Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

How To Use Dti Ratios To See How Much House You Can Afford

Targeting a good DTI ratio for you can help you plan for how big of a mortgage to take out, and ultimately, what kind of house to shop for. Once you know the monthly payment you can afford, you can use a mortgage calculator to see what mortgage amount and down payment can get you to that monthly payment amount.

For example, if you’re using the 25% post-tax rule and you bring home $5,000 per month, that means sticking with a mortgage payment of up to $1,250. Using the slider on the mortgage calculator, you can see that this means you can afford to buy a house worth $233,000 if you make a 20% down payment.

Considering Your Mortgage Term

Your mortgage term is the total length of your mortgage. If you have a term of 30 years on your loan, it means youll make a premium payment every month for 30 years. After this period, your loan is fully matured and the lender closes your account. The most popular mortgage terms are 15 years and 30 years.

However, lenders can create their own custom loan offerings. At Rocket Mortgage®, you can get a term as short as 8 years or as long as 30 years.

Taking a longer mortgage term lowers your monthly payments. This can allow you to buy a more expensive home. However, youll pay more for your loan over time with interest charges.

Also Check: Who Is Rocket Mortgage Owned By

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

How Fast Can You Pay Off 50000 In Debt

In order to pay off $50,000 in credit card debt within 36 months, you need to pay $1,811 per month, assuming an APR of 18%. While you would incur $15,193 in interest charges during that time, you could avoid much of this extra cost and pay off your debt faster by using a 0% APR balance transfer credit card.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

What Is A Good Front

While recommended front-end ratios vary based on rules of thumb, a “good” front-end ratio will depend on your situation. For you, that may mean youll be able to pay for and live in a home you like while still allowing you to reach your other financial goals, such as saving for retirement and emergencies, paying down debt, and enjoying hobbies.

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Don’t Miss: Requirements For Mortgage Approval

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Also Check: Reverse Mortgage On Condo

Finding The Right Lender

One place to start is with , a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford:

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Also Check: Can You Refinance Mortgage Without A Job

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

Benefits Of A 20% Down Payment

A large down payment helps you afford more house with the same monthly income.

Say a buyer wants to spend $1,000 per month for principal, interest, and mortgage insurance . Making a 20% down payment instead of a 3% down payment raises their home buying budget by over $100,000 all while maintaining the same monthly payment.

Heres how much house the homebuyer in this example can purchase at a 4% mortgage rate. The home price varies with the amount the buyer puts down.

| Down Payment | |

| $1,000 / $0 | $261,500 |

Even though a large down payment can help you afford more, by no means should home buyers use their last dollar to stretch their down payment level.

And, as the charts below show, you dont save a ton of money each month by putting a lot down.

Making a $75,000 down payment on a $300,000 home, you only save $500 per month compared to a zerodown loan.

You May Like: Bofa Home Loan Navigator

What Is The 28/36 Rule

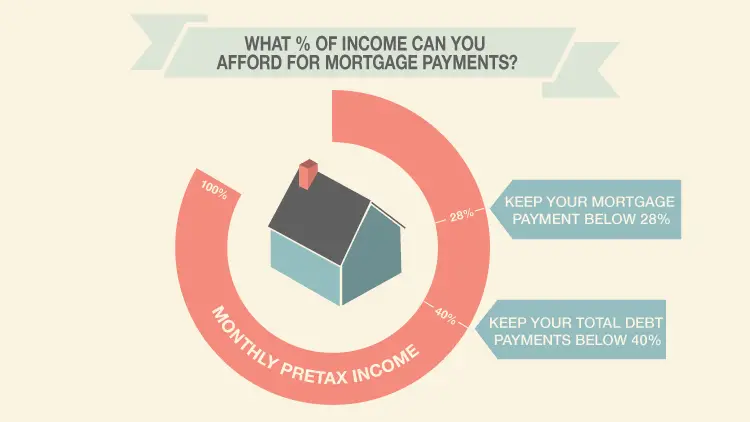

Lenders may determine your ability to afford a new home by using the 28/36 rule. Breaking it down, the rule establishes that:

Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, annual property taxes, and private mortgage insurance payments .

Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above credit cards, car loans, personal loans, and student loans so long as these monthly debt payments are expected to continue for 10 months or more.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month. If youre a renter, thats the most you should spend on your lease to maintain good financial health.

However, for a homeowner, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Recommended Reading: Reverse Mortgage For Condominiums

The Math Behind Your Down Payment

In my case, I was selling my condo to finance the purchase of my new home, so I calculated how much I would have for a down payment based on an estimate of my current homes value.

First, I tallied the costs associated with moving, including real estate agent commissions, legal fees, moving-day expenses, a home inspection and land transfer taxes . To calculate closing costs, the rule of thumb is to budget for 4% of your homes purchase price. A $500,000 home, for instance, would require $20,000.

I decided not to touch my investments or savings to cover these costs, so I subtracted them from the potential profit of the sale. That left me with a down payment of over 20%, which means I didnt have to pay mortgage default insurance.

Lets bring the math to life using the example of a 25-year mortgage for a $500,000 home, assuming a 5-year term and 3% fixed interest rate.

| Scenario 1 | |

|---|---|

| $100,000 | $200,000 |

Because I was able to make a larger down payment, I knew that would lower my monthly mortgage payments as well as the amount of interest I would pay over time. My own calculations suggested I would save at least $50,000 in interest.

Paying Your Mortgage Down Quicker

If your mortgage payment is mostly interest with relatively little principal paydown, you do have another option. You can choose to pay extra every month and have it applied to your loan’s balance. If you do this, make sure that you let your lender know that you want the extra money applied to your loan’s principal balance.

Also Check: Rocket Mortgage Qualifications

So How Much House Can I Afford

The amount you can afford to spend on a house will take into account how much capital you have to play with and how much you can borrow from a mortgage lender . The total amount of money available to you needs to cover the total cost of buying your home. If not, you will need to scale back your ambitions or find some more money. But being able to afford to buy your new home is only the first step to avoid repossession or mounting debts, you need to be able to afford to live in it.

How To Calculate Mortgage Affordability

First, lets define mortgage affordability. Though its sometimes used in reference to the cost of living in a particular city relative to the average income in that area, you should think about it as the amount a bank or financial institution will allow you to borrow based on your income, debt and living expenses.

Your mortgage affordability is based on:

- Your annual income before tax

- Your monthly debt payments, which includes credit cards, loans and car payments

- Housing costs such as property taxes, heat and half of your condo/HOA fees . For the latter, only half the amount is used, because condo fees can cover things like property maintenance, insurance and some utilities, which are not used in debt-service calculations for other types of properties.

According to the Canadian Mortgage and Housing Corporation, a mortgage is affordable when your gross debt service ratiowhich accounts for your housing costsdoesnt exceed 39%. To be considered affordable, your total debt service ratiowhich accounts for housing costs as well as other debt obligationsmust not surpass 44%.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

You May Like: Rocket Mortgage Requirements

What Percentage Of Salary Should Go To Mortgage Australia

Asked by: Lauriane Zemlak

How much money should mortgage repayments be as a percentage of income? The amount of income directed towards your mortgage depends on your loan size, budget, interest rates, income, and more. However, the general rule is 28% of your income should be funnelled into your mortgage.