Do You Have Any Other More Expensive Debts

Expensive debts are those that cost a lot to pay off over time.

Other expensive debts could include unsecured loans, where the interest rate is much higher than the cost of your mortgage borrowing.

Always pay off more expensive debts before thinking about reducing your mortgage but be careful not to rack them up again.

Mark Extra Mortgage Payments Principal Only

If you make your mortgage payment on the first of the month, and then on the 20th you send another regular payment, your lender may apply it as an early payment for the following month, rather than applying the entire amount to your principal balance.

But when you make your payment, you can mark extra amounts for principal only. The extra portion then goes directly toward your balance. You can specify principal only payments in your lenders online payment system or when you send in a payment voucher by mail.

Of course, no one says you have to pay thousands of extra dollars at a time. Even an extra $50 here or $100 there can put a dent in your balance and remaining payments.

Every time you make additional payments and reduce your principal balance, you jump ahead in your amortization schedule. Which in turn skips that early high-interest period in your loan.

The Pros Of Paying Off Your Mortgage Early

- Save money on interest. Each month that you make a mortgage payment, some money is going toward interest so the fewer payments you have, the less you will pay in interest. Paying off your mortgage early could save you tens of thousands of dollars.

- No more monthly payments. By eliminating monthly mortgage payments, you free up that cashflow to put toward other things. For example, you could invest the extra money or pay for your child’s college tuition.

- You own the home outright. If you hit a financial rough patch, there’s the possibility that you won’t be able to afford monthly mortgage payments. Your house could be foreclosed upon if you default on payments. When you completely own the home, there’s no chance of losing the house.

- Peace of mind. You may simply like the idea of not having a mortgage hanging over your head. The freedom that no mortgage payments gives you is a powerful motivator.

Read Also: Who Is Rocket Mortgage Owned By

Should You Pay Off Your Mortgage Or Invest In The Stock Market

On the one hand, given the current low-interest rate environment, investing could be much more profitable than paying off a fixed-rate mortgage with a low rate. On the other, being debt-free could provide homeowners great peace of mind.

If you were to find an investment that could generate an after-tax rate of return that is higher than your current mortgage rate, investing could be a better deal.

Going back to the example in the previous section, if you had a 30-year mortgage with a 4% interest rate and could pay an extra $500 each month, you could get out of your mortgage 10 years earlier and save around $63,442 overall. If you chose to invest those $500 in a stock market fund instead and continued investing the same amount each month for 20 years, assuming an annual return of 7% , your investment could be worth $247,908 at the end of that period.

While the numbers might make this decision seem like a no-brainer, the choice should come down to your personal financial situation, says Haley Tolitsky, CFP at Cooke Capital. “Remember, you actually need to invest the funds that you would be using to pay down your mortgage consistently, and the stock market can be volatile in the short-term, so make sure you are investing for the long-term and understand the risks of investing first,” she adds.

Here are some of the pros and cons of investing:

Shop For The Best Rate

Quite often, then, buyers will stick with banks or financial institutions they already know and have accounts with. But when shopping for the best mortgage rate, its actually better to cast your net wide and far. Consider outside-of-the box lenders, including credit unions and mono-lenders , as quite often these institutions can offer much better rates and terms than big banks.

Also Check: Rocket Mortgage Loan Types

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

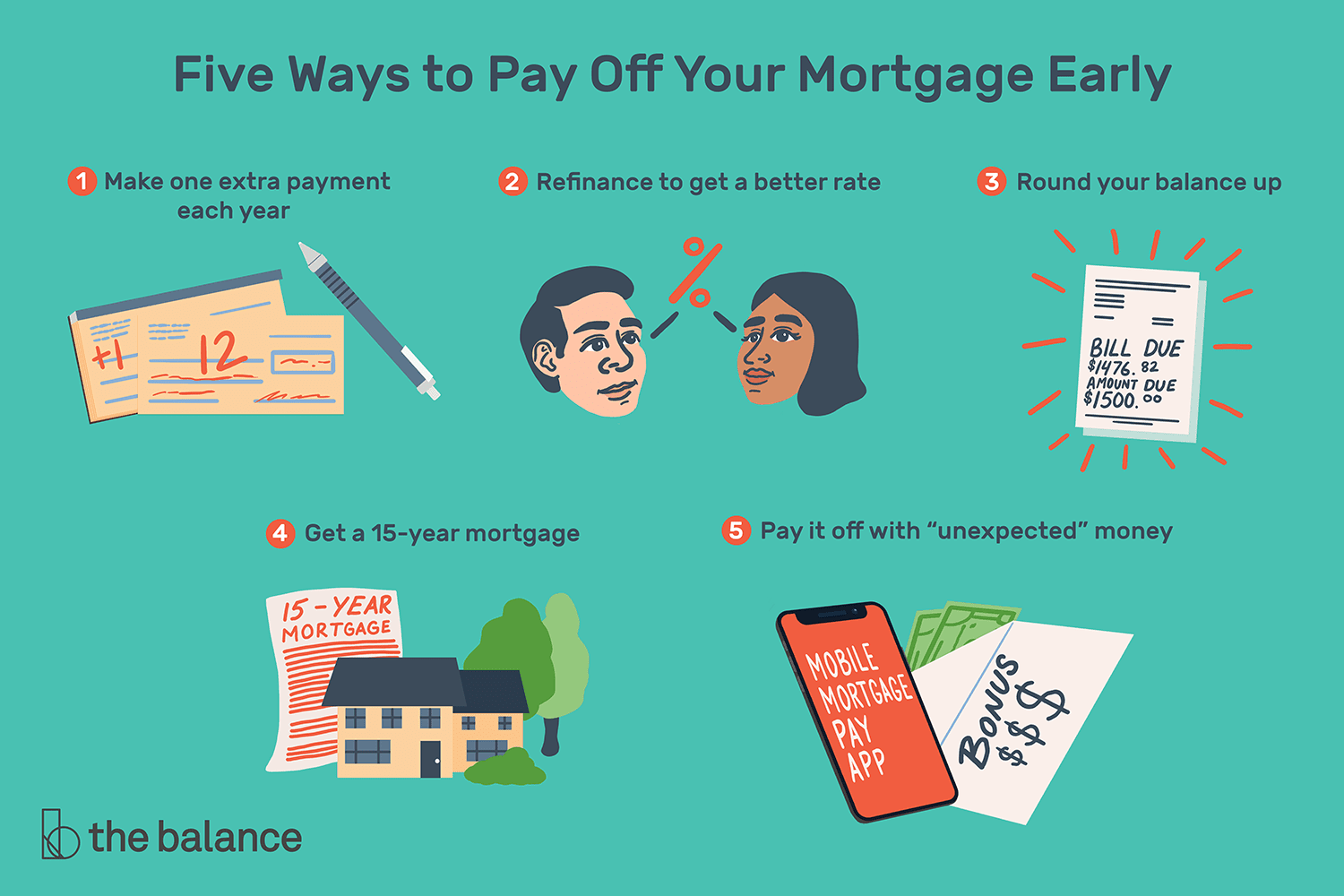

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

If You Decide To Pay Your Mortgage Off Before You Retire

Ideally, you would accomplish your goal through regular payments. However, if you need to use a lump sum to pay off your mortgage, try to tap taxable accounts first instead of retirement savings. If you withdraw money from a 401 or an individual retirement account before 59½, youll likely pay ordinary income taxplus a penaltysubstantially offsetting any savings on your mortgage interest, Rob says.

Don’t Miss: Monthly Mortgage On 1 Million

Remortgage For A Cheaper Shorter Deal

If your current mortgage provider is making it expensive or difficult to pay off your mortgage early, consider getting a remortgage deal. By switching to a new mortgage provider, you can often get a cheaper mortgage interest rate for up to 5 years of the mortgage term. You may also be able to get a shorter mortgage term.

Just be careful as remortgaging will probably activate the early repayment penalty fee on your current mortgage, and you will probably have to pay a fee to switch mortgage providers. Do the sums before to see if you could save. Remortgage deals generally work out better when you are coming close to the end of your current fixed rate mortgage deal, but its always good to shop around well in advance just in case.

The Extra Money Might Be Better Used For Investments That Could Make You Money

There are very few people in the world that have more money than they know what to do with, that being said what you choose to do with the amount of money you have is important. Putting some extra money into your mortgage payments above the minimum required amount can be a good decision, but it could also mean that you are missing out on other investment opportunities that could be making you a bigger profit. Some other beneficial investments you could use this money for could include investing in a retirement plan, building up an emergency fund, investing in the stock market, or investing in other areas that could bring a higher and quicker rate of investment return on your money.

You May Like: Bofa Home Loan Navigator

Refinance To A Shorter Term

Imagine you buy a home with a 30-year mortgage, and at the time, the monthly payment is all you can afford. A few years later you take a new job with a hefty pay raise, and suddenly you can afford much more each month.

You could simply send more money with each monthly or biweekly payment. And in most cases thats precisely what you should do. Otherwise, youll face thousands of dollars in closing costs associated with a refinance loan.

But if interest rates have dropped since you took out a loan, or your credit score has improved, or you want to lock in the higher monthly payment to force yourself to pay down the loan faster, you can always refinance to a 15-year mortgage.

Dont be afraid to negotiate and make lenders compete for your business. Sure, you should contact your current lender to ask about pricing. But you should also shop around to compare price quotes from other mortgage lenders to make sure you score the best deal.

Before committing to a shorter loan, read up on the pros and cons of refinancing and make sure youre going to come out ahead. Often youre better off just funneling more money toward your current mortgage to escape it faster.

Check : Can You Overpay Without Penalty Most Can Overpay 10% Per Year But Get It Wrong And You Risk 1000s In Fees

Most lenders allow you to pay 10% of your mortgage balance as an overpayment per year if you’re still in your introductory fixed or discount period.

If you’re on a tracker mortgage, or you’re beyond that intro deal and paying your lender’s standard variable rate , you can usually overpay by as much as you want. But many SVRs are expensive, so if on one it’s best to check if you can save by remortgaging, rather than only overpaying.

However, the 10% rule is not universal. Some lenders punish those who try to overpay by more .

Fees for paying too much are typically between 1% and 5% of the amount overpaid depending on your mortgage, though the fee you pay usually decreases the closer you are to the end of the fixed or discount period. The amount you pay as a penalty will vary between mortgage deals.

Say you’ve a five-year fix on a £100,000 mortgage and decide to overpay a lump sum two years into the deal. However, instead of sticking to the 10% limit free of penalty, you overpay £15,000 instead.

This means you must pay a 3% penalty on the extra £5,000 overpayment £150. However, this ‘percentage left on loan’ rule of thumb is very rough, so always double-check with your lender.

The reason for such harsh penalties is because lenders want you to stick with them once the cheap rate ends and because they’ve also budgeted to earn a certain amount of interest from you during the mortgage deal, and overpaying means they’ll get less.

Also Check: Can You Get A Reverse Mortgage On A Condo

Should You Pay Your Mortgage Off Faster

A 30-year mortgage is pretty painful. It sounds like a given that you would want to relieve the biggest debt of your life as soon as possible right? Well not always! Paying off your mortgage faster might actually be a hindrance to your financial goals.

Paying off your mortgage loan early is worthwhile if:

- You plan to stay in one home for the long haul

- You dont plan to relocate or refinance

- You are sensitive to debt and would feel better mentally without it

- The mortgage interest rates are not in your favor

B How Fast Can I Pay Off My Mortgage

You can pay off your mortgage as fast as you want if your bank allows it.

Some people decide to pay off their mortgage in just a few years, whereas others may keep their mortgage for the full 30 years.

You may want to think about the pros and cons of paying off your mortgage to see what timeframe is best for you.

You can learn how to pay off your mortgage in 5 years, 10 years, 20 years and so on with the tips Im about to share with you.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

You Save Money On Interest

The biggest perk to paying off a mortgage before the entire mortgage term is that you will accrue less interest and pay less money for your home. By cutting off the time period in which you pay back the amount of money you borrowed the less interest you will have to pay over the purchase price of the home. The sooner you pay off your home the less it will actually cost.Ocean City Realtor Deeley Chester

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How Does Rocket Mortgage Work

Refinance To A Shorter Mortgage Agreement

Refinancing to a shorter loan term mortgage could be an option for you. A 30-year term is the most popular. You could bring that down to a 15-year fixed-rate mortgage if its financially realistic for you.

Youll be covering a much bigger monthly payment if you shorten your mortgage contract term. Be sure to check your monthly expenses and have a padded emergency fund. If you have quite-high interest rates, refinancing may not be a bad idea anyway. Refinance your longer-term home loan to a 15-year loan.

If your interest rates are reasonable and refinancing wont get you a better deal, there are still options. You can pay some extra money with your monthly mortgage payment as if it was an unofficial 15-year mortgage. You get the same benefit without harming your interest rate.

Drawbacks Of Paying Off Your Mortgage Early

- Opportunity cost: Any extra money you spend on paying down your mortgage faster is money you arent able to use for other financial goals. You may be paying off your mortgage early at the expense of your retirement savings, emergency fund or other higher return opportunities.

- Wealth is tied up: Property is an illiquid asset, meaning you cant convert it to cash quickly or easily. If you faced a financial emergency or had an investment opportunity you wanted to jump on, youd not only have to sell your house, but also wait until a buyer was available and the sale closed.

- Loss of some tax breaks: If you choose to pay down your mortgage instead of maxing out your tax-advantaged retirement accounts, you will give up those tax savings. Plus, you may lose out on tax deductions for mortgage interest if you normally itemize.

Recommended Reading: Rocket Mortgage Qualifications

Should I Overpay My Mortgage

Although a mortgage is one of the biggest debts you’re ever likely to have, it isn’t always the most expensive., personal loans and especially store cards often have a higher rate of interest on them, so if you have been unfortunate enough to accrue large debts with those types of credit, it’s likely you’ll be paying, relatively speaking, much more in interest.

If you have extra income or a lump sum of cash to use to lower your mortgage debts, it might be better to put that towards your more expensive debt first.

If your debts are generally under control, paying off your mortgage early makes a lot of sense, but there are other useful ways to make your money go further. For example, investing it into a pension scheme or a high-rate savings account could give you a greater return when you decide to retire. By then your mortgage may have already been paid off, too, so you’ll have more money to enjoy your retirement with.

On the subject of the future, which is uncertain, you may wish to protect your family and those who depend on you financially by investing in life insurance. Even if you decide to start making mortgage overpayments, is there a financial back-up in place should the worst happen to you?

Make sure to weigh up all your options first before deciding whether or not to pay off your mortgage early. Keep in mind both the advantages and disadvantages of paying off your mortgage early:

Am I Saving Enough For Retirement

If youre not already maxing out your retirement contributions, this might be a worthwhile alternative to paying off your mortgage early. The more you invest the better the chance you have of successfully funding your retirement years.

You should ideally be contributing enough to take full advantage of any employer match youre offered. You should also consider putting enough in any tax-advantaged accounts you have , like a 401 or IRA, to reach your maximum annual contribution threshold.

Recommended Reading: What Does Gmfs Mortgage Stand For

Pros Of Paying Off Your Mortgage Early

There are obvious pros to paying off mortgage loans early. For starters, you don’t have to make any more monthly payments, and you’ll have peace of mind knowing your home is your own. By eliminating that monthly payment you will have more disposable cash on hand each month. There would be no need to squirrel away mortgage money or worry whether you made the payment on time. The extra cash can more easily go toward other things like hobbies, traveling, investing, or saving. It also gives you the freedom to start investing, saving money for home improvements, boosting your savings accounts, or more. In short, you’re no longer tied to your home loan.

Looking forward to finishing up monthly mortgage payments once and for all? Credible can also help you determine if you’re ready to refinance your mortgage.

Aside from the obvious, there are some other pros of an early mortgage payoff, including:

- Improving your creditworthiness

Improving creditworthiness: While experts agree that closing your mortgage has little effect on your actual credit score, a mortgage that is paid in full will be reflected on your credit report for 10 years. By eliminating your mortgage and having it show as a closed account in good standing, you will be more attractive to lenders and it also lowers your debt to income ratio. Ryan Dibble, COO of Flyhomes, told Fox an early mortgage payoff also lowers the risk of your home being foreclosed on.