How To Find The Best Mortgage For You

Once youve settled on the length of the mortgage, its time to do your research to find the best mortgage for you . This due diligence will mean comparing mortgage rates from several lenders, which might include mortgage brokers, traditional banks and online lenders. Its smart to prepare for your mortgage search by reviewing your credit report to confirm its correct and evaluating your financial landscape to determine how much you can afford to put toward a home each month. The key is to make sure the client is comfortable with their budget and payment, says Reiling.

While there is no official best season to shop for a mortgage since rates are driven by the market and overall economic landscape, Reiling says, Banks are much more competitive on rates when business is slow, which tends to be in the dead of winter around January or February.

Lots Of Reserves Left To Release

Wells Fargo’s credit quality is excellent, and net charge-offs to total loans in the quarter were a mere 0.12%.Just for comparison, Bank of America’s net charge-off ratio declined to 0.20%, a level that the bank’s management said was the lowest in 50 years. As a result, Wells Fargo released $1.7 billion previously set aside for loan losses back into earnings, boosting profits. The bank still has $14.7 billion in reserve capital, which is enough to cover losses on 1.7% of the bank’s total loan portfolio. At the current net charge-off rate of 0.12%, that seems excessive, but the bank has been slower to release reserves than its peers.

Before the pandemic, the bank’s total reserve capital was $9.3 billion, so there could be as much as $5 billion left to shift back into earnings. Santomassimo said on the earnings call that the bank may not return to running with reserve capital that low, but I would still expect billions of dollars to be released back into earnings at some point.

Where Can You Get A Loan With Wells Fargo Home Mortgage

NMLS ID: 399801

With over 5,000 locations across 36states, Wells Fargo has more branches than many other big financial services providers.

Indeed, some reports say it has the most branches. So it may be ideal for those who prefer toconduct their business in person, especially if they dont have an existingrelationship with a local bank or credit union.

And for those who prefer digitalservices, the Wells Fargo Home Mortgage website is informative and fairly easyto navigate. The ability to save an application part way through and completeit later gives borrowers extra flexibility.

Read Also: What Is The Mortgage Rate In Florida

Wells Fargo Vs Bank Of America

Wells Fargo has more home loan options than Bank of America. If you’re looking for a USDA loan or new construction loan, Wells Fargo is the clear choice. Bank of America doesn’t have these loan mortgage products.

However, if you need a lender that offers a HELOC, Bank of America will be a better match since Wells Fargo currently doesn’t offer any.

Bank of America has homebuyer assistance programs that provide home grants and credit. Bank of America’s Our America’s Home Grant program can give eligible homebuyers up to $7,500 in credit toward closing costs, and the Our Down Payment Grant System can offer up grants of up to $10,000. You’ll have to contact a lending specialist if you want to know whether you’re eligible.

Wells Fargo also offers home grants and credits through the Dream. Plan. Home. Mortgage, but your eligibility in these programs may ultimately determine which one is the more appealing choice.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Read Also: How Do I Apply For A Usda Mortgage

Determine Your Estimated Costs

When you refinance, you may pay:

- An origination charge , which may include fees such as application or processing.

- Discount points to lower your interest rate further. .

- A prepayment penalty if your current loan has a penalty for early payoff.

- Other settlement charges such as appraisal, credit report, title search, and title insurance fees.

Assess how much longer you’ll stay in the home If you plan on owning the home for an extended period of time, and the interest rates are 1/2% to 5/8% lower than your current rate, refinancing may be the right choice for you.

Determine your break-even point Your break-even point occurs when the cumulative monthly payment reduction from your new loan equals the cost of getting the new loan.

Additional considerations Keep in mind that you are starting over. Refinancing replaces your existing loan with a new one. If you refinance to a term that is the same as your original loan, you may pay more interest than you would if you refinance to a term that is the same as or shorter than the remaining term of your original loan.

Use our refinance calculator to help determine if refinancing may be right for you.

Should You Get A Mortgage From Wells Fargo

Wells Fargo should have enough mortgage options available to satisfy just about any possible client. This is clear not only from the many different types of mortgages it includes in its portfolio, but also from the terms for which theyre offered.

For anyone whos inexperienced when it comes to mortgages and loans in general, Wells Fargo presents an opportunity to work face-to-face with an actual human employee. So if you fall into this group, you might want to accept the slightly higher interest rates and APR Wells Fargo has. It may be worthwhile to have someone walk you through the mortgage process.

Read Also: What Banks Look For When Applying For A Mortgage

Is Wells Fargo The Best Mortgage Lender For You

Competitive rates and rising customer satisfaction scores are a testament to Wells Fargos popularity as a mortgage lender.

And while its hard to ignore the banks spotty track record, there may be a silver lining. The bank is now under intense scrutiny from customers and regulators. Its making a serious effort to improve and data shows that for many, its succeeding.

So if Wells Fargo can offer you a competitive mortgage rate, its definitely worth your consideration. You can check your personalized rates right here.

Wells Fargo Mortgage Rates

- Largest mortgage lender in America

- Plenty of branches

Best For

- Anyone unsure of what type of loan to get

Wells Fargo is one of the largest mortgage lending institutions in the U.S. The bank backs that distinction up with many different mortgage options that vary in term-length, style and size. This breadth provides a high level of customization to make choices based on your specific profile. Thats often lacking when it comes to other lenders and provides a leg up for Wells Fargo. A financial advisor can help you with mortgages and any other financial issues you have.

But taking a mortgage with Wells Fargo isnt all great. In fact, its interest rates and annual percentage rates are slightly higher than a sizable portion of its direct competition. This is partially an indication that Wells Fargos extra costs are higher too, as the APR includes fees and other expenses that the interest rate does not.

| These rates assume a credit score of 740 and 0.50 discount points. |

| Mortgage |

| Compare Rates |

Read Also: What Percent Down Payment To Avoid Mortgage Insurance

Home Affordable Refinance Program

The HARP program was created by the federal government, to make it easier for eligible homeowners to refinance their homes at a lower rate. In many cases, an appraisal is not required and fewer documents are needed.

Borrowers with regular Freddie Mac and Fannie Mae mortgages can refinance their mortgages even if they owe more than their homes are worth through the Home Affordable Refinance Program. If you have a good history of being current on your payments and have not yet taken a HARP refinance, you could refinance your loans mortgage to a new one at todays lower rates through Wells Fargo Mortgage.

What Does The Future Hold For Mortgage Rates

Mortgage rates plumbed new depths in January 2021, setting all-time lows south of 3 percent. Rates have climbed a bit since then, and their trajectory for the rest of the year depends on the strength of the economic recovery. Given the robust rebound, the Federal Reserve has indicated it will ease back on its stimulus. That sets the stage for rates to rise. However, increases are likely to be gradual rather than sudden. Many mortgage experts expect rates to climb above 3.5 percent by the end of 2021.

Learn more about historical mortgage rate trends.

Recommended Reading: How To Get Assistance With Mortgage Payments

Wells Fargo Mortgage Process

As is sometimes the case with traditional banks, it used to be you couldnt apply for a Wells Fargo mortgage online. That changed in 2018 when Wells Fargo launched a streamlined online application.

If youre already a Wells Fargo customer, the online application can prepopulate much of the required information, cutting down the time needed to apply for and close a mortgage. Of course, you can still get the ball rolling by walking into a Wells Fargo branch office or picking up the phone to speak to a loan officer, too, if you prefer.

Once your application is in progress, you can check where you are in the process from your computer or smart device using yourLoanTracker. Youll have the option to sign and upload any required documents and review disclosures online.

After youre preapproved, Wells Fargo says you can expect closing to take place within the rate-lock period youve selected, which can be anywhere from 30 to 90 days.

When Is The Best Time To Obtain A Mortgage

The best time to secure a mortgage is when the rates are the lowest. Compare the National Mortgage Rate average over the past 10 -20 years. If the rate is at one of its lowest points historically, then it can be a safe entry point into the market. Many investors purchased when the market was low, but it had not reached its lowest point. Now, home buyers owe more than the house is worth. Those who wish to sell cannot fully recoup the costs of the home. Therefore, instead of having equity in the home, consumers owe more than the home is worth. Many individuals, in this instance will negotiate with the bank and âshort sellâ in order to relieve themselves of the debt.

As stated above, the rates change based upon the Federal Reserve and the desire to keep the economy stable. Read the reports from the office and inquire with lenders to get a fair prediction of the direction of the Federal Reserve. If the Federal Reserve decides that consumers need to spend and borrow, interest rates will remain low. However, if the Federal Reserve decides that it needs consumers to save, invest, and deposit money, the interest rates will remain high.

You May Like: How Much Mortgage Do You Pay A Month

/1 Arm Mortgage: Wells Fargo Wins

Next is the adjustable-rate mortgage , specifically the 5/1 ARM. This type of mortgage locks in your payment for five years. In year six, the interest rate begins to adjust on an annual basis, often based on the prime rate plus a margin. Rarely will the payment not rise.

People who choose a 5/1 ARM either dont plan to stay in the home for more than five years or plan to refinance at the end of the 5-year period. Note that the monthly payments are lower, but the total cost over 30 years will likely be higher than a fixed-rate mortgage.

Bank of America offers a 5/1 ARM with an APR of 3.424% and 0.948 of discount points. The payment is $653. Wells Fargo offers an APR of 3.382% and a monthly payment of $870. The total that the interest rate can move over the life of the loan, either up or down, for Wells Fargo is 5%. Bank of America’s cap is higher at 6%, but Bank of America has individual caps of 2%i.e. no individual rate adjustment can be more than 2%.

In this instance, Wells Fargo wins because they offer a better interest rate, however, Bank of America offers discount points, which means the upfront closing costs will be higher if a home buyer choose to pay more upfront, which reduces the loan’s interest, thereby reducing monthly payments.

Loan Products At Wells Fargo Home Mortgage

As youd expect of a big bank, WellsFargo has a wide range of mortgage options.These include:

- Fixed-rate mortgages Choose your fixed-rate loan term from 30, 20 ,or 15 years with low down payment options

- Adjustable-rate mortgages Choose a fixed rate for an initial 5- or 7-year period . After that, your rate can fluctuate each year

- VA loans VA loans offer zero down payment for qualifying service members and veterans, plus other privileges

- FHA loans Use an FHA loan to put down as little as 3.5% of the purchase price. But note that youll have to pay continuing mortgage insurance premiums

- USDA loans Wells Fargo calls this program the Easy to Own Guaranteed Rural Housing program. Like all USDA loans, it allows zero down payment in qualified rural or suburban areas

- Jumbo loans For when you want to borrow more than Fannie Mae and Freddie Mac allow in your area. In most of the U.S., a jumbo mortgage is any loan amount bigger than $548,250

- New construction loans An easier way to borrow when youre building from the ground up

- yourFirst Mortgage A Wells Fargo proprietary product that lets you buy with a low down payment of 3%. Available to both first-time buyers and existing homeowners, in spite of the name

Theres a very good chance the type of mortgage youll need is on Wells Fargoslist.

Though Wells Fargo hassuspended its home equity lines of credit during the COVID-19pandemic, the bank has cash-out refinancing and rate and term refi optionsavailable.

You May Like: What Is Mortgage Rate Vs Apr

What Is A Good Mortgage Rate

Average mortgages rates have been at historically low levels for months, even dipping below 3% for 30-year fixed-rate loans for the first time ever. If you can get a mortgage with an interest rate below 3%, you could be getting the deal of a lifetime.

But even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

What Is A 10

A 10-year fixed mortgage is just a 10-year amortization, says Silverton Mortgage President Josh Moffitt, whose company is based in Atlanta. Your rate payment is done over 10 years, as opposed to many traditional mortgages which are paid over 30 years. By shortening the term it’s a massive amount of savings because you’re putting 20 years of interest away.

For the buyer who wants to pay off their mortgage quickly while reducing how much total interest they pay, the 10-year mortgage offers a way to do just that. To find out if a 10-year mortgage is right for you, do the math using the Bankrate Mortgage Calculator.

Get the latest interest rates for 10-year fixed-rate mortgages. Be sure to check back regularly, as rates change all the time. The great news for borrowers is that mortgage rates have never been lower and rates on 10-year loans tend to be even lower than those for the more common 30-year mortgage.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

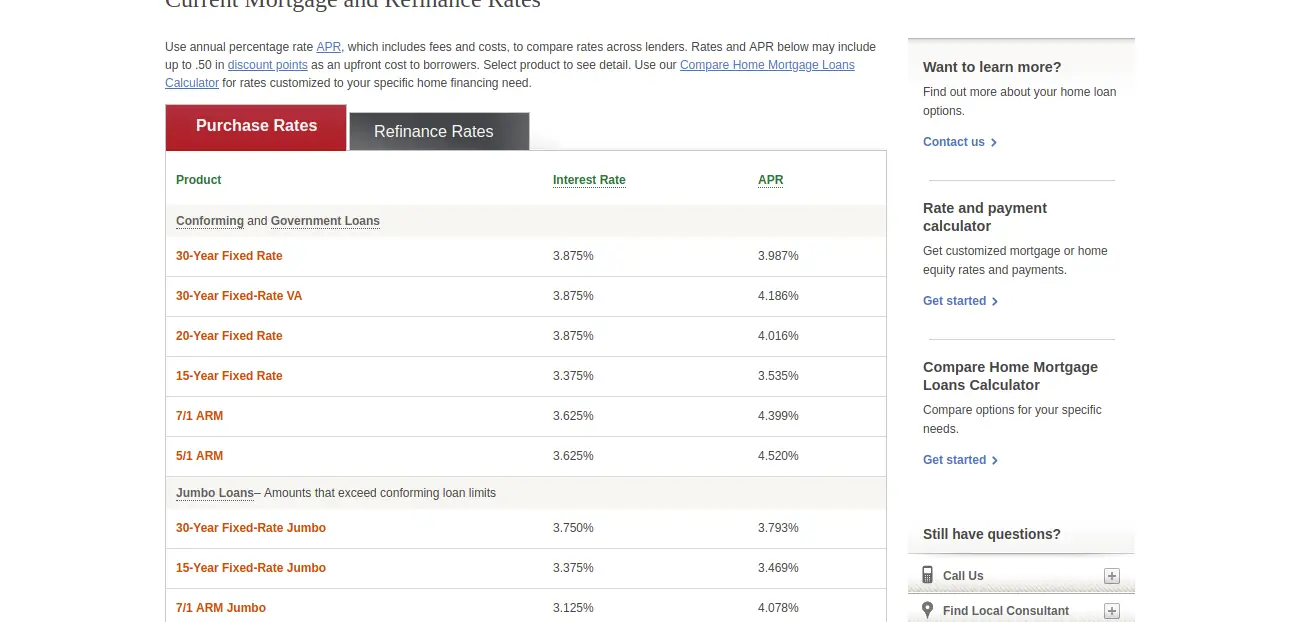

Current Mortgage Rates: Today’s Interest Rates

Rate, points and APR may be adjusted based on several factors including, but not limited to, state of property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value and your credit score. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

What Is A Mortgage

A mortgage is a type of secured loan that is used to purchase a home. The word mortgage actually has roots in Old French and Latin, and literally means death pledge. Thankfully, it was never meant to be a loan you paid for until you died , but rather a commitment to pay until the pledge itself died .

You can also get a mortgage to replace your existing home loan, which is known as a refinance.

Don’t Miss: What Documents Do I Need To Get A Mortgage