No Cost Mortgage Refinance

Depending on your particular situation, you may be inclined to ask for a no-cost loan. This means the lender will pay for all loan costs, including their fees and third-party fees .

Most of the time a no cost loan is used when doing a cash out loan so you can access as much money as possible. Though, this will lead to a higher interest rate to compensate the lender for not charging anything upfront.

Its not the right solution for everyone, so be sure to consult with a mortgage consultant who has your best interests in mind. This way, you can feel confident youre not being pressured into the wrong program.

Benefits Of Mortgage Refinancing

Refinancing your mortgage means that you pay off your existing mortgage with a new loan. The new loan typically is better in some way.

You might refinance your loan to obtain:

- A lower interest rate

- Lower monthly payments

- A different kind of interest rate either fixed or adjustable

A lower interest rate saves you money on interest overall. A shorter-term helps you pay off the loan faster, meaning theres less time to accrue interest. While lower monthly payments might not save you money overall, they free up your budget each month to spend money on other things you need.

Switching from an adjustable to fixed-interest rate mortgage allows you to predict how much money youll owe on the mortgage in total and keep your payments consistent. On the other hand, switching to an adjustable-rate mortgage helps you take advantage of falling interest rates without always having to refinance.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How Much Is Mortgage Tax In Ny

Reasons To Refinance A Mortgage

There are several reasons to consider a mortgage refinance:

Make Sure Your Credit Is Mortgage

Long before you apply for a mortgage refinance, check your credit score and review your credit report to get an idea of where you stand. Even if you can get a lower interest rate with your current credit and financial situation, you could save even more if you can improve your credit before you apply.

Don’t Miss: How To Get Approved For A Higher Mortgage

Should I Refinance My Mortgage

If interest rates have dropped since you signed your mortgage, you might think about refinancingOpens a popup.. But before you take the leap, there are a few things to consider.

When you refinance your mortgage, you replace your existing mortgage with a new one on different terms. To find out if you qualify, your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your property into the current value of your property. If your loan-to-value ratio is lower than 80%, you can refinance.

The lender also looks at your monthly income and debt payments. You may need to provide a copy of your T4 slip, notice of assessment or a recent pay stub your mortgage statement a recent property tax bill and recent asset statements for your investments, RRSPs and savings accounts.

What You Need To Know About No Closing Cost Refinancing

Did you know its possible to do a no closing costs refinance? Many people have no idea this is even possible. When you were buying a house, you probably didnt give this much thought.

If you have a higher interest rate right now than the going rate, it will probably make sense to refinance.

Quite often, though, if you are paying closing costs, it does not make sense unless there are significant savings going from the higher interest rate to something much lower.

When you are looking to refinance your mortgage, it is easy to underestimate closing costs. Perhaps the closing costs are putting you off refinancing your mortgage?

If you are in this situation, you can choose from a couple of no closing cost refinance options.

Not paying closing costs when you refinance can be a great way to save money over the life of the loan.

The beauty of a no-closing cost refinance is that you are not taking any cash out of your pocket! You will be reducing your monthly mortgage payments without having any upfront closing costs that typical closing costs loans would have.

Nobody wants a higher monthly payment, so there are few reasons why a no points, no closing cost mortgage refinance doesnt make sense.

Everyones financial situation is different, so lets look at what you need to understand about this type of refinancing, helping you find out if it is right for you.

A no-cost refinance makes a lot of sense in many circumstances.

Don’t Miss: Can You Sell House Before Paying Off Mortgage

Its Becoming Increasingly Common How To Refinance Your Home And Spend $0 At Closing To Do It

- Resize icon

With some mortgage refi rates below 3%, many people are likely pondering a refi, but wonder: Can you refinance your home without any money coming out of your pocket at the closing? The short answer is yes, but you will end up paying those closing costs down the road.

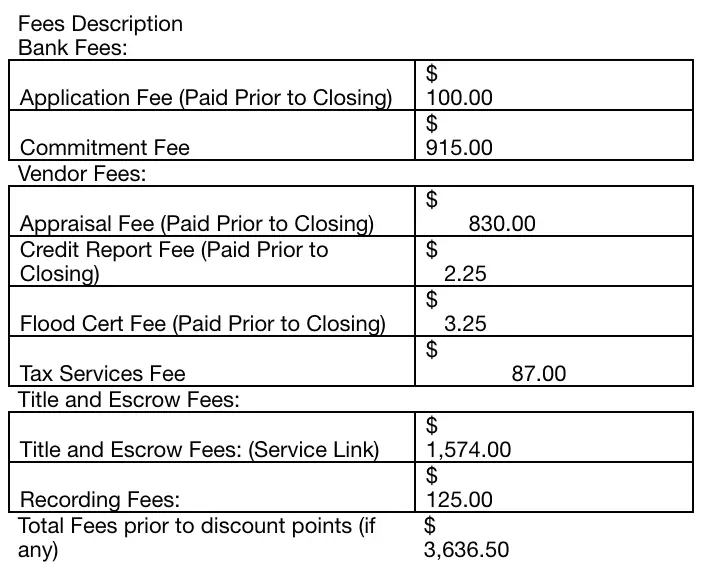

Closing costs associated with refinances tend to run about 2-5% of the total principal amount that you owe, and the average closing costs on a refi are upwards of $5,700, according to data from fintech firm ClosingCorp. Closing costs are generally made up of a variety of fees ranging from an origination fee, which the lender charges upfront to process the loan application an appraisal fee title search credit report fee and more. Needless to say, coming up with an out-of-pocket lump sum might make obtaining a refinance difficult for some people which is why a no-closing-cost refinance can be a helpful option.

But in some cases, those fees can be rolled into the loan in whats called a no-closing-cost refinance meaning borrowers dont have to pay anything upfront out-of-pocket to refinance. Of course, no-closing-cost refinances dont mean a borrower is off the hook for all expenses, instead theyre just transferred to the principal or exchanged for a higher interest rate.

Pros and cons of a no-closing cost refinance

What Is The Average Cost Of A Refinance

Refinancing a mortgage can yield significant interest savings over the life of a loan. But all those savings dont come for free. Generally, youll encounter costs $5,000 on average, according to Freddie Mac when refinancing your mortgage.

Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Typical refinancing costs include:

- The cost of recording your new mortgage

- Appraisal fees

- Lender fees, such as origination or underwriting

- Title service fees

- Mortgage points

- Prepaid interest charges

Keep in mind theres no such thing as a truly no-cost refinance. Lenders who market “no-cost loans” typically charge a higher interest rate and roll the costs into the loan which means youll pay more interest over the life of the loan.

Credible is also partnered with a home insurance broker. If you’re looking for a better rate on home insurance and are considering switching providers, consider using an online broker. You can compare quotes from top-rated insurance carriers in your area it’s fast, easy, and the whole process can be completed entirely online.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Recommended Reading: What Credit Score Is Needed To Get A Mortgage Loan

Are Their Examples Of Legitimate Differences

Absolutely!

Title, escrow and recording fees might be listed a bit higher on the Loan Estimate than your initial quote as they are usually listed as a worst-case scenario. And the difference is more like $100 $500 not thousands of dollars.

For example some title and escrow companies quote $375 $450 for government recording fees however they usually come in below $200 when the loan actually closes and that is reflected on the final Settlement Statement. Another example is the lender may require a specific endorsement issued from the title company which may increase your costs $50 $200.

HOA Certification Fee:

And there is the HOA Certification Fee which is listed in the Loan Estimate but its not charged by the lender. What is the HOA Certification Fee? If you live in a Condo or Townhome your Loan Officer will have to complete a HOA Certification. Its a form and its completed by your HOA or property management company.

Usually, the HOA or property management company charges a fee . This is why its not included in the quote but is listed on the Loan Estimate.

So its important to keep in mind that the document you are reading is an estimate however if there are differences from the quote be sure to ask your Loan Officer to explain the difference. And if you are working with a top-rated company and top-rated loan officer who has years of experience you can probably trust what they are saying.

How Does Refinancing Work

The first step is to see if you qualify for a refinance. You must already have a significant amount of equity in your home if you want to take a cash-out refinance. Most lenders wont refinance 100% of your equity, so make sure you have enough equity built to cover your expenses.

You also need to consider closing costs. Just like when you bought your home, you pay closing costs to your lender when you sign on your new mortgage. You can expect your closing costs to equal about 2% 3% of the total value of your loan. As a general rule, you need to live in your home for at least a year to gain a financial advantage through a refinance.

Next, find a lender to service your loan. You dont need to refinance with the same company that services your current loan. Compare lenders current interest rates and fees and ask about availability and how long the process usually takes.

Once you choose a lender, submit an application. Applying for a mortgage refinance is very similar to applying for your first mortgage. Your lender will ask you for a few documents, including your two most recent pay stubs, W-2s and bank statements. You may need to provide additional documentation if youre self-employed.

You may have the option to lock in your interest rate once youve completed your application. Locking your interest rate protects you against rising rates while you finish closing on your loan.

Read Also: Can You Add A Name To A Mortgage

Be Prepared Before You Obtain Quotes

Being prepared before you obtain your quotes will also save you money and lots of time. Gather your income documentation, any mortgage statement from your current lender and your homeowners insurance declaration page (or at a minimum the contact information for your Insurance Agent.

Having your documentation ready to go means youll be better prepared to answer the Loan Officers questions.

It also means you can send in your documentation faster which helps speed along the process. And dont forget that Loan Officers are people too and when a Loan Officer sees someone is prepared they are more likely to go that extra step in making sure you obtain the lowest rate possible at the best possible terms.

The goal is to lower the cost to refinance a home and this is a great step to take.

If you go into the process unprepared and take a long time putting together your documentation then the Loan Officer is more likely to focus on clients who make his/her job easier.

Chasing down clients for their income documents is time-consuming so the more you can help your Loan Officer with the process the better off youll be.

Costs To Consider Before Refinancing A Mortgage

While there are some clear benefits to refinancing a mortgage loan, it’s important to consider the costs associated with the process. According to the Federal Home Loan Mortgage Corporation , closing costs include:

- Government recording costs

- Attorney fees

- Underwriting fees

It’s important to note that these fees can vary from lender to lender. For example, some digital mortgage companies don’t charge lender fees at all. And some fees, such as origination, underwriting and title fees, can be negotiated.

Read Also: How To Calculate Percentage Of Mortgage

Increasing The Loan Amount

If your closing costs are added to the amount of money you borrow from the lender, you are, of course, going to spend more each month to pay that back.

When refinancing a $200,000 loan, lets say your closing costs are $9,000, and this would mean refinancing for $209,000. Over a 15-year term with a 3.5% interest rate, you would pay $1,430 per month for the $200,000 loan and $1,494 per month for $209,000. A difference of $64 per month, but $11,520 over the 15-year term, or $2,520 more than the cost of closing.

Before you decide to increase the amount you borrow, you need to afford the monthly payments.

When refinancing, the size of your loan and the life of your loan can change depending on what you desire them to be. These are things you need to think about whether doing a no-cost refinance or not.

Your new loan amount could reflect some kind of plans you have to make improvements to the property. You might need additional funds to be included in your refinance. In this case, your principal loan amount would be bumped up.

The Simple Breakdown Without Lender Credits:

- Lender Fees: $1100.00

- Recording Fees: $350.00

Total = $3,310.00

It is important to remember that this is just a generic break down and it does not include any lender credits that might be issued. Also, some refinance transactions dont need an appraisal or sometimes the lender refunds the appraisal fee.

You May Like: How To Remove A Cosigner From A Mortgage

Cost To Break Your Mortgage Contract

The cost to break your mortgage contract depends on whether your mortgage is open or closed. An open mortgage allows you to break the contract without paying a prepayment penalty.

If you break your closed mortgage contract, you normally have to pay a prepayment penalty. This can cost thousands of dollars.

Before breaking your mortgage contract, find out if you must pay:

- a prepayment penalty and, if so, how much it will cost

- administration fees

- appraisal fees

- reinvestment fees

- a mortgage discharge fee to remove a charge on your current mortgage and register a new one

You may also have to repay any cash back you received when you got your mortgage. Cash back is an optional feature where your lender gives you a percentage of your mortgage amount in cash.

You Want To Get Rid Of Pmi

Private mortgage insurance protects your lender in the event that you default on your loan. Most lenders require PMI if you have less than 20% down on your loan at closing. You may refinance and cancel your PMI if you now own more than 20% equity in your home.

Its a little different with FHA loans, which are backed by the Federal Housing Administration and protect your lender if you happen to default on your loan. You must pay for mortgage insurance throughout the life of your FHA loan if you had a down payment of less than 10%. Many people who buy a home with an FHA loan refinance to a conventional loan after they reach 20% equity and remove their monthly insurance requirement.

Read Also: How To Get A 2nd Mortgage

How Much Does It Cost To Refinance My Mortgage

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Refinancing a mortgage is a good way to lower your monthly payments, and given that today’s refinance rates are sitting near record lows, it could be a good time to get a new home loan. But there are closing costs involved in refinancing. Here’s what you need to know.