Advantages Of Biweekly Mortgages

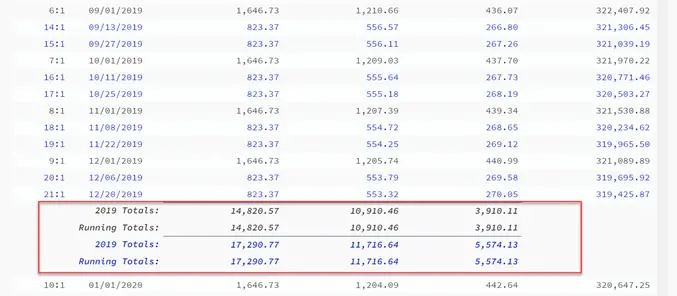

Borrowers can pay off the mortgage sooner by making one extra payment per year. For example, let’s say a borrower has a $200,000 mortgage with a rate of 5% and a 30-year term. If the borrower does the biweekly mortgage, the loan would be paid off in 25 years or five years earlier versus the traditional mortgage with monthly payments. The extra payment per year adds up over time and allows the borrower to own the home sooner.

The interest saved as a result of a biweekly mortgage is also a significant benefit. Using the financial details from the above example, the total interest for the traditional mortgage would be $187,000, while the biweekly mortgage would cost $151,000 over the life of the loan. Not only does a biweekly mortgage pay off the mortgage sooner, but it also saves the borrower $36,000 in interest over the life of the loan.

Another advantage of a biweekly mortgage versus a traditional mortgage loan is that equity is built up sooner. Home equity represents the portion of the home that the borrower owns. For example, let’s say a home has a market value of $200,000, and the borrower has paid off $80,000 of the $200,000 mortgage. The equity in the house would be $80,000, which the borrower could borrow from to make improvements to the home or use the funds for other purposes. In short, a biweekly mortgage helps homeowners build equity faster.

Making Biweekly Mortgage Payments Can Be A Great Repayment Strategy

Biweekly mortgage payments can be a great early-repayment strategy. Most people will not realize they are making an extra payment twice a year because the payment amount is so small. For most months, you wont pay any more than your current mortgage payment and you will still repay your mortgage early while saving thousands of dollars in interest. Plus, you might not have to make drastic changes to your spending habits!

Post navigation

About Jackie

Im Jackie Beck. My husband and I paid off over $147,000 in debt

My award-winning app, Pay Off Debt by Jackie Beck, was featured in Oprah Magazine and has helped over 54,000 people.

Learn more about how to get out of debt here.

Less Money For Other Needs

Before you commit to making biweekly mortgage payments, consider whether doing so would benefit your overall financial plan. A biweekly plan means putting more money toward your mortgage every year, which could pull from other financial obligations like saving for retirement or paying off high-interest debt. Be sure to work a biweekly payment plan into your budget and see if the savings outweigh any losses elsewhere.

Paying the extra amount means a portion of your monthly money is tied up elsewhere, and without proper planning, this might affect your budget and your ability to pay for other pressing financial needs besides your mortgage, explains Connie Heintz, founder and president of DIYoffer, a for-sale-by-owner toolkit.

If you have already locked in a low interest rate, accelerating your mortgage might not make much of a difference, Heintz adds. Youll just put in more of your money toward paying the mortgage.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Beware Of Payment Processing Companies

Some mortgage lenders offer biweekly payment options. For example, Navy Federal Credit Union offers a dedicated program for those who want to make payments every two weeks indefinitely, says Kevin Torres, a mortgage product strategist at the credit union. It also has a free Budget Easy program that lets you make those biweekly payments automatically if you want or switch back to monthly payments if your finances change.

Heres where things get tricky: When lenders dont offer a biweekly payment option, some borrowers turn to third-party services that do. However, these payment processing companies charge a setup fee in the range of $300. Some also charge monthly fees, and it may be hard to get out of the contract once it begins.

Even worse, some of these services simply hold onto your second payment for two weeks and just make monthly payments on your behalf, nullifying the impact of one extra annual payment. So if you get contacted by a company offering to save you thousands by handling your mortgage payments, tread carefully.

The Bottom Line: Are Biweekly Payments Right For You

For the right type of borrower, biweekly payments can help you save on interest and quickly add equity into your home. As with any major financial decision, its important that you weigh the pros and cons of paying your mortgage more frequently.

If you have questions on how you can start biweekly payments through Rocket Mortgage, you can talk to a Home Loan Expert today for more information.

Don’t Miss: Can You Refinance A Mortgage Without A Job

How To Do It Yourself

The good news is that if your lender doesnt offer a biweekly payment option, you can take matters into your own hands.

Take your monthly mortgage payment and divide it by 12. Make an extra principal-only payment of that amount every month. Or save that amount every month for 12 months in a separate savings account, then make one extra mortgage payment for that year using the total, which is the equivalent of how much extra you would pay annually on a biweekly plan.

Before you go this route, however, confirm with your lender that there are no prepayment penalties on your loan and that the extra payments will be applied entirely to your loans principal rather than to principal plus interest.

Biweekly payments are certainly worth making if your finances allow for it, Torres says. You can use a biweekly mortgage payment calculator to estimate your potential savings.

About the author:Emily Starbuck Crone is a former mortgage writer for NerdWallet. Her work has been featured by USA Today and MarketWatch. Read more

Reasons To Make Biweekly Mortgage Payments

There are several benefits of paying a mortgage biweekly. While it may require a little extra work on your end, at least in the beginning, you may find it completely worthwhile.

Here are the top five reasons to consider paying your mortgage every two weeks, and what they can do for your finances.

Also Check: Chase Recast

What Are The Benefits Of A Biweekly Mortgage Payment

When you make biweekly payments instead of monthly payments, as long as they are processed when received, you will pay down your principal faster. Here are a couple of benefits to consider regarding biweekly payments:

- Paying a half payment every 2 weeks results in 13 full payments in a year rather than 12, reducing the principal balance on the loan, which means youll not only pay less interest, but pay off the loan sooner.

- Paying a half payment every 2 weeks rather than the full amount each month may be easier to budget for depending on when and how often you receive your paycheck.

Does A Biweekly Mortgage Work As Advertised

Biweekly mortgage repayment schemes to allow you to own your home faster. It, like other methods of accelerating your mortgage repayment, do in fact pay your balance down more quickly and save you interest costs.

Whether the biweekly mortgage is the most effective strategy depends on if the loan servicer charges more to process your payments this way, and if there is a mortgage refinance available that could do a better job of saving you time and money.

Understanding your options is the first way to make sure youre making a good choice. Read more about biweekly mortgages below.

Recommended Reading: Rocket Mortgage Requirements

The Secret Bonus Of Making Bi

Since there are 52 weeks in a year, 26 bi-weekly payments mean homeowners who pay this way are making 13 monthly payments each year, instead of the standard 12. This equates to just one additional mortgage payment a year, but this one extra payment substantiallyshortens the lifespan of the loan.

A homeowner with a $300,000 loan at a 4 percent interest rate makes one additional monthly payment each year. This shortens payoff on a standard 30-year mortgage by five years and saves over $35,000 in interest over the life of the loan.

Even if you dont plan on staying in the home for 30 years, paying bi-weekly builds more equity in the home since youre paying down more of the principal each time. More equity in the home means a homeowner can take advantage of a home equity loan for large purchases or leverage the equity to get into a larger home down the road.

If the interest rate on your current mortgage loan is higher than these averages, it may make sense to consider a mortgage refinance loan. You can visit Credible to compare rates and lenders in your area.

Is A Biweekly Mortgage Plan A Good Idea

On the Clark Howard Show a couple of years ago, a listener called in to ask if a biweekly mortgage plan was a good idea. I was shocked when Clark emphatically told the caller that no, the biweekly mortgage plan was never a good idea.

I was shocked because the biweekly mortgage plan just seems to make sense. If you pay half your payment two weeks early, shouldnt that reduce some of your principal faster, which should in turn reduce the amount of interest you pay over the life of the loan?

Did Clarks advice stink? I decided I needed to figure out once and for all if the biweekly mortgage plan was a good idea.

You May Like: How 10 Year Treasury Affect Mortgage Rates

Are Biweekly Mortgage Payments Right For Me

Switching to biweekly mortgage payments may not be right for everyone. Its important to evaluate your financial situation to see if theyre feasible with your payment schedule and budget. Its also important to determine whether the financial benefits outweigh any potential fees charged by your lender.

Fortunately, there are alternative ways to pay your mortgage faster, including:

Paying extra each month. Look at your budget to see if you have extra cash that can be applied to the mortgage principal. Even $50 can help reduce the principal and the total amount of interest you pay on the mortgage.

Refinancing and paying the savings. Its possible to refinance your existing mortgage for a new loan with a lower interest rate and monthly payment. To chip away at your mortgage balance, continue to pay your previous monthly payment and instruct your lender to apply the extra cash to your principal.

Rounding up payments. Instead of sending the exact payment amount say, $1,235.50 round it up to $1,300 and apply the extra amount to the mortgage principal.

Applying bonuses or tax refunds. Any time you receive some extra cash, such as a tax refund or year-end work bonus, apply that money to your principal.

Youll Pay Your Mortgage Off Faster

So, just how much sooner would you pay off a mortgage with biweekly payments, versus standard monthly payments? Lets look at the math.

There are 52 weeks in a year, which means that with biweekly payments, youll make a total of 26 contributions toward your home mortgage. At the end of the year, that actually equates to 13 full monthly payments versus the 12 you would have made with your standard repayment schedule.

This additional payment each year can significantly reduce your principal balance, meaning that youll pay off your home even faster than planned.

Lets say that you have a $200,000 mortgage loan at a rate of 4.00% for 30 years. If you pay according to your lenders standard amortization schedule, your loan will take you 30 years to repay.

However, by paying biweekly and essentially making one extra monthly payment a year youll actually pay your loan off midway through year 25. Think of all the things you could do being mortgage-free for nearly 5 extra years!

| Standard Repayment Timeline |

You May Like: What Does Gmfs Mortgage Stand For

What Advantage Is There With Mortgage Plans That Have Bi

By | Submitted On May 04, 2007

Some mortgage companies allow you to set up your mortgage so that you are making bi-weekly payments. This allows you to pay off your mortgage at a much faster rate. While certainly not for everyone, here are some things that you need to know as to why you may want to consider getting your mortgage with bi-weekly payments.

The most beneficial bi-weekly payment option, which is a true bi-weekly mortgage payment plan, will take payments out every two weeks. Yes, they like the automatic payments – probably better for you, too, that way you do not have to worry about late payments. The first payment is half of your monthly mortgage payment, and then the second one is also half. All together, you will have paid the equivalent of 13 months of payments in only 12 months.

The difference in programs that have bi-weekly payments makes a real difference in how much you end up paying. This means that you need to understand exactly what happens with the payments when the company gets them. What you want is to have your lender apply the payment to the mortgage on the very day that they receive it. This will give you a nice reduction in interest.

Anytime that you make extra payments on your mortgage – the effect is the same – reduced interest rates. Bi-weekly payments allow you to have big savings on your mortgage, and will also allow you to build up equity in your home at a much faster rate, too.

Visit today:

The Pros And Cons Of Making Biweekly Mortgage Payments

Have you ever considered paying off the mortgage on your home in two biweekly payments rather than one monthly payment? It might seem like this wouldnt make a difference, but the truth is that biweekly payments really do add up more quickly.

Since there are 52 weeks in a year you will end up making 26 payments in total which is equal to 13 months rather than 12. This means that your mortgage will be paid off more quickly and you will save money on interest payments in the long run.

This arrangement might be the best for you when it comes to paying off your mortgage quickly and saving money, but its important to consider the possible disadvantages before you make the decision.

Cons Of A Biweekly Mortgage Payment

- Often lenders do not offer biweekly services free of charge. You will be required to pay a registration fee as well as paying biweekly charges.

- If your budget doesnt allow the room to pay more toward your mortgage every year, this could be a foolish move. Dont neglect the importance of having an emergency savings fund or paying your bills.

- If you have your mortgage payment set up via direct debit from your bank account, taking out a payment every two weeks could catch you out if the funds are not there, especially if you are only paid once per month. This would result in charges for insufficient funds from both your lender and your bank.

Pros Of A Biweekly Mortgage Payment

Also Check: Does Rocket Mortgage Service Their Own Loans

Biweekly Payments Can Save Thousands And Shave Years Off Your Mortgage

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Chances are that if you own a home, youre making monthly mortgage payments. The typical mortgage is structured to make a single payment each month, for 12 payments per year. The good thing about this is it means you pay the same amount at the same time each month, so there are no surprises, and its easier to budget.

But what would happen if you were to split that monthly payment up and make biweekly payments instead? Surprisingly, you could save yourself tens of thousands of dollars in interest charges and achieve mortgage debt freedom sooner. Heres how to make biweekly mortgage payments work for you.

Low Rates Mean Less Savings

Biweekly mortgage payments tend to be much more attractive when interest rates are higher. For example, suppose you have just taken out a 30-year fixed mortgage at 7%. Paying that mortgage biweekly from the very beginning means you will have the home paid off in less than 24 years. It would save you over $33,500 in interest on every $100,000 of principal. That sounds like a great deal.

On the other hand, if the exact same loan has an interest rate of 3% it would take over 26 years for biweekly mortgage payments to eliminate the loan. Additionally, the diligent homeowner would only be saving roughly $7,139 of interest per $100,000 of principal.

While biweekly payments will help no matter what, they have a much more potent influence when interest rates are higher than they currently are.

You May Like: How Much Is Mortgage On 1 Million

You Can Pay Off Your Mortgage Faster

As shown in the example above, making biweekly payments can help you pay off your mortgage early even years early, in some cases.

If you have that $250,000 mortgage mentioned above and youre making biweekly mortgage payments, you can actually shave four years and two months off of your loan. Instead of being in debt for 30 years, youll only be in debt for 25 years and 10 months. Imagine what you could do with four mortgage-free years!

Biweekly Mortgage Payments Can Save You Thousands Of Dollars

Lets see how making two extra payments each year can save you in interest payments on your mortgage.

If your mortgage principal is $200,000 at 4% for 30 years:

- Monthly Payment : $954.83

- Biweekly Payment : $477.42

- Total Interest Saved: $22,533.31

Not only will you save over $20,000 in interest, which is enough to buy a new car, you will also pay your mortgage off four years sooner! That means four fewer years of monthly payments and more money in your wallet.

All you have to do is make two extra half payments each year!

To calculate how much you can save with biweekly payments, plug your mortgage payment information into a calculator.

Read Also: Can I Get A Reverse Mortgage On A Condo