How Does Prepaying Your Mortgage Actually Work

When you make an extra payment on your mortgage, that money goes directly toward reducing the balance on your loan. Because of how the loan is structured, the extra payment triggers a cascade effect that speeds up the repayment of the loan. In what follows, I discuss the mechanics of your mortgage and illustrate exactly how prepaying works. Armed with this information, in my next article, I will focus on how prepaying your loan can be thought of as a financial investment. Although I focus on home loans, the following analysis is readily applicable to all types of fixed-payment debt such as student and auto loans.

How does your mortgage work?

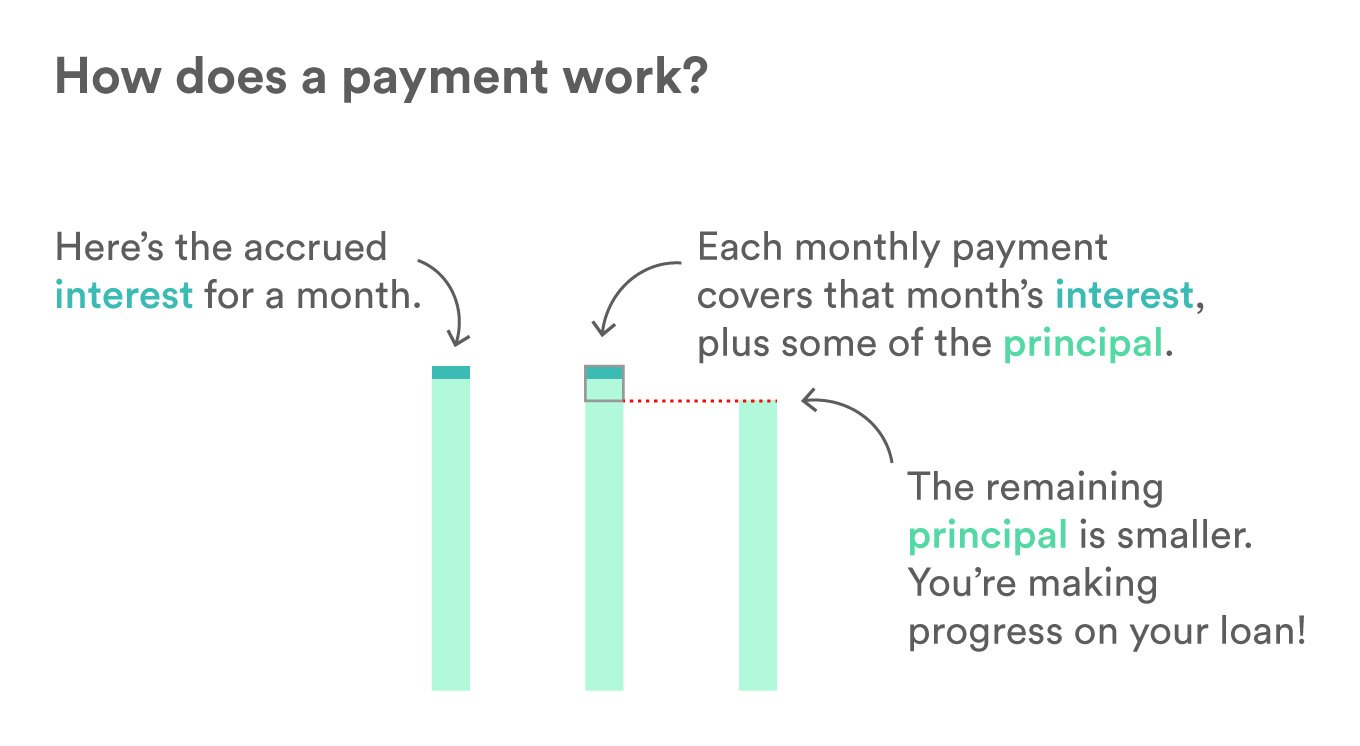

You pay your home loan on a fixed repayment schedule of regular installments over a specified period. This process is referred to as amortization. Assuming you dont make any extra payments towards the loan, amortization of a fixed rate mortgage is rather straightforward. A 30-year fixed rate mortgage with a 4% interest rate means a $2,387 monthly payment on a $500,000 loan. This monthly payment is fixed, meaning it never changes over the duration of the loan. Although the total monthly payment is fixed, the interest portion of each payment and the part that goes towards the balance will vary each month. The total payment is your principal and interest payment .

Interest payment = Interest rate X Beginning of period loan balance

How does prepaying your mortgage work?

Phone: 573-4131

How A Mortgage Works

Every month you make a mortgage payment, it gets split into at least four different buckets that make up principal, interest, taxes and insurance or PITI for short. Here is how each bucket works:

In the early years of your mortgage, interest makes up a greater part of your overall payment, but as time goes on, you start paying more principal than interest until the loan is paid off.

Your lender will provide an amortization schedule . This schedule will show you how your loan balance drops over time, as well as how much principal youre paying versus interest.

THINGS YOU SHOULD KNOW

Mortgage lenders require an escrow account to collect your property taxes and homeowners insurance each month if you make less than a 20% down payment on your mortgage. Your lender uses the funds in an escrow account to pay your property tax bills and homeowners insurance premiums.

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Read Also: Are There Zero Down Mortgages

How Much Of A Mortgage Goes To Principal

The amount of mortgage going to principal varies depending on how long you have been paying the loan. While your monthly payment may be the same each month, different portions are designated for different parts of the loan in reality. In most cases, lenders will see that most early payments go towards paying off the loans interest. This is to ensure they get paid upfront. As the loan term carries on and the interest is paid down, more of the monthly payment will go directly to the principal. The reason for this is because of loan amortization, which essentially breaks down your payment schedule. Several amortization calculators online can reveal exactly how much of your payment is going towards the principal. I recommend using this calculator provided by Bankrate.

How Does Paying Down A Mortgage Work

The amount you borrow with your mortgage is known as the principal. Each month, part of your monthly payment will go toward paying off that principal, or mortgage balance, and part will go toward interest on the loan. Interest is what the lender charges you for lending you money.

Most peoples monthly payments also include additional amounts for taxes and insurance.

The part of your payment that goes to principal reduces the amount you owe on the loan and builds your equity. The part of the payment that goes to interest doesnt reduce your balance or build your equity. So, the equity you build in your home will be much less than the sum of your monthly payments.

With a typical fixed-rate loan, the combined principal and interest payment will not change over the life of your loan, but the amounts that go to principal rather than interest will.

Heres how it works:

In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower. So, more of your monthly payment goes to paying down the principal. Near the end of the loan, you owe much less interest, and most of your payment goes to pay off the last of the principal. This process is known as amortization.

Don’t Miss: Is An All In One Mortgage A Good Idea

You Must Choose Between A Fixed Interest Rate Mortgage Or A Variable Interest Rate Mortgage

Lenders like banks dont give you money to buy a house unless they are guaranteed financial gains in doing so. Therefore, in exchange for lending you the money you needed, you must also pay for their services in the form of interest.

These lenders usually give borrowers the option to choose either a mortgage with a fixed interest rate or one with a variable rate.

Fixed interest rates, in general, are higher than variable interest rates, but they are guaranteed to stay the same throughout the mortgage term.

A mortgage with a variable interest rate means the interest you owe your lender will vary depending on the rise and fall of market rates. You may be paying a low interest rate now, but that can change in the future. Given the unpredictability of the market, variable mortgages offer lower interest rates than fixed mortgages.

Some lenders, however, offer hybrid or combination mortgages. In these types of mortgages, a part of your mortgage is protected from market rate fluctuations . The rest wont be. Hence, if interest rates drop, you still stand to gain some benefit though not as much as a variable rate mortgages usually do.

Why Does Homeowners Insurance Increase Our Mortgage Payments

Homeowners who do not like carrying debt anticipate the day they become mortgage-free. You may have taken out a mortgage with a long repayment term to get an affordable payment. If you intend to pay the loan off sooner than scheduled, you might consider switching to a biweekly payment program and using a third party to facilitate the task. It is important to understand how a biweekly mortgage payment company really works before signing up for an accelerated payoff plan.

You May Like: Is Us Bank Good For Mortgages

How Do I Get The Best Mortgage Rates

There is no one best type of mortgage or mortgage rate. It’s important to find the mortgage product and rate that is best for you.

Title

Description

If you would like help navigating and understand mortgage rates, you can discuss with an expert, like an advisor or home financing advisor, who can walk you through the process.

Remember that the mortgage rates offered to you by a lender will depend on a number of criteria including:

- Your credit score

- The length of your mortgage term

- The type of loan you choose

- The type of lender you choose

- The current prime and posted interest rate

- If you qualify for a discounted interest rate

- If you are self-employed

How Does Paying Your Mortgage Biweekly Work

Interest on mortgage loans is typically calculated on a monthly basis. This means that the lower your principal balance, the lower the interest charged will be.

By paying biweekly, youll reduce your principal balance just a little bit extra, prior to that monthly interest being calculated. These savings will add up month after month, not only reducing your total mortgage interest, but also paying off your loan sooner.

Also Check: How To Get A 15 Year Fixed Mortgage

What Would My Payment Schedule Look Like

There are a couple of different ways your balloon mortgage payment could work. Lets take a look at some examples starting with an interest-only loan. Although both of these examples well discuss below are based on fixed interest rates, the interest rate could also adjust based on market rates.

Interest-Only Balloon Schedule

| $531.25 | $150,000.00 |

If you have an interest-only loan, you have a standard monthly interest payment thats smaller than it would be on a loan that pays off at the end of a term. But unless it transitions to a different payment at some point, youre never paying off any principal. The full balance would be due in a big payment at the end of the term.

In a different balloon mortgage setup, there are payments to the principal each month, although they are lower than they would be if the loan fully paid off by the end of the term.

Balloon Schedule With Principal Payments

| Month | |

| $1,897.89 | $35,000.00 |

If there are payments toward the balance, your mortgage documentation will define the amount of the balloon payment you owe at the end of the term. In the example above, theres a $35,000 balloon payment at the end of a 17-year term.

Note that while you should always check your mortgage terms, usually theres not a prepayment penalty involved in paying your loan down or paying it off early. You can often make payments toward the principal in order to minimize the impact of a large balloon payment at the end of the loan.

What Is A Cashout Refinance

A cashout refinance lets you access your home equity and refinance your mortgage at the same time.

When you use a cashout refinance, your new loan will be larger than what you currently owe on the home.

With the new loan, youll pay off the old loan and then keep the additional cash you didnt need to pay off the old loan.

The lump sum you keep is your cash out, and you can spend it on a variety of financial needs.

A few important notes on cashout refinancing:

- Cashout refinance rates are slightly higher than traditional mortgage refinance rates

- Your refinance rate depends on your credit profile and how much cash you take out

- You can typically cash out up to 80% of your home equity

- Your new loan will be larger than your old one, so youll pay more in mortgage interest in the long run

- Since mortgage rates tend to be lower than personal loan or credit card rates, cashout refinancing can be a better way to finance larger expenses

There are no rules about how you can or cant use the funds from a cashout refinance.

These additional funds can be used for many purposes, including home improvements, consolidating debt, and other consumer needs or wants, says Tom Trott, branch manager at Embrace Home Loans.

But because the loan is secured by your home, you typically want to spend your funds on something with a good return on investment like home renovations or consolidating higherinterest debt.

See a few more good examples of how to use a cashout refinance here.

You May Like: Can You Apply For A Mortgage Before Finding A House

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

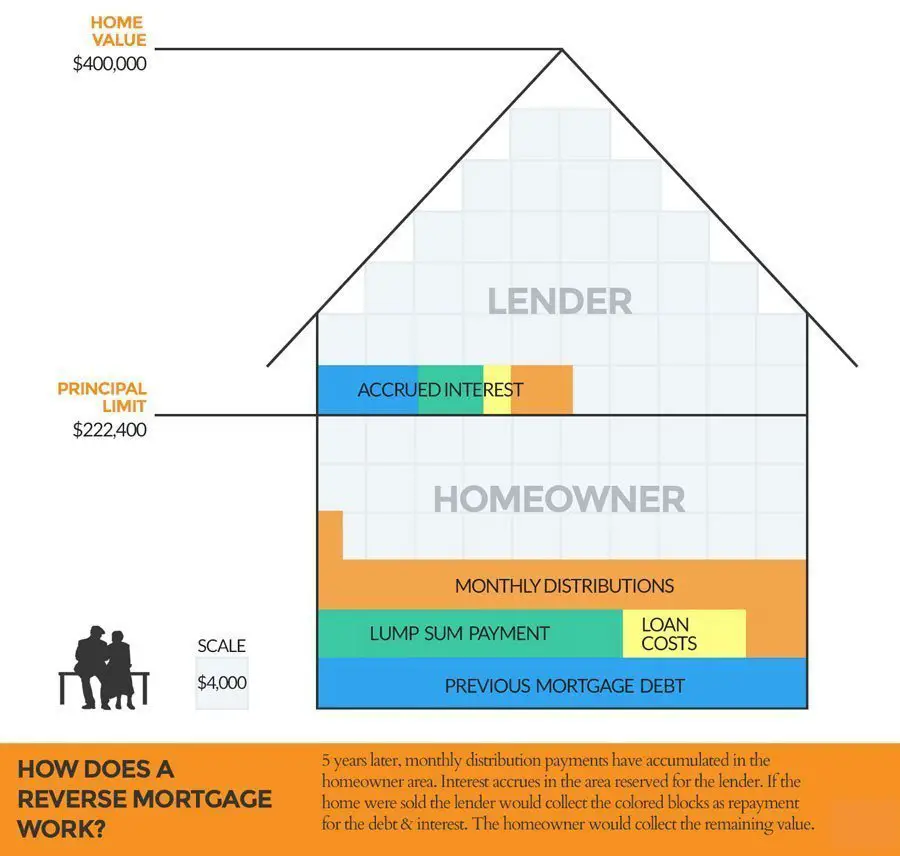

Shopping For A Reverse Mortgage

If youre considering a reverse mortgage, shop around. Decide which type of reverse mortgage might be right for you. That might depend on what you want to do with the money. Compare the options, terms, and fees from various lenders. Learn as much as you can about reverse mortgages before you talk to a counselor or lender. And ask lots of questions to make sure a reverse mortgage could work for you and that youre getting the right kind for you.

Here are some things to consider:

Read Also: Can A Mortgage Include Renovation Costs

Mortgage Breakdown: What Are The 4 Parts Of A Mortgage Payment

A mortgage payment has four parts: principal,interest, taxes, and insurance. A principal is the repayment of your loan amount, which typically adds on interest, or the profit that goes to the lender, while taxes represent the portion that goes to the government, and the insurance is what protects lenders in the case that a loan goes into default.

If you have ever made mortgage payments before, have you ever stopped to think exactly what the mortgage breakdown looks like? Or were you under the assumption that you were chipping away at a lump sum? As it turns out, the anatomy of a mortgage payment is a lot more complex than that. For example, if you put down less than 20 percent towards your down payment, then your mortgage loan breakdown most likely includes private mortgage insurance as well, to be discussed later on. Keep reading to learn more about the role each of these components plays in the mortgage payment breakdown:

Pro : Pay Off Your Mortgage Faster

For example, if youre buying a $100,000 home and you put 20% down, youll have an $80,000 mortgage. With a 30-year mortgage, it will normally take you 30 years to pay this off. But if you make biweekly mortgage payments, you will be making what equates to 13 monthly payments each year. Assuming a 6.5% interest rate and biweekly payments of $252, you would pay off your mortgage in a little over 24 years, or about six years early.

Read Also: What Salary Is Required For A Mortgage

Things To Do Before Shopping For A Mortgage

Buying a home may be the largest purchase of your life, so its a good idea to know the following factors before you start shopping.

1. Know your credit score and take steps to boost it

Your credit score is one of the most significant factors in getting approved for a mortgage, and it also influences the interest rate youll end up with. You can check your credit score and improve it by:

- Requesting a free credit report from annualcreditreport.com

- Disputing any errors that may be dragging your score down

- Keeping your credit card balances low, or better yet pay them off

- Paying all your monthly bills on time

2. Find out how much you can afford

Check out our affordability calculator to get an idea of where you stand before you start looking for houses. Remember that your monthly payment will be more than just principal and interest. It will also include homeowners insurance, property taxes and, potentially, mortgage insurance . Also, be sure you budget for:

- Utilities

- Maintenance costs

- Extra mortgage reserves in case of a financial emergency

3. Shop around for your best deal

Whether you choose a government-backed or conventional loan, fees and interest rates can vary widely by lender, even for the same type of loan, so shop around for your best deal. Collecting loan estimates from at least three different mortgage lenders can save you thousands over the life of your mortgage. You can start your search by comparing rates with LendingTree.