimes hidden in mortgage contracts. By learning about penalties now, you can approach your mortgage search and eventual contract with more knowledge, armed with strategies for finding the best mortgage lender to fit your needs. Its important to note that Rocket Mortgage® does not have any prepayment penalties.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

What Does It Mean To Pay Off Your Mortgage Early

Many homeowners would love to fast forward to when they own their houses outright and no longer have to worry about monthly mortgage payments. As a result, the idea of paying off their mortgage early could be worth exploring for some people. This will allow you to lessen the amount of interest youll pay over the term of your loan, all while giving you the ability to become the homes full owner earlier than expected.

There are a few different methods by which you can go about paying early. The simplest method is just to make extra payments outside of your normal monthly payments. Provided this route doesnt result in extra fees from your lender, you can send 13 checks each year instead of 12 . You can also increase your monthly payment. By paying more each month, youll pay off the entirety of the loan earlier than the scheduled time.

If youre considering paying off your mortgage ahead of time, make sure you avoid these five critical mistakes.

Should I Leave 1 On My Mortgage

Historically, leaving a small amount of money outstanding on a mortgage meant that the lender kept the deeds for the property in safe keeping but nowadays, deeds for the majority of properties are no longer required in paper format – records are now held electronically by the Land Registry.

On top of this, leaving a nominal amount on a mortgage in the past made it easier to borrow from an existing lender. However the impact of the recession and the tightening of affordability criteria means that any new line of credit will require a separate application with new credit checks, regardless of the lender.

Read Also: Chase Mortgage Recast Fee

How To Avoid Penalties For Breaking Your Mortgage Early

Mortgage penalties can be exorbitant, and some of the most extreme can hit five figures. Fortunately, homebuyers dont have to contend with enormous penalties just to break their mortgages early particularly since statistical data shows that the majority of borrowers do in fact break their mortgages or refinance early.

Internal lender statistics suggest that greater than 60% of mortgages will be paid out or restructured at an average of 36 months, Dustan Woodhouse, DLC Canadian Mortgage Experts broker, told Canadian Mortgage Trends.

Breaking a fixed mortgage entails a penalty that is usually the greater of three-months interest or the interest rate differential . Regardless of how the penalty is calculated, the sum is often quite significant.

The average penalty Woodhouse sees is roughly 4.5% of the balance on a four-year fixed or longer fixed term, while the record was 7.7% with a major chartered bank on a significant mortgage.

We see absolute devastation when it is 5%-down buyers in a flat or declining market that also paid a 4.15% CMHC premium, and are paying realtor fees to sell, he said. It is costing some of those people tens of thousands to get out of their property. And it could have been avoided.

Being informed is a homebuyers greatest defence against punishing penalties down the line. The greatest danger in our business is not unanswered questions the greatest danger is unasked questions, Woodhouse said.

Why Do Lenders Charge A Mortgage Prepayment Penalty

Lenders primarily make their money through charging interest, and an early payoff of a mortgage means losing out on tens of thousands of dollars of interest over the years. The beginning of the loan term proposes more financial danger to lenders because they havent had the chance to receive enough payments for the loan to be profitable.

An early sale or refinance of a house is a loss of opportunity for the lender. Since the lender recently sunk resources into providing the mortgage, theyre looking for a return on their investment for years to come, not the loan balance they just lent.

During the closing process, lenders disclose crucial information to the borrower, including the prepayment penalty. So, if you are currently shopping for a mortgage, note the different rates and fees among lenders to pick what suits you best.

Recommended Reading: Rocket Mortgage Loan Types

Should You Renew Early

Lenders may allow you to renew your mortgage early, within 121 to 180 days prior to your renewal date, without penalty.

But dont be alarmed if a lender does not offer you an early renewal rate. Not all lenders offer early renewals. Many lenders offer you a mortgage renewal approximately 4 months prior to your renewal date .

If your lender does offer early renewal, its important to note that this is not always the best option for most borrowers.

Lenders will typically only offer an early renewal in certain cases because most lenders only reserve rates for 120 days prior to the disbursement date. This means that if you want to look at other options and you are 180 days prior to your renewal date, it will trigger a penalty to switch to a different lender. Therefore, the existing lender hopes you simply sign the early renewal and move on, without having any competition on their end.

The only time an early renewal is beneficial for borrowers is when you are in a rate increasing environment. Thats because the existing lender is essentially saying, I will renew your mortgage right now at a current rate before rates go up. Whereas, if you want to get a current rate with any other lender right now, you will have to pay a penalty to break the contract with the existing lender.

Drawbacks Of An Early Renewal

Locking in a mortgage rate early may come at a cost, such as an extra 0.10 to 0.30 of a percentage point on your new locked-in interest rate. And if interest rates end up dropping before your mortgage term is up, then locking in a rate early on could mean missing out on better rates.

Early renewal may also come with a penalty of breaking your mortgage term early. This penalty is usually three months interest at your current rate or the interest rate differentialwhich is calculated using the current rate, the new rate, and the remaining months left in your mortgage term.

Also Check: Can I Get A Reverse Mortgage On A Condo

Know Your Annual Prepayment Limits And Try To Stay Below Them

This is important if you want to pay down your mortgage faster. With most ATB closed mortgages, you can make a lump-sum prepayment of up to 20 per cent of your mortgage balance every year. You can also increase your regular payments by 20 per cent annually.

For any amount you go over those limits though, you will be charged a prepayment penalty.

Reasons To Prioritize Investing First

Some homeowners would rather put every spare penny into an investment rather than paying down their mortgage debt. Their rationale is that the return on the invested dollar is greater than the guaranteed return youd get for paying off your mortgage.

Take for instance a homeowner with $50,000, deciding whether to invest or pay their mortgage. They could make a lump sum payment towards their current mortgage. The additional $50,000 would reduce the principal borrowed and this reduces the overall interest paid. If the mortgage was $450,000, the homeowner locked in their mortgage rate at 2.85%, and if they made no other accelerated or lump sum payments, this additional $50,000 would reduce the overall amount of interest theyd pay on their mortgage by $44,880. . This is like getting a guaranteed return of 2.8% on your invested money. Compare this to high-interest savings accounts that pay between 1.5% and 2% or GICs that pay 1.95% or 2.25%, and this return looks good.

But if youve been a disciplined saver or if you have a pension you can count on in retirement, it may be possible to take the $50,000 and invest it in riskier investments for a possible better return.

Also Check: 10 Year Treasury Vs Mortgage Rates

Review Important Mortgage Terms

What’s an open mortgage?

You can prepay open mortgages, in part or in full, without a prepayment charge. Open mortgages usually have higher interest ratesOpens a popup. than closed mortgages. But, open mortgages are also flexible. If rates start to increase, you can easily pay off an open mortgage and switch to a closed one.

What’s a closed mortgage?

You can’t prepay, renegotiate or refinance a closed mortgage before the end of the term without a prepayment charge. But, most closed mortgages have certain prepayment privileges, such as the right to prepay 10% to 20% of the original principal amount each year, without a prepayment charge. A closed mortgage often has a lower interest rate than an open mortgage.

What’s a fixed-rate mortgage?

With a fixed-rate mortgage, in most cases your interest rate doesn’t change during your mortgage term. Your regular mortgage payment amount doesn’t change. You know exactly what your regular payments will be and how much of the principal balance you’ll pay off during the term.

What’s a variable-rate mortgage?

With a variable-rate mortgage, the interest rate changes as the CIBC pOpens a popup.rime rateOpens a popup. changes. Your regular mortgage payment amount is fixed and doesn’t change.

When the CIBC prime rate goes down, you’ll pay less interest. A smaller portion of your regular mortgage payment is applied to pay the interest, and a larger portion is applied to pay down the principal.

Why choose a short-term mortgage?