How Much Income Do I Need For A 500k Mortgage

You need to make $153,812 a year to afford a 500k mortgage. We base the income you need on a 500k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $12,818.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

- Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

- Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

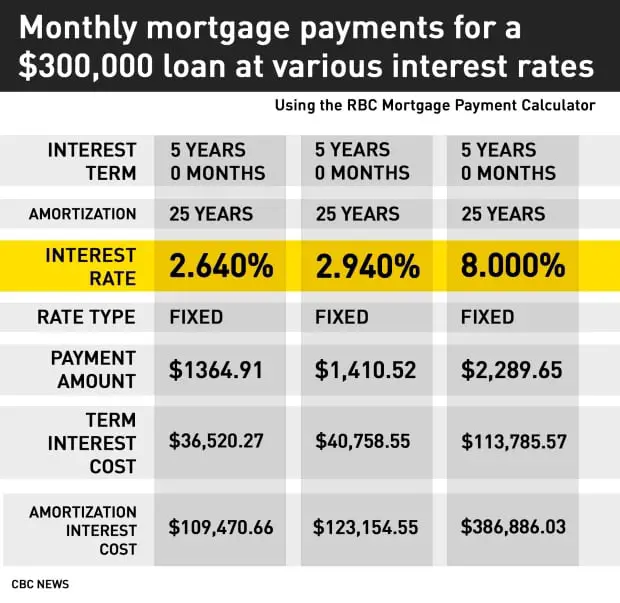

- Look for a lower interest rate.You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Why Use A Mortgage Repayment Calculator

Understanding roughly how much your monthly repayments will be is a crucial step in budgeting for a new mortgage. Taking out a mortgage at the upper end of your affordability may at first seem like a good idea but depending on the type of mortgage you decide to go for, mortgage rate increases could see you saddled with repayments that you cant afford. Instead, its best to opt for mortgage repayments that you can comfortably afford even if this means borrowing slightly less.

Also Check: How Much Mortgage For 60000 Income

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Required Income For 500k Mortgage Under The Stress Test

Lets determine the Gross Debt Service for a $500,000 condo using the mortgage stress test rate of 5.19% over 25 year amortization. Your household expenses break down like this:

- Property tax $255/month ÷ 12)

- Heating $60/month

- Mortgage payments $2,927/monthTOTAL: $3,442

With your monthly household expenses amounting to $3,442 this means the required minimum income for a 500K mortgage under the Stress Test is $130,000 per year. This could also be two salaries of $65,000 per year.

$130,000 ÷ 12 = $10,833$10,833 x 0.32 = $3,447

Expenses $3,442 < $3,447 GDS

Dont forget about any debts, keeping in mind they should not exceed 40% of your monthly household income.

So while the above is how the bank will approach determining what you can afford, below is closer to the income one actually needs to afford a 500K mortgage.

Don’t Miss: How To Calculate Percentage Of Mortgage

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you won’t be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, you’ll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

You May Like: How To Determine My Mortgage Payment

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

Is Your Income Consistent

Those who are in regular employment and receive a consistent wage will typically find it easier to secure a £500,000 mortgage. If you are self-employed, or you have a more complicated income structure, your chosen lender may wish to see proof of earnings from the last two or three years to establish your eligibility for the loan. Therefore, its a good idea to get all your paperwork in order if youre looking to start the process soon.

You May Like: Are Mortgage Discount Points Worth It

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance – also called CMHC insurance – must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

Your Total Interest On A $500000 Mortgage

On a 25-year mortgage with a 3% fixed interest rate, youll pay roughly $209,868.25 in interest over the life of your mortgage.

If you instead opt for a 15-year mortgage, youll pay roughly $120,719.56 in interest over the life of your mortgage or just over half of the interest youd pay on a 25-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest $415,587.22

Don’t Miss: What Bureau Do Mortgage Lenders Use

K Mortgage Repayment Comparison

In this table, we show the total you will repay – including interest payments – on a £500,000 mortgage over different mortgage terms. It assumes a rate of 2.5% for the life of the mortgage.

| Mortgage term | Total repaid over full term | Total interest paid |

| £600,158 | £100,158 |

The figures clearly show the high price you pay to secure a lower monthly payment. For example, taking out a £500,000 mortgage over 25 years at 2.5% will mean you pay £407 per month less compared with taking out the same deal over 20 years. However, instead of paying £135,949 in interest if you took out the shorter term, you would pay £173,01 by opting to spread it over 25 years. That is a difference of £37,061.

There is advice on how to reduce your mortgage term and save money in our article “How to pay off your mortgage faster – and is it a good idea?“

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

Don’t Miss: What Does Prequalification For A Mortgage Mean

What Mortgages Does Cmhc Insurance Not Cover

TheCMHC has eligibility requirementsthat limit the type of mortgages that can be insured.

CMHC insurance will not cover homes with a cost of $1 million or more.

Mortgages with an amortization period greater than 25 years are also not eligible for CMHC insurance.

You can still get CMHC insurance for mortgages with a down payment larger than 20%.

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

Don’t Miss: How To Sell A Mobile Home With A Mortgage

How Much Is Cmhc Insurance

CMHC insurance premiums are a percentage of your mortgage and are paid by your mortgage lender.Provincial sales taxis added to premiums for mortgages located in Ontario, Quebec, Manitoba. and Sadkatachewan.

Premiums start at 2.4% of the mortgage amount for down payments of 20% or less, going up to 4% for a down payment of 5%. While your mortgage lender will pay the insurance premium, they will usually pass this cost indirectly onto you. However, you may still save money after these premiums through lower mortgage rates that insured mortgages usually have.

To find out how much CMHC insurance would cost for your home, visit ourCMHC insurance calculator.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Much To Pay Mortgage Off Early

What Happens At The End Of A Term

You will need to either renew orrefinance your mortgageat the end of each term, unless you are able to fully pay off your mortgage.

- Renewing your mortgage means that you will be signing another mortgage term, and it may have a different mortgage interest rate and monthly payment.Mortgage renewalsare done with the same lender.

- Refinancing your mortgagemeans that you will also be signing another mortgage term, but youll also be signing a new mortgage agreement. This allows you to switch to another lender, increase your loan amount, and sign another term before your current term is over. This lets you take advantage of lower rates from another lender, borrow more money, and lock-in a mortgage rate early.

Should I Choose A Fixed Or Variable Rate

A variable rate lets you benefit from decreases in market interest rates, but it will cost you more if interest rates rise. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future.

Of course, its not possible to exactly predict future interest rates, but a2001 studyfound that variable interest rates outperform fixed interest rates up to 90% of the time between 1950 and 2000. If youre comfortable with taking on risk, a variable mortgage rate can result in a lower lifetime mortgage cost.

Don’t Miss: Why Would A Mortgage Be Declined

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

What Is Mortgage Insurance

Mortgages with adown paymentof less than 20% are required to be insured due to the higher level of risk that they carry. This insurance protects the mortgage lender should you default on the mortgage. Mortgage default insurance does not protect you or help you cover mortgage payments.

The largest provider of mortgage loan insurance in Canada is the Canada Mortgage and Housing Corporation , which is owned by the Government of Canada. Some mortgage lenders allow you to go through a private mortgage insurer instead, such as Canada Guaranty or Sagen.

Recommended Reading: What Questions Do Mortgage Lenders Ask Employers

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

Total Interest Paid On A $450000 Mortgage

The exact amount of interest youll pay on a $450,000 loan will depend on your rate and your loans term . A shorter term will typically offer fewer interest costs than a loan with a longer term.

Example:

A 15-year mortgage with the same terms would come with $109,371.13 in interest costs around $123,000 less.

Credible can be a big help when trying to find a great interest rate. You can easily compare our partner lenders and see prequalified rates in as little as three minutes all without leaving our platform.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Checking rates wont affect your credit score.

You May Like: What You Need For A Mortgage