How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Read Also: How To Determine What You Qualify For A Mortgage

How Do I Calculate My Mortgage Payment

There are two ways to go about calculating a monthly mortgage payment. You can go old school and figure it out using a fairly complicated equation, or you can use a mortgage payment calculator. Either way, youll need to know several variables, so lets run through these.

- Loan Amount: If youre buying a home, youll want to put in the price of the homes youre looking at and subtract your down payment. If youre far enough along, you may be able to also add any costs being built into the balance. For a refi, include the expected balance after you close.

- Interest Rate: You want to look at the base rate and not the annual percentage rate . You use the lower base interest rate because your monthly payment doesnt contemplate closing costs. Knowing APR is still useful, but its more in the context of the overall cost of the loan as opposed to monthly expenses.

- Term: This is how long you have to pay the loan off. Longer terms mean smaller payments, but more interest paid. Shorter terms have the opposite properties.

- Property Taxes: Since property taxes are often built into your mortgage payment, having a fairly accurate estimate will help you get a better picture of cost. Regardless of whether you have an escrow account, these need to be accounted for as a cost of ownership.

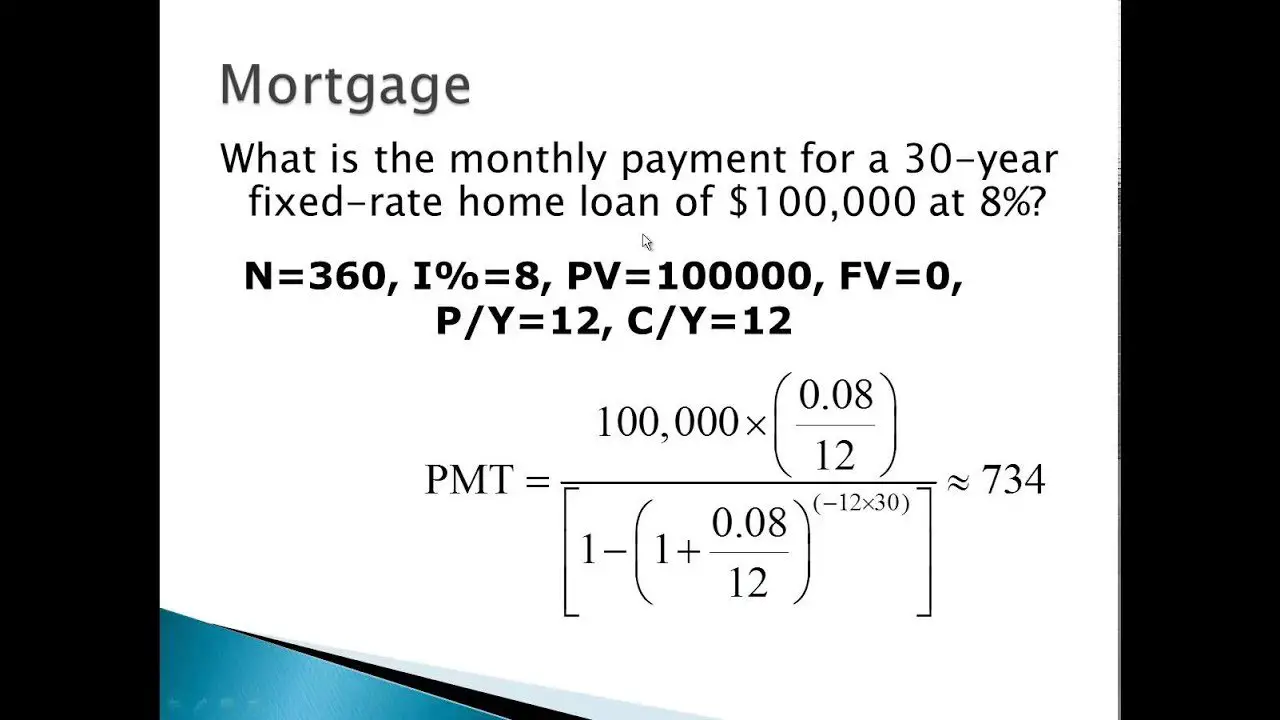

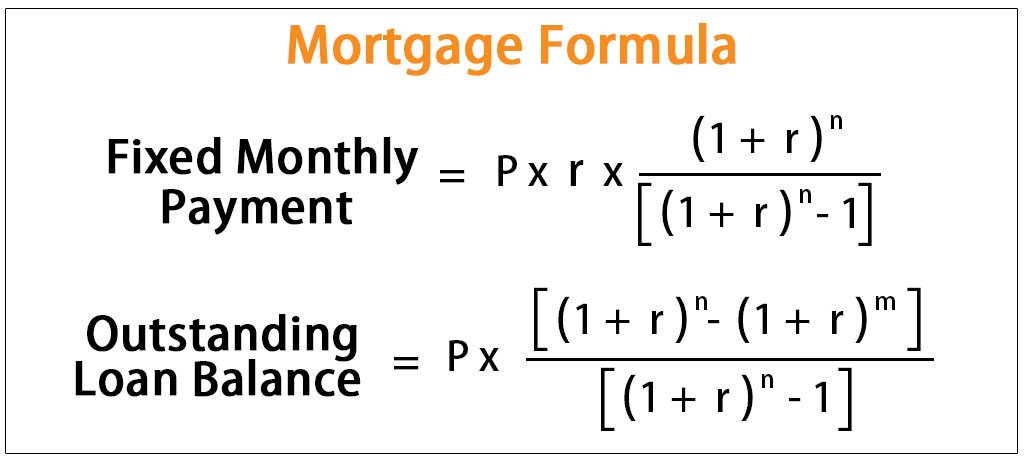

What Is The Equation For Mortgage Payments

What is the equation for mortgage payments? If you want to do the monthly mortgage payment calculation by hand, youll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

How are mortgage repayments calculated manually? To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12. Next, add 1 to the monthly rate. Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments youll make.

How do you calculate principal and interest on a mortgage? The principal is the amount of money you borrow when you originally take out your home loan. To calculate your principal, simply subtract your down payment from your homes final selling price. For example, lets say that you buy a home for $200,000 with a 20% down payment.

How do you figure out an interest rate? How to calculate interest rateStep 1: To calculate your interest rate, you need to know the interest formula I/Pt = r to get your rate.I = Interest amount paid in a specific time period P = Principle amount t = Time period involved.r = Interest rate in decimal.More items

You May Like: Can Non Permanent Resident Get Mortgage

Whats The Necessary Credit Score To Get A Mortgage

In addition to making sure you can afford your mortgage payments, lenders also look at your credit score when deciding both whether to lend to you and the amount of interest to charge you for borrowing.

When lenders look at your credit score, most have a minimum score requirement before you can even get approved for a mortgage loan. This minimum credit score is lower with government-backed loans, including FHA loans, VA loans, and USDA loans than it is for conventional mortgage loans.

For a loan backed by the FHA, you usually need a credit score of 580, although its possible to get a loan with a score as low as 500 under certain circumstances if you make a larger down payment. VA lenders typically require a score between 580 to 620, depending on the lender, while USDA loans typically wont be available to you if your score is less than 640.

Conventional loans, on the other hand, generally require a minimum credit score of 620but you will pay much higher rates and could be stuck with a subprime mortgage if your score is low. To get the most competitive rates on a mortgage, a score of 740 or higher is preferred.

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

Also Check: How Much Do I Have Left On My Mortgage Calculator

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Mortgage Calculator: How To Calculate Your Monthly Payments

See Mortgage Rate Quotes for Your Home

There are quite a few factors that go into the calculation of your mortgage expenses, but most homebuyers like to begin by determining their monthly payments and the lifetime cost of the mortgage. Calculating these two figures is a good first step toward understanding all of your other expenses.

You May Like: How To Calculate Self Employed Income For Mortgage

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into because it might be cheaper than the closing costs on a refinance.

Recommended Reading: How Do I Qualify For A Mortgage With Bad Credit

What Is Pv Nper Formula

Nper Required. The total number of payment periods in an annuity. For example, if you get a four-year car loan and make monthly payments, your loan has 4*12 periods. You would enter 48 into the formula for nper.

Also, What is PV and fv in Excel?

The most common financial functions in Excel 2010 PV and FV use the same arguments. PV is the present value, the principal amount of the annuity. FV is the future value, the principal plus interest on the annuity.

Hereof, Is PV positive or negative?

Pv is the present value, or the lump-sum amount that a series of future payments is worth right now. Pv must be entered as a negative amount. Fv is the future value, or a cash balance you want to attain after the last payment is made.

Also to know How do you calculate PMT manually? Suppose you are paying a quarterly instalment on a loan of Rs 10 lakh at 10% interest per annum for 20 years. In such a case, instead of 12, you should divide the rate by four and multiply the number of years by four. The equated quarterly instalment for the given figures will be =PMT.

How do you calculate PMT?

Payment

To calculate a payment the number of periods , interest rate per period and present value are used. For example, to calculate the monthly payment for a 5 year, $20,000 loan at an annual rate of 5% you would need to: Enter 20000 and press the PV button. Enter 5 and then divide by 12.

20 Related Questions Answers Found

How To Pay Less Interest On Your Loan

To further minimize your loan costs, try to pay off your debt early. As long as there’s no prepayment penalty, you can save on interest by paying extra each month or by making a large lump-sum payment.

Depending on your loan, your required monthly payments going forward might or might not changeask your lender before you pay.

Recommended Reading: How To Purchase A House That Has A Reverse Mortgage

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails…

- Super Formula Bar Reading Layout Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns… Prevent Duplicate Cells Compare Ranges…

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select…

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments…

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic…

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

Renting Vs Owning A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment as opposed to giving your money to a landlord and the ability to paint your living room with zebra stripes if you so desire.

However, theres a mathematical piece of this as well. You have to know how much you need for a down payment and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. However, not every situation is the same.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: How To Transfer A Mortgage To Someone Else

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

Factors Affecting Mortgage Monthly Payment

The amount of a mortgage monthly payment is affected by three factors: how much you borrow, your mortgage interest rate and the length of your mortgage. The more you borrow, the higher your monthly payment. Similarly, the higher the interest rate, the larger each monthly payment will be. If the mortgage rate changes during the life of the mortgage, such as with an adjustable rate mortgage, youll have to recalculate the monthly payments at that time. Finally, the longer the term of your mortgage, the lower your monthly payment. However, with a longer term, you will pay more interest over the life of the mortgage.

Also Check: Does Getting Pre Approved For Mortgage Hurt Credit

Creating An Amortization Schedule