How Does Bad Credit Affect A Home Loan Application

Lenders check borrowers when deciding whether to approve a loan application and how much interest to charge. Lenders consider other factors, as well, including loan-to-value and debt-to-income ratios, but credit scores are especially important.

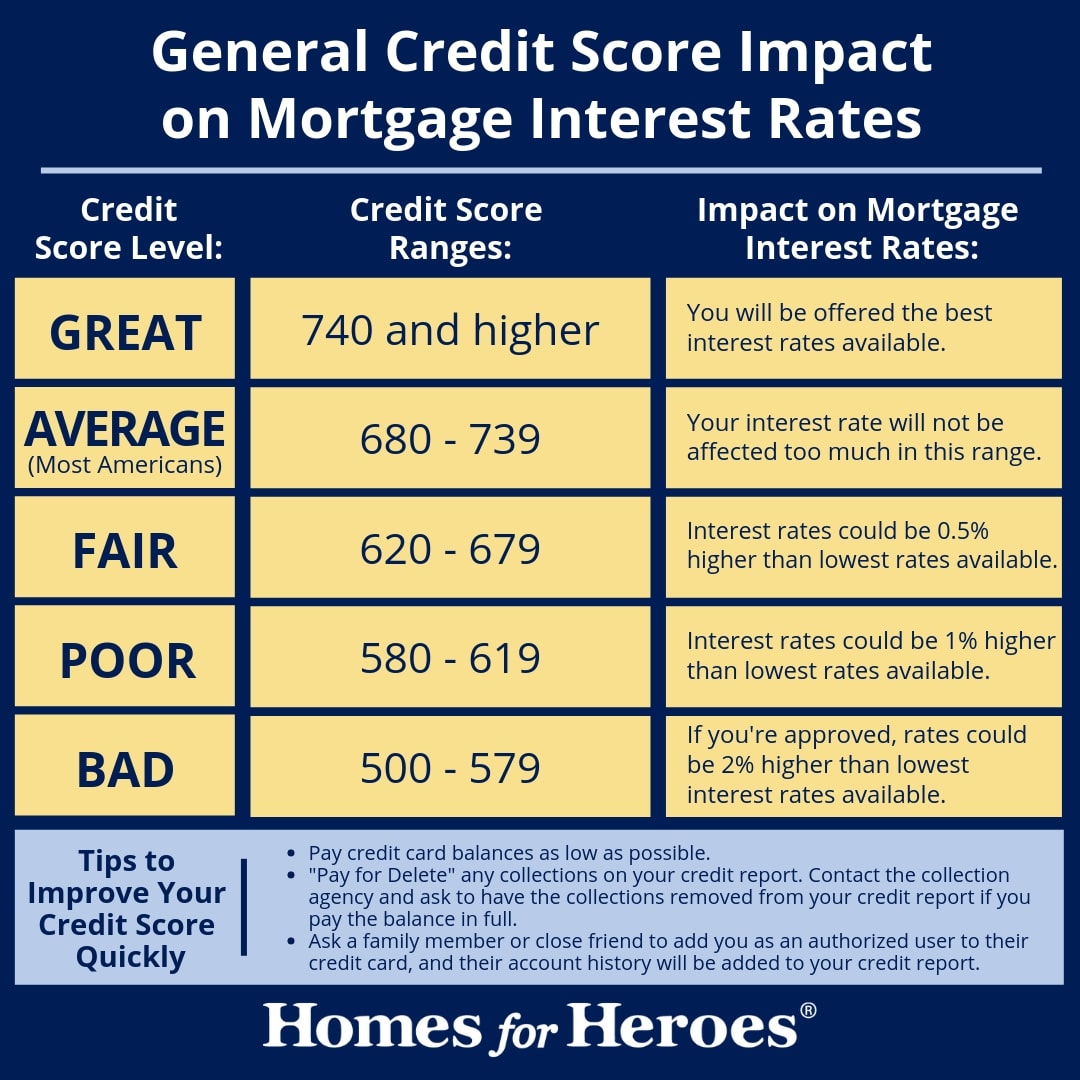

With conventional mortgages, the lowest mortgage rates are reserved for borrowers with excellent credit. Credit scores in the mid-600s or lower may make it harder to qualify for a loan, and those borrowers usually have to pay a much higher interest rate, which means the loan will ultimately be more expensive.

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

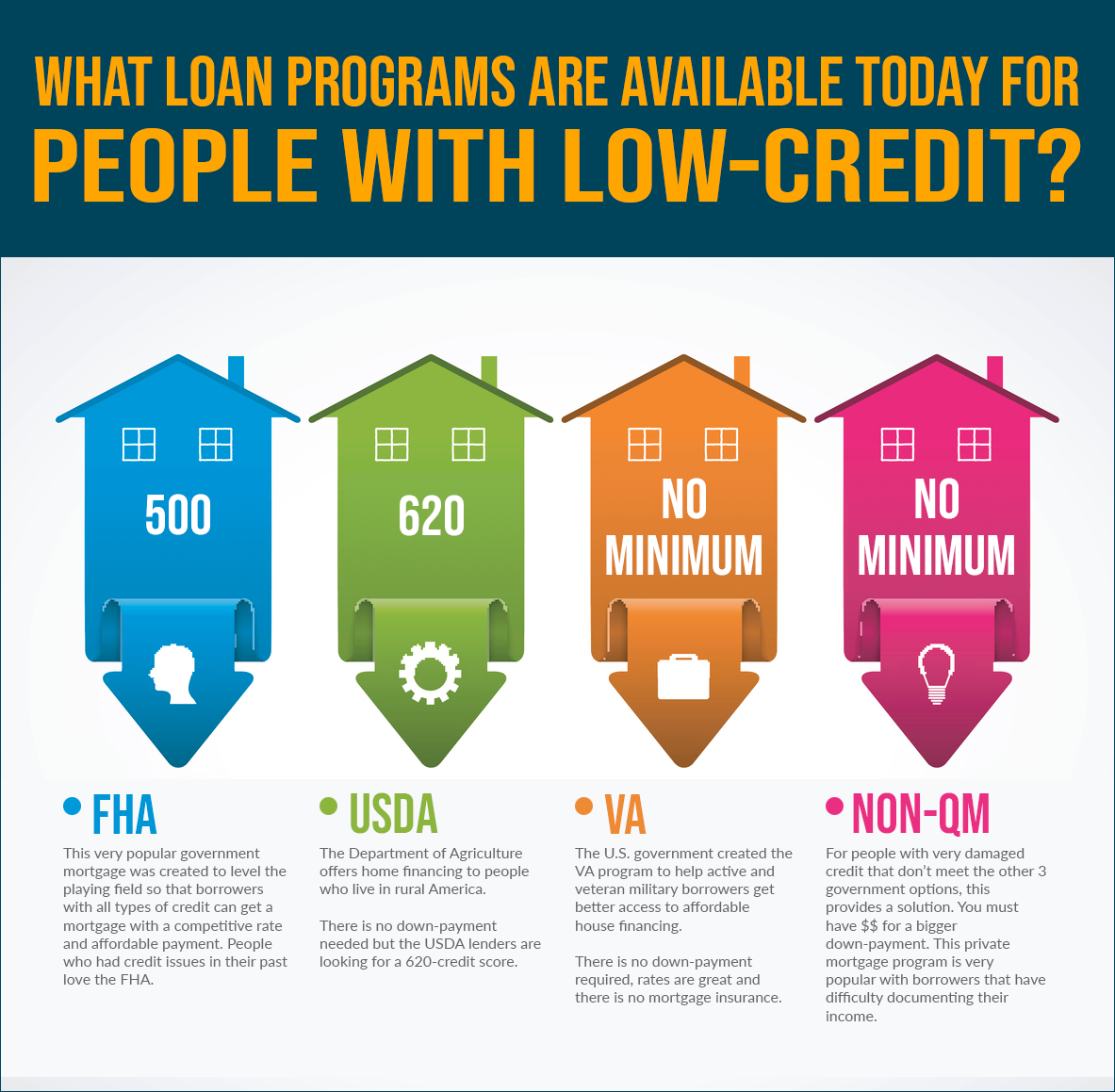

Current Minimum Mortgage Requirements For An Fha Loan

Down payment. FHA loans require a 3.5% down payment with a 580 or higher credit score, and funds can come from employers, close friends, family members or charitable organizations. The down payment requirement jumps to 10% with a credit score of 500 to 579.

Mortgage insurance. FHA borrowers are required to pay two types of FHA mortgage insurance. The first is an upfront mortgage insurance premium of 1.75% of the loan amount, typically financed into the mortgage. The second is the annual mortgage insurance premium that ranges from 0.45% to 1.05% of the loan amount, and is divided by 12 and added to your monthly payment.

. You can have a credit score as low as 500 up to 579 with a 10% down payment. Homebuyers making a minimum 3.5% down payment will need a score of at least 580.

Employment. FHA loan income requirements look at the borrowers stability of income and employment for the past two years. Job-hoppers need to explain changes or gaps in employment.

Income. There are no income limits for FHA loans. However, borrowing power is limited to the FHA maximum loan limit cap of $356,362 in 2021, compared to $548,250 for conventional loans in most parts of the country.

Cash reserves. FHA loan qualifications dont usually require cash reserves unless youre buying a two- to four-unit home, or trying to qualify with a lower credit score.

Occupancy. A one- to four-unit home financed with an FHA loan must be your primary residence for at least the first year after buying it.

Recommended Reading: Can I Get A Mortgage With No Credit

Calculating A Credit Score

Each time you pay your bills, you are building credit. Companies that bill you for goods and services report your payment history and credit use to credit bureaus. Your credit score is primarily calculated by tracking your payment history, use of different types of credit, and the length of time that you have utilized your credit.

You may not know that there are different types of credit, and using more than one type of credit helps you build a better credit score. Utilizing these various types of credit and paying all bills on time is the best way to build your credit score.

Tips To Improve Your Credit Score Before Applying

- Check Your Credit For Errors: The first thing you should do is get a copy of your credit report from all three major credit bureaus. You can get a free copy of your credit reports from the government website www.annualcreditreport.com

- Pay down credit card debt Your is the percentage of available credit youre using on your credit cards. Credit utilization ratios account for 30% of your credit score. The more credit card debt you have, the lower your credit score will be. Try to pay your credit card balances to below 30% of the cards credit limit before applying for a mortgage.

- Pay your bills on time your payment history determines 35% of your overall FICO score. A single late payment can have a significant impact on your score. Remember to pay your bills on time. Set up auto-pay if you find yourself forgetting to make your payments.

- Negotiate a Pay for Delete settlement with creditors If you have any collections on your credit report, they are obviously having a significant negative impact on your credit score. You can contact the collection agencies directly and ask them if they will do a pay for delete. A pay for delete is an agreement that you agree to pay the balance, and in return, the creditor agrees to remove the account from your credit report.

Recommended Reading: How Much Mortgage Can I Get With 50k Salary

Benefits Of Learning How To Improve Your Score

Of course, qualifying for the mortgage loan you want isnt the only perk to improving your score. Rather, the advantages of better credit extend far beyond your mortgage. There are the obvious benefits, such as more easily qualifying for loans and better terms and interest rates on those loans. Change doesnt happen overnight, especially good change. Thinking ahead can save you money as well as headaches are you strive to own a home.

As you can see below, especially if your credit is currently Fair, Poor, or Bad, it can take a significant amount of time to get your score to a place where you can qualify for a conventional mortgage loan . In other words, even if youre not planning to buy a house in the immediate future, it can still benefit you to put in the work to improve your credit score now to make it easier to purchase a house in the future.

Average Time to Improve Credit Rankings to Qualify for a Mortgage Loans

| High Approval Percentage with 20% Down Payment | High Approval percentage with +10% Down Payment |

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

You May Like: How Many Times Can You Pull Credit For Mortgage

Current Minimum Mortgage Requirements For A Va Loan

VA entitlement. VA borrowers must provide a certificate of eligibility that shows enough military service to be entitled to a VA home loan. Most lenders obtain the COE from the VA directly, but current military personnel and veterans can also apply for it on their own online.

Down payment. VA loans dont typically require a down payment. However, you may need one if you try to buy a new home with VA financing, yet still have an unpaid VA loan on another home, or if you need a jumbo VA loan.

VA funding fee. Although VA loans dont require mortgage insurance, a VA funding fee of 0.5% to 3.6% may be charged to military borrowers to offset the cost of the program to taxpayers. The amount depends on your down payment amount, and whether youve used your home loan benefits before.

. The VA doesnt set a minimum credit score, but many VA lenders require a 620 minimum.

Employment. A two-year employment history is required, but exceptions may be made for military borrowers who are recently discharged from active-duty service.

Income. VA-approved lenders analyze your income to make sure its stable. Military training and education related to a non-military job may be considered for borrowers with less than a two-year income history.

DTI ratio. The VA recommends a total DTI ratio of no more than 41%. However, higher DTI ratios may be allowed if you meet the residual income test.

Occupancy. VA loans are offered for primary residences only.

What Credit Score Do I Need For A Conventional Loan

Lenders issuing conventional mortgages have considerable leeway in determining credit score requirements for their applicants. Lenders may set credit score cutoffs differently according to local or regional market conditions, and they may also set credit score requirements in accordance with their business strategies. For example, some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO® Score scale range of 300 to 850, while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. Many lenders offer a catalog of mortgage products designed for applicants with a range of credit.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620.

Read Also: How Do I Qualify For A Zero Down Mortgage

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

You May Like: Does Chase Allow Mortgage Recast

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Step by Step Guide

The Three Main Types Of Credit:

- Revolving Credit This type of credit allows you to continually borrow and repay money from a credit line. Credit cards and other types of revolving credit have a maximum amount or limit. Keeping the amount you borrow against your revolving credit line under 30% of the maximum and making on-time payments, will help build your score.

- Installment Debt This type of credit is usually borrowed as a lump sum and then repaid over a set period of time in installments. A car loan, financing for furniture or appliances, student loans, business loans, and mortgages are all types of installment debts. Paying these bills on time is important to building a healthy credit score.

- Open Credit This type of credit involves a payment for goods and services that can vary from month to month. Examples of open credit are utilities, insurance payments, rent or lease payments, phone/wifi/data plans, and subscription services. Paying the bills for these goods and services on time will aid in building your credit score.

We are here to help you answer all of your mortgage related questions. If you are ready to buy a new home of refinance you current home, we can be the experts on your team. Reach out to us and speak with a licensed mortgage consultant about your goals.

If you would like to see more articles like this one about mortgage information and home ownership,

Read Also: How Much Second Mortgage Can I Afford

What Should My Credit Score Be To Get The Best Mortgage Rates

Hereâs a brief overview of what your credit score looks like to lenders and mortgage brokers. The higher your credit score, the better rates you can qualify for.

-

741 or more: Wow â your credit score is excellent! This is where the best mortgage rates live.

-

713 to 740: You have a good credit score. You should receive a very good interest rate on your mortgage and have plenty of options.

-

660 to 712: This is considered a fair credit score by lenders. However, once you get to 660, youâll be entering average credit score territory.

-

575 to 659: In the eyes of banks and lenders, this is a below-average credit score. If your credit score is below 640, you might have trouble getting a conventional mortgage from a bank or online lender. Consider working on improving your credit score before applying for a mortgage.

-

300 to 574: Your credit score is poor and needs improvement, but thatâs OK. As your credit stands right now, youâd be considered a high-risk borrower. Even if youâre approved for a mortgage, you would end up paying extremely high interest rates. You should make an effort to improve your credit score in order to access better mortgage rates in the future.

For every 20-point increment that your credit score drops, youâll likely see small changes in the interest rate youâre offered. Lenders typically adjust their offer rates each time your credit score moves up or down by 20 points.

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read Also: What Factors Go Into Mortgage Approval

I Have A Good Credit Score What Should I Do Now

First of all, though your score means you probably already have good credit habits, do your best to make sure you keep your score high while you look for mortgage approval.

Most Canadians take their mortgages from the big banks, so this may be the place to start for you. Banks are all in competition with each other and will offer similar packages, though with subtle differences. Its important to shop around and find what works best for you.

If you feel unsure about choosing the best mortgage, a mortgage broker may be good for you. A mortgage broker is a professional whose job is to evaluate the different mortgages available to you and help you get the best deal possible. Mortgage brokers can help you save time and find a better deal by comparing the many mortgage rates across major banks, credit unions, and alternative lenders. They will also help you submit your mortgage application and secure mortgage pre-approval. Of course, you will pay for the services of a broker, so make sure to weigh the costs and savings.