Find Out How Much A Bank Is Likely To Lend You For A Mortgage With Our ‘how Much Can I Borrow’ Calculator Plus How Lenders Use Affordability Testing To Make Their Decisions

Hoping to buy a property but not sure how much you’ll be able to borrow for a mortgage?

This guide explains how mortgage lenders assess affordability, how loan-to-value ratios work, and the circumstances in which you might be able to boost your borrowing.

Other Costs To Consider

Of course, homebuying is a multi-faceted endeavour and other costs need to be factored into your application in addition to your monthly repayments.

These include:

- Arrangement fee: Sometimes called a product fee, most mortgages include one. This can usually be paid upfront or added to your loan and is likely to be at least £1,000.

- Booking fee: This is typically between £100 and £200. Not all providers charge this and a broker will make sure it is a consideration when working out your best deal.

- Valuation fee: This is different from your survey. It is instructed by the lender as they need to confirm the property value before approving a deal. This is usually around £300.

- Survey: Depending on the type of survey you opt for, it can cost anywhere between around £400 and £1,500.

- Stamp duty: This is a tax you pay to the government and is based on the price you pay for the property. Properties bought for less than £125,000 are not subject to stamp duty.

- Land Registry fee: This is essentially an admin fee you pay to the Land Registry for them to change the register entry to your name. It only applies to properties valued at £100,001 and above so may not be relevant if you are only borrowing £40,000.

- Solicitors fee: Also known as the conveyancing fee, this is the amount you pay your solicitor for their work on the deal. These can vary considerably but as a general guide, expect to pay somewhere between £800 and £1,500.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Also Check: How To Add A Name To A Mortgage

Pros And Cons Of Financing A Car

The big advantage of car finance is that it means you can drive a car that you couldnt afford to buy outright. It can be used on new and used vehicles.With car finance, the agreements normally secured against the vehicle you buy. You dont own the car until the final payments made. If you cant make the payments, the vehicle could be repossessed and you could be responsible for covering any shortfall in value. Plus, it could affect your credit score and you could be liable for extra fees, interest and charges. Read about different types of car finance.

Common Misconceptions About Homeownership

There are many misconceptions about how difficult it is to become a homeowner. Its important to understand the facts before you start and how they apply to your individual situation so that you dont get overwhelmed or discouraged.

If you have less than 20 percent saved for a down payment, you should add PMI to the list of housing costs when youre figuring your budget.

Low income families can get down payment assistance from the government and non-profits. Before you go all-in with your house hunting. Decide if now is the right time for you to buy a home.

In any event, mortgage rates are currently at a historic low, the average rate on 30-year mortgages stood at 3.04 percent this week, unchanged from last week, according to Bankrates weekly survey of large lenders. If youve been thinking about becoming a homeowner, it may be time to take the plunge and buy now before interest rates rise again.

Most first-time buyers have to dip into savings or investments to have enough for a down payment. And if you have or student loan debt, be aware that some lenders may not approve your mortgage application because of how high the total monthly payment is.

Dont wait to start saving for a down-payment on your home. The sooner you begin putting money towards this goal, the easier it will be for you to become a homeowner.

You May Like: How To Lower Your Mortgage

Get Expert Advice Immediately If

- You need to borrow more than 4.5 times your annual income

- You are only using one income on your application

- You earn income through sources such as Benefits, Commission or Rental income

- You consider yourself to be on low income

If one or more of the above apply to you, its important to get expert advice before making an application. The right broker can help maximise your chances of approval based on your circumstance.

Can I Get A 50000 Mortgage

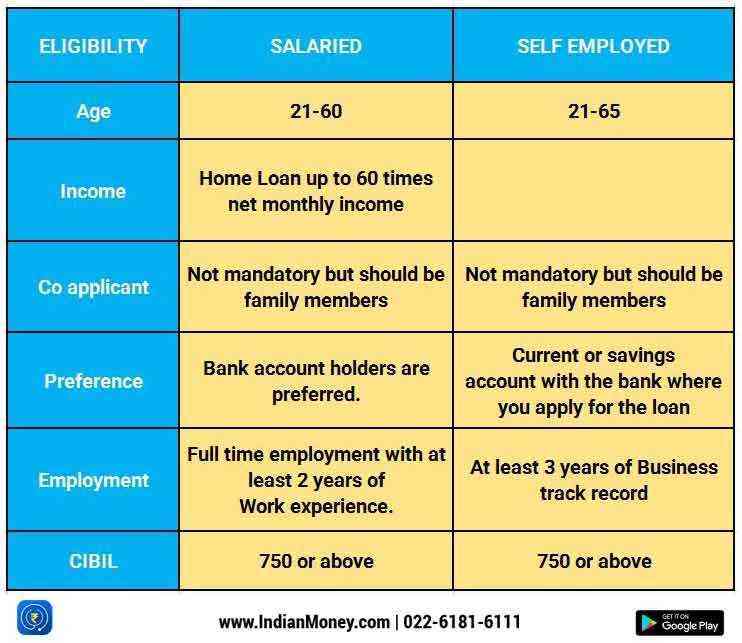

You may be able to get a £50,000 mortgage in the UK, though this will depend on various factors including your total income, credit rating, age, and employment type.

Income is one of the main considerations for mortgage providers, though for a mortgage of £50,000, they may accept applicants with a smaller salary. Alternatively, if youre looking to renovate your property or purchase a more expensive home, there may be other lending options for you. Make an enquiry to get started.

Also Check: What Is The Forecast For Mortgage Interest Rates

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability and how our calculator works, have a read of the information below.

You May Like: Can My Parents Cosign A Mortgage

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

What If You Cant Afford An Interest Rise

Once youve used our mortgage interest rates calculator, check your outgoings to see if there are any savings you could make. If you are concerned, its really important to contact your existing lender as soon as possible and they will support and set out the options available to you.

The other sensible option is to look at whether youre on the best deal for your circumstances. If your current deal is about to come to an end, start looking at your options for switching to ensure youre still on the best rate. Your current mortgage is likely to switch you to a standard variable rate when you come to the end of your current deal, which could be significantly higher than the best rates available on the market. Get in touch with our expert team at L& C who can help you to navigate the deals on offer and find the best one for your situation.

Even if your mortgage deal isnt due to expire, its still worth looking at whether remortgaging could be the right option for you. Its likely that youll have to pay early repayment charges to exit your deal early, but it may still be more cost-effective to switch, depending on how much your repayments are due to go up by and what rates are currently available.

Don’t Miss: How To Invest In Mortgages

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow based on your current income, debt and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrow, including the household income of the applicants purchasing the home, the personal monthly expenses of those applicants and the expenses associated with owning a home .

Future Changes In Your Income And Expenditure

A lender will also want to stress-test your finances to be satisfied that you will be able to cope with any changes in your expenditure during the term of your mortgage.

The lender will want to be assured you will be able to meet your mortgage commitments if there is an increase in interest rates, if one of the applicants were unable to work or if you were to have children.

Such stringent affordability assessments are performed to provide confidence both for the lender and yourselves that you dont run the risk of falling behind with your mortgage payments.

Lenders all use their own criteria for affordability assessments, therefore, you really need to speak to a specialist who understands all the different nuances. Make an enquiry and well have one of the advisers we work with give you the right advice.

Also Check: Reverse Mortgage On Mobile Home

Recommended Reading: What Does It Mean To Close On A Mortgage

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

If You Have A Low Credit Score How To Improve

First of all, start by checking for errors on your credit report before applying for loans or mortgages. You can get one free copy from each of the three bureaus once every 12 months so you can face any looming obstacles head on.

But there are also steps you can take to establish credit history and improve your credit score, like how long it takes for lenders to report payment or how much of their balance is available on short-term loans. You may want to review the list of common myths about mortgages, too.

Recommended Reading: Is Quicken Loans A Mortgage Broker

Can You Afford A 4500000 Mortgage

Is the big question, can your finances cover the cost of a £45,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £45,000.00

Do you need to calculate how much deposit you will need for a £45,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Mortgage Payment Calculator Canada

Content last updated: March 2, 2022

Looking to buy a home and get a mortgage some time soon? Know what you’ll be signing up for with Ratehub.cas mortgage payment calculator. Understanding how much your monthly mortgage payments will be is crucial to getting a mortgage that you can afford.

Our mortgage payment calculator shows you how much you’ll need to pay each month. You can even compare scenarios for different down payments amounts, amortization periods, and variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

Also Check: What Are Discount Points In A Mortgage Loan

Identify The Best Mortgage Type For You

Its important to determine the kind of mortgage you want as well as what you qualify for especially as a first-time buyer.

There are several types of mortgage programs available, but most people go with a fixed-rate loan that offers lower rates than variable-rate mortgages in the long run. You also need to decide whether or not you want a conventional loan or an FHA loan. Here are some of the most popular homeowner programs:

The most popular type of mortgage is the fixed-rate, 30-year, but thats not right for everyone. If youre self-employed and want to take out a large sum of money in order to invest it will be impossible with this kind of loan because they require borrowers to be able to show how they will make their mortgage payments in the long term.

For new homebuyers, finding the right mortgage can be a challenge. Having a real estate agent or mortgage brokers help you navigate the process of finding loans is an excellent way to get started.