Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Current Mortgage Rates For $260000 Home Loans With Discount Points Included

The following table highlights current local mortgage rates. By default 30-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other loan adjustment options including price, down payment, home location, credit score, term & ARM options are available for selection in the filters area at the top of the table.

Current Local Mortgage Rates

Compare your potential loan rates for loans with various points options.

The following table shows current local 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

Don’t Miss: How Does Rocket Mortgage Work

How To Calculate The Break

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Before you refinance your mortgage, figure out when you would break even. Your break-even point occurs when you begin saving money in other words, when your accumulated savings exceed the costs of the new loan.

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

You May Like: 70000 Mortgage Over 30 Years

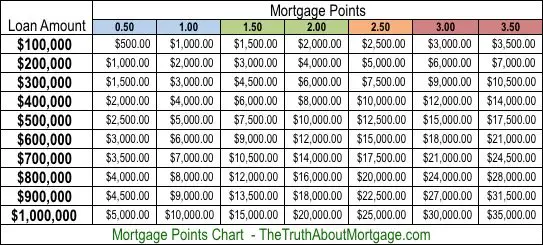

What Is A Mortgage Loan Point

When an individual begins the process of securing a mortgage, their lender will evaluate the financial history of the applicant and propose an interest rate for the sum of money needed that they feel mitigates as much risk as possible. This figure will also be influenced by the size of the down payment offered by the home buyer. At this point, the individuals taking on the mortgage may have the option to purchase loan points. For each point purchased, a mortgage lender will lower the interest rate on the mortgage by a fractional amount, typically no more than 0.25 percent.

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

Recommended Reading: Does Chase Allow Mortgage Recast

If You Keep The Mortgage For 30 Years It Is Generally Worth It But Almost No One Does This For Either Their Home Or An Investment Property If You Sell The Property In 3 Months It Doesnt Make Sense To Pay $10k In Points To Get A $170 Monthly Savings The Question Is: How Long Do You Need To Have The Mortgage To Make Paying That Fee Worth It

Paying points is a major decision not only because it could cost you thousands of dollars in points if you shouldnt have paid the points, but it could also cost you tens of thousands of dollars in extra lifetime interest expenses if the mistake is you should have paid the points. This is further complicated by the opportunity cost represented by paying the points – the fact you cannot use the money for other purposes.

You shouldnt just look at how many months of savings it would take to equal the cost of points, as it is not a fair comparison. While this is better than not doing any calculations, it will give you a highly inflated value for paying points which will cause you to make a decision more in the banks favor.

You have to look at what else you could do with the money and consider tax consequences and inflation. This means doing a time value of money calculation to find the present value of the monthly future savings and comparing the net present value of the points and the monthly mortgage savings.

Finding The Best Deal

Todays homebuyers have a plethora of mortgage options to sort and understand. Note that each lender will be different, and they will likely offer you multiple deals to consider. How you choose the right mortgage deal is determined by these common factors:

- Time: How long do you intend to own the property? Short-term plans are often bolstered by negative points, and potentially financing options. However, if you intend to keep your property for a long time, paying cash for discount points will help. Likewise, financing negative points would be costly.

- Cash: If you can pay for your discount points at closing, it has a direct and compounding impact to your loans value over time. This does not negate financing options. But rolling the costs of points into the loan is not as desirable as having cash to pay for them upfront. Your cash flow should guide you, both on-hand and to cover monthly premiums.

- Break-even: Will you have a decent break-even point to recoup your investment? If a benefit is countered by too much time to break even, it may be less valuable or not worth the investment. You can use our calculator on top to determine the break-event point on a prospective investment.

Taken together, these three factors should help guide you in choosing the best deal that suits your budget.

30-Year Fixed-Rate Mortgage

| $1,66,955.58 |

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Types Of Mortgage Points

So what types of points are we playing for here? Just like with basketball , there are different types of mortgage points: origination points and discount points.

Lets get origination points out of the way . This type of mortgage point is basically a fee that doesnt lower your interest rate. It just pays your loan originator. Trust us, youre better off paying out-of-pocket for their service. Skip origination points.

Next up , lets talk discount points. Lenders offer mortgage discount points as a way to lower your interest rate when you take out a mortgage loan. The price you pay for points directly impacts the total interest of the loan. And the more points you pay, the lower the interest rate goes.

That might sound all sunshine and roses at first, but get thisits going down because youre prepaying the interest. In reality, youre just paying part of it at the beginning instead of paying it over the life of the loan.

How To Calculate Basis Points

1 basis point equals 0.01% or 1/100 of 1%, so if youre adding 25 basis points, move the decimal over to the left twice so it turns into 0.25%. Or if youre trying to figure out many BPS 0.45% is, move the decimal point over to the right twice and you get 45.

There’s also a metric around the price value of a basis point. This is intended to measure how much the price of the bond moves given a shift in interest rates. You can also use a basis point calculator to convert basis points into a percent or decimal. However, it’s also easy to do this yourself.

You May Like: Reverse Mortgage On Condo

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Should You Buy Mortgage Points

You should buy mortgage points if you have the resources to pay for them and plan to stay in your home long enough to recoup them. There are a few other situations where it may make sense to pay points for a mortgage:

The seller has agreed to pay your closing costs. Some loan programs allow a seller to pay a percentage of your sales price toward your closing costs, which is commonly called a seller concession. If youre able to negotiate this into your purchase agreement, it may be worth it to use the sellers money to buy a lower interest rate. The table below gives you a snapshot of the maximum percentage of your purchase price the seller is allowed to pay on your behalf:

| Loan program |

- You may be able to deduct the cost of mortgage points at tax time.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

How Do You Calculate Basis Points For Commission

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: Chase Mortgage Recast

Mortgage Points Explained: What They Are & How They Work

A common question for home buyers, especially first-time buyers, when they first see a loan estimate , is about mortgage points. Unless youre familiar with the mortgage industry, you probably arent aware of how mortgage points work or if they might make sense for your situation. Because your interest rate is impacted by the points included on your mortgage, its important to know the basics of what they are and how they work to fully understand the pros and cons.

Are They Worth It

Depending upon how long you choose to stay in your home, mortgage loan points can provide valuable cost savings over time. In order to offset the initial cost of the points through savings as a result of interest rate deductions, it will likely take many years of residence within the property. Therefore, mortgage loan point purchases are typically only recommended for those who are looking to settle down and start the rest of their life in their new house. For those who may still be pondering a future move, these points will likely not be worth the investment. If you are keen on purchasing mortgage points, you should consult with several different lenders before committing to borrowing in order to ensure that you find the best possible rate deductions per point.

References

Also Check: Can You Get A Reverse Mortgage On A Condo

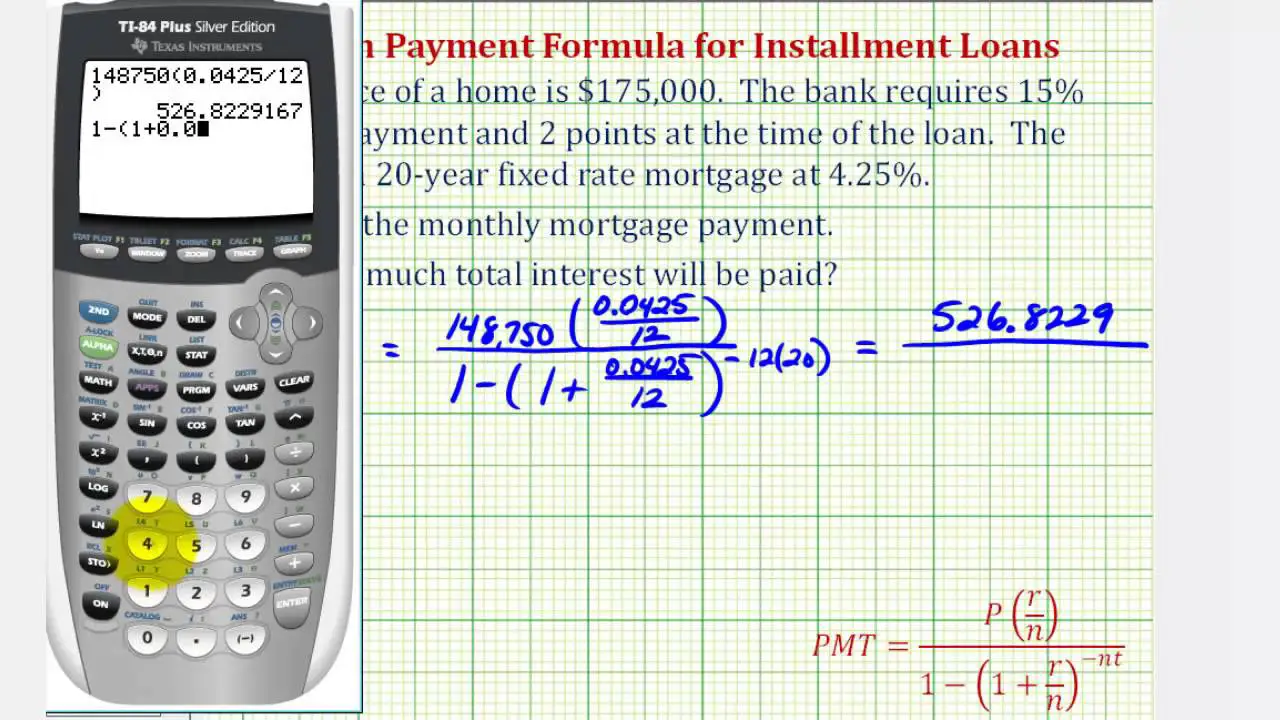

How Are Mortgage Points Calculated

Did you know that mortgage points can lower your interest rate? It’s true!Here’s how mortgage points work. The lender needs to earn a certain amount of interest on a loan. The lender could offer you a 5% interest rate on the loan amount of $100,000 for 30-years and you would pay $93,256 in interest over the life of the loan. Ouch!

But if you’re willing to prepay some of the interest at the settlement, the lender can offer you a lower interest rate since you are paying some interest upfront. Here’s what I’m talking about. Below, is a typical interest rate chart that displays the interest rates for a 30-year mortgage.

Discount Points For Adjustable

For adjustable-rate mortgages , a discount point typically reduces interest rates by 0.375% per point. But again, this is just an estimate and it varies per lender. The discount point also corresponds to the fixed-rate period of the ARM. For example, with 5/1 ARM, expect to see a reduced rate for the first 5 years of the loan during the fixed-rate introductory phase. Likewise, for a 10/1 ARM, your interest rate will be decreased for the first 10 years of the mortgage.

Some ARM lenders may also allow you to apply points to reduce the margin. The margin is basically the amount added to the rate index which determines your adjusted rate. This means you could reduce the interest rate for much longer than the introductory period. For example, a margin reduction on a 30-year 7/1 ARM affects the interest rate on the remaining 23 years of the loan, while a rate adjustment would apply to just the first seven years of the same loan.

Make Sure to Compare Options

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

How To Convert Basis Points To A Percentage Or A Decimal

If you’re trying to convert decimal points to a percentage, you move the decimal point two places to the left, so 50 basis points is 0.5%. To convert it back to basis points, you move the decimal point two places to the right.

To get to the decimal value of a basis point, you move the decimal point back four places to the left, so 100 basis points is .01. If you want to convert that into a percentage, you move the decimal back two places to the right from the decimal value. Going back to basis points would require moving the decimal four places to the right of the decimal value. Check out the table below for examples.

|

Basis Points |

Don’t Miss: Rocket Mortgage Loan Types

The Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into, because it might be cheaper than the closing costs on a refinance.