Definition Of A Mortgage Statement

A mortgage statement is a document prepared by a mortgage holder and provided to the borrower.

A mortgage statement will show the current mortgage balance, current interest rate, amount remaining on the mortgage term and amortization and the contact information for the mortgage holder.

A mortgage statement may also provide a history of payments from the date of the last issuance. The mortgage statement is provided to the borrower periodically, at least annually, and can be provided to the borrower upon request.

Discharging When Changing Lenders

You may choose to renegotiate your mortgage contract and change lenders because another lender offers you a better deal.

When you change lenders, the information on your propertys title must be updated. You, your lawyer or your notary must discharge the mortgage and add your new lender to your propertys title. Some lenders charge other fees, including assignment fees when you switch to another lender. Ask your new lender if they will cover the costs of a mortgage discharge.

Why Haven’t I Got A Statement For A Mortgage That I Repaid Earlier Last Yearpress To Expand/collapse

We don’t send out annual statements for accounts that have been repaid within the year because they would have the same information that was already included in your ending redemption statement. However, if you do need a closing statement, you can request one using the Mortgage Statement Request form.

Read Also: Chase Recast Calculator

Explanation Of Amount Due

The explanation of amount due is a further breakdown of the amount you owe for the current month. It will detail the following:

-

The principal payment, which is the portion for the current month thatâs paying off the remaining loan balance.

-

The interest payment, which is the portion for the current month being applied to interest on the remaining loan balance.

-

The escrow payment, which is the portion for the current month going into your escrow account. Your escrow account pays for property taxes, homeowners insurance, and private mortgage insurance if itâs required.

-

The total payment for the month, which is the sum of the previous three items.

-

Any fees, which could include charges like late fees.

-

The past due amount, which will be indicated if you still owe money from any previous monthsâ statements.

Transaction History Since Last Statement

This section details the date, description, and amount of all recent charges or credits to the account as of the borrowerâs last mortgage statement.

For example, your transaction activity could detail an escrow reimbursement or credit if, at the end of the year, your mortgage company determines you paid too much for property taxes or homeowners insurance premiums and have a surplus in your account.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Ensure Your Payments Are Accurate

Your monthly mortgage statements detail how much you owe on your loan and what youve already paid off. Compare your statements with one another and make sure that all your payments are accurate.

This is especially important if you want to make an extra payment on your loan. Some lenders may apply an extra payment to next months balance instead of directly to your principal. Keeping tabs on your statements will allow you to catch this mistake quickly before more interest can accumulate.

Will Gambling Affect My Chances Of Getting A Mortgage

This is a question we find ourselves being asked on a regular basis. All too often do customers find themselves stuck when they have a history of gambling behind them. The occasional bit of fun is harmless, but if you are frequently betting large amounts of money, whether youre making it back or not, a lender will not look at your situation favourably at all.To learn more, please see our article on Do Gambling Transactions Look Bad on My Bank Statements?

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

A Breakdown Of A Mortgage Statement Template

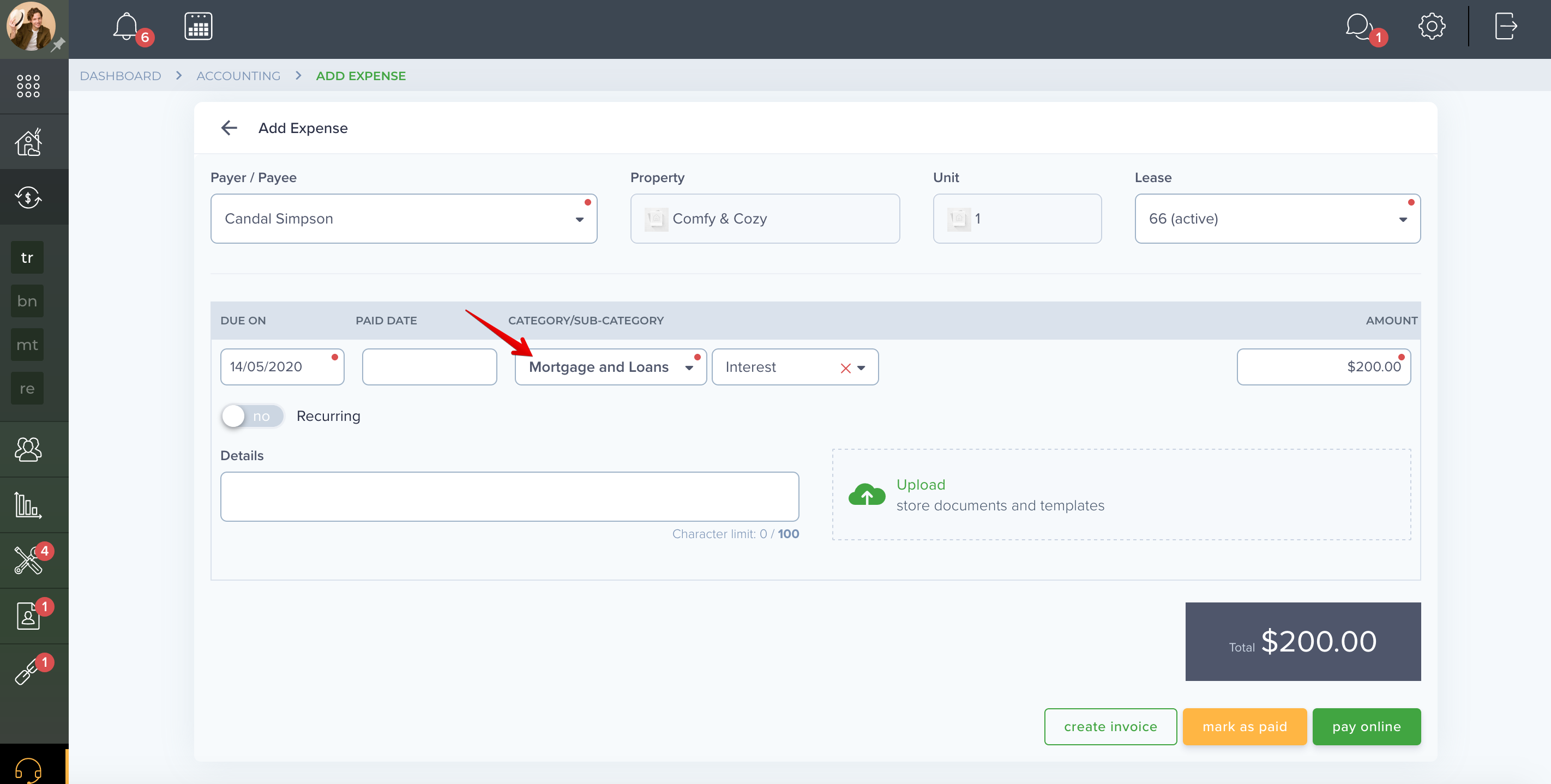

The Consumer Financial Protection Bureau created a mortgage statement sample on its website, which LendingTree adapted in the image below to explain how to read your home loan statement. Each number in the graphic corresponds to an item in the list below.

#1 Mortgage servicer information

First up on your mortgage statement will be information about your loan servicer. This is the bank or company that sends your monthly mortgage statement and handles the payments. The companys name, address, website and phone number are typically displayed here. Use this contact information if you have any questions about your mortgage.

#2 Account number

Your mortgage loan account number is what identifies the mortgage as yours. If you need to contact your loan servicer with a question or an issue, youll need to provide your account number.

#3 Payment due date

This is self-explanatory: the date by which you need to make your mortgage payment. Generally speaking, most lenders offer a grace or courtesy period usually two weeks before your payment is .

#4 If received after

Your payment is late if you dont pay it by the due date. But, as noted above, youll usually get a two-week grace period. The if received after date refers to the end of the courtesy period, at which point youll incur a late fee. Youll usually find this date grouped along with the payment due date and the amount due.

#5 Outstanding principal amount

#6 Interest rate

#7 Current mortgage payment breakdown

To Access Your Account Statements In Online Banking:

- From the Accounts Summary page, select Statements/Documents.

- On the View eDocuments tab, follow the instructions under Search eDocuments to download and view your document.

You’ll be able to view your last 6 statements. You can also select a different statement period by using the dropdown menu. You’ll only be able to see the statements for accounts you’ve switched to electronic.

Only accounts that youâve switched to electronic documents will be available. If you donât see the statement that youâre looking for, give us a call at 1-800-769-2511.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Make The Switch To Estatements Today

Already registered for CIBC Online Banking?

1 Paperless record-keeping is a paper-free alternative to printed statements. This option enables clients to track account activity online or by phone or CIBC bank machine. Please note, no printed statements will be sent to clients selecting this option. Clients must review their account transactions through CIBC Online Banking, CIBC Mobile Banking , CIBC Telephone Banking or CIBC bank machines at least once every 30 days and examine all entries and balances at that time. If there are any errors, omissions or irregularities, clients must notify CIBC in writing within 60 days after the date on which the entry was, or should have been, posted to the account.

2 Applies to CIBC Personal Portfolio Services and CIBC Securities Inc. mutual fund account statements from the time of eStatement registration .

3 Choosing paperless eStatements helps to reduce the amount of paper and ink we use.

How Can I Get An Electronic Periodic Mortgage Statement

If you want to receive your mortgage statement electronically, tell your mortgage servicer.

The CFPB doesnt prohibit servicers from sending periodic mortgage statements electronically, as long as your servicer has your consent.

Under CFPB rules, your mortgage servicer is generally required to provide a periodic mortgage statement to you each billing cycle. That statement should cover basics such as:

- An explanation of your amount due

- Your payment and transaction history

- Your account information

- The contact information for your servicer

The CFPB rules do not require mortgage servicers to provide electronic statements, but they do allow servicers to give you the option of receiving your periodic statements electronically instead of through the mail. As long as your servicer gets your consent in advance, it can send electronic periodic statements to you. In fact, if you currently receive electronic statements from your servicer for any account , CFPB rules say that your servicer should consider you to have already agreed to receive electronic periodic mortgage statements.

Depending on your individual circumstances, you may prefer to receive paper or electronic statements. Mortgage servicers may be capable of offering you the option for electronic statements.

If you have a problem with your mortgage, you can submit a complaint with us online or by calling 411-CFPB .

Don’t Miss: Chase Mortgage Recast Fee

Keep Your Monthly Mortgage Statements

Unless you request only online statements, your mortgage company will probably mail you printed statements every month, too. It usually arrives at least a couple of weeks before the next payment is due. The paper statement should be straightforward and detailed, offering information that is also in the online statement, such as the amount that is due each month and your simple or actuarial interest.

Print A Summary From Internet Banking

You can print a summary of your statement from the Internet Banking mortgage overview screen. You’ll need to use a desktop or laptop computer to do this.

When you print a statement, you can:

- Check your current balance

- Find out how much interest weve charged

- Find details of all the payments you’ve made over the last 12 months

Don’t Miss: Mortgage Recast Calculator Chase

Reviewing A Mortgage Statement

Like a credit card statement or , a mortgage statement is an important disclosure document for the buyer for a number of reasons. First, it keeps the borrower aware of the current mortgage balance, allowing the borrower to check the balance for discrepancies. It should be reviewed upon receipt for errors, and if errors are found, the mortgage holder should be notified immediately. Mortgage holders can double check the number appearing on the statements by using mortgage calculators like the ones on this site.The mortgage statement should provide the borrower with the amount of time left in the mortgage term. Having this information tells the borrower when their mortgage is up for renewal and gives them notice to decide if they want to stay with their current lender or if they want to shop around for a different interest rate.

Need help reviewing your mortgage statement? Contact us anytime!

Why Its Important To Read Your Mortgage Statement

Its crucial to read your mortgage statement each month. By doing so, youll know in advance of an interest rate increase or changes to your escrow payments. Additionally, you might be able to catch issues such as overdue or delinquent payments or incorrect late charges.

If you see any errors on your mortgage statements, contact your loan servicer immediately. If you call, make a note of who you spoke to, the case number and the outcome of the conversation, and request a corrected statement. Follow up with your lender if you dont receive one. If you write to your loan servicer, make sure the letter has your name, address, account number from your mortgage statement and the exact reason for the dispute. Generally, lenders must address your written dispute within 30 days.

Many consumers question how long to keep mortgage loan statements. Whether you receive them via mail or online, the CFPB recommends you hold on to them for about three years.

Don’t Miss: Reverse Mortgage For Mobile Homes

Things To Look For On Your Monthly Mortgage Statement

The entire home buying process is a learning experience, and the truth is, you never stop learning once you become a homeowner. Staying informed is so important, especially when it comes to your mortgage. When your first monthly mortgage statement arrives, youll notice there is a lot of information to digest but dont fret. Were going to highlight the different sections and what you should be looking for below.

Its important to note that your monthly statement may vary slightly, depending on your loan servicer. The following details are those that youll see most commonly, so use this as a guide when reviewing your individual statement.

Tips On Making Your Payments

Paying on time

Are you the forgetful type? Look into setting up automatic withdrawals from your bank account to your loan servicer. Or schedule the payments ahead online. Your servicer might also offer reminder emails or texts.

Are you the do-it-now type? You might assume that paying early will save you a little interest, as it would with a credit card balance. Nope. Mortgage interest is calculated monthly, not daily, based on the previous months balance. If you do pay early for some reason, let your servicer know, to be certain the money goes to the right place. You wouldnt want the payment to go to principal, for example.

Partial payment

Note that if you ever make a partial payment on your mortgage, it will probably be held in a separate account not applied to your loan until you pay the balance. In other words, the partial payment wont be considered on time.

Paying extra

You might want to pay more than the amount due for a variety of reasons. Make sure the extra goes where you want it to go. Principal? Escrow? A previous late payment? If the servicer hasnt provided a clear way to indicate how you want the excess applied, get in touch with them first.

Also Check: Can I Get A Reverse Mortgage On A Condo

Why Are There Arrears Showing When I Have Made All Of My Payments

Typically this is because a mortgage payment was not received before the end of the financial year. To ensure that repayments are received and cleared in time, direct debits and standing orders should be arranged for payment by the 25th of each month. If you are having problems meeting your repayments, our Credit Services Department will be able to provide help and advice. Please contact them to discuss the options available.

What Can I Do To Show The Lender I Am Reliable

From our experience in working with many First-Time Buyers in Hull& Home Movers in Hull, we have found that most mortgage lenders will want at least three months bank statements from an applicant.With that in mind, its time for you to forget the past and think about the future. You have at least three months to work on your finances. The first thing wed suggest is if you are a frequenter of the local bookmakers or online gambling scene, you take a break for some time. This not only benefits your financial state but can also benefit your mental health too.The next steps we would recommend taking are to trying to save money. For example, cooking in as opposed to eating out, treating yourself to unnecessary purchases and cancelling unneeded subscriptions are great ways of freeing up additional cash to ensure bills can be paid on time.What this boils down to is simply being sensible and planning with plenty of time ahead of what youre looking to do. The further away you find yourself from bouts of debt and financial uncertainty, the better your chances will be with a lender.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Mortgage Statement As Documentation

If a borrower is considering selling the property or considering refinancing with another lender, a current mortgage statement is nearly always required as proof of the approximate existing balance and to determine a payoff balance upon closing of the sale or refinancing.In most cases, your new lender will accept an annual statement, even if it is several months old. However if there has been a change to the mortgage balance due to a refinance or pre-payment, the lender will require you to obtain a current statement. There may be a small fee charged from your current mortgage holder for updating the mortgage statement. A current mortgage statement is usually on a document checklist of items to provide to the mortgage broker, real estate agent or broker and the seller.At First Foundation, we can review your current mortgage statement with you and answer any questions you may have. Often, after reviewing the statement and explaining the options available to the borrower, a refinancing of the mortgage can prove to be beneficial to the borrower.

Related Term:

How Does Making Overpayments Impact My Mortgagepress To Expand/collapse

If your mortgage has interest that is charged daily, this is reduced as soon as we receive a payment. The interest is then calculated based on the lower balance. The monthly payment will not change at this time.

If your mortgage has interest charged on an annual basis, your balance will go down straightaway. However, the balance on which interest is charged will not go down until 31 March. Interest for the following year will then be calculated on the reduced balance.

When we recalculate your monthly mortgage payment, we use any overpayments you have made to reduce what you owe once we have done this, you will need to start building up new overpayments before you will be able to underpay again.

More information on making extra payments and how you can do this can be found on our Mortgage Overpayment page.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Why Is There A Minus Figure In The Debit Column

These are credits to your account that reduce the balance and may occur when a capital repayment is made, therefore reducing the balance and the amount of interest charged. This difference in interest charged will be shown on your account. Any charge required for early repayment will also be shown in the Debit column.

The Ultimate Guide To Mortgage Pre

A mortgage pre-approval is an important step in the home buying process. It shows that you are serious about purchasing a home and gives you an idea of what you can afford. In order to get pre-approved, you will need to provide your lender with some documentation.

The benefits of mortgage pre-approval are numerous. Youll know exactly how much you can afford to spend on a home. This will help you narrow down your search and avoid looking at homes that are out of your budget.

Having mortgage pre-approval in your back pocket can also make you a more attractive buyer and give you an edge over other buyers when competing for the same home. It gives sellers peace of mind knowing that you are committed about purchasing a home and have taken the time to ensure financing is in place. Being mortgage pre-approved also gives you a better idea of what you can afford.

This mortgage pre-approval checklist will tell you everything you need to bring with you when meeting with your lender. Buckle up!

Don’t Miss: How Much Is Mortgage On 1 Million