What Your Lender Needs To Tell You

If your lender is a federally regulated financial institution, such as a bank, they have to provide certain information.

The following details must appear in an information box at the beginning of your mortgage agreement:

- prepayment privileges

- prepayment penalties

- other key details

Your lender must tell you how they calculate your prepayment penalty. Your lender must also tell you what factors they use to determine the penalty. These details must be clear, simple and not misleading.

Read your mortgage contract carefully. Make sure you understand the details about penalties before you sign your contract. Ask questions about anything you dont understand.

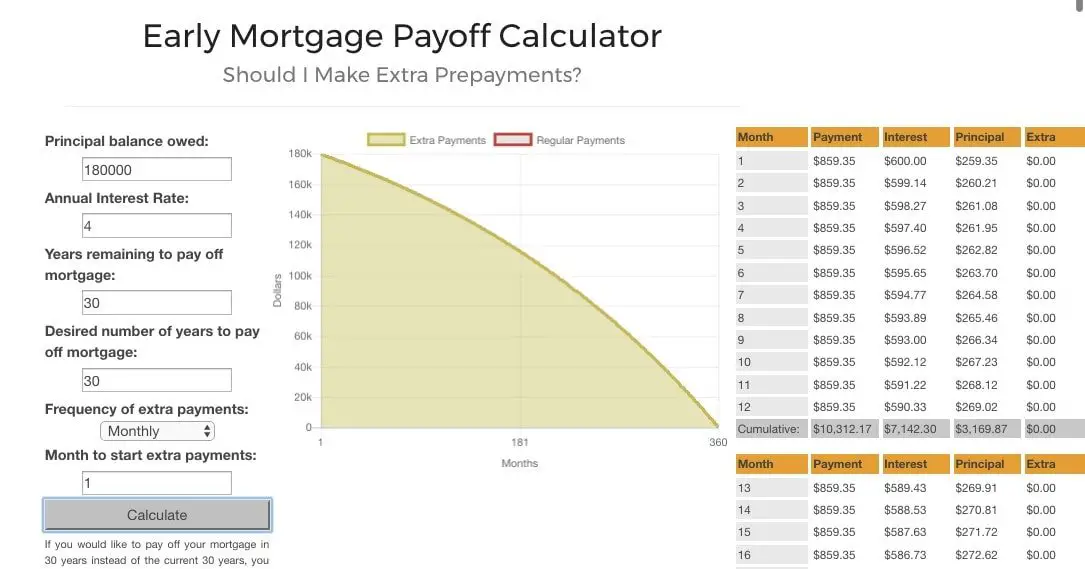

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed â The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment â The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage â The remaining number of years until you want your mortgage paid off.

- Principal â The amount of money you borrowed to buy your home.

- Annual Interest Rate â The percentage your lender charges on borrowed money.

- Mortgage Loan Term â The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction â A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required â The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings â How much you’ll save on interest by prepaying your mortgage.

Calculation Of The Ird

To calculate the IRD, your lender typically uses 2 interest rates. They calculate the entire interest fees left to pay on your current term for both rates. The difference between these amounts is the IRD.

To do so, they can first use one of the following interest rates:

- the posted rate at the time you signed your mortgage contract

- your current rate or discounted rate as described in your contract

Your lender can calculate a second interest rate based on the following:

- the current posted rate for a term with a similar length

- the current posted rate for a term with a similar length minus the discount you were originally offered

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

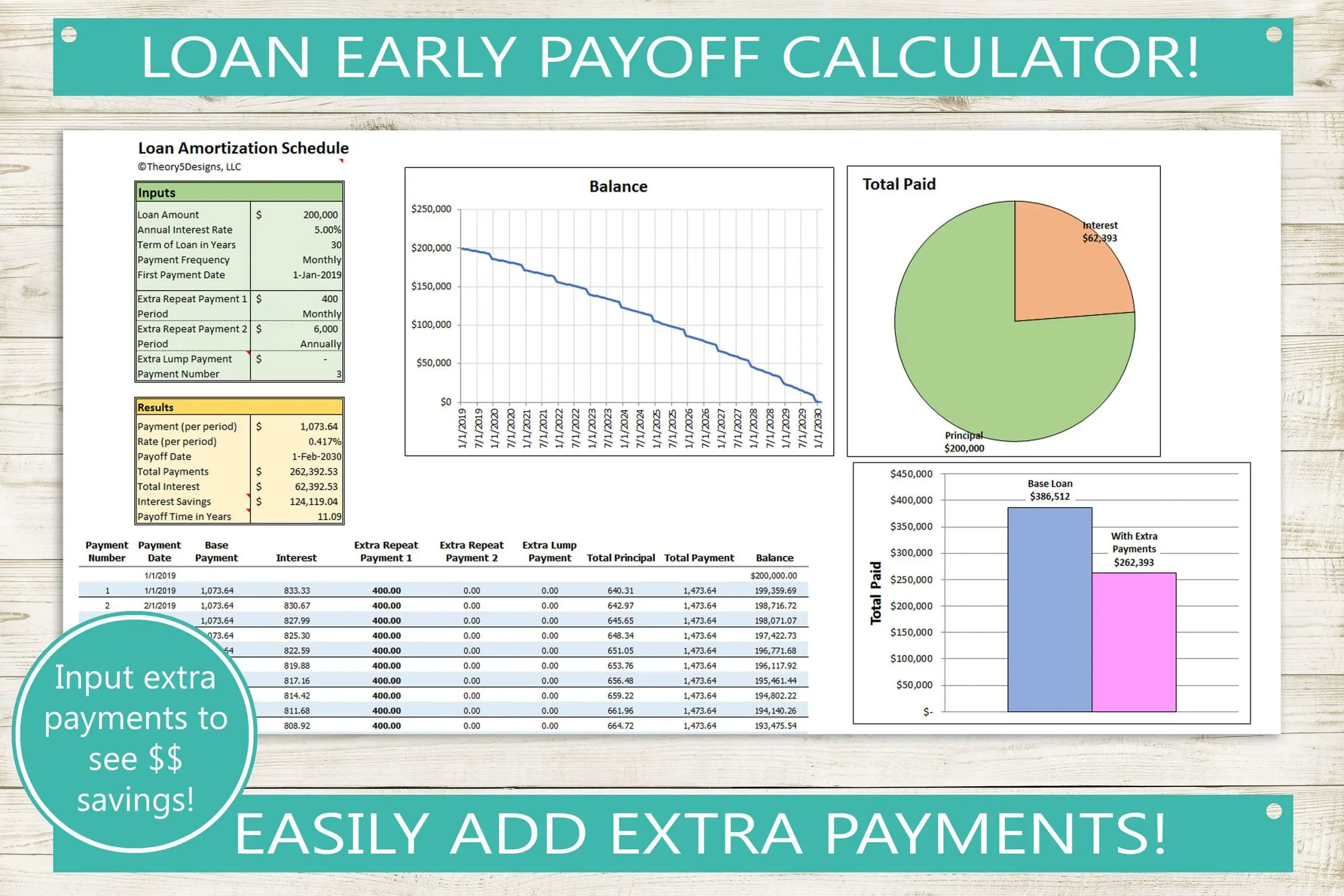

Pay A Lump Sum Toward The Principal

If you are capable of paying off an even bigger amount of the mortgage, you can choose to make a single large payment in a year.

For example, in a year, you will need to pay a total of $11,000, which is separated into installments for each month. You can pay the $11,000 along with one of your monthly payments to knock off a year of the loans term.

A one-time payment like this will depend on your ability to pay for it. However, it doesnt need to be a years worth of payments.

This can range from three to six months worth of the mortgage, as long as it will be able to make a significant deduction from your balance.

Should You Pay Off Your Mortgage Early

Whether you should pay your mortgage off early depends on many factors, including the interest rate of your current loan and your personal risk tolerance.

Start by considering the opportunity cost. If you repay your mortgage ahead of schedule, youre putting money into the mortgage when you could have used those funds for other financial priorities. Youll save on interest, of course, but if you invested the extra payments elsewhere instead of putting them toward your mortgage, you might find youd have earned a higher return.

On the other hand, if you know youre likely to spend that extra money if you dont put it toward your mortgage, making additional payments can be a good idea. The peace of mind that you get from owning your home mortgage-free can also be worthwhile, and is important to consider.

Also, think about how much cash you have available for emergencies. You dont want to tie all of your money up in your home and have no way to access it quickly if you encounter a crisis.

Ultimately, with mortgage rates still low, its generally better in the long run to hold a mortgage with a low rate now and to invest your extra cash. Still, you can check Bankrates mortgage payoff calculator to see how much you can save by settling your mortgage early if youre set on doing so.

Also Check: Chase Recast Calculator

Are You Prepared For A Financial Emergency

Also, think about your liquid cash do you have 6 to 12 months of cash savings on hand? Diverting your savings to your monthly mortgage payments wont help you much in the event of a financial emergency, like the loss of a job or a major medical issue.

There are some liquidity options when you have either a low mortgage or none at all. If you need cash, you have more equity to tap into for a HELOC, home equity loan, or cash-out refinance. Of course, that puts you back in debt, but it could still be a helpful option to have in your back pocket.

The downside to cash savings is that these financial products can take time to apply for and get funded. Plus, they depend on the value of your home. So if home prices drop, you may have less equity to take advantage of.

How To Calculate Your Mortgage Payoff

Its a glorious day when the home mortgage is paid off. No longer does the bank have a claim on your home. You are the sole owner. Getting to that point takes time and payment after payment. Many people dont live long enough to see that day, and others see it quite often as they pay off the mortgage every time they refinance the home.

However, calculating the payoff amount is a confusing mathematical formula that most homeowners dont even want to think about, much less do. In addition, the loan balance and the payoff amount are not the same. Calculating interest in arrears accounts for some of the difference while late payments penalties, early payoff penalties, and liens are other possible sources of the discrepancy.

The first step is to call the mortgage company who has your home loan and ask for a payoff statement. They will ask for a specific date in order to calculate the interest. Also for the current balance and loans interest rate. This way you can compare what youve been told with what is in writing. If there is a discrepancy, call the mortgage company back and ask for clarification.

There are several free mortgage payoff calculators online. Armed with the mortgage balance and the interest rate, its possible to double check the mortgage lenders payoff statement.

If youre really old school or just enjoy math, the following equation will work. Good luck.

Loan Balance X Interest Rate = xx / 365 days of the year = Daily Interest + Loan Balance = Payoff Amount

Also Check: How Much Is Mortgage On 1 Million

Refinance To A Shorter Term

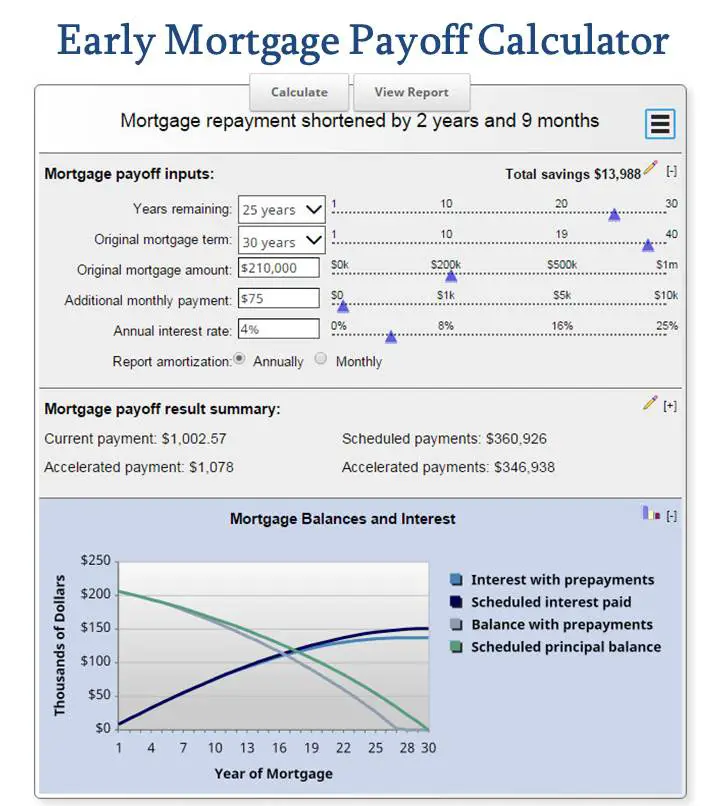

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Read Also: Monthly Mortgage On 1 Million

What Is A Prepayment Penalty

A prepayment penalty is a fee that your mortgage lender may charge if you:

- pay more than the allowed additional amount toward your mortgage

- break your mortgage contract

- transfer your mortgage to another lender before the end of your term

- pay back your entire mortgage before the end of your term, including when you sell your home

Your lender may also call the prepayment penalty a prepayment charge or breakage cost.

Prepayment penalties can cost thousands of dollars. Its important to know when they apply and how your lender calculates them.

If you have an open mortgage, you can make a prepayment or lump-sum payment without paying a penalty.

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

What Is An Amortization Schedule And How Does It Work

7 Minute Read | December 10, 2021

Amortizationwhat a crazy word! This hard-to-say financial term pops up whenever you borrow money to buy big-ticket items like a house.

When your lender mentions an amortization schedule, your eyes might glaze over. We get it. Amortization isnt exactly the most exciting subject. But its an important one!

Well help you define what it means and walk you through a typical amortization schedule using our mortgage calculator so youll know how to pay off your house as fast as possible!

Lets get started.

How Can You Pay Your House Off Early

Once you decide that paying off your house early is a good idea for you, be smart about your strategy. Make sure you designate any extra mortgage payments towards the principal balance. If you dont, your lender may be able to apply the money towards future interest payments. This defeats the purpose of making those extra payments in the first place.

If you send in a check each month for your mortgage payment, you can send a second check with a note in the memo line denoting that the payment should go towards the principal only. If you pay online, there may be a special field for extra principal payments. If not, call your lender to figure out the best way to send in your extra mortgage payments.

Recommended Reading: How Does Rocket Mortgage Work

Amortization Period Vs Mortgage Term

An amortization period tells you how long itll take to pay off your mortgage, while a mortgage term tells you how long you are locked into a specific mortgage contract with your lender.

For example, you could do a mortgage refinance to change your mortgage term. This would change things like your interest rate, monthly payment amount and amortization period.

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Things To Consider Before Starting Your Plan

Don’t Lose Money On Your Early Mortgage Payoff Plan

Before starting an early mortgage payoff plan please consider the following cases where it may end up costing you money instead of saving you money.

Higher Interest Rate Debt

If you have other debts that have a higher interest rate than your mortgage, you will save a lot more money if you pay off the higher-interest debt first, and then redirect those higher-interest debt payments to paying off your mortgage.

Employer Matches 401K Contributions

If your employer matches all or part of your 401K contributions, you may be better off contributing the extra payments to your 401K. So be sure to check with a qualified financial planner before starting your accelerated mortgage payoff plan.

Mortgage Company Penalizes You for Prepayments

Be sure to check with your mortgage company to make sure you can prepay your mortgage without penalty. Believe it or not, there are mortgage companies out there that will fine you for cutting into their forecasted profit margins — despite the fact that they will still make a fortune off your home loan.

Mortgage Company Escrows Your Prepayments

Check to make sure your mortgage company doesn’t simply escrow your prepayments instead of applying them to the balance when they are made. If so, your prepayments will likely be better invested elsewhere.

How a Coffee Habit Can Cost You $33,000, or More!

How To Pay Off Your Mortgage Early

8 Minute Read | September 24, 2021

So youre eager to join the nearly 40% of American homeowners who actually own their home outright.1 Can you imagine that? When the bank doesnt own your house and you step onto your lawn, the grass feels different under your feetthats freedom.

But the problem is youre currently stuck dragging around that ball and chain called a mortgagejust like most homeowners.

Dont worry. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Lets get started.

Don’t Miss: Rocket Mortgage Loan Requirements

How Do I Calculate Amortization

To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your current month.

Finally, subtract that interest fee from your total monthly payment. What remains is how much will go toward principal for that month. This same process repeats every month until your loan is completely paid off.

We know calculating amortization can make you want to throw a desk out the window. But stay with us. Well walk you through an example.

How To Pay Off Your House Faster

Understanding amortization can help you get creative with paying off your mortgage early. For example, you could throw extra payments at your mortgage that go toward the principal instead of the interestwhich would also save you thousands of dollars!

To see how this plays out, try our mortgage payoff calculator. Lets use the same example from earlier of the $240,000 mortgage at a 15-year term with a 3.5% interest rate.

After 15 years paying the minimum monthly payment of $1,716, youll have paid nearly $69,000 in total interest. But if you squeeze another $100 out of your monthly budget to make your monthly payment $1,816, youll save more than $5,000 in interest and be debt-free a whole year sooner!

Read Also: Rocket Mortgage Loan Types

Why Is Amortization Important

Remember, an amortization schedule shows you how much of your monthly payment goes toward principal and interest. It helps you see a full view of what itll take to pay off your mortgage.

As with any type of goal setting, an amortization table gives you a game plan and the confidence to take on the mammoth task of paying off your house.

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?

Read Also: 10 Year Treasury Vs Mortgage Rates

How Do I Calculate A Monthly Mortgage Payment

As promised, well now show you how to calculate a monthly mortgage payment manuallyin case you want to know the magic behind our mortgage calculator.

This is useful to know when it comes to amortization since your monthly payment is what actually pays down your mortgage.

To calculate a monthly mortgage payment, heres a scary-looking formula your lender might use:

M = P x ir ^n / ^n – 1

- M = monthly payment

- ir = interest rate per month

- n = number of months

- ^ = This is the exponent symbol. Youll need a special calculator for exponents, which you can find online.

If we use the formula on our example from earlier, your mortgage details would look like this:

- M =

- P = $240,000

- ir = 0.0029167

- n = 180

Lets start with the first part of the formula, P x ir ^n. Heres how that breaks down:

- 240,000 x 0.0029167 ^180

- 700 ^180

Okay, now lets figure out the second part of the formula, ^n-1:

- ^180 – 1

And now lets divide the two parts to get our answer:

- 1,182.42 / 0.6891777009157 = 1,715.70

If we round up, that $1,716 is your fixed monthly mortgage paymentthis is what youll pay every month in order to pay off or amortize your mortgage.