How Do I Calculate My Mortgage Rate

When youre getting ready to take out a new mortgage, you likely have questions about your interest rates and monthly payments. Its important to understand how to budget for and around these costs, which can be some of the largest youll have month after month. Fortunately, you can use some key tools and information to get solid estimates. Heres what you need to know about calculating your mortgage rate.

How Much Mortgage Payment Can I Afford

As you think about your mortgage payments, its important to understand the difference between what you can spend versus what you can spend while still living comfortably and limiting your financial stress. For example, lets say that you could technically afford to spend $4,000 each month on a mortgage payment. If you only have $500 remaining after covering your other expenses, youre likely stretching yourself too thin. Remember that there are other major financial goals to consider, too, and you want to live within your means. Just because a lender offers you a preapproval for a large amount of money, that doesnt mean you should spend that much for your home..

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Also Check: What Are Adjustable Rate Mortgages Based On

How Can I Find The Best Cash

To find the best cash-out refinance lender for your needs, its important to shop around and compare your options from as many of them as possible, including your current mortgage lender. Consider not only interest rates but also repayment terms, any fees charged by the lender and eligibility requirements.

After doing your research, youll be able to more easily identify which lender will work best for you.

How Much Will My Mortgage Cost

The cost of your mortgage depends on several factors, including how much youre borrowing, your mortgage term, and the rate of interest youre paying. If your mortgage is a repayment mortgage youll make monthly mortgage repayments which cover both the capital you borrowed and the interest due. If its interest only youll just be paying the interest rather than reducing the amount you owe. You can find out more about this in our repayment vs interest only guide and use our interest only mortgage repayment calculator to find out how much you can expect to pay.

On a repayment mortgage the longer the mortgage term you choose the cheaper your monthly payments will be, but youll end up paying back more overall. If you choose a shorter term, your monthly payments might be higher, but youll reduce the total amount of interest you need to pay back, as youll be paying off the loan more quickly.

If youre not sure which mortgage deal is likely to be most cost-effective for you based on your individual circumstances, our expert advisers can run you through the available options to make sure youre getting the best deal possible.

You May Like: Are There Zero Down Mortgages

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

Read Also: Does Rocket Mortgage Affect Your Credit Score

Make More Frequent Repayments

As well as making extra repayments, making more frequent repayments can also help you get ahead on your loan. For example there are 12 months in a year but 26 fortnights. If you make fortnightly repayments instead of monthly ones, youre making one extra month of repayments per year which puts you slightly ahead.

What Is A Mortgage Payment

Your mortgage payment is the amount of money you must pay every month to pay down, and ultimately pay off, your mortgage loan. Your mortgage payment covers both the principal and the interest on the loan. It can also include mortgage default insurance, also sometimes known as CMHC insurance , property taxes and other fees. When you first begin making payments, more of it goes towards covering interest, but over time, more of your payment will eventually go to paying down your mortgage balance.

Don’t Miss: How To Shorten A 15 Year Mortgage

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Read Also: What Is A Good Tip For Mortgage

When Will I See The Price Increase

The small print of your mortgage will tell you how quickly the rise will be passed on but its typically within a month .

Some banks have already announced when their mortgage rates will go up:

- Santander has confirmed its tracker mortgage products will increase by 0.5% from 3 September. This includes the Santander Follow-on Rate which will increase to 5%. Its standard variable rate will increase by 0.5% to 5.99% from the beginning of September.

- All Alliance & Leicester mortgage products linked to the base rate will increase by 0.5% from 1 September. Its standard variable rate will also increase to 5.99%.

- Barclays will also follow suit by increasing its rates on 1 September. Its standard rate will increase from 5.74% to 6.24%. The bankss buy to let standard variable rate will increase from 6.24% to 6.74%.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Read Also: How To Figure Mortgage Payments With Taxes And Insurance

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- new mortgages

- intertest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

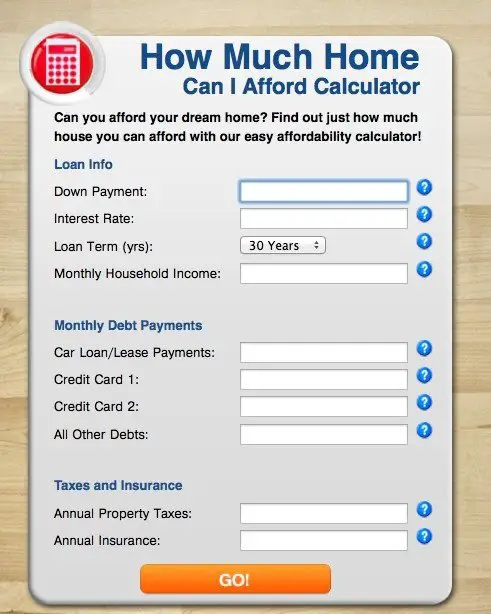

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

You May Like: Does Rocket Mortgage Affect Credit

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Read Also: Is A 4.5 Mortgage Rate Good

What Is The Average Interest Rate On A Mortgage

Mortgage interest rates change day-to-day and are influenced by various economic factors, including:

- Inflation

Below were the average monthly rates for 30-year fixed-rate mortgages from 20102020, according to the Federal Reserve Bank of St. Louis:

Image source: Federal Reserve Bank of St. Louis.

Of course, the interest rate you see at the closing table could be higher or lower than the average rate. That’s because your interest rate depends on what’s happening in the economy at largeplus individual factors, such as the following:

- Interest rate type

- Loan type

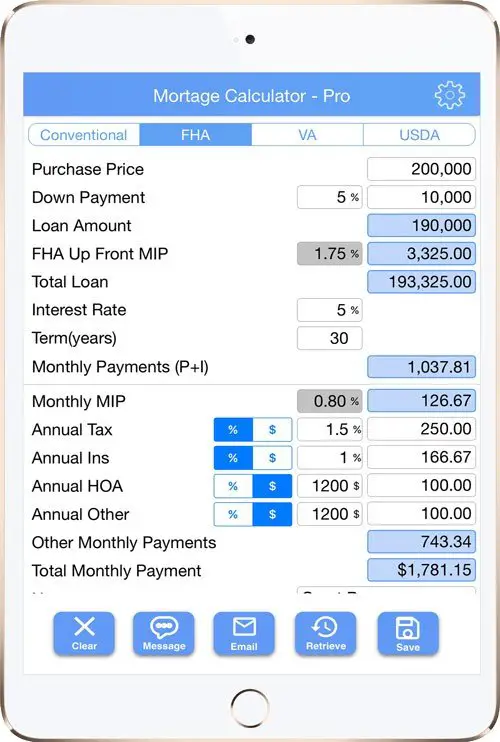

Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

Recommended Reading: What Would The Mortgage Be On A 200 000 House

Why Use A Mortgage Refinance Calculator

Refinancing your mortgage can be a really valuable option as a homeowner. However, there are costs associated with refinancing that can outweigh any potential savings you might build. As a result, it’s important to understand how much a mortgage refinance will cost you before you pull the trigger – that’s where a mortgage refinance calculator comes in handy.

The mortgage refinance calculator above will do the hard work for you, estimating the penalties associated with refinancing as well as the potential savings you’ll make from getting a new mortgage at today’s rates. While there are some non-financial reasons you might want to refinance your mortgage, our calculator gives you the information you need to start making a decision.

How Are Mortgage Repayments Calculated

Monthly repayments on a repayment mortgage are calculated based on the outstanding mortgage amount, the interest rate that applies at the time of repayment and the length of the mortgage term.

As you pay off your mortgage, part of each monthly repayment covers the monthly interest owed on the mortgage balance and part goes towards reducing the mortgage debt. The outstanding mortgage balance will reduce each year, but your monthly payment will always be based on the interest rate that applies to your mortgage at the time of repayment. So if you have a fixed-rate mortgage, youll pay a fixed amount each month. If you have a variable-rate mortgage, your repayments will fluctuate.

Read Also: Can I Sell A Home With A Mortgage

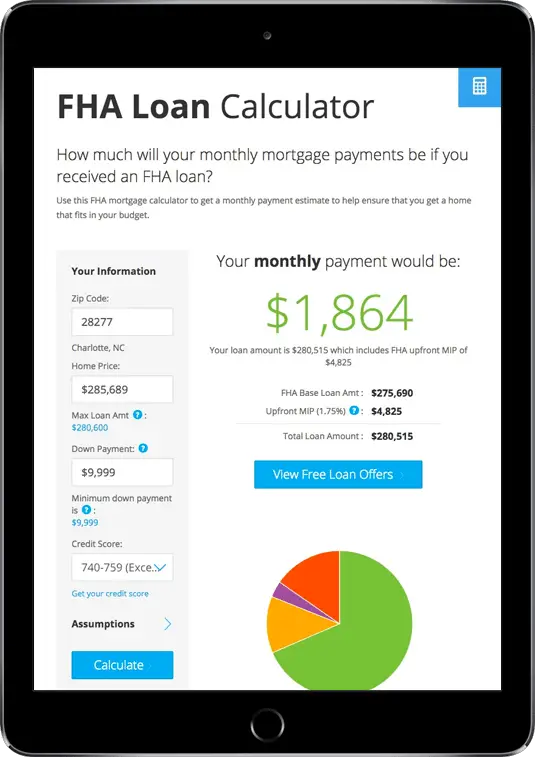

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.