When Will Housing Prices Fall

As housing markets become less accessible, buyer demand is declining. This can have a cooling effect on the market. In general, however, property values ââare expected to continue to rise through 2021 and 2022. None of the available reports or forecasts suggest that house prices will fall in 2022.

What Is The Lowest Mortgage Rate

Historically, a rate of less than 4% has been an excellent mortgage rate. In today’s market, the best prices can range from 2% to 3%. Remember that the lowest mortgage rate is for borrowers with high credit, low debt and a down payment of at least 20 percent. Who has the best mortgage rate?

Subordination agreement,Definition of Subordination agreement:An official document that acknowledges that one party’s claim or interest is less than that of the other party. For example, a company may agree that bank loans should take precedence over loans made by the company’s directors or owners. When a contract is part of a larger contract, it is a sub-clause.A subpoena is a legal document that proves that one debt is superior to another in repaying the debt. When a lender fails â¦

How Can I Calculate My Mortgage

Also know, how do you calculate a 30 year mortgage?

The Math Behind Our Mortgage Calculator

Secondly, how much is my mortgage? Total principal: $240,000

| Loan Term |

|---|

Also to know is, how is mortgage insurance calculated?

The PMI formula is actually simpler than a fixed-rate mortgage formula.

What is the mortgage payment on a $150 000 house?

So, for a 30 year mortgage at 6.5% interest, your monthly payment for $150,000 would be $948.10 for Principal and Interest on the loan. In addition, you will have to pay your taxes and homeowner’s insurance. If your taxes are $2400 per year, divide that amount by 12 months = $200 per month.

Read Also: Chase Mortgage Recast

How To Calculate Mortgage Interest Paid

Mortgage payments constitute a large financial obligation for many people. In addition to the principal of a mortgage, homeowners must also pay a lender interest over the course of the loan. This interest adds up to a significant amount due to the size of the loan and the length of the loan period. You can calculate mortgage interest paid over the course of a loan to see how much money you will pay to the lender in interest.

1

Find your monthly mortgage payment in your loan papers. Look in the amortization schedule that the lender provides you to find this amount, if you do not know it.

2

Multiply your monthly payment by the number of payments you will make over the entire course of the mortgage. For example, if your monthly payment is $825.00 and you will make 180 payments over the course of a 15-year loan, multiply 825 by 180 to get 148,500.

3

Subtract the principal from this figure to calculate the interest paid to the lender. If your principal is $110,000, subtract 110,000 from 148,500 to get $38,500 in interest.

References

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Read Also: Can You Do A Reverse Mortgage On A Condo

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

How To Find The Best Mortgage Rates

- 1. Improve your credit score. If you are currently looking for a home, it can be difficult to get your finances in order. So maybe I’ll try to anticipate

- 2. Save on bail.

- 3. Collect information about your income and professional history.

- 4. Know your debt-to-income ratio.

- 5. Use a mortgage calculator.

You May Like: Chase Recast Mortgage

Understanding Mortgage Interest Rates

When you take out a mortgage to buy a home, you are borrowing money backed by the home’s price. Naturally, the lender won’t allow you to borrow money for free. To make money, the lender charges interest that accrues over the life of the loan. The amount that you borrowed in the first place is known as the principal on the mortgage.

On a fixed-rate mortgage, this interest rate will remain the same for the term of the loan, whether that’s 20 years, 30 years or longer. For an adjustable rate mortgage, the rate will change based on prevailing interest rates at various intervals.

Either way, you should be able to find your current interest rate in your mortgage paperwork or through your bank’s online lending site. You can also check to see if your mortgage statement specifies how much of the current month’s payment is attributed to interest. If it doesn’t, you can make that calculation yourself.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Don’t Miss: Rocket Mortgage Payment Options

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

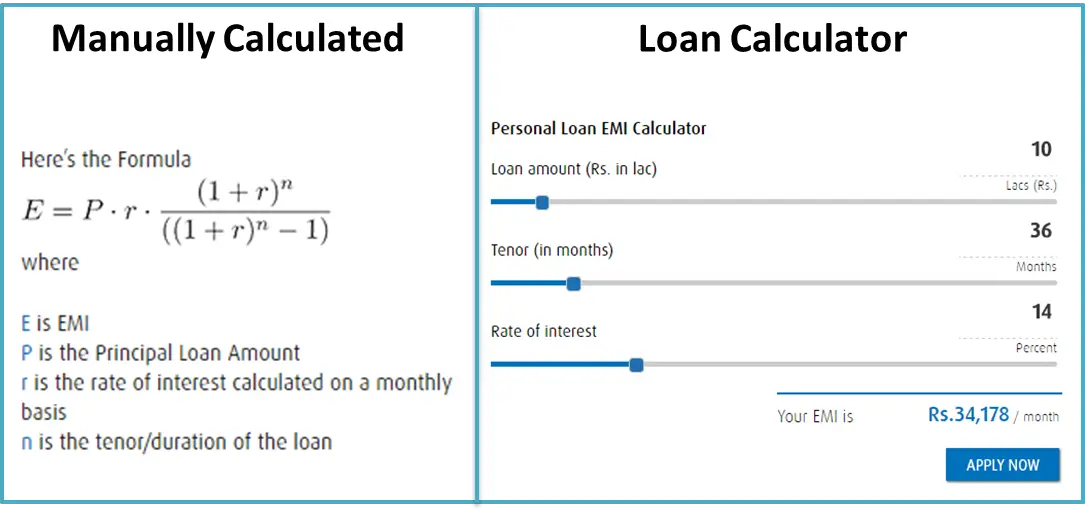

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

What If The Math Still Doesn’t Add Up

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

Don’t Miss: Rocket Mortgage Requirements

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans such as 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Don’t Miss: Does Getting Pre Approved Hurt Your Credit

How Amortizing Payments Work

If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin. With a fixed rate loan the amount of each payment stays the same across the duration of the loan, but the percent of each payment that goes toward principal or interest changes over time. Early on in the loan’s term a relatively large share of the payment is applied toward interest, then as the borrower pays down the loan an increasing share of the payment goes toward interest.

Rather than using the above calculator repeatedly you can use an amortization schedule to print out the entire schedule for a loan. We host an amortization calculator which enables you to create printable amortization tables. It shows the monthly payments and amortization schedule for the principal and interest portion of loans, while other costs of borrowing like licensing or taxes are excluded.

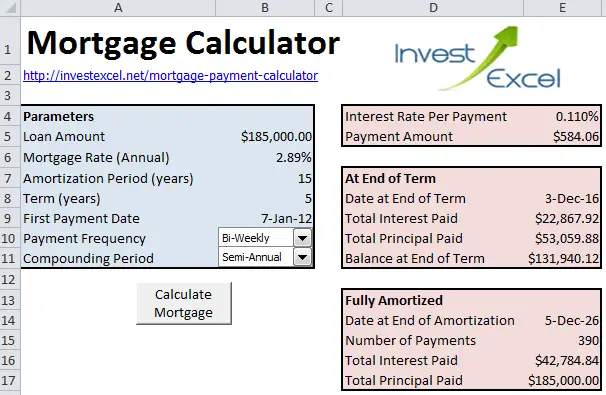

More Ways to Calculate Your Loan Payments

If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or future balance will be.

Prefer to calculate offline? See our free Simple Excel loan calculator.

What Is Mortgage Formula

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

Fixed Monthly Mortgage Repayment Calculation = P * r * n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance=P * /

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Mortgage Formula

Recommended Reading: Rocket Mortgage Qualifications

What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate and determine your mortgage rate in terms of an annual percentage rate . APR is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716.12. If you take the same loan with a 6% interest rate, youd pay $899.33 each month.

The interest rate on your loan depends upon a number of factors. Your credit score, income, down payment, and the location of your home can all influence how much you pay in interest. If you know your credit history isnt that great, you may want to take some time to raise your credit score so you can save thousands of dollars in interest over time. Lets take a look at an example.

Say you have a choice between two lenders. One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate.

Find out what you can afford.

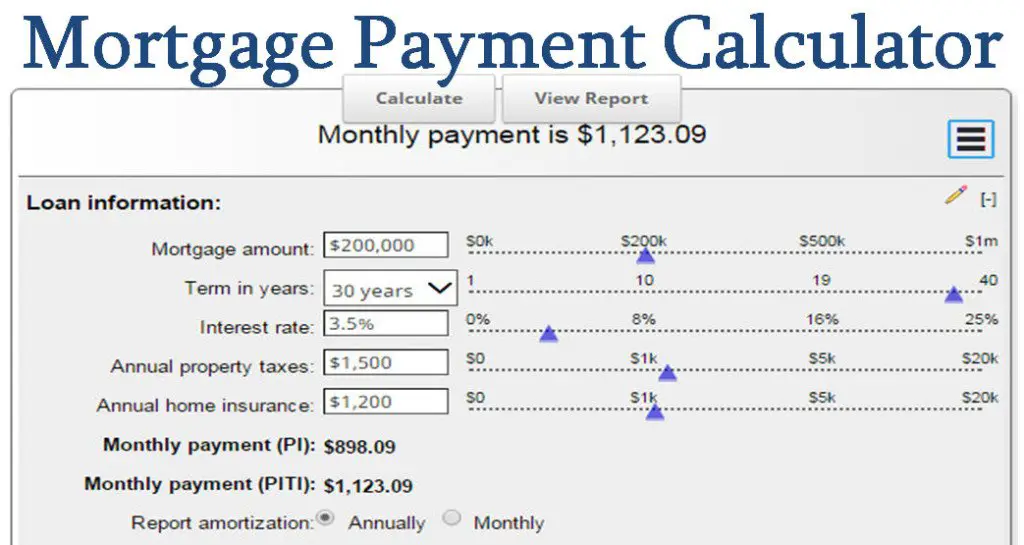

Basic Mortgage Payment Calculator

This calculator requires the use of Javascript enabled and capable browsers. This script calculates the monthly payment of a typical mortgage contract. Enter the dollar amount of the loan using just numbers and the decimal. Next, enter the published interest rate you expect to pay on this mortgage. Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. You may click on Clear Values to do another calculation. In our example, a loan of $100,000.00 for 30 years at 6% will yield a payment of just less than $600.00 a month for principal and interest. Designation

Don’t Miss: How To Get Preapproved For A Mortgage With Bad Credit

What Can A Mortgage Calculator Help Me With

Whichever mortgage calculator you use, its objective should always be to help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

Are Mortgage Rates Going Up Or Down Right Now

Mortgage rates rose again this week on concerns about the new Omicron coronavirus and the increasing likelihood of impending rate hikes. Average 30-year mortgage rates rose from interest to interest last week, according to a weekly Bankrate survey of top lenders.

Supreme lending reviews How many comments does Sport Advantage have?1 Supreme Lending He was the first PissedConsumer to be recorded on July 20, 2010. From it he received a note of 105 commentaries. 2 Supreme Lending Ranked 96th out of 897 in the loan and mortgage category. The company’s overall ratings have been upgraded, and users are mostly dissatisfied. 3 The recommendations of this businessâ¦

You May Like: Rocket Mortgage Loan Requirements

Year Mortgage Interest Rates Forecast

The forecast for the average interest rate is based on a fixed interest rate for 30 years and a fixed interest rate for 15 years in 2022. Looking ahead, it is important to bear in mind that mortgage interest rates have remained relatively low. And for the foreseeable future, they should not stray too far from historical lows.

Best money sending appWhat are the best apps to send money instantly? google wallet. With the Google Wallet app, you can send and receive money almost instantly from anywhere in the world. All you need is an email address or a phone number. Once the money is in your wallet, you can transfer it to your bank account or spend it with your Google Wallet card.What are the best money transfer apps?The Best International Moneâ¦

Which Is The Best Mortgage Calculator

- google. This is a new Google feature that allows you to search for terms like “I can pay a mortgage, I can pay 900 a month” or a mortgage calculator.

- Mortgage calculation. The calculator stands out for its simplicity.

- CNN money. This calculator is also great for its simplicity.

- Zillow.

Your Guide To A Smarter Home Loan.,Your Guide To A Smarter Home Loan. means,A simple definition of Your Guide To A Smarter Home Loan. is: Find the navigation menu.Mortgage 101.21 Frequently Asked Questions About MortgagesAm I entitled to a mortgage?Do you need 20% to buy used?Getting a W Mortgage: From S to the End.Calculate your DTI.Your mortgage will be paid over time.Mortgage adjustmentWhat are mortgage points?How much credit do you need to get a mortgage?What is a mortgage?â¦

Recommended Reading: Can You Refinance A Mortgage Without A Job