What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default.

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Mortgage Interest Rates For Jan 27 202: Rates Are Still Rising

If you’re in the market for a mortgage, see how your payments might be affected.

Key mortgage rates, including 15-year fixed and 30-year fixed mortgages, are continuing to climb to the highest levels since before the pandemic. The average rate of 5/1 adjustable-rate mortgages has also gone up. With mortgage rates at historic lows over the last period, it’s been a fine time for prospective homebuyers to lock in a fixed rate. However, rates fluctuate and are projected to keep going up. Before you buy a house, consider your personal needs and financial situation, and remember to speak with multiple lenders to find the best one for you.

You May Like: Can You Get A Reverse Mortgage On A Condo

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Also Check: Chase Recast Calculator

What About 30year Refinance Rates

Refinancing from one 30year mortgage to a new one will often lower your monthly payment, provided rates are lower than when you first got your loan. Thats because in most cases youre lowering the interest rate and spreading your loan repayment over a longer time period.

However, you have to be careful when refinancing into a new 30year home loan.

If youve had the loan a long time or your new interest rate is not low enough to negate the time difference you could actually end up paying more in interest in the long run.

For homeowners with only 15 or 20 years left on their original loan, it might make sense to refinance into a shorter loan term. This could help you secure a lower interest rate and pay your home off on schedule .

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

Recommended Reading: Rocket Mortgage Payment Options

Interfirst Mortgage Company: Best Non

Interfirst Mortgage Company is a combo-direct mortgage lender, wholesale lender and correspondent lender.

Strengths: Interfirst has an A- rating from the Better Business Bureau and high marks from borrowers on Bankrate and elsewhere. Plus, with its multiple business channels, the lender can offer several loan options for many types of borrowers.

Weaknesses: Interfirst isnt licensed in every state, and if youre trying to compare mortgage rates, you might have a harder time, since this lender doesnt showcase rates publicly on its website.

> > Read Bankrate’s full Interfirst Mortgage Company review

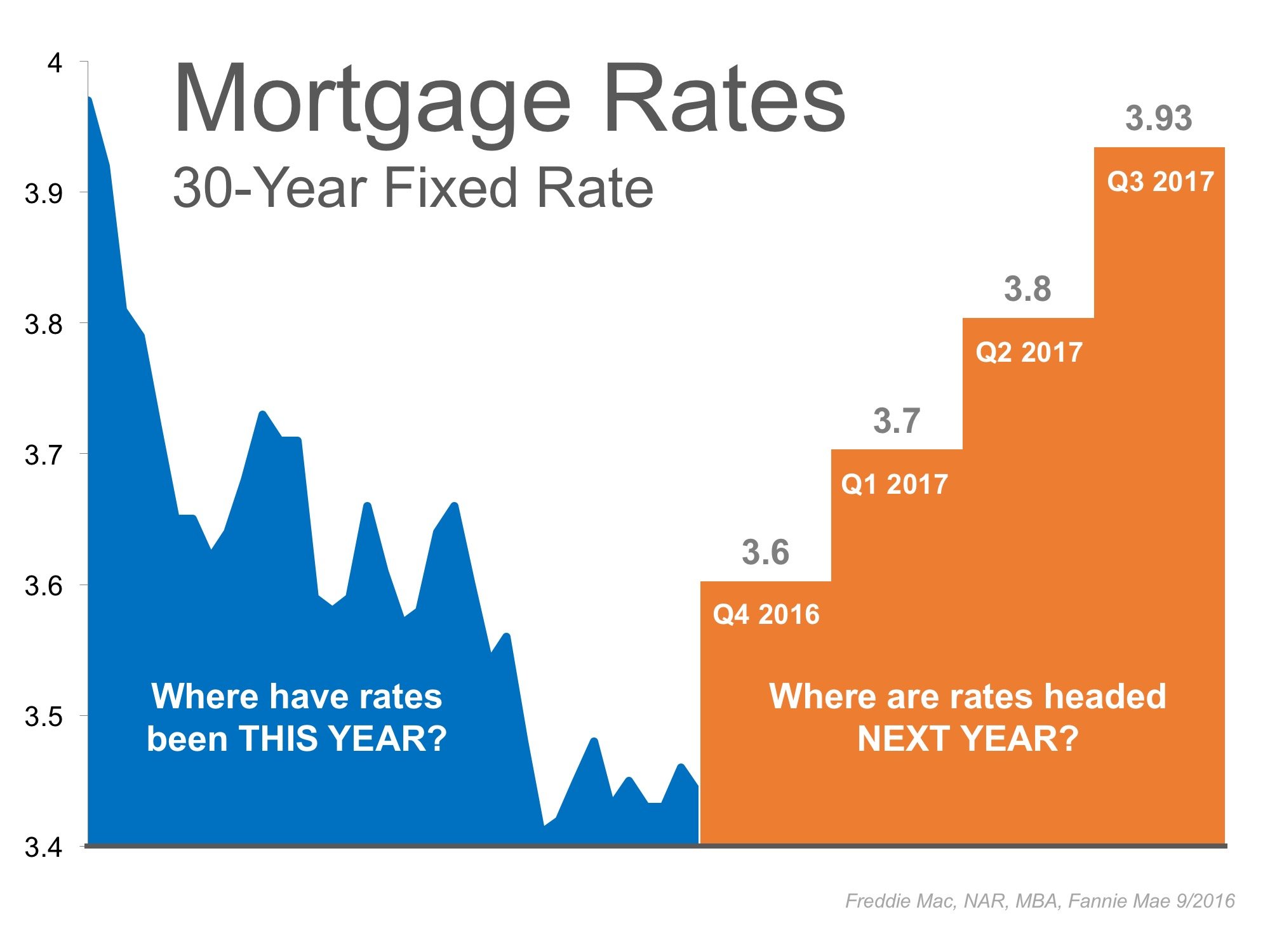

Mortgage Rate Predictions For 2021

At the time of this writing , the U.S. economy was in a strong growth period coming out of the pandemic. And the Fed had just announced plans to start withdrawing its mortgage stimulus, pushing interest rates higher.

Inflation was also at a 30year high. And rising inflation tends to drag rates up with it.

In short, all signs point toward higher rates in 2022 as the economy continues to expand.

So dont wait on lower 30year interest rates. They could fall for short periods of time, but were likely to see an overall upward trend in the coming months.

Also Check: Reverse Mortgage For Condominiums

What Are The Pros And Cons Of A 30

How can you tell if a 30-year fixed-rate mortgage is right for you? Compare the pros and cons.

- Pros: You have more time to pay back your loan, and your monthly payment is cheapercompared to a 15-year term for the same loan amount. Plus, the fixed interest rate protects you from the possibility of rising rates that could send your monthly payments through the roof.

- Cons: Youre charged a relatively high interest rate over 30 years, which means you pay an unbelievable amount of interest compared to a 15-year term.

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Also Check: Can You Do A Reverse Mortgage On A Condo

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

Tips To Get The Lowest Mortgage Rate

To get the best rate possible, it helps to get your finances shipshape before applying for a mortgage.

For example, managing debts well and keeping your credit score up can help you qualify for a lower interest rate. As can savings for a bigger down payment.

Dont worry. Nobodys expecting miracles. But small improvements can make a worthwhile difference in the mortgage rate youre offered.

Here are some quick hits:

Few of us can afford to boost our savings and pay down our debts at the same time. So focus on areas where you think you can make the biggest difference. Youll see the biggest improvement in your credit scores by paying down highinterest, revolving credit accounts such as credit cards.

The other big way to lower your interest rate is by shopping around.

Mortgage lenders have flexibility with the rates they offer. Some will offer you lower rates than others because theyre more favorable toward your particular situation.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Is It A Good Time To Buy A Home

Whether its a good time to buy a house depends on who you ask. Many economists, forecasting low, stable interest rates and only modest rises in housing prices, say, unequivocally, yes.

Others, citing tight inventory of affordable housing nationwide, throw up a caution flag.

Still, home sales were at a record high in the spring of 2021, with many people anxious to take advantage of low interest rates and blind to the inflated price they paid.

But buying a house is an intensely personal experience in many ways, the ultimate microeconomic decision.

Whatever else is going on in the residential market space, whether its a good time for you to buy is dependent upon factors such as these:

- You have access to a substantial down payment .

- You are confident about the stability of your household income, not only to meet the payments, but also to take care of upkeep and weather financial surprises.

- Your credit score is in good shape.

- You can be happy for a number of years in the house and neighborhood you can afford.

Do Different Mortgage Types Have Different Rates

There may be different rates depending on the type of mortgage you take out. There are mortgages that vary in the length of term with rates being lower for shorter terms. Adjustable rate mortgages also have different rates with their rates not being fixed for the entire loan term. For instance, ARMs tend to have a lower initial rate compared to fixed-rate loans, but after a predetermined amount of time itll go up according to the current market conditions.

Also Check: Who Is Rocket Mortgage Owned By

Interest Rates And The Housing Market

Mortgage rates affect how much you need to pay on your mortgage. They can also change the housing market as a whole. Understanding how these causes and effects work will help you search for the best deal for a new home or decide whether it’s time to refinance your current place. Learn which rates and indexes to watch to make a sound decision about your next step.

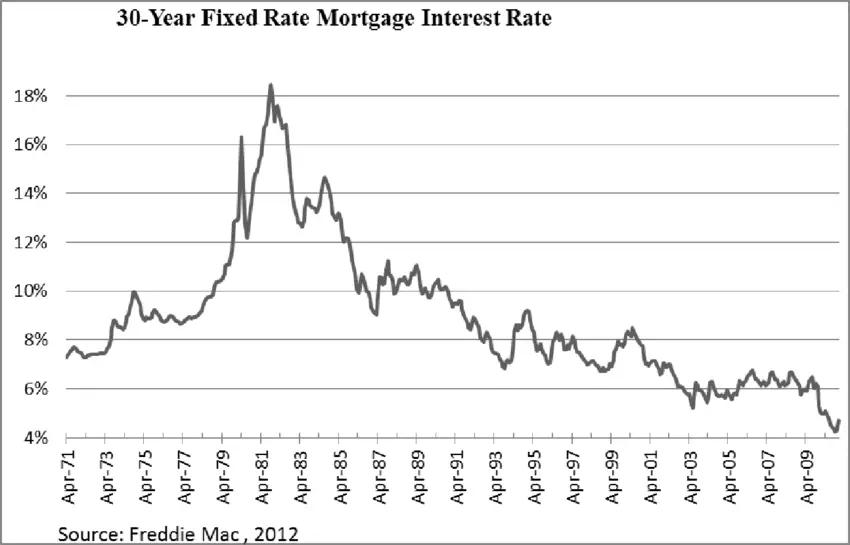

Historical Perspective: Banner Years For Mortgage Interest Rates

The longterm average for mortgage rates is about 8%. Thats according to Freddie Mac records going back to 1971.

But mortgage rates can move a lot from year to year even from day to day. And some years have seen much bigger moves than others.

Heres a look at just a few, to show how rates often buck conventional wisdom and move in unexpected ways.

Read Also: Chase Recast

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

What Is An Amortization Schedule

A major advantage of a 30-year fixed mortgage is the security in knowing exactly how much youll be paying each month. The ability to predict your largest expense for up to the next 30 years provides a huge advantage in financial planning. Not only can you accurately predict the amount going towards your mortgage, but youll also know how much youll have left over to contribute towards other investments and savings accounts.

This predictability allows lenders to build a repayment plan known as an amortization schedule. Amortization refers to the process of steadily paying off a debt through regular payments over a period of time. For a fixed rate mortgage, building an amortization schedule is much simpler thanks to the locked-in interest rate and monthly minimum.

Heres an example of what a one-year amortization schedule might look like on a $165,000 loan:

| Payment Date | |

|---|---|

| $7,370.55 | $162,338.18 |

The amortization schedule, provided by the lender when shopping for a loan, projects your monthly payments throughout the term of the mortgage. This chart also gives a precise estimate of how much equity youll have gained in a given month. With this knowledge, you can get a head start on your long-term financial goals and prioritize savings years in advance.

Amortization schedules are a great resource when taking out a fixed rate loan, but become much more complicated when applying for an adjustable rate mortgage.

Also Check: Reverse Mortgage Mobile Home

Mortgage Rates: Current Home Interest Rates

Rate, points and APR may be adjusted based on several factors including, but not limited to, state of property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value and your credit score. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products except IRRRL are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

What Are Mortgage Points

Mortgage points, or discount points, is a type of prepaid interest borrowers pay when taking out a mortgage to lower their interest rate. This one-time fee costs 1% of your mortgage, or $1,000 for every $100,000. Paying one point will lower the rate by 0.25%, or a quarter of a percent. That means if you got offered an interest rate of 3.5%, paying one mortgage point will lower it to 3.25%.

Read Also: Can I Get A Reverse Mortgage On A Condo

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.