Are There Any Other Fees

Some advisors charge customers extra fees which can be frustrating for many borrowers who already have so many other expenses to pay for such as stamp duty, removal costs and financial advisor mortgage fees.

While every broker will charge different amounts, they could include all, some, or none of the following extra charges:

- Mortgage broker finder fees

- Mortgage broker application fees

- Cancellation fees

There are some fees which wont reflect in your final bill and are exclusively for the broker themselves. Every mortgage broker within the UK must either be regulated by the FCA or be the agent of a regulated firm, and must pay a fee to be regulated.

To avoid the shock of acquiring extra fees, get in touch. The expert advisors we work with will be clear about the fees they charge, or we can pass you to a broker who wont charge a fee, should your circumstances allow it.

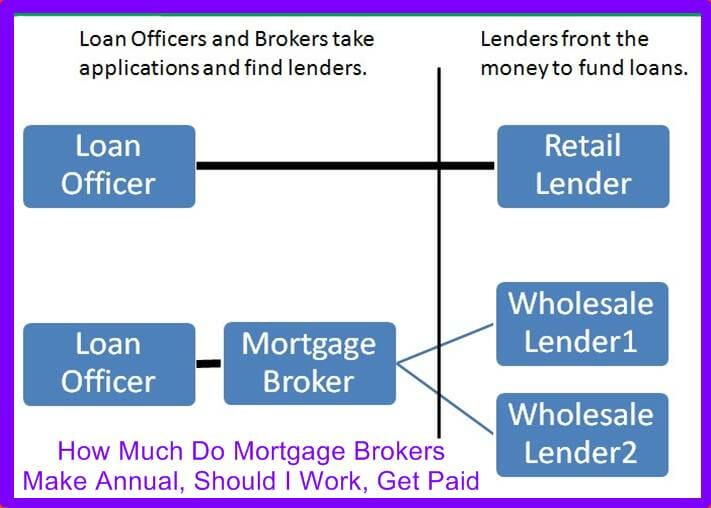

How Mortgage Brokers Get Paid

Often, lenders pay the broker a fee or commission for selling their products, so you don’t pay the broker anything.

Some brokers get paid a standard fee regardless of what loan they recommend. Other brokers get a higher fee for offering certain loans.

Sometimes, a broker will charge you a fee directly instead of, or as well as, the lender’s commission.

If you’re not sure whether you’re getting a good deal, ask around or look online to see what other brokers charge.

Mortgage Broker Fees: The Complete Guide

If youre looking to buy real estate, you probably dont have the time to evaluate all of the loan options available to you. Indeed, for new homebuyers, finding the best loan for their financial situation can be a challenging task. A mortgage broker can help you make the right decision and navigate through the complexities of the closing costs associated with home loans.

However, you also need to know how to pick the right mortgage broker and how to understand their fees. Mortgage broker compensation is confusing, and finding the right mortgage broker can be one of the more difficult steps when buying a home.

But dont worry: SuperMoney is here to demystify the process and help you better understand mortgage broker fees so that you can make the right choice for your situation. Well look at the different ways brokers get paid, explain how you can decide which payment structure best suits your budget, and give you tips for making sense of the information available to you to choose the right broker.

At the end of this article, youll find a checklist of important questions you should ask when choosing a mortgage broker for your next home purchase. These will help you gather all of the necessary information to choose confidently.

Read Also: Reverse Mortgage Manufactured Home

Cons Of Hiring A Mortgage Broker

On the other hand, mortgage brokers may not have access to all lenders. Not all lenders work with brokers, so you may be missing out on some deals that are out there.

There is also more documentation involved in working with a mortgage broker. Since they’re involved in the process, their name appears in the documentation. So, you may need to sign more forms and offer more information than usual.

Lastly, some people don’t like working with new people. So, working with someone new on something as sensitive as a mortgage can be intimidating.

If you’re uncomfortable working with strangers, a mortgage broker may not be the right move. This is especially if you don’t like the idea of that stranger having access to your financial information.

Although, we should note that mortgage brokers are legally required to keep your information private.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

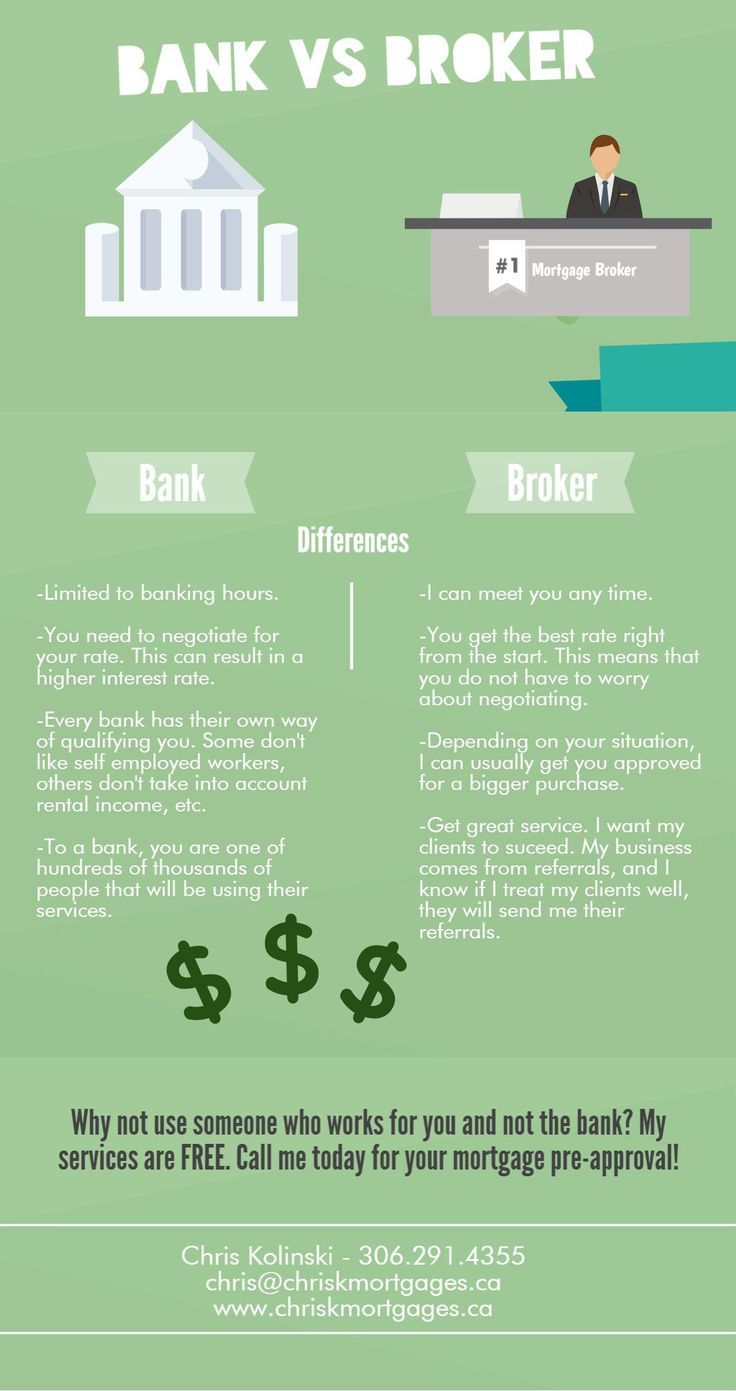

Bank Vs Broker: Which Should You Choose

The number one differentiator is that mortgage brokers offer choice. They have access to multiple product lines from a wide variety of lenders including banks, credit unions and trust companies. In contrast, bank specialists can only offer you a mortgage from their one product line. More choice from brokers means youll be matched with the best product and rate catered to your unique financial situation. And if you happen to be self-employed or have credit blemishes, mortgage brokers can still help you, because they have access to specialized lenders as well.

Your mortgage broker will also get lenders competing for your mortgage again at renewal or anytime you need to renegotiate your mortgage. Its your brokers job to guide you through every step of the homebuying and mortgage processes. And that means staying on top of your ever-changing needs as a homeowner.

Mortgage brokers must also be licensed and adhere to strict government rules and regulations. And, in order to keep their licence, theyre required to take continuing education and relicensing courses to ensure theyre best able to advise on your ideal mortgage solutions. Bank mortgage specialists arent licensed. They can start working for a bank and begin selling mortgages with zero financial training or experience.

What Are Trailer Fees

Trailers fees are payments that lenders make to mortgage brokers over time. Lenders make these payments to the mortgage broker in equal amounts for the length of the term that the client/broker contract.

These payments are meant to prevent mortgage brokers from recommending regular lending switching. If borrowers switch lenders, the lender they used to work with loses money. So, by paying the mortgage broker over time, the lender is hoping to convince them to keep the borrower with that lender.

Trailer fees do amount in a small up-front commission, but they can result in a higher overall payment if the borrower sticks with the lender.

Also Check: Rocket Mortgage Payment Options

How To Find A Mortgage Broker In Ireland

There are several ways to find a mortgage broker, you can use the Brokers Irelands website to find a broker nearby.

Your mortgage lender may provide you with a choice of brokers in your area.

Alternatively, you may find a mortgage deal on a comparison website thats arranged by a broker or you can search for a free online broker.

Remember, some brokers offer a face to face service, whereas others operate purely online.

A Broker May Have Better Access

Some lenders work exclusively with mortgage brokers and rely on them to be the gatekeepers to bring them suitable clients. You may not be able to call some lenders directly to get a retail mortgage. Brokers may also be able to get special rates from lenders due to the volume of business generated that might be lower than you can get on your own.

Read Also: Rocket Mortgage Loan Requirements

Are Private Mortgage Loans Bad

Con: High interest rates Interest rates are much higher with private-money lending than with conventional loans, Curtis says. … “Loans from private lenders are generally secured by the property in question, so it’s usually not as important to the lender if the borrower has pristine credit or not,” Curtis says.

How Do Mortgage Brokers Make Their Money

Brokers usually work on commission that’s paid by banks and lenders as a percentage of the loan amount you take out. This can come in two parts: the upfront commission and a trailing commission.

The upfront commission is the most common, and the amount that’s paid to brokers varies between lenders. As an example, if you ended up taking out a $500,000 home loan and your broker was working on a 0.5% commission, they would make $2,500 straight up.

The trailing commission is an ongoing payment also made by the bank or lender, and is generally a smaller percentage of the remaining loan amount for each year you hold the home loan. The 2017 Royal Banking Commission recommended the removal of this commission structure, but changes are yet to take place so it’s still an option for brokers.

You May Like: Reverse Mortgage On Condo

A Broker May Save You Legwork

Mortgage brokers have regular contact with a wide variety of lenders, some of whom you may not even know about. A broker also can steer you away from certain lenders with onerous payment terms buried in their mortgage contracts.

That said, it is beneficial to do some research of your own before meeting with a broker. An easy way to quickly get a sense of the average rates available for the type of mortgage you’re applying for is to search rates online, then use a mortgage calculator. Tools like this will let you compare rates easily and provide you with extra knowledge when assessing a mortgage broker’s credibility.

Questions To Ask Your Mortgage Broker

Ask questions. Lots of them. For example:

- Do you offer loans from a range of different lenders? What sort of lenders do you work with? What kind of lenders can’t you access?

- How do you get paid for the advice you’re giving me? Does this differ between lenders?

- Why did you recommend this loan to me? Why is this loan in my best interests?

- What fees will I have to pay when taking out this loan?

- What features come with this loan? Can you show me how they work?

- How do the fees and features of this loan affect how much the loan will cost me?

- Can you show me a couple more options, including one with the lowest cost?

- What is the threshold for lender’s mortgage insurance and how can I avoid it?

You May Like: Mortgage Rates Based On 10 Year Treasury

Is A Financial Advisor The Same As A Mortgage Advisor

A mortgage advisor, or mortgage broker, gives advice on all aspects of your mortgage. They search the market to get you the top interest rates and best mortgage lender. They can also help with the application process.

A financial adviser, on the other hand, simply gives advice on the financial aspect of your mortgage. Their service looks at your wider financial picture. It will include your mortgage, but wont be exclusive to it. Their mortgage advice may be less detailed than that of a broker.

For example, they consider all of your current and future finances to see whether you are likely to be able to afford repayments on your mortgage. However, they do this alongside other things such as assessing whether you need life insurance, and giving investment advice.

One of the most common reasons people are declined mortgages is due to a poor credit score. If this happens to you, a financial advisor can help you turn things around. They will be able to advise you on debts such as credit cards, to improve your credit score.

So, when navigating the complicated market of mortgage lenders, a mortgage broker can give specialist advice on mortgages. This can be used in conjunction with a financial adviser whose financial advice can help you plan in the long term.

Should I Pay A Fee Or Commission For Mortgage Advice

Whether an advisor is paid a fee or a commission, shouldnt make much difference to the level of service you get. For instance, the main goal for yourself and your broker should be to find the best mortgage deal possible. That said, youll still need to know your costs before you make any commitments.

Although advisors are upfront about how theyre going to get paid, its perhaps more important to understand whether your advisor is independent or tied to a lender. This is because brokers that are tied to lenders will only be able to recommend you their lenders products. In comparison, an independent broker will search the entire market to find you the right product.

Also Check: Can You Get A Reverse Mortgage On A Condo

What Questions Should You Ask When Choosing A Mortgage Broker

Broker fees are not the only factor to consider if you decide to use a mortgage broker. You need to collect additional information to make the right choice. Make sure you ask your broker enough questions, both when deciding whether to work with them and also when negotiating the loan amount, rate, and conditions.

Heres a quick checklist of the things you need to consider when vetting a mortgage broker and the questions you can ask them.

Should I Pay For A Mortgage Advisor

Fees for mortgage brokers can be off-putting. A mortgage is an expensive financial product, and often buyers want to save as much money as possible. This might limit their options when it comes to using a mortgage broker.

However, an adviser can help you save money in the long term. Furthermore, they can save you a lot of time when it comes to applying for a mortgage. If you need to get a mortgage quickly, to avoid losing out on the house you want to buy, this can be invaluable.

You May Like: Reverse Mortgage For Condominiums

Can Mortgage Brokers Save You Money

Yes. Mortgage brokers receive deep discounts for borrowers because they do all the work for the lender, as opposed to the lender having to pay a frontline sales staff members salary, commissions and benefits. Brokers also only get paid by the lender once your mortgage funds. That means its always in your mortgage brokers best interest to keep clients happy throughout the homebuying and mortgage processes, and beyond.

But, more important than rate, is the fact that mortgage brokers understand the ins and outs of numerous mortgage product lines because thats what they do daily. They can help save you money throughout your life as a mortgage holder by suggesting accelerated payment cycles and other prepayment strategies that wont see you put into a no-frills mortgage to save money upfront, while risking thousands down the road should you need to break your mortgage early.

A mortgage is a huge financial commitment and its important to have the peace of mind that comes along with being able to rely on your provider any time you need a new mortgage or to renew/refinance an existing one.

Tip

There is more involved in saving you money with your mortgage than just the interest rate. Your mortgage broker understands features and payment plans that can save you more money over time than a cheaper upfront rate on its own.

Should You Pay Off Your Mortgage Early Or Invest

Where should my money go? When youre paying off your home, this is a valid question to have. Often, new homeowners arent sure whether to put all their money towards their mortgage or split it up and invest as well. Todays article outlines some key points you should consider for both paying early and investing.

Read Also: Monthly Mortgage On 1 Million

Find The Right Mortgage Broker For Your Next Home Purchase

Ready to start shopping for a mortgage broker but not sure where to look? Weve got you covered.

Head over to the SuperMoney mortgage broker review and comparison page. Youll find a collection of industry-leading brokers who you can easily compare. Read reviews, compare offerings, and cut down on your research time!

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.

Benchmark A Good Mortgage Rate Using Mse’s Best Buys Tool

There are lots of mortgage comparison sites out there, but none guarantees to show you all the deals available. This is because the mortgage market is complicated and some deals are only available through certain brokers, making it very difficult for a comparison site to know about every single deal at all times. But our Mortgage Best Buys tool has all deals available direct, and most available to brokers, so it’s a great place to start.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Paying A Mortgage Adviser Fees Or Commission

You have the right to know in advance how your mortgage broker will be paid. Remember to ask him or her whether they take a fee from you, commission from the bank/lender, or both. You should also ask how much the fee and/or commission will be, and confirm that any fee you pay will depend on the mortgage deal going ahead.

Some mortgage brokers will let you decide whether to pay a fee or let them take commission instead.