Mortgage Insurance: What You Need To Know

Mortgage insurance helps you get a loan you wouldnt otherwise be able to.

If you cant afford a 20 percent down payment, you will likely have to pay for mortgage insurance. You may choose to get a conventional loan with private mortgage insurance , or an FHA, VA, or USDA loan.

Mortgage insurance usually adds to your costs.

Depending on the loan type, you will pay monthly mortgage insurance premiums, an upfront mortgage insurance fee, or both.

Mortgage insurance protects the lender if you fall behind on your payments. It does not protect you.

Your credit score will suffer and you may face foreclosure if you dont pay your mortgage on time.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

How To Get The Best Mortgage Rate

For the best chance at the lowest mortgage rate, follow these tips:

- Improve your credit score Lenders offer their lowest rates to those with strong credit. Some ways to boost your score include paying your bills on time and lowering your credit utilization ratio, the ratio of your credit balance to your credit limit.

- Build a record of your work history Lenders generally look favorably on borrowers with at least two years of consistent employment. If your work history has significant gaps or youre self-employed, you might have to provide more paperwork to get approved for the best possible rate.

- Save more for a down payment Putting more money down upfront can help you secure a lower rate. One way to grow your savings is to automatically set aside a portion of your income into a savings account. You can also look into down payment assistance programs, which can help you get the funds you need.

- Compare rates Comparing offers to find the lowest mortgage rate can save you thousands over the course of a 30-year loan.

- Consider a low-credit mortgage If your credit score isnt as high as youd like it to be, consider getting an FHA loan. FHA loans can sometimes have a lower interest rate, by about a half a point or more, compared to a conventional loan.

- Work with a mortgage broker A broker can help find you the best deal and negotiate a lower rate, and many dont charge any fees. Be sure to look for a broker who has experience with the type of loan youre after.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

Read Also: Rocket Mortgage Loan Types

Mortgage Interest Rates Today

Here’s what you need to know to lock in the best rate possible for that home loan.

Now’s the time to get an awesome mortgage rate on your dream home.

In response to market volatility at the outset of the COVID-19 pandemic, the Federal Reserve cut its benchmark interest rate for the first time in more than a decade, creating a ripple effect in the market. For homebuyers, this has meant home mortgage rates at historic lows. It’s a great time to investigate the mortgage rate you could qualify for on a future home.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

You May Like: 10 Year Treasury Yield Mortgage Rates

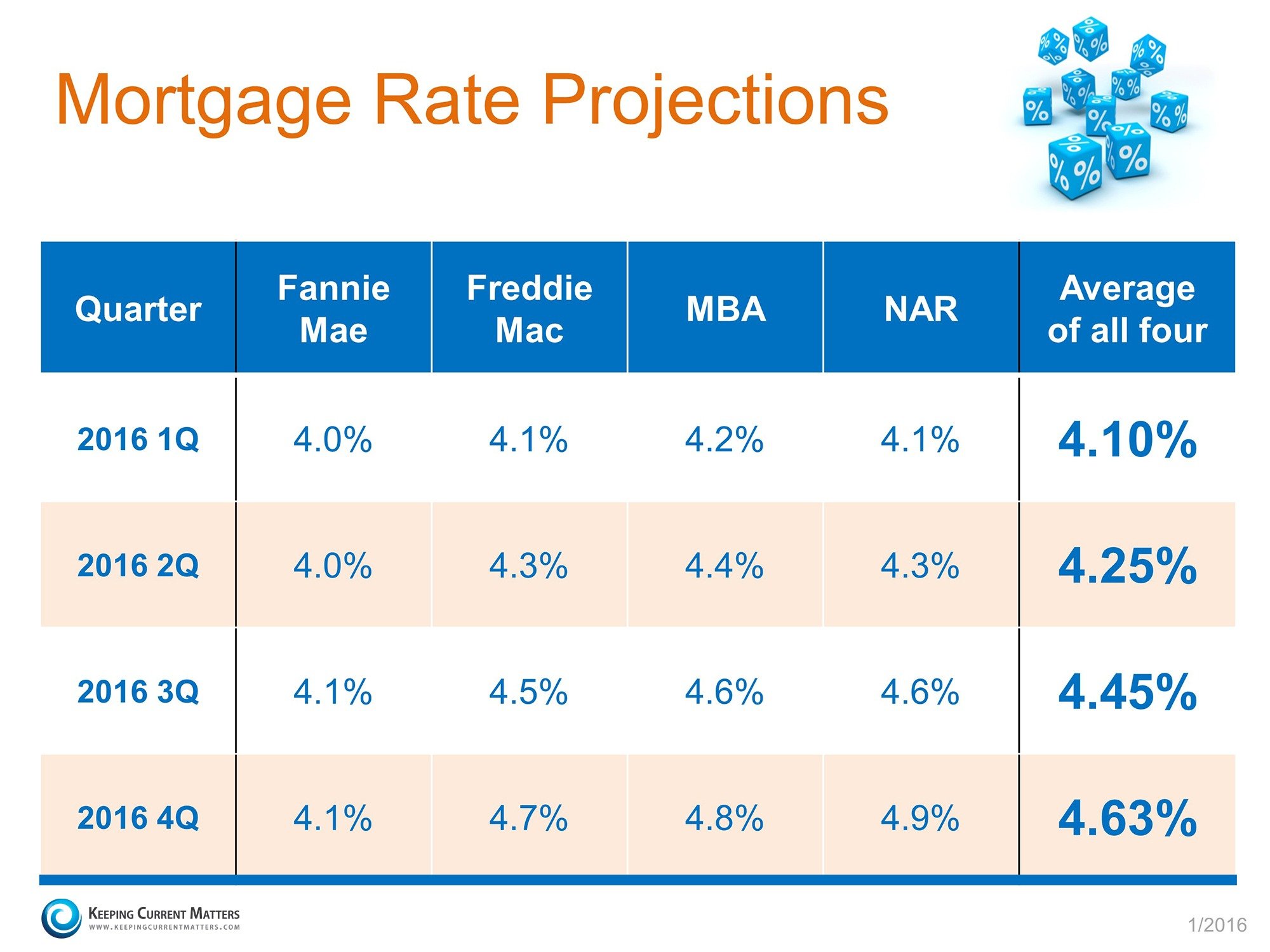

Mortgage Rate Forecast: Where Are Mortgage Rates Headed In 2022

This year started off with record low mortgage rates and weve seen rates climb since then. However, this rate growth has come in fits and spurts due to competing factors pushing and pulling on rates. A healthy economy and soaring inflation have helped to push rates up. Nevertheless, new Coronavirus variants such as Omicron have injected uncertainty into the markets and dampened interest rates somewhat. It is believed that mortgage rates will climb in 2022, and the decision by the Federal Reserve to reduce its bond purchases will contribute to that.7

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

What Is Mortgage Interest

The term mortgage interest is the interest charged on a loan used to purchase a piece of property. The amount of interest owed is calculated as a percentage of the total amount of the mortgage issued by the lender. Mortgage interest compounds and may be either fixed or variable. The majority of a borrower’s payment goes toward mortgage interest in the earlier part of the loan.

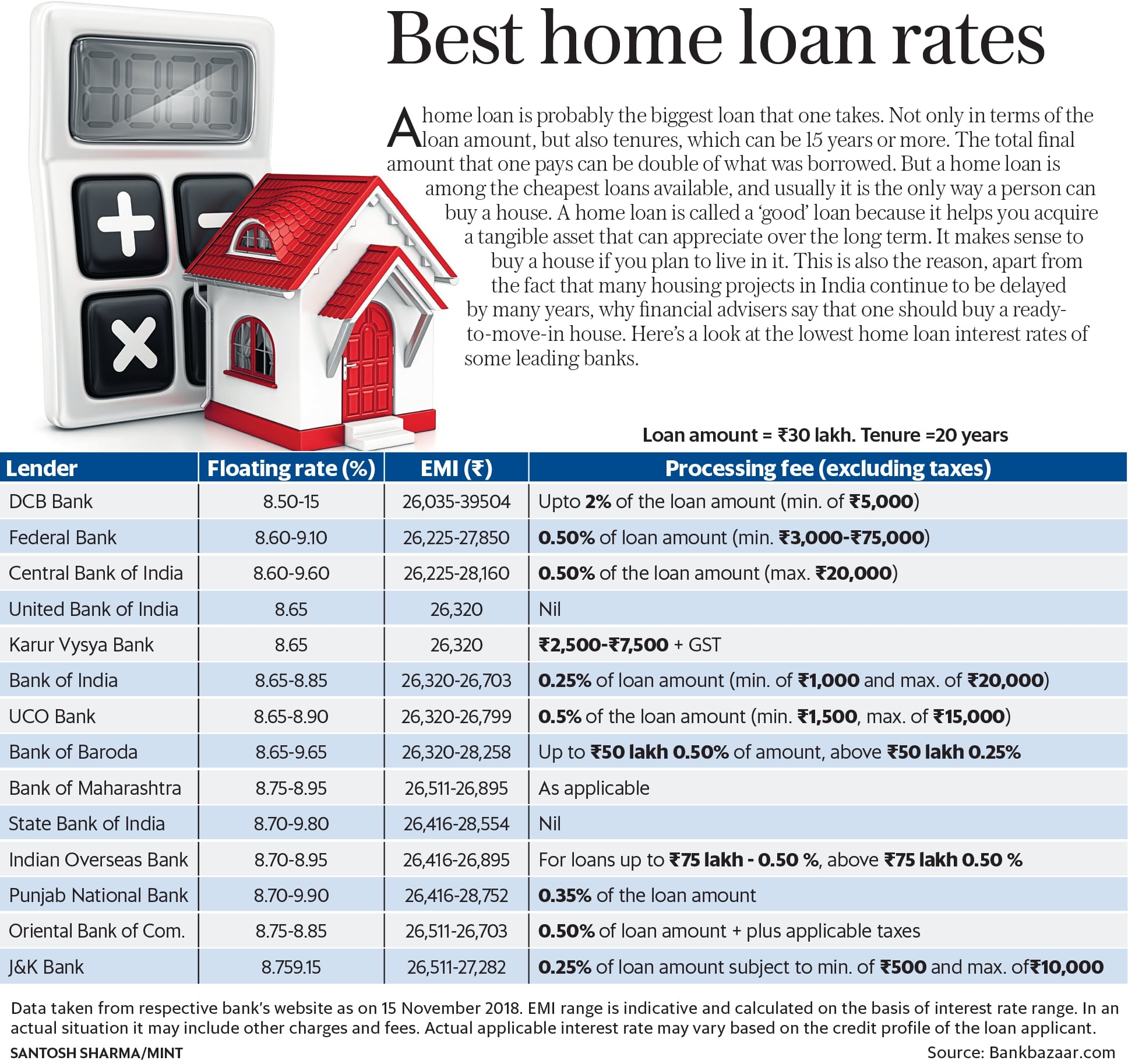

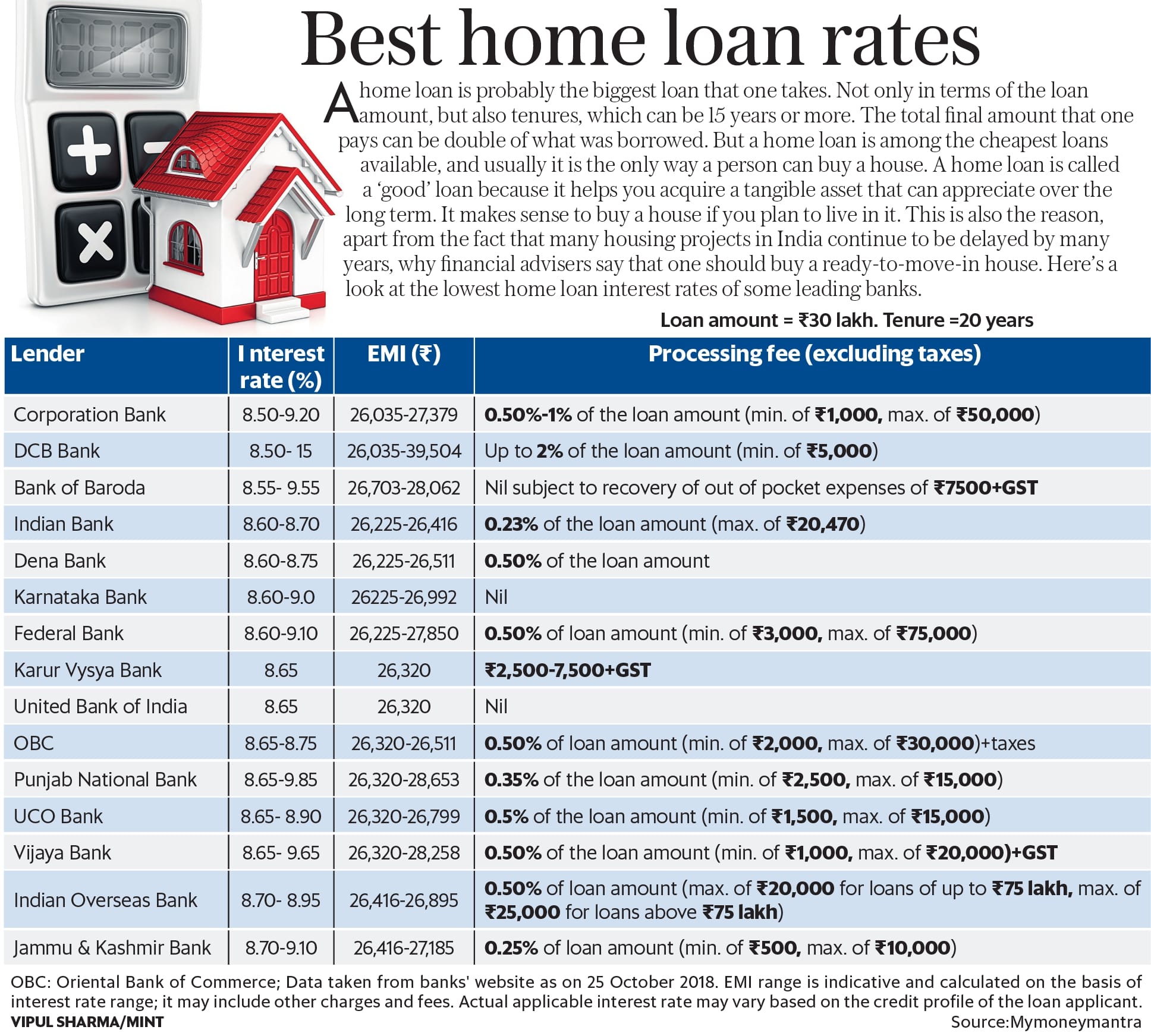

Oriental Bank Of Commerce

Benefits/key highlights:

- The Oriental Bank of Commerce offers two variants under its Mortgage Loan Schemeterm loan and overdraft facility.

- You can borrow this loan to meet your personal or business expenses by submitting immovable property as collateral.

- Several types of borrowers are eligible for this loan:

- Individual and joint borrowers who are income tax assessees for more than two consecutive years.

- Individuals involved in agricultural activities.

- NRIs with a residential Indian as a co-borrower.

- The maximum amount you can borrow through this loan is Rs.10 crore and the repayment can be done before the superannuation of non-pensionable salaried employees, and extends up to 75 years for salaried applicants with pension.

- Companies or firms jointly with directors or partners .

| Bank |

|---|

- There are no documentation charges when you apply for this loan.

- A penal interest rate of 2% will be charged for delayed payments.

Also Check: Rocket Mortgage Qualifications

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

The Ontario Housing Market: Things To Know

- Homes in Ontario typically cost above $675 000, which is higher than the national average.

- Residential property prices are expected to see steady gains, in part due to a growing demand for homes in Toronto and the greater Toronto region.

- The federal government has taken steps to make homeownership more affordable for certain first-time buyers whether in Ontario or nationally by introducing the First-Time Home Buyer Incentive.

- Before you start searching for your home, its important to consider how much debt you can take on. Enter your details to find out how much you might be able to borrow.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

What The December 2021 Mortgage Rate Forecast Means For You

Todays rates are still exceptionally low compared to historical rate standards. If rates remain in a similar ballpark in December, thats great news for borrowers who havent refinanced yet, or those who could potentially benefit from refinancing again. Low rates and rising home prices have given homeowners all sorts of options to refinance. You could tap your home equity with a cash-out refinance to consolidate high-interest debt or finance a home improvement project. A rate and term refinance could lower your interest rate and reduce your monthly payment.

Keep in mind that your interest rate isnt everything. Make sure your plan accounts for what youll pay upfront in closing costs, specifically the lender fees, which can greatly increase the cost of refinancing.

Unfortunately for homebuyers, todays hot housing market has pushed prices higher. Many buyers may be eligible for rock-bottom rates, only to have potential savings erased by the need to pay more to get an offer accepted. Some experts see signs that home prices are starting to cool, ever so slightly. But dont expect prices to drop. They are likely to continue to increase, just at a slower pace. Rather than trying to time the market, its best to understand how much house you can afford and stay within your budget. If now is the right time for you to buy, then consider expanding your search to more affordable areas.

Also Check: Chase Mortgage Recast

How To Calculate Fixed

The actual amount of interest that borrowers pay with fixed-rate mortgages varies based on how long the loan is amortized . While the interest rate on the mortgage and the amounts of the monthly payments themselves dont change, the way that your money is applied does. Mortgagors pay more toward interest in the initial stages of repayment later on, their payments are going more into the loan principal.

So, the mortgage term comes into play when calculating mortgage costs. The basic rule of thumb: The longer the term, the more interest that you pay. Someone with a 15-year term, for example, will pay less in interest than someone with a 30-year fixed-rate mortgage.

Crunching the numbers can be a bit complicated: To determine exactly what a particular fixed-rate mortgage costsor to compare two different mortgagesits simplest to use a mortgage calculator.

You plug in a few detailstypically, home price, down payment, loan terms, and interest ratepush the button, and get your monthly payments. Some calculators will break those down, showing what goes to interest, to principal, and even to property taxes theyll also show you an overall amortization schedule, which illustrates how those amounts change over time.

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

Don’t Miss: 70000 Mortgage Over 30 Years

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

Is 325% A Good Mortgage Rate

Let’s preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But don’t be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.

Don’t Miss: Chase Recast

Record Low Mortgage Rates

We saw mortgage rates hit record lows multiple times in 2021. The trend started in February of 2020 when investors turned to bonds and mortgage-backed securities as a safety net. It wasn’t long after that rates plummeted to historic lows and remained low as of September 2021.

Keep in mind that concern about the coronavirus is driving bond rates down significantly. When bond rates drop, so do mortgage rates. It’s a major reason why rates dipped to new record lows in mid-May and again several weeks later.

Many homeowners are seeing this unprecedented time as an opportunity to save money. Lenders haven’t seen this volume of refinance applications since the early 2000s. And there are still millions of homeowners who could benefit from a lower rate.

Key Mortgage Rates For Jan 3 2022 Ticked Up: Here’s What That Means For You

A handful of major mortgage rates increased today. Let’s examine how that can affect your mortgage plans.

A number of important mortgage rates moved up today. 15-year fixed and 30-year fixed mortgage rates both moved higher. At the same time, average rates for 5/1 adjustable-rate mortgages also ticked up. Mortgage interest rates are never set in stone, but interest rates are historically low. Because of this, right now is a good time for prospective homebuyers to get a fixed rate. Before you buy a house, remember to take into account your personal needs and financial situation, and shop around for various lenders to find the right one for you.

Read Also: Can I Get A Reverse Mortgage On A Condo

How To Apply For A Mortgage Loan

You can apply for a mortgage loan through the banks official website or by visiting the nearest branch. For an online application, go to the lenders website and choose the product you wish to apply for. If they entertain online applications, you will find an Apply Now option on the page. Depending on the process, you may have to fill an online application form and submit the details.

You can also go to the nearest branch, request for an application, and submit it along with the required documents.

Heres a look into the application process for a mortgage loan:

- Document collection to process the loan

- Verification of personal/business information provided

- Sanction letter delivered via post and email post approval

- Request for disbursal

- Evaluation of your property and its documents

- Post successful verification, disbursement cheque delivered