How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

What Exactly Is A Fico Score Mean

The FICO score is a credit score created by the Fair Isaac Corporation . 1 Lenders use borrower FICO scores and other details from borrower credit reports to assess credit risk and make credit decisions.

Credit cards for 580 credit scoreCan you get a credit card with a score of 580? The general rules for credit cards are that any point value over 600 points can qualify for an unsecured card. If your credit score is 580, you are only eligible for a secured credit card and you must make a minimum deposit to open your credit card.Is a 580 credit score good or bad cholesterolA credit rating of 580 is not goo

How Is A Credit Score Calculated On A Joint Mortgage

When two people decide to buy a house together, they have a lot to consider. You and your partner have likely talked about how you’ll combine your finances, share expenses and save for major purchases.

Buying a home is one of the biggest decisions people will make. You’ve probably kept careful track of your credit score and made sure not to do anything that could lower it.

But what about your partner’s credit score? If you and your partner decide on a joint mortgage, both of your credit scores will come into play. This guide will review how credit scores work, how they affect mortgage applications, how to calculate credit score on a joint mortgage and what to do if your partner has bad credit.

You May Like: Rocket Mortgage Payment Options

No : Pay Down Your Debts

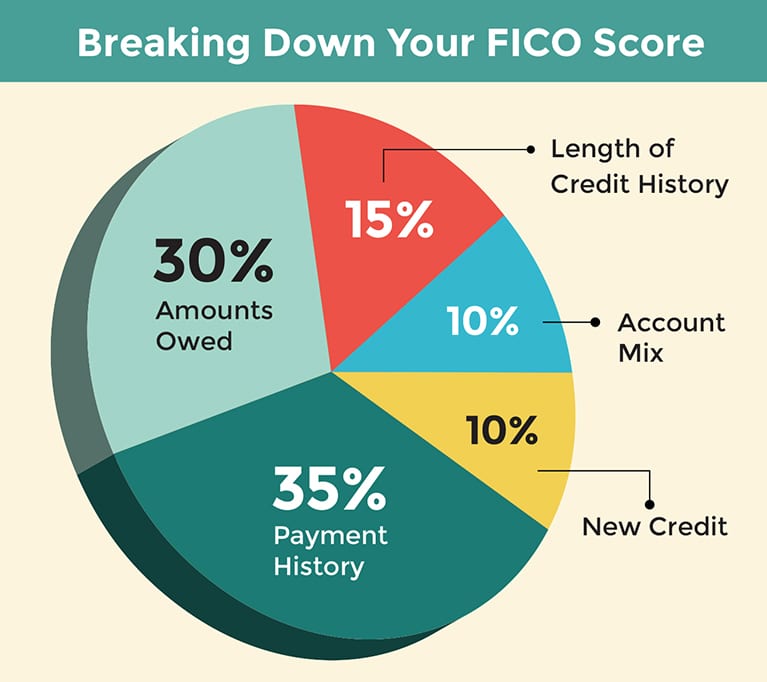

“Keeping your balances low can have a positive impact on your FICO Score,” says Scott. That’s because your Amounts Owed category accounts for around 30 percent of your FICO score.

If you can swing it, paying down your credit card debt balances to at least 30 percent of your total limit is an easy way to give your score a bump, notes McNamara.

“In most cases, paying down revolving unsecured debt provides a positive impact on the credit scores, especially on files that have a high utilization ratio, thus allowing borrowers to obtain a better rate on their mortgage,” says McNamara.

Fourth Stop: Contact The Expert

Looking to sort through the credit score maze, I contacted personal finance guru and author of Your Credit Score, Your Money and Whats at Stake, Liz Weston and explained my situation to her.

First, Liz explained to me my Credit Sesame score.

It is true that the scores many consumers get arent FICOs, and these consumer education scores can be 30 to 100 points higher than your FICOs.

Okay, great! Consumer education scores. That helps a ton! I quickly began to realize there are several different types of credit scores. So in fact, Credit Sesames credit score gives you a general range of where your credit score is at. My score there wasnt too far off, so at least it gave me a good starting point. Now, what about the mortgage report credit scores

Liz had an idea but verified with a contact at FICO nothing like going straight to the source! She states,

It was my understanding that most mortgage lenders use the classic FICO score, which is what you get at MyFico.com. The scores will be different day-to-day because the information in your credit files is constantly changing.

Im not sure what your banker means when he says Fannie and Freddie worked with the bureaus to changed the FICO formulas, since they wouldnt be able to do that. Thats FICO purview.

But this wouldnt be the first time a banker or mortgage lender gave bad info. Theres a whole chapter in my credit scoring book devoted to myths perpetrated by those who should know better.

Also Check: Mortgage Recast Calculator Chase

How Are Mortgage Rates Determined

In general, mortgage rates are determined by economic factors. These include the Federal Reserve benchmark interest rates and the job market. Mortgage rates aren’t directly tied to Fed rates, but they tend to trend in the same direction. If the job market is poor and fewer people are working, rates will drop to attract buyers.

Lenders then look at factors like credit score and history, income, and total debts to determine what mortgage rate to offer specific borrowers.

Reduce Credit Card Debt

If avoiding new debt helps burnish your credit, it’s probably no surprise to learn that lowering existing debt can also help your credit standing. Paying down credit card balances is a great way to address this. Paying them off altogether is an ideal goal, but that isn’t always feasible within the span of a year or less. In that case, it’s wise to be strategic about which balances to tackle when paying off your credit cards.

One of the biggest influences on your credit scores is the percentage of your credit card borrowing limits represented by your outstanding balances. Understanding how credit utilization affects your credit scores can help you determine the smartest approach to paying down your current balances.

Your overall credit utilization ratio is calculated by adding all your credit card balances and dividing the sum by your total credit limit. For example, if you have a $2,000 balance on Credit Card A, which has a $5,000 borrowing limit, and balances of $1,000 each on cards B and C, with respective borrowing limits of of $7,500 and $10,000, your total your utilization ratio is:

You May Like: Can You Do A Reverse Mortgage On A Condo

Why Do Mortgage Lenders Use Older Fico Scores

The reason mortgage lenders use older FICO Scores is because they dont have a choice. They are essentially forced to use them.

Unlike every other industry, mortgage lenders dont have the flexibility to choose the scoring model brand or generation they want to use. Mortgage lenders must follow the direction of the government-sponsored enterprises , Fannie Mae and Freddie Mac, as it pertains to scoring models.

The GSEs play an important role in mortgage lending. These publicly traded companies buy mortgages from banks, bundle them together, and sell them to investors. This frees up funds so that banks can offer new mortgages to additional homebuyers.

For a bank to sell a mortgage to Fannie Mae or Freddie Mac, the loan has to meet certain guidelines. Some of these guidelines require borrowers to have a minimum credit score under specific FICO Score generations.

If a lender uses a different scoring model other than what the GSEs approve when it underwrites a mortgage, it probably wont be able to sell that mortgage after it issues the loan. This limits the lenders ability to write new loans because it will have less money available to lend to future borrowers.

How Does Refinancing Impact My Fico Score

Refinancing and loan modifications may affect your FICO® Scores in a few areas. How much these affect the score depends on whether its reported to the consumer reporting agencies as the same loan with changes or as an entirely new loan. There are many reasons why a score may change. FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix . If a refinanced loan or modified loan is reported as the same loan with changes, two pieces of information associated with the loan modification may affect your score: the new credit inquiry and changes to the amounts owed. If a refinanced loan or modified loan is reported as a new loan, your score could still be affected by the new credit inquiry and an increase in amounts owed, along with the additional impact of a new open date which may affect the credit history category. In the end, a new or recent open date typically indicates that it is a new credit obligation and, as a result, may impact the score more than if the terms of the existing loan are simply changed.

You May Like: Does Rocket Mortgage Service Their Own Loans

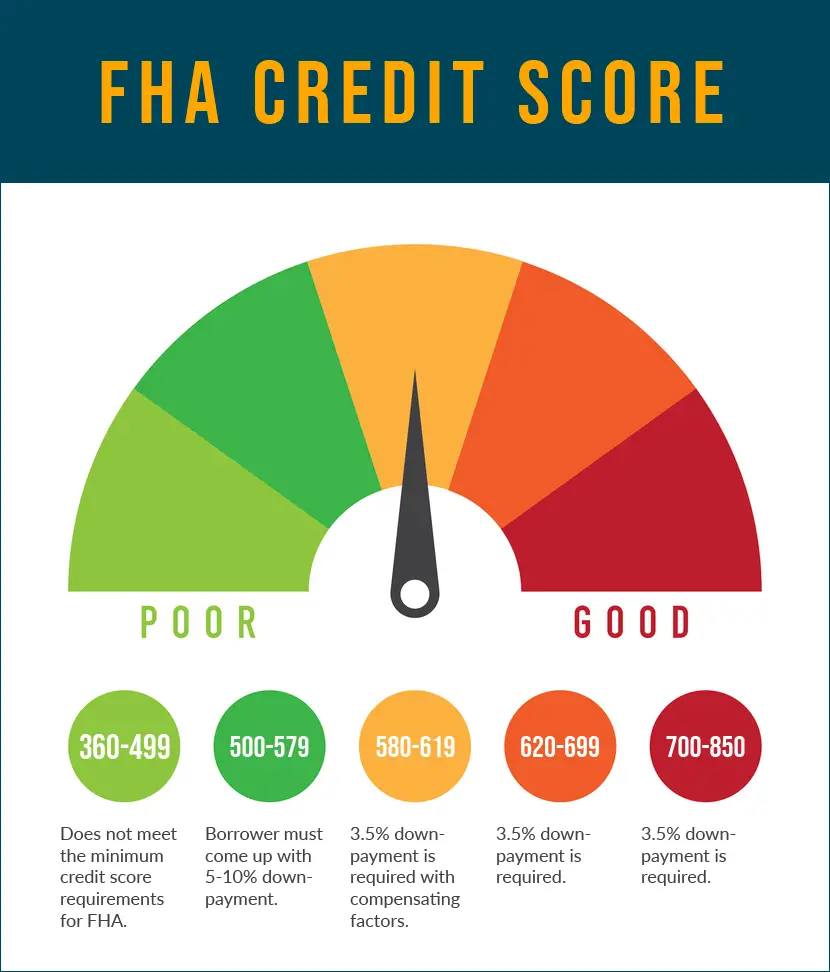

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as how much debt you have, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

Don’t Miss: Does Prequalification For Mortgage Affect Credit Score

Alternative Credit Scoring Won’t Matter

You can boost your credit with alternative solutions, which count bills that don’t normally go onto your credit report. However, they may not work for government-backed mortgages.

Experian Boost can bring up your score on Experian by counting phone, utility and streaming service bills, while eCredable Lift reports utility and phone payments to TransUnion. Perch allows you to boost your score with recurring expenses such as subscription services and rent.

The platforms use a newer version of the FICO algorithm, Rossman said. Government-backed mortgage companies Fannie Mae and Freddie Mac request older versions, so they won’t see the score improvement.

How Do I Get My Real Fico Score

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

You can get a real FICO® Score from many sources, including credit bureaus, lenders, credit card issuers and other financial institutions. There are many versions of the FICO® Score, and they may have different uses, but they’re all real. When you’re reviewing your score, you’ll want to know which type of FICO® Score it is, and whether it’s the best version to be looking at in your situation.

Read Also: Can You Refinance A Mortgage Without A Job

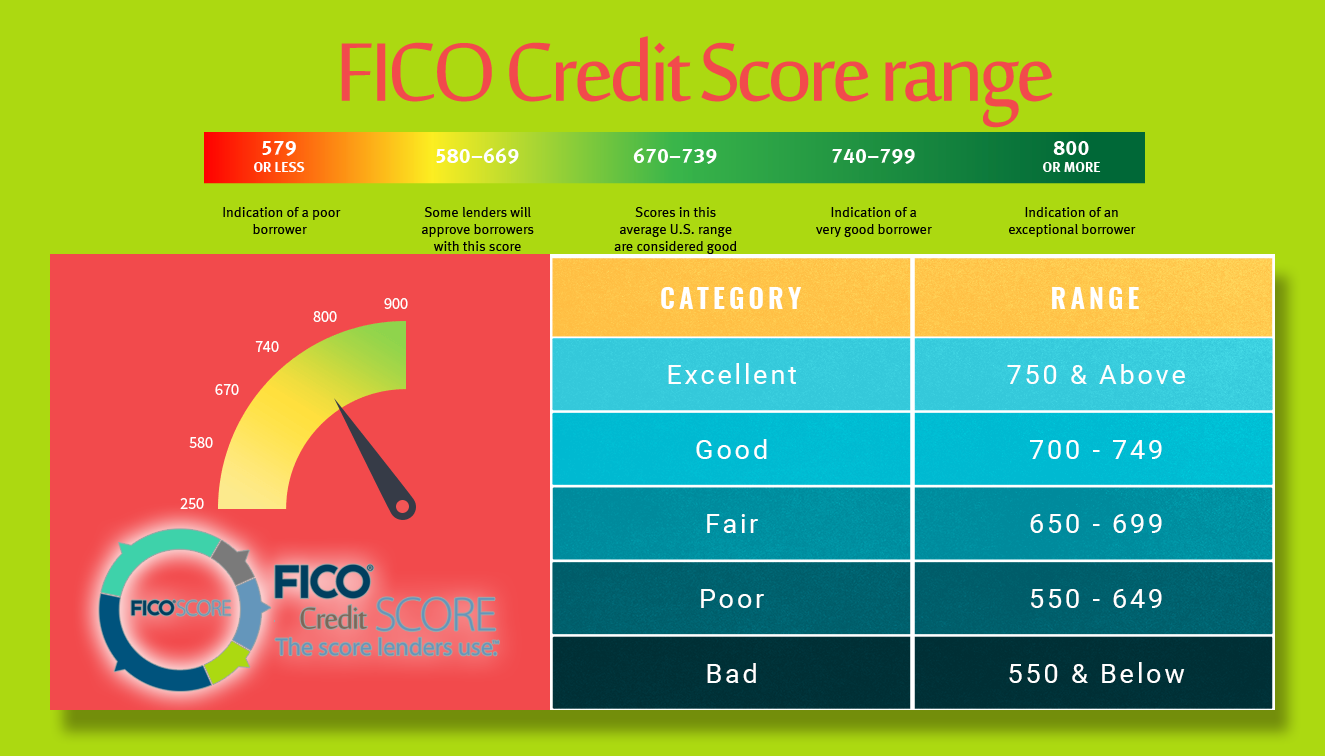

What’s A Good Credit Score

Credit scores range from about 300 to 850. The higher your score, the less of a risk a lender believes you will be. The interest rate you’re offered will often drop as your score climbs.

Borrowers with a credit score over 670 are offered more financing options. But don’t be discouraged if your scores are on the low side. There’s a mortgage product for nearly everyone.

The average credit score in the U.S. reached a record high of 710 in 2020, according to a report from Experian, and 69% of Americans had a “good” score of at least 670.

First Check Your Credit History

You are allowed one free credit report a year from the three main credit-scoring companies: Experian, Equifax and TransUnion. You can reach out to each directly or you can access them through annualcreditreport.com.

Not only should you know your score, you should also make sure there are no mistakes or unintended skeletons in your closet, like a missed payment you forgot about.

Pulling your report before you apply for a mortgage or preapproval, ideally a few months in advance, will give you time to correct any issues.

Don’t Miss: Rocket Mortgage Launchpad

Where To Obtain Free Monthly Fico Scores

- Examine your credit card. One of the best ways to access your FICO Credit Score for free is with the Discover Credit Scorecard.

- American Express credit cards. American Express offers cardholders access to their free FICO Score and 12 months of FICO Score history.

- Citibank credit cards.

What’s an average credit scoreWhat is a good credit score range? According to Experian, one of the three major credit bureaus, credit scores are as follows: Excellent: 750 to 850 Good: 700 to 749 Fair: 650 to 699 Poor: 550 to 649 Very Bad: 300 to 549.What is a good FICO 8 score?FICO 8 is the most widely used FICO scoring model. A FICO credit score of 670-739 is considered “good.” A FICO credit score of 740-799 is considered

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Recommended Reading: Reverse Mortgage On Condo

What Is The Fico Credit Score Ranges

In most cases, the FICO credit score range is 300 to 850. However, there are many versions of the FICO score and some use other ranges. For example, some of the FICO scores used in the auto and credit card industries are between 250 and 900. In addition, NextGen’s FICO score is between 150 and 950.

FICO® ScoreSee Credit Score. Financial Center,What is The Meaning of FICO® ScoreSee Credit Score. Financial Center?FICO® ScoreSee Credit Score. Financial Center can be defined as, Bank of America Agency Find a financial centerLiteral Meanings of FICO® ScoreSee Credit Score. Financial CenterScore:Meanings of Score:Number of points, goals, poi

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Recommended Reading: Reverse Mortgage For Condominiums

What Exactly Is A Fico Score Range

FICO score varies Very poor: 300 to 579 Average: 580 to 669 Good: 670 to 739 Very good: 740 to 799 Excellent: 800 to 850.

Is 620 a good credit score What faith can I get with faith?Technically you can do a conventional loan The score is 620, but you need to have strong applications in all other areas .What do 620 credit cards do?620 It’s fair faith twenty. A person with a credit rating of 620 can get a loan But people with higher credit valuations pay higher interest

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Also Check: Rocket Mortgage Qualifications