How To Avoid Closing Day Problems

Avoid unwanted delays or cancellations. Here’s how.

- Resource Centre

- What to Expect on Closing Day

Closing dayOpens a popup.is a milestone for any home buyer: You sign the papers, pay the funds and get your keys. Sounds easy. But closing the deal isn’t always simple. Closing day involves many people, so delays can happen. But, you can do your part to help it go as smoothly as possible.

Confirm Your Closing Date Before You Schedule

There’s lots of scheduling to do when you buy a home. If you are renting a home or apartment, you might have to give the landlord notice. You might be hiring movers or contractors too. Make sure you have a confirmed closing date before you lock down dates for these other things. We’ll work with you to find a closing date, time, and location that is convenient for you.

You Make Unusually Large Account Deposits Or Withdrawals

Keeping your finances stable throughout the closing process will help keep your closing on track because you wont need to provide additional documentation to lenders justifying large deposits or withdrawals.

Why would a large deposit be a problem? Because it could indicate you borrowed money that youll have to repay, which will affect the DTI you qualified for the loan with. A large withdrawal could mean you wont have enough cash to close or you wont have the required cash reserves after closing.

Dont forget that youll need cash for both your down payment and closing costs.

Also Check: Can You Refinance A Mortgage Without A Job

Mortgage Lenders That Have Qc Underwriting Review

QC Underwriting Review is the final stage done by lenders prior to sending out the mortgage documents and sending the wire out to the title company. Not all lenders have a QC Underwriting Review process. Why have QC Underwriting Review when the mortgage underwriting has fully underwritten the borrowers and issued the clear to close? A QC Underwriting Review may just be a senior underwriting manager signing off on a mortgage underwriter file prior to a clear to close. Other lenders will literally re-underwrite the whole file by a separate underwriting department. In the following paragraphs, we will discuss and cover QC Underwriting Review After Mortgage Approval Prior To Clear To Close.

How Long Does It Take The Underwriters To Clear To Close

Your purchase agreement likely contained a tentative closing timeline, with a move-in date. Home sellers need to plan when theyâll vacate, and home buyers need to hire movers or sell their current home. Itâs part of your realtorâs job to manage this closing timeline, but

If youâre buying in a normal market transaction, rather than a foreclosure, it should take just 72 hours within submitting all of your information to be approved. Getting pre-approved for a mortgage before house hunting can speed this along. Then it can take an additional week after you provide all documentation to your loan officer.

While it may feel like how long it takes is out of your hands, you can make it go faster by having all the paperwork you need gathered and ready to submit.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Theres A Difference Between Preapproval And Approval

Getting preapproved for a loan is one step toward financing your future home, but its not the only step.

Your loan gets preapproved when you complete a mortgage application, which is when your lender conducts a credit check to confirm youre financially capable of taking on the loan. This step is usually done before you go house hunting so you know how much home you can afford.

Many sellers want to know home buyers are serious and they may request a preapproval letter before moving forward in negotiations. Otherwise, sellers might think youre just casually browsing homes.

Your loan approval happens after youve found the home you want. Youll put an offer in and if accepted, youll apply for your mortgage, which is usually contingent on an appraisal and inspection. A preapproval increases your chances of getting approved in the final steps, but its not guaranteed.

Role Of The Qc Review Mortgage Underwriter

Depending on the mortgage lender, a QC Review Underwriter is often a different underwriter that cross-checks the original underwriters work:

- The QC Underwriter goes through everything the original mortgage underwriter has done to see that there are no errors

- The QC Review underwriter often times will run a soft credit check pull to make sure borrowers have not incurred any additional debt

- Also makes sure there are no fraud alerts issued

- Once QC Review underwriter signs off on the QC Review, it goes back to the original mortgage underwriter for them to sign off on a clear to close

- The QC Review process normally takes 24 to 48 hours

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

How Does A Closing Delay Affect My Rate Lock

Rate locks typically last between 3060 days which is enough time to get most loans through underwriting and to the closing table. If your rate lock does expire before this time, in most cases it can be extendedjust make sure to check with your lender to see if doing so will result in any additional fees. Typically a mortgage rate lock extension fee is less than half a percent of the loan amount, but the actual costs vary based on the length of the extension. At Better Mortgage, rate lock extension fees are added to your closing costs. If we caused the closing delay, we cover the costs so you can extend your rate free of charge.

What Is Closing And When Does It Happen

Closing is the final step before that house is finally freakin yours! Your closing date is the day you become the legal owner of your new home.

During the contract negotiation phase, you and the seller set a closing date, which must be listed on the purchase agreement contract. After the seller accepts your offer and earnest moneymoney given to secure the contractyoull likely wait a while before your actual closing date.

Even though you and the seller may agree on a closing date, your agents will probably work with your lender and title agency to suggest a timeline that allows them enough time to correctly execute their end of the deal. That could push your closing date out several weeks or even months after your offer is formally accepted.

You May Like: Chase Mortgage Recast

Mortgage Processing And Underwriting

Once your full loan application has been submitted, the mortgage processing stage begins. For you, the buyer, this is mostly a waiting period.

But if youre curious, heres what happens behind the scenes:

First, the Loan Processor prepares your file for underwriting.

At this time, all necessary credit reports are ordered, as well as your title search and tax transcripts.

The information on the application, such as bank deposits and payment histories, are verified.

Respond ASAP to any requests during this period to make sure underwriting goes as smoothly and quickly as possible.

Any credit issues, such as late payments, collections, and/or judgments, require a written explanation.

Once the processor has put together a complete package with all verifications and documentation, the file is sent to the underwriter.

During this time, the underwriter will review your information in detail. Its their job to nitpick the information youve provided looking for missing items and red flags.

Theyll primarily focus on the three Cs of mortgage underwriting:

- Capacity Do you have the cash to pay for your loan?

- Does your credit history show that you pay debts on time?

- Collateral Is the value of the property youre buying sufficient collateral for the loan?

During the underwriting process, they may come back with questions. You should respond as quickly as possible to ensure a smooth underwriting process.

Documents Reviewed By Mortgage Underwriter Prior To Ctc

All mortgage documents are scrubbed by the mortgage processor before it is submitted to the mortgage underwriter. Any incomplete mortgage docs will be kicked back to the mortgage processor by the underwriter. Incomplete mortgage docs are one of the main reasons for delays in the mortgage process.

The following documents will be thoroughly reviewed by the mortgage underwriter prior to issuance of a CTC:

- Paycheck stubs

- The final verification of employment has been confirmed.

- Some mortgage lenders have a quality control department that every mortgage application needs to go through prior to a clear to close can be issued.

- The quality control department has a quality control mortgage loan underwriter who will review the original mortgage underwriters work

- This is done to make sure there are no mistakes made and that the mortgage loan can be sold on the secondary market to Fannie Mae or Freddie Mac

- Once a clear to close has been issued, the mortgage lender prepares docs

- A clear to close means that funds can get wired once final figures are approved

- With a CTC, the mortgage loan can close

- All docs need to be complete, verified, and make sure that is insurable on government loans

- Conventional Loans are double-checked to make sure that the lender can sell it to the secondary market and need to meet Fannie and/or Freddie Mortgage Guidelines

Don’t Miss: Who Is Rocket Mortgage Owned By

Title Search And Insurance

A title search and title insurance provide peace of mind and a legal safeguard. They ensure that when you buy a property, no one else can try to claim it later. A title search is an examination of public records to determine and confirm a propertyâs legal ownership and find out what claims, if any, exist on the property. If there are any claims, they may need to be resolved before the buyer gets the property.

Title insurance is indemnity insurance that protects the holder from financial loss sustained from defects in a title to a property. It protects real estate owners and lenders against loss or damage stemming from liens, encumbrances, or title defects.

Go Rate Shopping And Choose A Lender

You may have already decided on a mortgage company when you got preapproved.

But if youre still shopping, now that youve found a home and your offer has been accepted, its time to make a final decision about your lender.

When shopping for a mortgage, remember your rate doesnt depend on your application alone. It also depends on the type of loan you get.

Look at a few different lenders rates and fees, but also ask what types of loans you qualify for. This will affect your rates and eligibility.

Of the four major loan programs, VA mortgage rates are often the cheapest, beating conventional mortgage rates by as much as 0.40% on average. Next are USDA mortgage rates. Third come FHA mortgage rates, followed by conventional rates.

So look at a few different lenders rates and fees, but also ask what types of loans you qualify for.

There may be much better deals available than what you see advertised online.

For a detailed explanation of how to compare offers and choose a mortgage lender, see: How to shop for a mortgage and compare rates

Also Check: Reverse Mortgage On Condo

What Does It Mean To Close On A House

Your realtor has found your dream home at last, your offer to the seller has been accepted, your loan officer has confirmed that your mortgage agreement is in place, and youve got the down payment ready. Its all been leading up to this. Finally, youre approaching closing day!

But, what does it really mean to close on a house? Heres a rundown of what you should expect.

How Long Does It Take To Close A Mortgage

According to loan software company ICE Mortgage Technology, it took 52 days to close a mortgage as of March 2021. But the time to close can vary a lot depending on your circumstances.

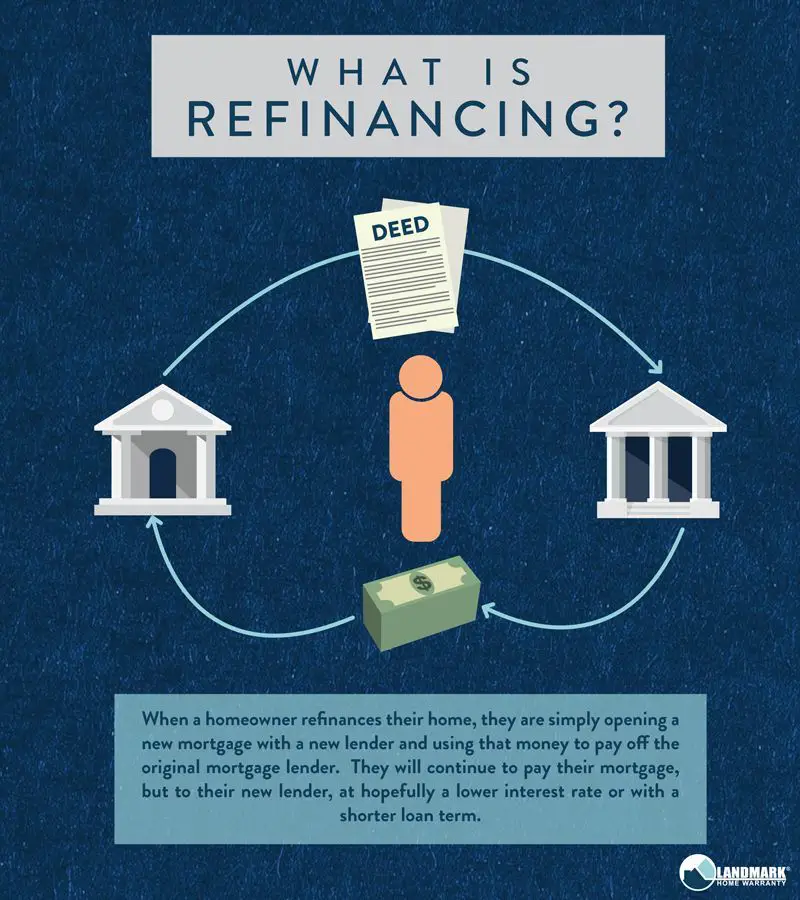

The time it takes to close a mortgage depends on where you are in the home buying or refinance process.

The home loan process itself from application to closing generally takes between 45 and 60 days. If youre refinancing a home you already own, thats your entire timeline.

If youre buying a new home, though, you have to factor in the house hunting process.

You need an offer accepted to get approved for a mortgage so you cant start the process in full until youve found the home you want. This could add an additional 12 months or more onto your timeline.

How long a mortgage closing takes if you havent found a house yet

Closing on a house takes time. Exactly how much time depends on your starting point.

If you havent yet found your dream home, you could spend a month or two just visiting houses with a real estate agent.

Once you find the house, it could take one to five days to make an offer, have the seller look at your offer, negotiate, and come to an agreement on price and other aspects of the real estate transaction.

At this point, you can make full application for the home loan.

You can speed up this process by getting a mortgage preapproval as soon as you start looking at homes. Dont let that 30 to 60 days go to waste.

Recommended Reading: Reverse Mortgage For Condominiums

Understanding Sell As Is

Its important to understand the term sold as is. Typically, when you buy a home from a seller, the seller must provide seller disclosures. These disclosures let you know anything that is wrong with the home, to the sellers knowledge.

When a home is sold as is, there could be problems with it. Unfortunately, the problems are yours once you own the home. You would face a similar situation if you were buying a bank owned foreclosure. The bank doesnt pay to have the issues with the home fixed you buy the home as it is and fix it up yourself.

Underwriter Reviews The Loan

Now that the appraisal and inspection are completed, the loan officer will submit a completed file to the underwriter to review. The underwriter will scour the entire file to make sure everything is correct.

This includes a look at an updated , final verification of employment, and checking to ensure the title is clear. Should the underwriter have any questions, they may ask for additional documentation before the loan is approved.

Once the underwriter has completed their review and conditionally approves the loan, the buyer will get a list of outstanding conditions that must be met before they can get a clear to close notification.

Also Check: Bofa Home Loan Navigator

Note : How Much Does It Cost To Close On A Home

To prepare for closing day, youll need to know how much youll have to pay out in closing costs. Closing costs usually include the premium for homeowners insurance, home inspection costs, appraisal fees, attorney fees and more. You can expect to pay around 3-4% of the purchase price of the home in closing fees, so be sure to budget for this.

Your Interest Rate Lock Expires

If your interest rate lock expires before your loan closes, and if market conditions have changed such that your new rate or closing costs will be higher, the worst-case scenario is that youll no longer qualify for your mortgage. If you still qualify but your annual percentage rate will change by more than one-eighth of a percent and the lender has already issued your closing disclosure, the clock will restart on the three-day waiting period before you can finalize your loan.

Read Also: Can You Do A Reverse Mortgage On A Condo

What Are Closing Costs

Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome. You can expect to pay 2-5 percent of the mortgage loan in closing costs. These can include:

- Origination fee, which you pay to your lender to start the loan application

- Underwriting fee, which you pay to your lender to process the application

- Appraisal fee, which you pay to your lender to get an estimate of the propertys value, basically to make sure youre paying a fair price and theyre not lending you more money than the house is worth

- Title search fee, which you pay to an agency to make sure the seller has the right to sell you the property

- Recording fee, which you pay to the local municipality to make the transaction official

- Transfer taxes, which you pay to the relevant government agencies

Can My Loan Still Be Denied

While its rare, the short answer is yes. After your loan has been deemed clear to close, your lender will update your credit and check your employment status one more time. Usually, a month or two will have passed since you filled out your loan application, and the lender wants to make sure you havent taken out any other loans or switched jobs during that time. If you have made changes in either of these areas, it could impact your loan.

For example, if you apply for a mortgage and then open a new credit card to buy furniture or appliances for your new home, it will increase the amount of debt you are responsible for and will change your financial profile. This could cause you to no longer qualify for your new home. In addition, if you miss paying any monthly bills since applying for your loan, it could impact your credit score and may impact your ability to qualify for the program you originally applied for.

Your lender also needs to confirm your job status before closing. This is typically done by placing a call to your employers Human Resources Department. If you quit or lost your job since your loan approval, your loan could be denied. Even if you left your job for another job with equal pay, your loan could still be denied, or delayed, depending on the type of loan you have.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans