How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

You May Like: Reverse Mortgage Mobile Home

What Is A 3

A 3-year fixed-rate mortgage will have a constant rate of interest over a term of three years. The term should not be confused with the amortization period, which is the length of time it takes to pay off your mortgage. The term, rather, is the period you are committed to the contractual provisions and mortgage rate with your lender.

What Is A Fixed Rate Mortgage

A fixed rate mortgage is pretty straightforward. Heres how it works: your lender offers an annual percentage rate and term, such as 2.80% for five years on a $500,000 loan, which will be paid back over 25 years. Since its a fixed rate mortgage, the interest rate will stay at 2.80% for the full five-years, even if the prime rate fluctuates during that time period . With a fixed rate, you make the same monthly, bi-weekly, or weekly installments, which goes towards paying down both the interest and the principal .

A fixed rate mortgage tends to be a favourite among Canadians because it offers peace of mind. According to the Mortgage Professionals Canada , 68% of borrowers who purchased a home in 2018 chose a fixed rate mortgage. Its easy to see why: you know exactly what your mortgage payment will be every month and it never changes . That way, you can make a budget that will help you live within your means.

The cons are that this security blanket comes at a cost. Fixed rate mortgages are usually higher than variable rate mortgages. Also, if variable interest rates plummet, youll be stuck paying a higher interest rate.

Read Also: Rocket Mortgage Qualifications

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written, Freddie Macs weekly average rate for a 30year, fixedrate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

How Your Mortgage Payments Are Calculated

Mortgage lenders use factors to determine your regular payment amount. When you make a mortgage payment, your money goes toward the interest and principal. The principal is the amount you borrowed from the lender to cover the cost of your home purchase. The interest is the fee you pay the lender for the loan. If you agree to optional mortgage insurance, the lender adds the insurance charges to your mortgage payment.

Recommended Reading: 70000 Mortgage Over 30 Years

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

How To Find The Best Mortgage For You

Once youve settled on the length of the mortgage, its time to do your research to find the best mortgage for you . This due diligence will mean comparing mortgage rates from several lenders, which might include mortgage brokers, traditional banks and online lenders. Its smart to prepare for your mortgage search by reviewing your credit report to confirm its correct and evaluating your financial landscape to determine how much you can afford to put toward a home each month. The key is to make sure the client is comfortable with their budget and payment, says Reiling.

While there is no official best season to shop for a mortgage since rates are driven by the market and overall economic landscape, Reiling says, Banks are much more competitive on rates when business is slow, which tends to be in the dead of winter around January or February.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Submit Your Loan Application

If youve found a home youre interested in purchasing, youre ready to complete a mortgage application. These days, most applications can be done online, but it can sometimes be more efficient to apply with a loan officer in person or over the phone.

The lender will require you to submit several documents and information, including:

- Recent tax returns, pay stubs and other proof of income

- Employment history from the past two years

- Financial statements from your bank and other assets, such as retirement accounts or CDs

The lender will also pull your credit report to verify your creditworthiness.

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Also Check: Rocket Mortgage Loan Types

Get Preapproved For A Loan

Once you find lenders youre interested in, its a good idea to get preapproved for a mortgage. With a preapproval, a lender has determined that youre creditworthy based on your financial picture, and has issued a preapproval letter indicating its willing to lend you a particular amount for a mortgage.

Getting preapproved before shopping for a home is best because it means you can place an offer as soon as you find the right home, Griffin says. Many sellers wont entertain offers from someone who hasnt already secured a preapproval. Getting preapproved is also important because youll know exactly how much money youre approved to borrow.

Keep in mind: Preapproval is different from prequalification. Mortgage preapproval involves much more documentation and will get you a more serious loan offer. Prequalification is less formal and is essentially a way for banks to tell you that youd be a good applicant, but it doesnt guarantee any particular loan terms.

When Should You Consider A 5/1 Arm

A 5/1 ARM makes sense if you plan to refinance your mortgage or sell your house before the introductory rate expires or if you expect the value of your house to rise quickly. If you choose an ARM, youll likely be able to qualify for a larger loan because of the low introductory rate. But be careful, your interest rate and monthly payment will increase after the introductory period, which can be 3, 5, 7 or even 10 years, and can climb substantially depending on the terms of your specific loan.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

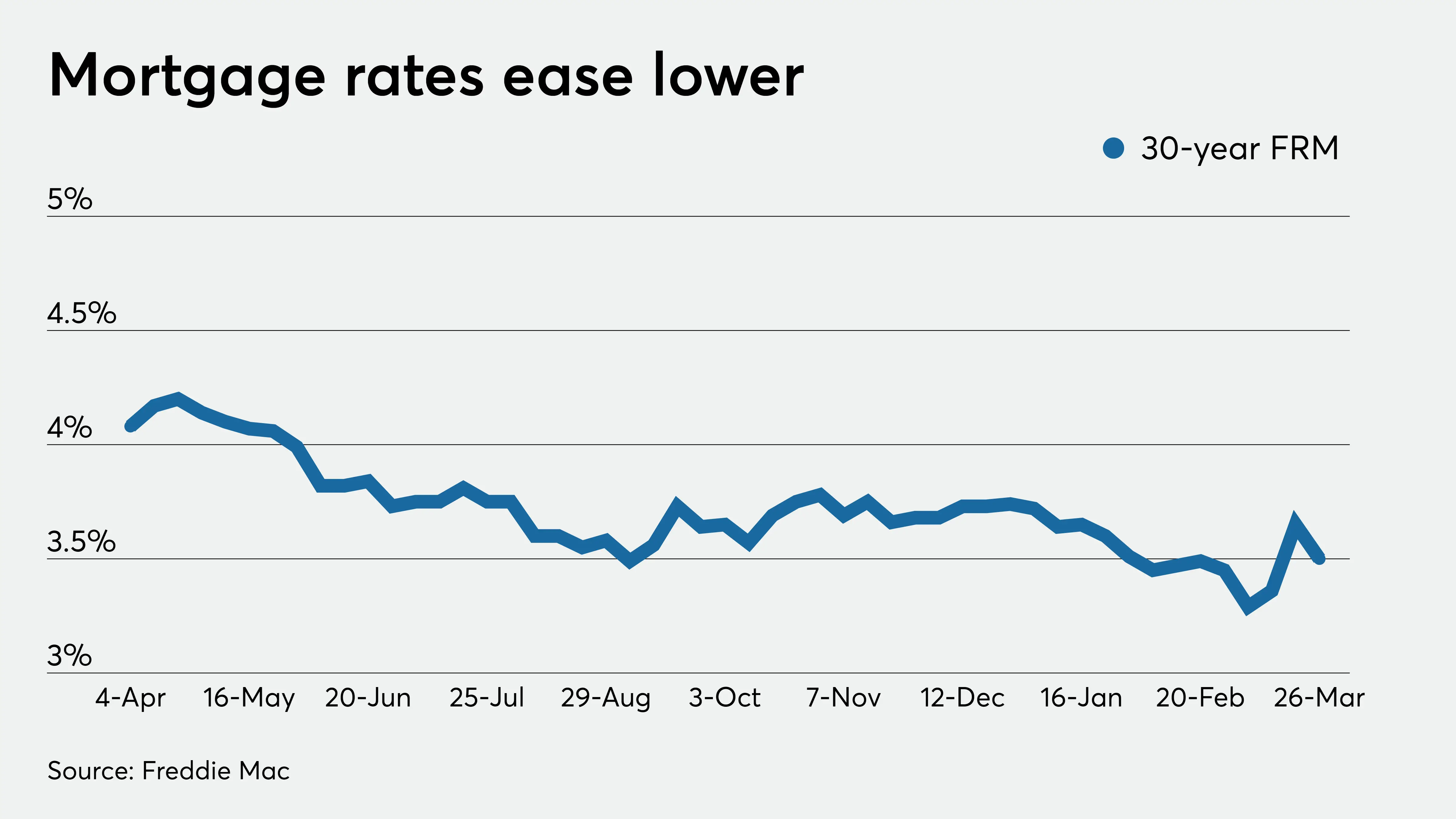

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

What Is A Good Rate On A Mortgage: Fixed Or Arm

What is a good rate on a mortgage? From a 20 year fixed rate mortgage to a 5/1 ARM, it is helpful to know the types of interest. Even balloon payment mortgages can be right for certain situations.

The two most common mortgage types are adjustable and fixed rate mortgages. Adjustable rate mortgages start with an initial fixed period, then become adjustable. Fixed rate mortgages maintain the same interest rate throughout the loan term. Understanding these two types of mortgages based on the interest rate type helps you make the right mortgage choice.

Various loan terms and fixed periods are available for fixed and adjustable rate mortgages. For fixed rate mortgages, the loan term can range from 10, 15, 20, 30 to 40 years. Adjustable-rate mortgages come with various fixed and adjustable terms, for example a 5/1 ARM.

What a good rate on a mortgage is becomes more obvious as you learn more about mortgages.

Recommended Reading: Reverse Mortgage For Condominiums

Selecting A Mortgage Term

Choosing between a short-term mortgage or a long-term mortgage can also affect your interest rate. A short-term mortgage generally offers a lower rate, and, as it requires more frequent renewal, you can benefit from lower interest rates when you renew, if rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you wonât need to renew it often. However, long-term mortgage holders may not be able to take advantage of lower interest rates if the market fluctuates.

Today’s Mortgage Rates: Still Near Historic Lows

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

For today, December 23rd, 2021, the current average mortgage rate for a 30-year fixed-rate mortgage is 3.324%, the average rate for a 15-year fixed-rate mortgage is 2.614%, and the average rate for a 5/1 adjustable-rate mortgage is 3.142%. Rates are quoted as annual percentage rate for new purchase.

A home is one of the biggest purchases you’ll ever make. Current mortgage rates are significantly lower than they were a year ago. You can save thousands of dollars simply by paying attention to the interest rate on your loan.

To land the best mortgage deal for you, it’s important to shop around with multiple lenders. Check out the most recent mortgage rates and get personalized quotes as well as a full rundown of your estimated monthly payment.

You May Like: How Much Is Mortgage On 1 Million

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score: You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. To help you better understand how your credit score affects your ability to obtain a mortgage, you can find more information on this page.

What’s The Best Loan Term

One important thing to consider when choosing a mortgage is the loan term, or payment schedule. The most common loan terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are stable for the life of the loan. For adjustable-rate mortgages, interest rates are fixed for a certain number of years , then the rate fluctuates annually based on the market interest rate.

One factor to consider when choosing between a fixed-rate and adjustable-rate mortgage is how long you plan on staying in your home. Fixed-rate mortgages might be a better fit for people who plan on living in a home for quite some time. While adjustable-rate mortgages might have lower interest rates upfront, fixed-rate mortgages are more stable over time. However you might get a better deal with an adjustable-rate mortgage if you only have plans to keep your home for a few years. There is no best loan term as a general rule it all depends on your goals and your current financial situation. Be sure to do your research and understand your own priorities when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Read Also: Can You Do A Reverse Mortgage On A Condo

What Is A Good Mortgage Rate

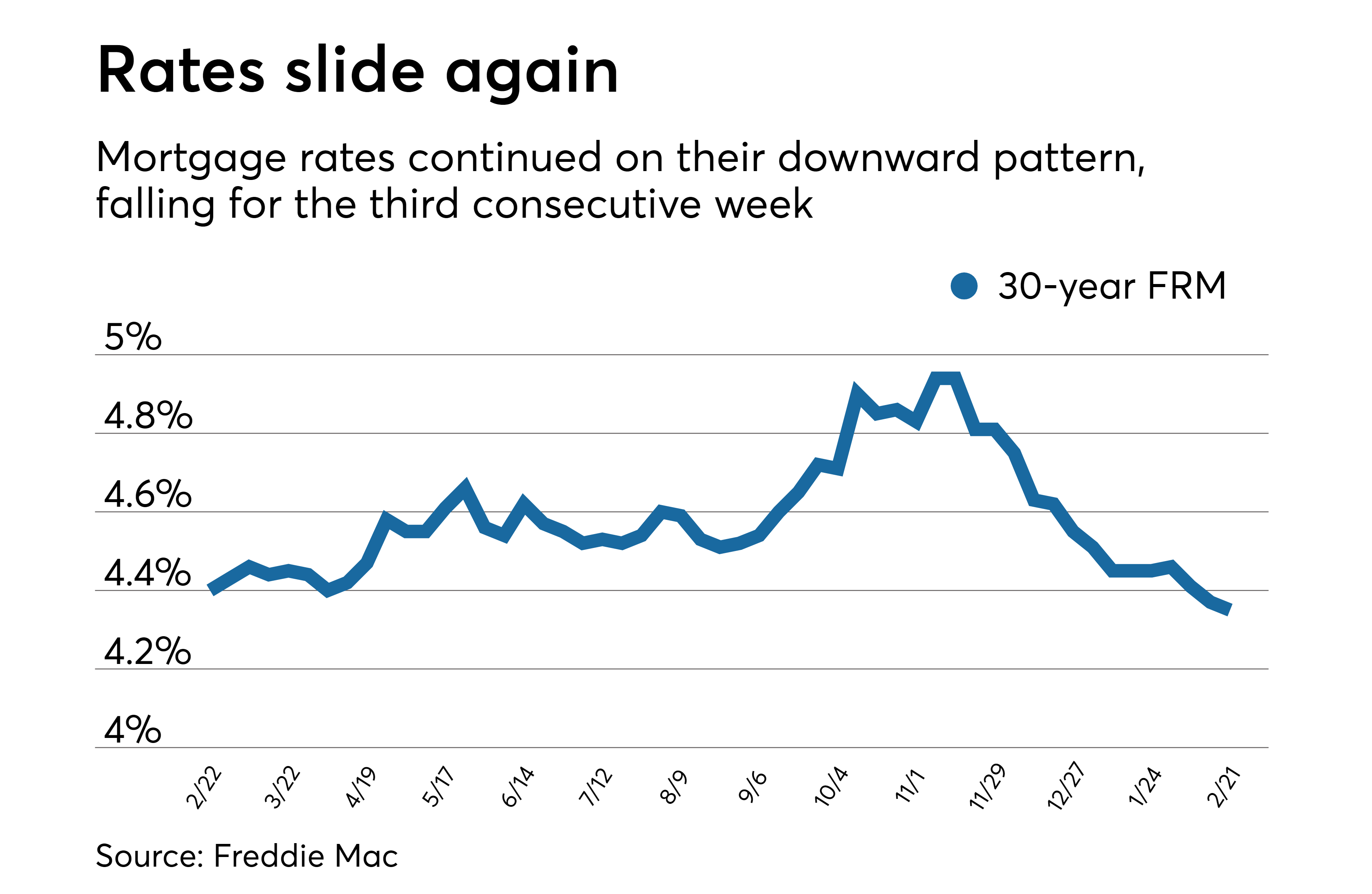

Average mortgage rates have been at historically low levels for months, even dipping below 3% for the first time earlier this year. Since then, rates have been on a slow but steady increase but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are approximately 1% lower than pre-pandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Best Mortgage Rates In Canada

- home equity line of credit

| Rate |

|---|

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates