How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

How To Beat Mortgage Interest Rate Rises

If you’re on a variable-rate deal such as a discount or tracker mortgage, changes to the Bank of England base rate or your bank’s standard variable rate will have an immediate impact on how much you’re paying each month.

If this happens, it’s worth investigating whether you could save money by remortgaging.

A rate rise can also hit you hard when you reach the end of an initial deal period – for example, if you’ve reached the end of your fixed-rate mortgage’s introductory period, which might be two or five years.

When this period runs out, youll usually revert to your lenders standard variable rate , which is likely to be a lot higher.

In most cases, youll be able to get a better deal if you remortgage your home at this point, as youll have built up more equity in your property and introductory rates on new deals will almost always be cheaper than your current lenders SVR.

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

You May Like: How Much Does Getting Pre Approval Hurt Credit

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

You May Like: Reverse Mortgage Manufactured Home

How Do You Calculate Amortization

How Much Does A 1% Difference In Your Mortgage Rate Matter

Modified date: Nov. 24, 2021

When you start looking to buy a house, youre going to hear all about mortgage rates and how much it sucks that theyre going up, how great it is if theyre going down, or even why low mortgage rates arent always a good thing.

Your mortgage rate is simply the amount of interest charged by whomever you took a loan out with to purchase your house.

So how do you get to this percentage? And how will it really affect how much you pay? For the purposes of this article, Ill take a look at how just a 1% difference in your mortgage rate can seriously affect how much you pay.

As youll see in the table below, a 1% difference in mortgage rate on a $200,000 home with a $160,000 mortgage, increases your monthly payment by almost $100. Although the difference in monthly payment may not seem that extreme, the 1% higher rate means youll pay approximately $30,000 more in interest over the 30-year term. Ouch!

Whats Ahead:

Also Check: Mortgage Recast Calculator Chase

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

How A Mortgage Calculator Can Help

- The loan length thats right for you. If your budget is fixed, a 30-year fixed-rate mortgage is probably the right call. These loans come with lower monthly payments, although youll pay more interest during the course of the loan. If you have some room in your budget, a 15-year fixed-rate mortgage reduces the total interest you’ll pay, but your monthly payment will be higher.

- If an ARM is a good option. With fixed rates at record lows, adjustable-rate mortgages have largely disappeared. But as rates rise, an ARM might be a good option for some. A 5/6 ARM which carries a fixed rate for five years, then adjusts every six months might be the right choice if you plan to stay in your home for just a few years. However, pay close attention to how much your monthly mortgage payment can change when the introductory rate expires.

- If youre spending more than you can afford. The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance.

- How much to put down. While 20 percent is thought of as the standard down payment, its not required. Many borrowers put down as little as 3 percent.

Also Check: Chase Recast Mortgage

How To Calculate Monthly Mortgage Interest In Excel

Asked by: Carmine Corwin PhD“= -PMTView full answerthe monthly interest rate just divide the annual interest rate by 12 Related Articles

=PMT

FV = PVn22 related questions found

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

Don’t Miss: Rocket Mortgage Payment Options

How Does Mortgage Interest Work

With a traditional, fixed-rate mortgage, your monthly payments will remain the same for the life of the loan, which might, for example, be 10, 20, or 30 years.

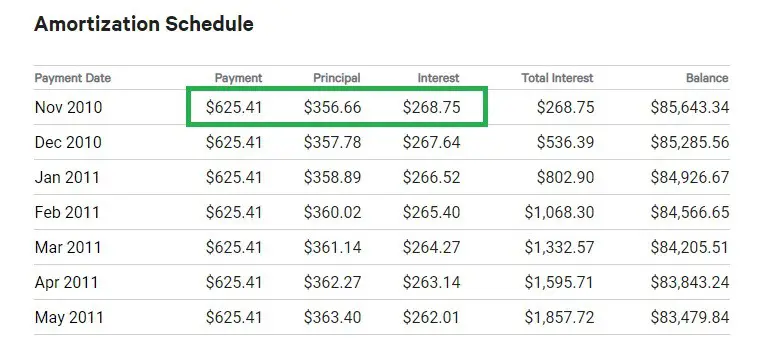

Initially, your mortgage payment will primarily go toward interest, with a small amount of principal included. As the months and years go by, the principal portion of the payment will steadily increase and the interest portion will decrease. That’s because interest charges are based on the outstanding balance of the mortgage at any given time, and the balance decreases as more principal is repaid. The smaller the mortgage principal, the less interest you’ll be paying.

This process is known as amortization. When you take out a mortgage, your lender can provide you with an amortization schedule, showing the breakdown of interest and principal for every monthly payment, from the first to the last.

How Do I Calculate Monthly Mortgage Payments

- M = the total monthly mortgage payment.

- P = the principal loan amount.

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

Don’t Miss: What Does Gmfs Mortgage Stand For

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Also Check: Rocket Mortgage Vs Bank

Calculating The Numbers Yourself

If you don’t want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, you’ll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

How Amortizing Payments Work

If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin. With a fixed rate loan the amount of each payment stays the same across the duration of the loan, but the percent of each payment that goes toward principal or interest changes over time. Early on in the loan’s term a relatively large share of the payment is applied toward interest, then as the borrower pays down the loan an increasing share of the payment goes toward interest.

Rather than using the above calculator repeatedly you can use an amortization schedule to print out the entire schedule for a loan. We host an amortization calculator which enables you to create printable amortization tables. It shows the monthly payments and amortization schedule for the principal and interest portion of loans, while other costs of borrowing like licensing or taxes are excluded.

More Ways to Calculate Your Loan Payments

If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or future balance will be.

Prefer to calculate offline? See our free Simple Excel loan calculator.

You May Like: 10 Year Treasury Vs Mortgage Rates