You Can Follow These Methods

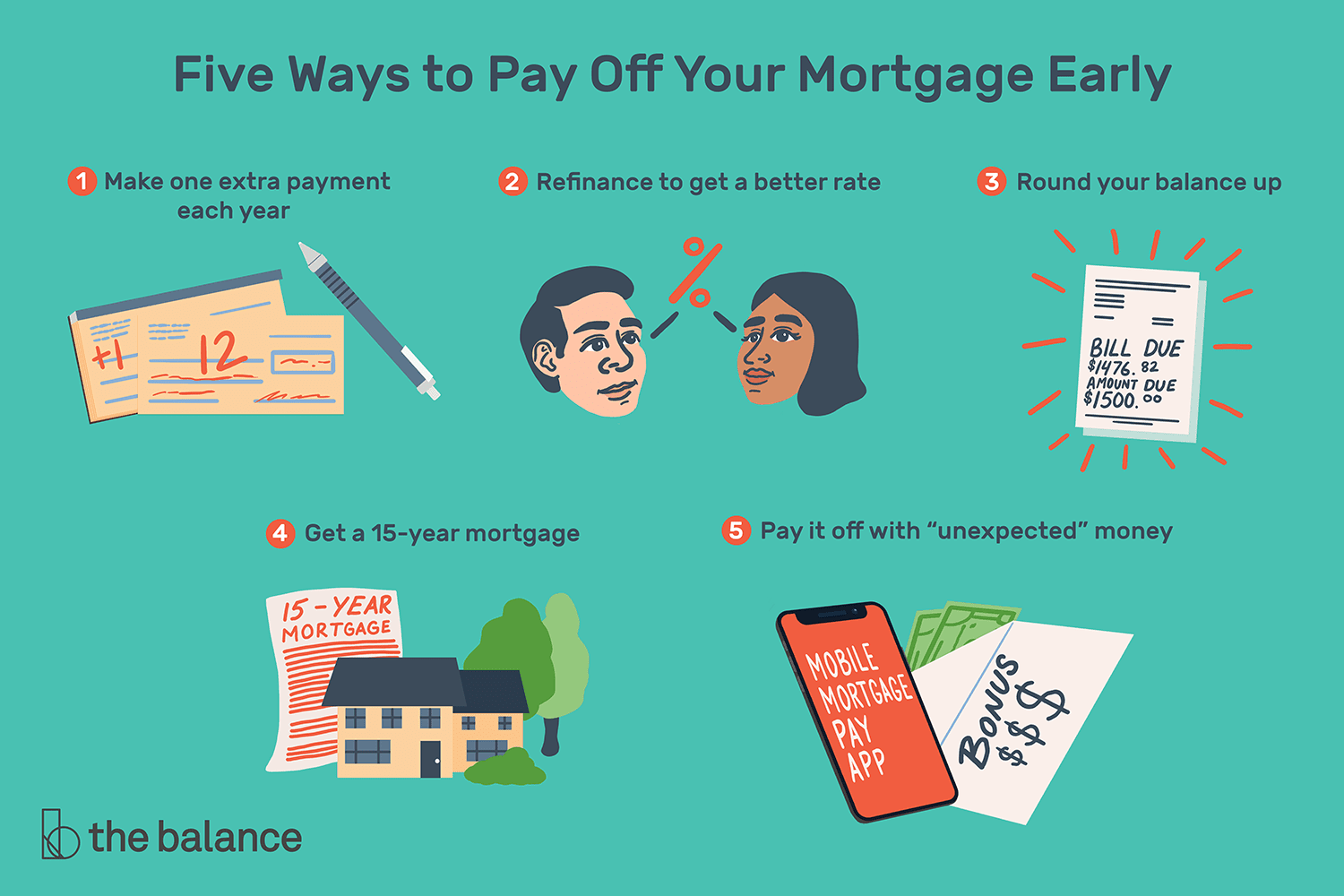

- Method #1: Make additional payments. When you make additional mortgage payments, they can go directly toward the loan principal, which reduces the balance and the total amount of interest youll pay. Try to make extra mortgage payments whenever you can and use any extra money you get during the year to pay down your loan, such as your tax return.

- Method #2: Make a larger monthly payment. Any extra money you contribute to your mortgage payment can also be applied directly to the loans principal. Even if youre only able to add $50 or $100 to your monthly payment, youll still shorten your loan term and save on interest.

- Method #3: Pay your mortgage biweekly. Instead of making monthly mortgage payments, some lenders will allow you to make biweekly payments. Because there are 52 weeks in a year, youll end up making 13 full mortgage payments instead of 12. Doing this can shave years off your mortgage.

- Method #4:Refinance your mortgage. Refinancing into a shorter-term loan can help you get a lower interest rate and pay off your mortgage earlier. Your monthly payments will increase, so make sure you can afford higher housing costs.

- Method #6: Consider downsizing. If you sell your house and use the proceeds to buy a smaller, less expensive home, you can reduce your mortgage debt and pay it off faster using the strategies above.

No : If You’re Trying To Qualify For An Income

If you have control over your income , you might find it beneficial to keep your reported income low. For instance, if you get your health insurance through the Affordable Care Act, your out of pocket insurance premiums are based on your income level. The lower your income, the lower your insurance costs will be.

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

Recommended Reading: Who Should You Get A Mortgage From

Federal Housing Administration Loan

FHA loans are another popular mortgage option, designed specifically for first-time home buyers. FHA loans make it easier for first-time buyers to make the leap to home ownership by requiring as little as 3.5% down. Plus, these loans are backed by the government, which means the government insures the bank so it wont lose its money if you dont make your payments. Whats the downside? New regulations require you to keep private mortgage insurance for the life of the loan. PMI can cost around $100 a month per $100,000 borrowed, and it doesnt go toward paying off your mortgage. Thats a cost you can do without!

My Best Advice: Plan For The Future

If you’re focused on paying off your mortgage, good for you. It’s generally always good to get rid of debt. Plus, with no mortgage, you get a guaranteed, risk-free return.

Just make sure you consider the downsides.

Aside from losing motivation, you also tie up capital in an illiquid asset when you pay your mortgage off early. Unless you have a very diversified net worth, having a lot of capital in the form of home equity can be a bad thing. Your home could collapse in the next storm or burn down in a fire.

And with interest rates at all-time lows, it might make more sense to refinance your mortgage into a low fixed-rate term for as long as you plan to own the property and then invest the rest.

The right answer depends on your current situation, tolerance for risk and long-term goals.

My best advice is to pay off your mortgage by the time you no longer want to work. Figure out when you plan to retire and divide your debt amount by the number of working years you have left.

There are free retirement planning calculators to help give you a realistic picture of your financial future. After all, there’s no rewind button in life. It’s always better to over-plan than it is to under-plan.

Sam Dogen worked in investment banking for 13 years before starting Financial Samurai, a personal finance website. He has been featured in Forbes, The Wall Street Journal, The Chicago Tribune and The L.A.Times. Sign up for his free weekly newsletter here.

Don’t miss:

Also Check: How To Sell A Mobile Home With A Mortgage

We Did It We Paid Off Our Home

Im proud to say that just before our five year refinance anniversary, we were able to pay our house off at 36 years old! We did this as a family of five on a single income. We were able to do it by living a frugal lifestyle, buying used instead of new, and keeping our mortgage payoff in the front of our minds.

In this article, I will give you some tips on how we were able to achieve this goal, and how you can also!

Should You Pay Off Your Mortgage Early Or Refinance

Do you want to pay off yourmortgage faster because youre worried about how much youre spending oninterest?

If youre simply concerned about your mortgage interest rate, consider refinancing to a lower rate and maybe a shorter term instead of making extra payments on your existing mortgage.

But if you already have a competitive interest rate and anideal loan term, you probably dont need to refinance. You may be tempted topay less interest by paying off your mortgage faster.

As you make your decision, consider whether you could earnmore investing in securities than youd save by paying down your mortgagebalance more quickly. Investing that money in a tax-preferred IRA could offermore financial peace of mind than owning your home outright sooner.

Any kind of investing can be risky. Check with a personalfinancial advisor before making any big moves if youre not sure about therisks youre taking.

Don’t Miss: How Much Do Mortgage Underwriters Make

The Benefits Of Overpaying Your Mortgage

If you can afford to make extra payments, overpaying your mortgage means you pay less interest in the future and pay off your mortgage sooner. This means you could save a lot of money.

On a £150,000 mortgage at 5% with 25 years remaining, paying off a £5,000 lump sum reduces the interest by £11,500 and means you would repay it 18 months earlier.

Overpaying when interest rates are low means youll have a smaller mortgage too if there are higher interest rates in the future.

But depending on your circumstances, there are some other questions you need to ask yourself.

Should You Get An Interest Only Lifetime Mortgage

Find Out How Much Cash You Could Release Today?

If youve reached retirement age and you need access to funds to help with your expenses or help a loved one on to the property ladder, youve likely come across interest-only lifetime mortgages. This is one of the types of lifetime mortgage products available in the UK, and you should be aware of its benefits and risks before making a decision.

Contents

Don’t Miss: Can You Get A Mortgage On A Condo

Make An Extra Mortgage Payment Every Year

Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. The earlier into the loan you do this, the more of an impact it will have. In a typical 30-year mortgage, about half the total interest you pay will accumulate in the first 10 years of your loan. That is because your interest rate is calculated against the very high principle amount you owe in the early years.

Tapping Into Hidden Income

These are savings you can get from negotiating your everyday bills.

In fact, you can save hundreds of dollars a month on bills for things like your car insurance, cell phone plan, gym membership, cable, and credit card bill through simple 5-minute negotiations.

And there are three things you need to do:

Of course, youre going to want to adjust this formula for whatever company youre calling. Check out my video on negotiating your bills for more on this topic.

You May Like: What Is Tip In Mortgage

Take Advantage Of Prepayment Privileges

Pay off your home quicker with mortgages that have prepayment privileges. Lenders offer open, closed and convertible mortgages Opens a popup.. Open mortgages usually have higher interest rates than closed mortgages, but they’re more flexible because you can prepay open mortgages, in part or in full, without a prepayment charge. Closed and convertible mortgages often let you make a 10% to 20% prepayment. Your loan agreement explains when you can make a prepayment, so get the details from your lender beforehand. Also, decide which privileges you want before finalizing your mortgage.

Should You Pay Off Your Mortgage Early

Paying off your mortgage early can help save thousands of dollars in interest. But before you start throwing a lot of money in that direction, youll need to consider a few things to determine whether its a smart option.

Well share some of the pros and cons of paying off your mortgage early and give you a few tips you can use to reduce your loan.

Read Also: How Much Net Income Should Go To Mortgage

No : If You’re Trying To Qualify For College Financial Aid

Colleges generally use one of two different sets of formulas for determining how much aid students qualify for. If they base their decisions on the Free Application for Federal Student Aid process, equity in your primary home is not considered as an available asset to pay for college. Colleges that use the CSS profile, on the other hand, may consider home equity as an available asset to pay the bill, but not all do.

If you assume you have a $400,000 house with a $250,000 mortgage balance and $250,000 worth of after-tax investments, schools that use FAFSA see those $250,000 of investments as available. If, on the other hand, you take those investments and pay off your mortgage, your net worth doesn’t change, but schools that use FAFSA no longer see that pot of investment money as available to pay for school.

Especially if you have more than one child for whom college is approaching soon, the benefit of lower out of pocket college costs might very well outweigh the returns from keeping that money invested.

Good Debt Vs Bad Debt

Some people think of all debt as bad, but thats not really the case. Experts refer to both good debt and bad debt. A mortgage lands squarely in the good debt column.

How a loan is secured determines whether its good or bad, says Stanley Poorman, a financial professional with Principal®. A mortgage is secured by an assetyour housewhich gives it an advantage. Personal loans and credit cards are not.

Think of good debt this way: Every payment you make increases your ownership in that asset, in this case your home, a little bit more. But bad debt like credit card payments? That debt is for things youve already paid for and are probably using. Youre not going to own any more of a pair of jeans, for example.

Theres another key difference between purchasing a home and buying most goods and services. Very often, people can pay cash for things like clothes or electronics. The vast majority of people couldnt pay cash for a home, Poorman says. That makes a mortgage all but necessary to buy a house.

You May Like: How Much A Month Is A 500k Mortgage

Make A Mortgage Payment Every Two Weeks

Most people pay their mortgage bills once a month. However, a strategy that allows you to apply more money towards the principal each month, save on the interest that accrues, and lessen the term of your mortgage loan is to make biweekly payments that are half the size of your monthly mortgage.

Suppose your mortgage is $1000 per month. With biweekly payments, you would pay $500 every two weeks. What difference does it make to make a half-payment every two weeks rather than one large one? By paying once a month, you make 12 payments a year. By splitting it up every two weeks, you make 13 payments a year.

That often reduces your loan by approximately five years.

Shorten Your Amortization Period

The amortization period is the length of time it takes to pay off a mortgage, including interest. The shorter the amortization period, the less interest you pay over the life of the mortgage. You can reduce your amortization period by increasing your regular payment amount. Your monthly payments are slightly higher, but you’ll be mortgage-free sooner. Find out how much you could save by shortening your amortization period with our mortgage payment calculator.

Also Check: Who Owns Prosperity Home Mortgage

Losing The Benefits Of Interest Deductions

Before deciding to pay off a mortgage early, it would be a good idea to weigh the pros and cons. The interest charged on up to $750,000 of mortgage debt used to purchase a principal residence can be used as a deduction on taxes in the year that it is paid. Because most of the monthly payments in the early years of a loan are interest, this can really add up. The mortgage interest deduction to homeowners is a very popular subsidy. However, the benefit would be lost if the mortgage is paid off early. In years gone by interest paid on home equity loans or HELOCs was tax deductible, but that is no longer the case in 2018, as equity debt is no longer treated like mortgage debt unless it is obtained to build or substantially improve the homeowner’s dwelling.

Discharging When Changing Lenders

You may choose to renegotiate your mortgage contract and change lenders because another lender offers you a better deal.

When you change lenders, the information on your propertys title must be updated. You, your lawyer or your notary must discharge the mortgage and add your new lender to your propertys title. Some lenders charge other fees, including assignment fees when you switch to another lender. Ask your new lender if they will cover the costs of a mortgage discharge.

Also Check: How Long Can I Lock In A Mortgage Rate

Will Your Mortgage Company Let You Pay It Off Early

When you pay off your mortgage faster, you pay less interest, and your mortgage company makes less money off your loan. For this reason, not all mortgage companies permit their clients to pay off their loans earlier than stipulated in their contract. So, before you make any grand plans, double-check that your lender will, in fact, allow you to pay off your mortgage faster.

Make One Extra Mortgage Payment Each Year

Making an extra mortgage payment each year could reduce the term of your loan significantly.

The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $975 each month on a $900 mortgage payment, youll have paid the equivalent of an extra payment by the end of the year.

Also Check: Can You Reverse Mortgage A Condo

How Much Money Can You Release Through An Interest

The amount you can release against your property will depend on the value of your home and your age. To get a proper estimate, you should contact a lender or mortgage advisor to discuss your options.

Heres an estimate that gives you a better idea of the costs involved:

- A 70-year old applicant with a property valued at £400,000 can release £104,650 at 2.93%. The maximum this applicant could release is £184,000 at 6.32%. With an interest-only lifetime mortgage, you would pay the cost of the interest every month so that at the end of your plan, you only pay the loan amount.

Note that your quote will likely be different since rates differ by company. Make sure to discuss your requirements with an advisor before making a decision.

Downsize To A Smaller Home

We have talked about the lure of buying a large home. It isnt unusual to see an empty-nester couple in a 3,500 square foot home or singles in a 2,200 square foot townhome. It is human nature to want to buy a larger home than we need either we want room to spread out, or we want to keep up with the Joneses.

However, one of the challenges we often fail to consider is the added expenses we incur with larger homes. For example, how much do you think it costs those empty-nesters in the large house to heat and cool such a big space? If they have a large yard and need to have landscaping done regularly, that is also a significant expense that adds to their housing cost.

In reality, if they could manage to live in a home half the size, they could save significantly by downsizing. There are many positives to downsizing, including being able to minimize the large number of items that we have collected through the years, in addition to the savings we could realize by living in a smaller home.

Read Also: How Does A 5 1 Arm Mortgage Work