Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

Why Should You Get Prequalified

While prequalification isnt a guarantee of anything, if can be an important step in guiding your home search. Having an idea of what you can afford and what price range you should be shopping in can help your or your agent find appropriately priced homes for you to consider and tour.

If youre not thrilled about the results of your prequalification, you can take a break from the home buying process, no strings attached, and try to improve your financial picture.

When Should I Get Pre

Always pick your yard based on your Summer lifetstyle.

~ KARL

Wondering when to get pre-approved for a mortgage during the home buying process? In this episode, we discuss when and how far in advance of buying a home should you look to getpre-approved. We also explore how long pre-approvals last for, what happens if your financial situation changes and how many times you can get approved.

Prefer to listen?

Today the question we’re going to answer is :

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Gather The Appropriate Documents

Lenders will want to verify your identity, credit history, employment history, income and financial assets to issue a preapproval. Theyll likely ask you to fill out a uniform residential loan application .

The 1003 application asks for your personal information, financial information and loan information, including

- Bank accounts, retirement and other accounts

- Any other assets you have

- Property you own

- Employer contact information

- Debts you owe or other liabilities

Your lender will also likely do a hard credit check, and may require additional documents based on your individual situation, such as pay stubs, tax returns or bank statements.

You May Like: How Does Rocket Mortgage Work

Want An Idea Of How Much Money You’ll Save With Our Rates

Try out our Compare & Save calculator. On average, we save our clients over $3,000, which can really add up over the life of your mortgage.

But more than our better rates, when you find the home or property that sings your song, we make sure you get the right mortgage for your unique situation, which can save you even more cash and stress later on.

Don’t just take our word for it â check out our 5-star reviews from clients thrilled with our lower rates and money-saving advice. We’ve funded over $13 billion in mortgages, helping one client at a time, like you, find their best mortgage.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Okay You Get It Now What

Gather the necessary financial paperwork typically pay stubs issued in the last 30 days, two years of W2s or tax returns, and quarterly account statements for all your assets. If you havent already, request your credit report . Review your report and reconcile any errors you may find. Next, youll want to take a look at your budget. Figure out how much you can afford to pay monthly for a mortgage.

Now, youre ready to start applying! Do your research, and pick a few of the best lenders in your area. Its worth shopping around to make sure youre finding the best lender for you.

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, or insurance advice. Opendoor always encourages you to reach out to an advisor regarding your own situation.

Related home buying guides and blog articles

More guides and blog posts about home buying

How Does The Mortgage Process Work

The mortgage process begins when you apply. Youll give the lender information about your income and assets, along with supporting documentation such as W-2s, 1099s, tax returns, and bank statements. The lender will check your credit to learn about your debts and determine your debt-to-income ratio.

If you pass the initial approvals, the lenders mortgage underwriter then takes a deep dive into your finances to make sure you can afford the loan youre applying for and decide how much to let you borrow. Once youre approved, the lender produces a bunch of documents for you to sign and have witnessed by a notary. Then, it wires the funds for your new loan, which is called closing.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Prequalified Vs Preapproved: Whats The Difference

Some people use the terms prequalify and preapproval interchangeably, yet these terms are not the same.

To be clear, neither a prequalification nor a preapproval guarantees a mortgage. Even so, when youre ready to make an offer on a property, some home sellers only accept offers from preapproved buyers.

For both processes, youll fill out a form and provide your financial information. The difference, though, is that lenders base prequalifications on selfreported information. In other words, the lender doesnt verify this information

In a competitive housing market, a seller might choose a preapproved buyer over a prequalified buyer.

Preapprovals, on the other hand, involve verification of stated income. Lenders will conduct a hard credit check, analyze your credit report, and review supporting documentation like your W2s, tax returns, and bank account statements.

A preapproval is a stronger indication of mortgage approval, which builds your credibility as a buyer. For this reason, in a multipleoffer scenario, a seller might choose a preapproved buyer over a prequalified buyer.

Does Getting Prequalified For A Mortgage Hurt Your Credit Score

Prequalification typically doesnt affect your credit score because it involves a soft credit pull. On the other hand, preapproval usually requires a hard credit pull and may affect your credit score if you try to get pre-approved by several lenders.

If youre considering more than one lender, try to request your home loan pre-approvals around the same time since credit bureaus typically count these separate requests as one single credit check.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

Do I Have To Get Prequalified For A Mortgage

Technically, you don’t have to get prequalified. You’re free to start house hunting and making offers without one. Realistically, however, you won’t get far without a prequalification letter.

Many real estate agents will request a copy of your prequalification letter before showing you a home, because it shows you’re serious about buying. They don’t want to waste time showing houses to people who are unlikely to get financing.

Including your prequalification letter with your offer can also give you an edge over rival buyers. In Hawaii’s competitive housing market, sellers usually have multiple offers. If a seller is looking at two identical offers, one from a prequalified buyer and one from a buyer who hasn’t yet talked to a lender about financing, they’re almost certainly going to lean toward the person who has a prequalification letter in hand.

Also, having a letter from a respected local financial institution like Bank of Hawaii can beat out a letter from a less recognizable lender. There’s something to be said for getting prequalified by a lender that understands the local market and has an almost 125-year-long history of helping people successfully buy homes in Hawaii.

Once your offer is accepted, you can officially apply for a mortgage, provide a range of documents to verify your income and assets and move through the rest of the mortgage application process.

Also Check: Does Chase Allow Mortgage Recast

What Should You Do Before Applying For A Mortgage

Before you apply for a mortgage, you should check your credit reports and scores with all three credit bureaus. Make sure no mistakes are hurting your scores. If your scores are below 620, learn what you can do to improve them. The closer you can get to an excellent score of 760, the less expensive your mortgage will be.

Make sure you have at least 3% saved for a down payment unless youre eligible for a Veterans Administration loan. Ideally, you should save even more to pay for closing costs, keep an emergency fund after closing, and put more toward your down payment to save on mortgage insurance.

Best For Jumbo Loan Borrowers: Pnc Bank

Application score: 4/4

Customer satisfaction: 99.99%

Loan types offered: Conventional fixed 30-year, 20-year, 15-year, 10-year ARM 7/1, 10/1 FHA VA fixed 30-year, 15-year USDA Community Loan Medical Professionals Jumbo $5,000 Closing Cost Grant

Minimum down payment: as low as 3%

-

Loans up to $5 million

-

Services most of the loans it originates

-

Has above-average customer satisfaction for loan servicing

-

Allows borrower DTI up to 43%

-

Apply online, by phone, in person, or at a branch

-

Advertised rates assume 30% down

-

Just average for customer satisfaction in mortgage origination

PNC Bank has a customer-friendly website full of educational resources about home borrowing, but the companys online efforts dont stop there. It earned our top rankings for providing loan details on its website and making it easy to apply online.

Advertised jumbo loan rates, while highly competitive, assume 15-20% down, closing costs paid out of pocket, On such a large loan, it may be hard to come up with that much cash. Advertised rates also assume a maximum DTI of 43%, which is on the low side, and escrowed taxes and insurance. Some borrowers might prefer escrows for convenience, while others might prefer greater control over their finances.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Why Are We Better For You Than Your Bank

- We put you first.

- We help you save money and stress.

- We’re fast.

We check with many lenders for the most flexible mortgage rate and product â in fact, we have access to the best rates and thousands of mortgage products.

Then, we hold your best rate for up to 120 days, protecting you from any sudden rate increases. Now, you can hunt around for the right place, knowing that your rate is secure.

When you find the home of your dreams, we’ll get you fully approved, and pass along our volume discount to help you save a pile of cash.

Document Your Income And Assets

Your lender will require documentation to support the info in your loan application. This is what makes getting preapproved different from getting prequalified.

Typically, your lender will require the following documents for mortgage preapproval:

- Identifying documents such as a valid drivers license or photo ID

- Last two years W2s and/or 1099s

- Last two years tax returns

- Profit & Loss statement if selfemployed

- Pay stubs for last 30 days, if applicable

- Statements from bank accounts, retirement accounts, and other asset accounts

- Divorce decree or separation agreement, if applicable

- Contact information for your landlord for the last two years, if youre a firsttime home buyer. If you are currently a homeowner, your housing payment history will show up on your credit report

To speed up the preapproval process, it helps to have these documents in hand before you get started.

Some lenders can pull documents directly from your employer and bank, but not all. Some can also verify your income with the IRS, with your consent.

You May Like: Rocket Mortgage Conventional Loan

What Is A Prequalification Letter

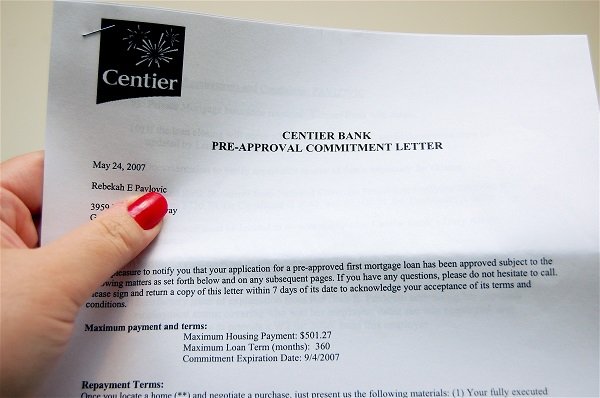

A prequalification letter is a document that lenders issue outlining how much its willing to lend based on a borrowers self-reported financial information. Prospective homebuyers can use a prequalification letter to demonstrate their financial strengthand the likelihood theyll be approved for a mortgageto sellers. For that reason, prequalification letters typically accompany offers to buy propertyespecially when closing is contingent on the buyers ability to secure financing.

Keep in mind that preapproval letters are similar, but youll have to undergo a more comprehensive process to receive one. Some lenders even require borrowers to complete a formal mortgage application. For this reason, preapproval letters are more meaningful than prequalification letters, but they also take longer to receive. And, like prequalification letters, preapproval letters are still not a guaranteed loan offer.

How Far In Advance To Get Pre

Mujtaba Syed:

Technically it could be the day you decide to go shopping, the day prior.

There’s no really set rule or time, but ideally we want it to be the first step.

We want it to be the first step is to get pre-approved for a mortgage before you start shopping around, so you can have a better idea.

It could factor into different areas in the city you might want to be able to move to, different styles of homes that you’re looking into.

It could change a lot of different things, so obviously you would definitely, definitely want to be able to get pre-approved before we even step into that market or speak to a real estate agent or anything of that sort.

Recommended Reading: Chase Recast Mortgage

When Should You Get Preapproved

The best time to get preapproved is a few weeks or months before purchasing. You shouldnt get preapproved too early. In most cases, a preapproval will expire after about 90 days.

You should also get preapproved before meeting with a real estate agent and actively looking at homes. If you dont know your budget, you could potentially make an offer on a home that you cant afford.

Plus, a preapproval provides additional information to help you prepare for a purchase. Youll not only receive information about loan amounts, but also estimates regarding interest rates, down payment amounts, and monthly mortgage payments.

To prepare for a preapproval, gather your documents early and submit these to a mortgage lender in a timely manner.

Borrowers typically need to submit the following documents along with their mortgage application:

- Tax returns and W2s from the past two years

- Recent pay stubs

- Bank statements for savings accounts and other assets

- A copy of your drivers license

- Employment verification

- Rental history

Depending on your circumstances, you might also provide a gift letter, a yeartodate Profit and Loss statement , as well as courtordered information about alimony or child support, if using this income for qualifying purposes.

If you have alternative sources of income, issues in your credit history, or unusual deposits in your bank account, you should be prepared to explain these anomalies to your loan officer.

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

Read Also: Rocket Mortgage Qualifications

Your Mortgage Lender Completes The Preapproval

Once youve filled out your loan preapproval application, turned in your documents, and paid your application fee , your work is done. The last step, underwriting, is up to your lender.

Most lenders use a universal automated underwriting system to preapprove customers for home loans. AUS is a technologydriven underwriting process that provides a computergenerated loan decision.

In other words: You dont have to wait for a human underwriter to read through all those documents and approve or deny you.

Why Should You Get Pre

There are many reasons why you should get pre-approved. The most important reason is that you will get an accurate idea of how much home you can afford. This can help to target your home search and ensure you only look at houses that are truly in your price range. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Some sellers might even require buyers to submit a pre-approval letter with their offers, though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. A pre-approval letter can make you stand out in a competitive real estate market. If you make an offer on a house without a pre-approval, your offer may not be taken as seriously as an offer from another person with a pre-approval.

Recommended Reading: What Does Rocket Mortgage Do