What Are The Different Types Of Mortgages

You may think that getting a mortgage is hard enough, but wait until you find out that there are all different types of mortgages. So how do you know which mortgage to choose? It all comes down to understanding the options available so you can choose whats right for your situation. Lets dive deeper into the different types of mortgages.

What You Need To Know Before Applying

- You are at least the age of majority, 18 or 19 years of age depending on your province of residence.

- You are a Canadian resident.

- You will be asked to provide personal details and gross annual income .

- You will be asked to consent to us obtaining your credit report.

- If you are applying for a joint loan, the co-applicant must complete the application. If there is more than one co-applicant, please call us to proceed at .

- All mortgages are subject to standard credit approval.

Mortgage By Conditional Sale

Mortgage by conditional sale is one where the mortgagor ostensibly sells the mortgaged property on the condition that

- On default of payment of the mortgage money on a certain date, the sale shall become absolute, or

- On such payment being made, the sale shall become void, or

- On such payment being made, the buyer shall transfer the property to the seller.

Read Also: Can You Get A Reverse Mortgage On A Condo

Other Types Of Mortgages

There are a few other types of mortgages that are less popular, but still available to buyers:

- Interest-only mortgages: This type of loan allows you to pay only interest during a set period of time, after which you need to refinance the loan or start paying higher monthly payments.

- Combination mortgage: Also known as a piggyback loan, this allows borrowers to combine two loans and qualify for a higher loan amount.

- Reverse mortgages: Available to homeowners who are 62 and older, this type of loan allows you to borrow against the value of your home without having to make monthly payments.

The right type of mortgage is a decision that will stay with you for a very long time. Start by understanding your needs and then choose the loan that fits you best. Make sure to shop around with different lenders to get the lowest mortgage rates possible. Experts recommend requesting and comparing at least three different quotes before deciding on a lender.

The Six Main Types Of Mortgages

Not all mortgage products are created equal. Some have more stringent guidelines than others. Some lenders might require a 20% down payment, while others require as little as 3% of the homes purchase price. To qualify for some types of loans, you need pristine credit. Others are geared toward borrowers with less-than-stellar credit.

The U.S. government isnt a lender, but it does guarantee certain types of loans that meet stringent eligibility requirements for income, loan limits, and geographic areas. Heres a rundown of various possible mortgage loans.

Fannie Mae and Freddie Mac are two government-sponsored enterprises that buy and sell most of the conventional mortgages in the U.S.

Also Check: How Does Rocket Mortgage Work

Pros Of Conventional Loans

- Can be used for a primary home, second home or investment property

- Overall borrowing costs tend to be lower than other types of mortgages, even if interest rates are slightly higher

- Can ask your lender to cancel private mortgage insurance once youve reached 20 percent equity, or refinance to remove it

- Can pay as little as 3 percent down on loans backed by Fannie Mae or Freddie Mac

- Sellers can contribute to closing costs

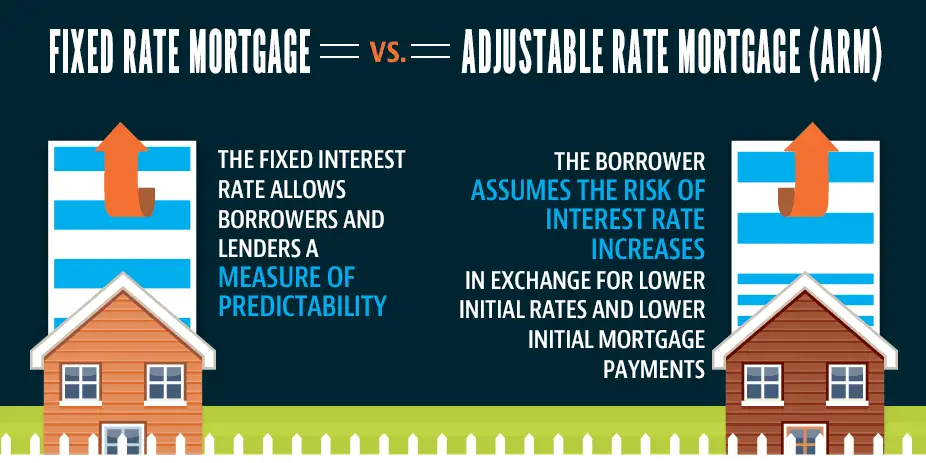

Fixed Rate Loan Vs Adjustable Rate Loan

Mortgages are available with two different types of interest rates: fixed and adjustable.

- On a fixed-rate loan, the interest rate stays the same for the entire life in the loan. That means you lock in the interest rate of todays market for the next 15-30 years.

- On an adjustable-rate loan, the interest rate varies along with the broader financial market. Its likely to go up and down over the course of the loan, which could cause big swings in your mortgage payments.

Rates right now are historically low. An adjustable-rate mortgage might get you a lower interest rate upfront, but you have to be prepared for that to go up over time.

If youre looking at that adjustable-rate mortgage, and youre getting in at what is probably the bottom now, odds are your rates are going to be higher, Bacon said.

But if you plan to stay in this home for many years, youll likely want to lock in a low fixed rate now.

Read Also: Can You Refinance Mortgage Without A Job

More Exotic Types Of Loans

6. COMBO / PIGGYBACK

The combo occurs when you put a down payment of less than 20% and take two loans of any type in combination to avoid paying Private Mortgage Insurance.

7. BALLOON

On a balloon mortgage, you pay interest only for a certain period of time five years for example and then the total principal amount is due after this initial period.

8. JUMBO

Jumbo refers to a mortgage thats too big for the Federal Government to purchase or guarantee. Currently, the limit is about $700,000. This means that the borrower wouldnt get the lowest interest rates available on smaller loans.

The 4 Most Common Types Of Mortgages

I found myself unexpectedly house shopping this month , and even for someone who works in the financial industry, there were plenty of terms I was unfamiliar with. One of the most confusing steps in the home buying process was understanding the different types of mortgages available. After a lot of late night spent researching the different types of mortgages available, I was finally about to make my choice, but I’ll save that for the end.

First things first. Are there different types of mortgages? Absolutely. But lets start with a couple of basic mortgage terms you will want to be familiar with before starting out on your own mortgage shopping experience. Understanding these terms is important because the differences in these areas are what makes each type of mortgage loan unique.

Interest rate/APR – An interest rate, or APR, is what it will cost you to borrow money over the duration of the mortgage loan.

Closing costs – These are extra fees that are charged when you buy a home. They can be between 2% – 5% of the total mortgage amount.

Down payment – This is a minimum amount of cash you have to pay upfront to secure the loan. It is usually expressed as a percentage of the total cost of the house.

Qualifications – These are the different criteria you need to meet in order to be eligible for a type of loan. These involve areas like your financial history, mortgage amount, house location, and any unique personal circumstances.

Don’t Miss: Reverse Mortgage Manufactured Home

Mortgage Basics: Types Of Mortgages

Traditional or conventional mortgagesHigh-ratio mortgagesFixed rate mortgageadjustable rate mortgage variable rate mortgage convertible mortgage hybrid mortgageClosed mortgagesOpen mortgagesReverse mortgages portable mortgageassumable mortgage Home Equity Line of Credit cash back mortgagecollateral mortgage

What Is A Reverse Mortgage

Reverse mortgage are financial products that have been around in the United States since a Maine-based bank released its first reverse mortgage in 1961. They were put under the purview of the U.S. Department of Housing and Urban Development in 1987.

A reverse mortgage is a loan that works a little differently than a traditional mortgage. It allows homeowners who are 62 or older to borrow money by using their homes as security to back the loan. It is often used to pay off current mortgages, help pay health care expenses, or supplement current income. Once a reverse mortgage is established, repayment is typically not required until you die, move, or sell your home.

There are three types of reverse mortgage loans available to homeowners. These are the single-purpose reverse mortgage, federally insured reverse mortgages, and proprietary reverse mortgages.

Don’t Miss: Chase Recast Calculator

Home Equity Lines Of Credit

A HELOC is a secured form of credit. The lender uses your home as a guarantee that youll pay back the money you borrow. Most major financial institutions offer a HELOC combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

HELOCs are revolving credit. You can borrow money, pay it back, and borrow it again, up to a maximum credit limit. It combines a HELOC and a fixed-term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender generally only requires you to pay interest on the money you use.

Find Out About The Different Types Of Mortgage And Understand The Pros And Cons Of Fixed

Interest-only and repayment mortgages Specialist mortgagesMortgage features to look out for

Choosing the right type of mortgage could save you thousands of pounds, so it’s really important to understand how they work.

After taking out your mortgage you’ll pay an initial interest rate for a set period of time. This rate can be fixed or variable .

Don’t Miss: Rocket Mortgage Launchpad

How To Compare Mortgages

Banks, savings and loan associations, and credit unions were virtually the only sources of mortgages at one time. Today, a burgeoning share of the mortgage market includes nonbank lenders, such as Better.com, LoanDepot, Rocket Mortgage, and SoFi.

If you’re shopping for a mortgage, an online mortgage calculator can help you compare estimated monthly payments, based on the type of mortgage, the interest rate, and how large a down payment you plan to make. It can also help you determine how expensive a property you can reasonably afford.

In addition to the principal and interest, you’ll be paying on the mortgage, the lender or mortgage servicer may also set up an escrow account to pay local property taxes, homeowners insurance premiums, and certain other expenses. Those costs will add to your monthly mortgage payment.

Also note that if you make less than a 20% down payment when you take out your mortgage, your lender may require that you purchase private mortgage insurance , which becomes another added monthly cost.

Home Equity Conversion Mortgages

Home equity conversion mortgages are federally insured, which means they are backed by HUD. This type of loan is likely to be more expensive than a traditional home loan and comes with high upfront costs. It is the most widely used reverse mortgage because it carries no income limitations or medical requirements, and the loan can be used for any reason.

Counseling is required before applying. This ensures that the homeowner is fully aware of the costs, payment options, and responsibilities involved. Interested parties are also informed about any nonprofit or government-issued alternatives, as long as they’re eligible. There is a charge for the counseling session, which can be paid from the loan proceeds.

After the counseling session, you find out how much you can borrow with a HECM. Your age, the value of your home, and current interest rates determine how much you can borrow. Those who are older and have higher equity are provided with more money.

Once the loan is established, you can choose between several payment options, A term option that allots monthly cash advances for a specific time, or a tenure option pays monthly advances for as long as the home is your primary residence. You can also choose a that lets you draw from the account at any time or a combination of this credit line coupled with monthly payments. You can change your payment option for a low fee if your situation ever changes.

Read Also: Can You Do A Reverse Mortgage On A Condo

Standard Variable Rate Mortgages

SVR is a lenderâs default, bog-standard interest rate â no deals, bells or whistles attached. Each lender is free to set their own SVR, and adjust it how and when they like. Technically, there isnât a mortgage called an âSVR mortgageâ â itâs just what you could call a mortgage out of a deal period. After their deal expires, a lot of people find themselves on an SVR mortgage by default, which might not be the best rate for them.

Pros And Cons Of Fixed

| Pros and cons of different mortgage types |

*Average rates according to Moneyfacts. Data sourced 16th May 2019.

Whether you should go for a fixed or variable-rate mortgage will depend on whether:

- You think your income is likely to change

- You prefer to know exactly what you’ll be paying each month

- You could manage if your monthly payments went up

Recommended Reading: Chase Recast Mortgage

Do You Know Which Mortgage Is Best

Even when you know about the different types of mortgages, it can still be hard to choose which one is best and LemonBrew is here to help. Answer a few simple questions and our top-rated mortgage advisors will help you decide how to finance your new home and help you better understand all of the different types of mortgages.

Work With A Ramseytrusted Mortgage Lender

Now that you know the types of mortgages, avoid the ones thatll cripple your financial dreams! To get the right home loan, work with our friends at Churchill Mortgage. Theyre full of RamseyTrusted mortgage specialists who actually believe in helping you achieve debt-free homeownership.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: Rocket Mortgage Requirements

How Mortgages Work

Individuals and businesses use mortgages to buy real estate without paying the entire purchase price upfront. The borrower repays the loan plus interest over a specified number of years until they own the property free and clear. Mortgages are also known as liens against property or claims on property. If the borrower stops paying the mortgage, the lender can foreclose on the property.

For example, a residential homebuyer pledges their house to their lender, which then has a claim on the property. This ensures the lender’s interest in the property should the buyer default on their financial obligation. In the case of a foreclosure, the lender may evict the residents, sell the property, and use the money from the sale to pay off the mortgage debt.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: 70000 Mortgage Over 30 Years

Getting A Mortgage Pre

In the current market, its imperative to get pre-approved for a mortgage before you begin house hunting. In Columbia, South Carolina, the housing inventory is so tight that many homes are closing quickly, and with multiple offers. If you want your offer to be accepted, especially when there are multiple offers on the table, you absolutely must include a copy of the pre-approval with your offer. Its just the nature of the beast right now.

Different Types Of Mortgages

Mortgage and type of mortgage is specifically and important Banking Awareness topic and questions from the same can be asked in the General Awareness section for the various Government Exams.

In this article, we shall discuss in detail what is a mortgage and what are its different types and also how the questions based on this topic may be asked in the upcoming competitive exams.

Candidates willing to know what other topics are included in the Banking Awareness syllabus can visit the linked article for more information.

| Wish to Strengthen your General Awareness Knowledge?? Refer to the links given below: |

| Banking Abbreviation |

Don’t Miss: Recasting Mortgage Chase

Conventional Mortgage Loan And Jumbo Loans

A conventional loan is the most common type of mortgage, and refers to any mortgage not backed by a government agency. Theres a reason why most buyers end up with conventional loans: Conventional loans have strict lending requirements from banks, so they come with fewer limitations when it comes to income and property type, and they tend to carry lower fees.

Lenders know them, and theyre pretty competitive, said Matt Bacon, an investment advisor at Carmichael Hill, a financial advisory firm. This is like the bread and butter for everything.

Conventional loans will work for most purchases. Usually, if you put down less than a 20% downpayment, youll have to pay private mortgage insurance, which can cost a few hundred dollars a month.

Be aware of the two types of conventional loans: conforming or jumbo. There is an upper limit on the purchase price before a mortgage becomes a jumbo loan, which has higher interest rates and stricter requirements. You can use this map to see what the conforming loan limits are in your area.

Hsbc Equity Power Mortgage

-

Access up to 80% of the value of your home4 to renovate, travel or make a major purchase.

-

Consolidate high-interest debt and reduce the amount of interest you pay.

-

Benefit from a combination of fixed and variable terms.

An ideal choice if you want to use the equity you’ve built up in your home for important goals or to simplify your borrowing needs.

Recommended Reading: Reverse Mortgage For Condominiums