What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

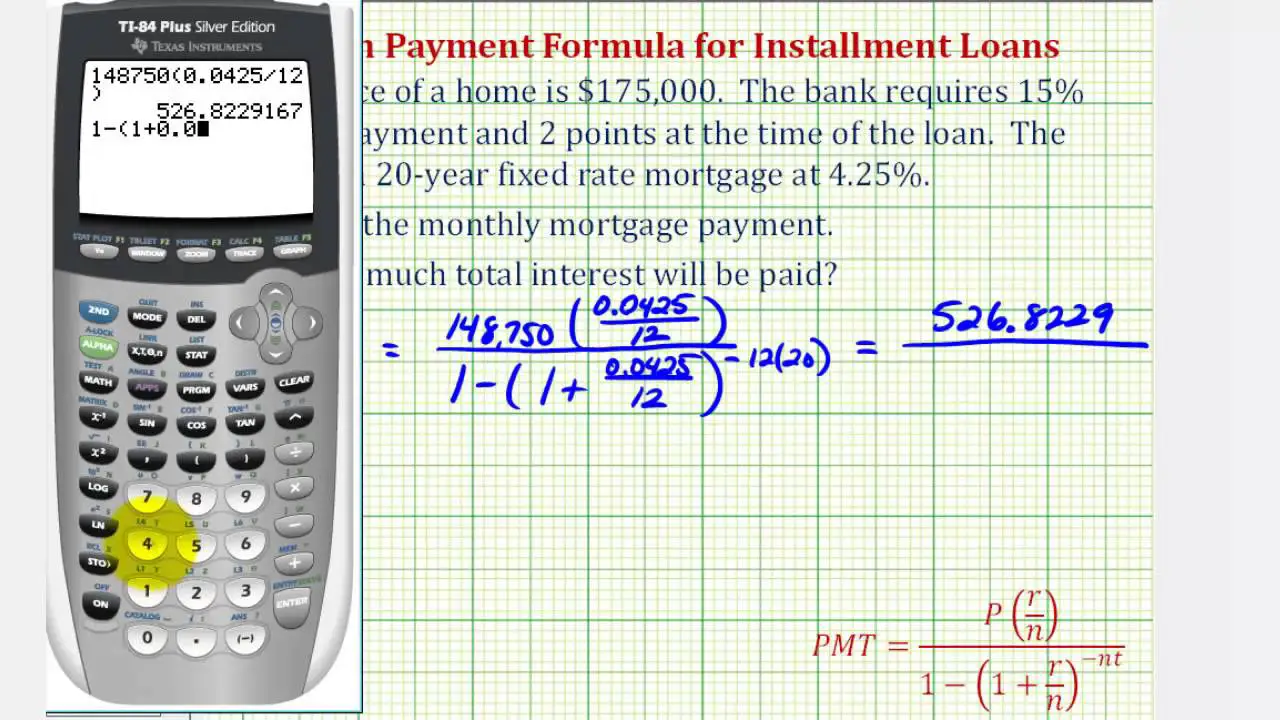

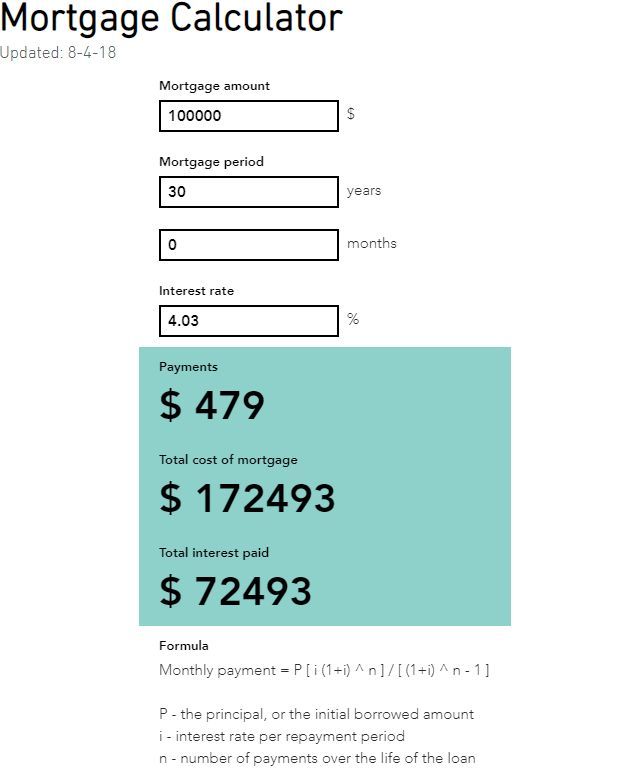

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

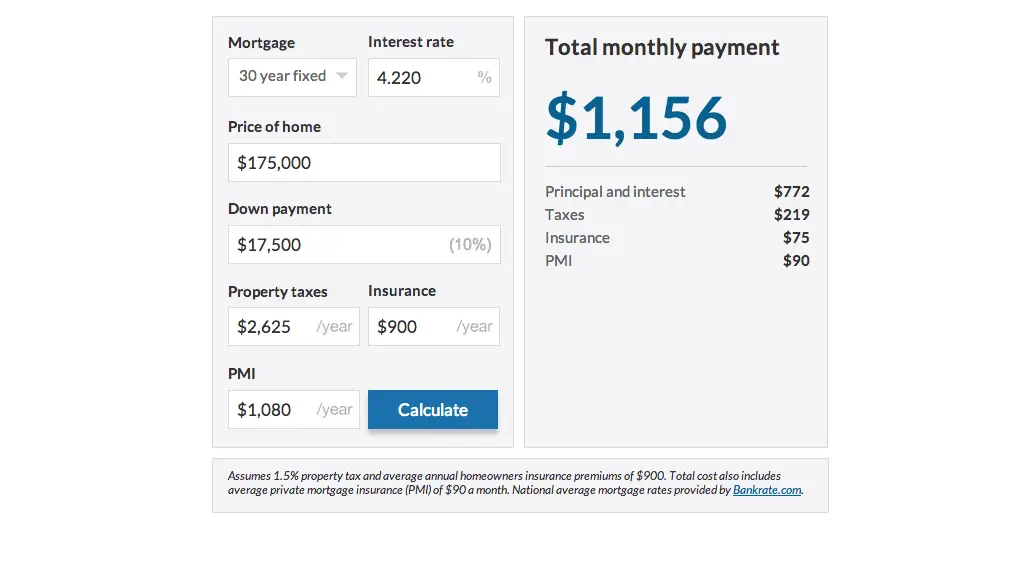

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

What Is Down Payment

The down payment is an initial payment for the purchase of an item oncredit. In simple terms, it is an advance payment for an expensivepurchase. The payment represents a percentage of the total purchaseprice. You would pay the initial upfront payment called the downpayment for the purchase of a car or a house.

You would make the down payment out-of-pocket instead of borrowing theamount. It is wise to make a down payment when availing of a loan evenif you dont have to. You save on interest payments across the tenureof the loan. It would be a good idea to make a down payment of 15%-20%of the cost of an expensive asset such as a house when availing a homeloan. You may repay the remaining loan amount over time through EMIsor equated monthly instalments.

Lenders may specify a minimum amount for the down payment. You couldmake a small or large down payment depending on your affordability. Ifyou make a large down payment, you will be able to comfortably repaythe equated monthly instalments as you have to repay a lower amount ofloan.

Your loan would quickly be approved, and you would also save on theloan processing fees. However, a large down payment would lock yourfunds resulting in lower liquidity, and you would have to cut back onspending. You could face a shortage of funds during a financialemergency. You must decide on the down payment before approaching thebank for a loan.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Understanding How Private Mortgage Insurance Works

A Note on Private Mortgage Insurance

Those who pay at least 20% on a home do not require PMI, but homebuyers using a conventional mortgage with a loan-to-value above 80% are usually required to pay PMI until the loan balance falls to 78%.

PMI typically costs from 0.35% to 0.78% of the loan balance per year. The annual payment amount is divided by 12 and this pro-rated amount is automatically added to your monthly home loan payment.

| Home Price |

|---|

Sources: * Census.gov, all others NAR

Down Payment And Closingcost Assistance

What if youre having trouble saving for a down payment andclosing costs? Even if you qualify for a low down payment home loan, it can behard to save the cash required in todays real estate market.

Luckily, you dont have to go it alone. There are manydifferent ways to get assistance with your upfront home buying costs.

Here are a few good strategies to explore:

Most lenders are familiar with all these programs and willing to help borrowers who dont have a big down payment saved up.

Your loan officer, broker, or agent can walk you through the steps to apply for and receive assistance.

Recommended Reading: Reverse Mortgage On Condo

Find Out How Much Down Payment You Need

Theres no hard-and-fast rule for how much down payment you need on a house. Twenty percent down used to be the norm, but these days you can buy a house with as little as 0-5% down.

The down payment youll need depends on the type of loan you qualify for and how much you plan to spend on your new home.

If you have a target price range, you can use the down payment calculator below to find out how much cash youll need and which loan types you might be eligible for.

Putting Money Into Your Home Means Its Not Available For Other Things

When deciding how much money to put down, keep in mind that once you put money into your home, its not easy to get it back out again. If you need the money for another major expense, like paying for college or medical expenses, you may find that there is no way for you to access this money. While home equity loans or lines of credit allow homeowners to borrow against their equity, you usually need to have owned your home for several years and built up significant equity in order to qualify. Borrowing against your equity also isnt free you pay interest on the loan.

Recommended Reading: Monthly Mortgage On 1 Million

Mortgage Payment Calculator Canada

Looking to take out a mortgage sometime soon? Know what you’ll be signing up for with our mortgage payment calculator. Understanding how much your mortgage payments will be is an important part of getting a mortgage that you can afford to service long term.

The mortgage payment calculator below estimates your monthly payment and amortization schedule for the life of your mortgage. If you’re purchasing a home, our payment calculator allows you to test down payment and amortization scenarios, and compare variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: Mortgage Recast Calculator Chase

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

You May Like: Mortgage Rates Based On 10 Year Treasury

Check Your Home Loaneligibility

Use the down payment calculator above to estimate how much down paymentyou need for a house.

If you have enough cash saved up and youre ready to start househunting, your next step is to get pre-approved by a mortgage lender.

Pre-approval will solidify your loan type, loan terms, interest rate,and monthly payment as well as the total amount you need for a down paymentand closing costs.

Ready to get started?

Get Help Calculating Monthly Mortgage Payments

The terms and details of your mortgage will impact your financial standing for years to come. It is essential to understand all aspects of your home loan and the payment schedule you will be using throughout the life of the mortgage.

At SimpleShowing, talented, experienced real estate professionals can help you navigate the complicated and confusing process of acquiring a mortgage. Contact a knowledgeable representative for complete information on the wide range of realtor services to assist in the home buying experience.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Benefits Of Cleartax Down Payment Calculator

- You can use the ClearTax Down Payment Calculator to calculate thedown payment before availing of a loan in seconds.

- The calculator helps you to select the bank which offers the bestrates on loans.

- The calculator also helps you to calculate the processing fees onthe loan.

- You may use the ClearTax Down Payment Calculator to determine theEMIs on the loan.

- It helps you budget finances before availing of a loan.

Read Also: Can I Get A Reverse Mortgage On A Condo

Current Mortgage Balance And Payment

Together with your home value estimate, your current mortgage balance is used to determine how much equity you have for the purposes of loan qualification as well as to figure how much cash you can take out.

The payment can be useful, because sometimes the reason for refinancing is to try to lower your payment usually accomplished either through lowering your rate or lengthening your term. Including this info will make it easier to compare options.

What Is The Down Payment Calculator

A down payment calculator is a utility tool that shows you the amountof down payment you must make while availing of a loan. It also helpsyou to calculate the EMIs on your loan.

The down payment calculator consists of a formula box, where you enterthe total cost of the asset, the percentage of the down payment, therate of interest on the loan, the processing fees, and the loan tenurein years. The down payment calculator shows you the amount of downpayment and the loan EMI to repay the loan.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

The Nerdwallet Down Payment Calculator

Saving for a down payment to buy a house can seem overwhelming. But dont worry, you can break it down into small, actionable moves that can help you save enough to afford a home sooner than you expected.

Four basic steps can help you save enough to buy a house: knowing how much down payment youll need, socking away the money, tapping any available outside sources to seed your fund and gaining a small edge with interest.

However you decide to save for your down payment, remember it’s all about persistence and small victories. Set up a monthly transfer to a special savings account, save your bonus instead of buying yourself a present, set aside that tax refund, don’t buy a new car, take advantage of any savings help your bank offers. You get the picture.

Large Vs Small Down Payment

Paying a larger down payment of 20% or more, if possible, usually lead to qualification for lower rates. Therefore a larger down payment will generally result in the lower amount paid on interest for borrowed money. For conventional loans, paying at least a 20% down payment when purchasing a home removes the need for Private Mortgage Insurance payments, which are sizable monthly fees that add up over time.

One of the risks associated with making a larger down payment is the possibility of a recession. In the case of a recession, the home value will likely drop, and with it, the relative return on investment of the larger down payment.

Making a smaller down payment also has its benefits, the most obvious being a smaller amount due at closing. Generally, there are a lot of different opportunity costs involved with the funds being used for a down payment the funds used to make a down payment can’t be used to make home improvements to raise the value of the home, pay off high-interest debt, save for retirement, save for an emergency fund, or invest for a chance at a higher return.

Read Also: Chase Mortgage Recast

Example: How To Calculate Your Minimum Down Payment

The calculation of the minimum down payment depends on the purchase price of the home.

If the purchase price of your home is $500,000 or less

Suppose the purchase price of your home is $400,000. You need a minimum down payment of 5% of the purchase price. The purchase price multiplied by 5% is equal to $20,000.

If the purchase price of your home is more than $500,000

Suppose the purchase price of your home is $600,000. You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000. Add both amounts together which gives you total of $35,000.

Set Aside Some Money To Cover Initial Home Expense

New homeowners often find things that need fixing, or discover that they need an additional piece of furniture to make the new home work for their family. Moving expenses and utility set-up fees can also add up. When thinking about how much you can afford for a down payment, make sure to set aside some money to cover these expenses.

Recommended Reading: Recast Mortgage Chase

What Is The Minimum Down Payment Required In Canada

The minimum down payment in Canada depends on the purchase price of the home:

- If the purchase price is less than $500,000, the minimum down payment is 5%.

- If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

- If the purchase price is $1,000,000 or more, the minimum down payment is 20%.

Mortgage default insurance, commonly referred to as CMHC insurance, protects the lender in the event the borrower defaults on the mortgage. It is required on all mortgages with down payments of less than 20%, which are known as high-ratio mortgages. A conventional mortgage, on the other hand, is one where the down payment is 20% or higher.

According to a recent TD Canada Trust Home Buyers Report1, 30% of homebuyers plan to or have at least a 20% down payment, the point at which mortgage default insurance is no longer required.

Determine How Much Money You Are Able To Spend Upfront On Your Home Purchase

- Gather your savings and investment statements and add up your total available funds.

- Now, subtract an additional amount for an emergency cushion. A good rule of thumb is at least three to six months’ worth of expenses.

- The result is your maximum available cash for closing how much you can contribute out of pocket at the time you close on your loan.

Read Also: Reverse Mortgage For Mobile Homes