Qualifying For A Cash Back Mortgage

Before extending a cash back mortgage to you, your lender will want to ensure that you are eligible to qualify for such a program. Generally speaking, you will need to meet the following criteria first:

- Be paid on salary or by the hour

- Have a of at least 650

- Be applying for a cash back mortgage as an owner-occupier

Can I Spend Money While Buying A House

Paying cash for big purchases during the mortgage process is a logical option. However, you have to be cautious too, as it can also put your approval at risk. You can pay cash as long as you have enough cash to cover for your down payment, closing costs, and cash reserve when the closing time comes.

What Can I Do With The Cash Back

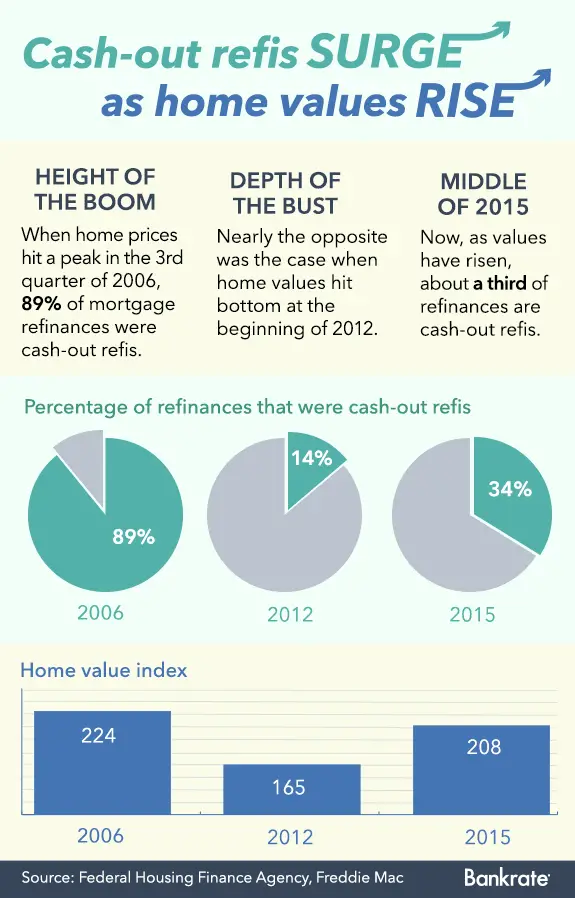

Refinancing can be beneficial for many homeowners, but be sure to research the basics of cash-out refinancing before you apply. Maybe youve accrued some significant non-mortgage debt from credit card expenses or old medical bills, or you just learned that youre expecting a new baby. With a cash-out refinance, you could set up a quick nest egg for some expected or unexpected expenses.

As you contemplate a cash-out refinance, it is important to do your homework and consider the refinance options available to you before you begin the application process. You should carefully examine the pros and cons of refinancing your home before deciding to act. For example, with a cash-out refinance, you take the chance of owing more on your house than it is worth if there is a downturn in the real estate market. You should also keep in mind that you might extend the length of time you will have to make mortgage payments. Having a stable job and the discipline to continue making your payments on time is also very important.

The potential benefits of a cash out refinance could possibly outweigh the risks, depending on your specific situation. If you have substantial home equity and a good credit score and you pay your bills on time, then a cash-out refinance might be just the tool you need to better handle non-mortgage debt and other expenses.

Don’t Miss: Reverse Mortgage Mobile Home

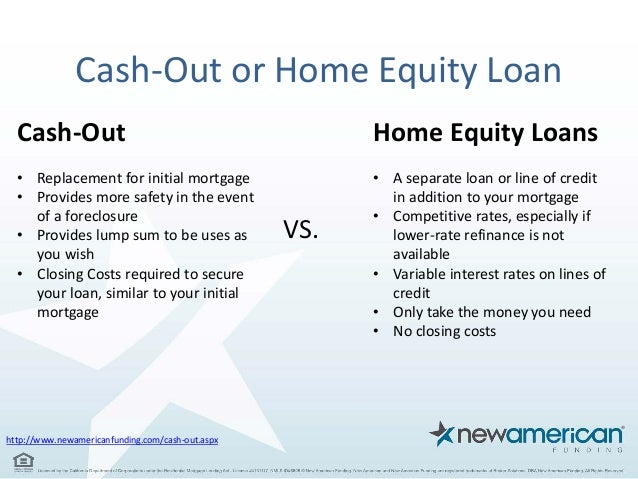

Cashout Refinance Vs Heloc

Similar to home equity loans, both cashout refinancing and home equity lines of credit allow homeowners to take advantage the equity in their homes.However, unlike a cashout refinance, which lends a borrower a lump sum, a HELOC is a revolving line of credit that gives homeowners flexibility to withdraw money as needed. Additionally, a HELOC is not a new mortgage and, as such, may not require upfront closing costs.

You Wont Get Cash Immediately

Similar to when you buy a home, you must submit to underwriting and appraisal processes before your lender approves your refinance. Even after you close, the Truth in Lending Act requires your lender to offer you 3 days to cancel the loan if you have a change of heart, and you wont get your cash until 3 5 days after closing. If you need money immediately, a cash-out refinance may not be the right solution.

Recommended Reading: Monthly Mortgage On 1 Million

What Does It Mean To Buy A House In Cash

Paying cash for a house means buying a home without a mortgage. Cash buyers, as a result, don’t need to account for mortgage interest or closing costs when they purchase a new property. Buying a house with cash can save you money in the long run, but it can also exempt you from the advantages of a mortgage.

Pros And Cons Of Cash

Before you decide to go through with a cash out refinance, its important to consider the pros and cons of cash out refinancing.

Some of the advantages include:

- You can lower your rate: This is the most common reason most borrowers refinance, and it makes sense for cash-out refinancing as well because you want to pay as little interest as possible when taking on a larger loan.

- Your cost to borrow could be lower: Cash-out refinancing is often a less expensive form of financing because mortgage refinance rates are typically lower than rates on personal loans or credit cards. Even with closing costs, this can be especially advantageous when you need a significant amount of money.

- You can improve your credit: If you do a cash-out refinance and use the funds to pay off debt, you could see a boost to your credit score if your credit utilization ratio drops. Credit utilization, or how much youre borrowing compared to whats available to you, is a critical factor in your score.

- You can take advantage of tax deductions: If you plan to use the funds for home improvements and the project meets IRS eligibility requirements, you could take advantage of the interest deduction at tax time.

Some of the drawbacks of cash out refinances are

Don’t Miss: Rocket Mortgage Launchpad

Potential Benefits Of Lowering Your Payments

Lowering your monthly mortgage payment by refinancing to a lower rate or extending your loan term can make it easier to pay your mortgage on time every month while also possibly covering your other debts and expenses. And if youre concerned about your ability to make your current mortgage payment in the future, lowering your monthly payment now can help relieve that pressure.

Get A Lower Interest Rate

If you put an unexpected bill on a variable credit card, you might pay a high amount of interest the prime rate thats tied to the federal funds rate set by the Federal Reserve, plus a certain number of percentage points on top of that. Mortgage and refi rates are generally lower than credit card interest rates often significantly lower. If you have enough equity in your home to cover your bill, you may save thousands in interest over time.

Also Check: Chase Recast Mortgage

How Much Money Can You Get With A Cashout Refi

For a conventional cashout refinance, you can take out a new loan for up to 80% of the value of your home.

Lenders refer to this percentage as your loantovalue ratio or LTV.

Remember, you have to subtract the amount you currently owe on your mortgage to calculate the amount you can withdraw as cash.

Heres an example of how a a conventional cashout refinance works: Home value: $400,000 Maximum conventional refinance loan amount : $320,000 Current mortgage balance: $250,000 Maximum cashout: $70,000

In the example above, the homeowner starts out with $150,000 in home equity.

But, since the homeowner must leave 20% of the homes equity untouched, the maximum amount this borrower could withdraw is $70,000.

If this homeowner already had a second mortgage using the homes equity a home equity line of credit, for example the lender would also subtract that loans amount from the available cashout.

Lenders limit the amount of equity you can withdraw because this protects them from losses in case of default.

What Is A Reasonable Cash Offer On A House

Many people put their first offer in at 5% to 10% below the asking price as a lot of sellers will price their houses above the actual valuation, to make room for negotiations. Don’t go in too low or too high for your opening bid. If you make an offer that’s way below the asking price, you won’t be taken seriously.

Also Check: Rocket Mortgage Loan Requirements

Va Cash Out Refinance

If you are an eligible active military member, veteran or surviving spouseyou may be able to access the equity youve built to do renovations, cover unexpected expenses or pay offsome credit card debt. You can cash out 100% of the appraised value for any reason you wish.

Ifyou are eligible for a VA loan you could convert your conventional loan into a VA cash out loanand get a better deal allwithout having to pay mortgage insurance. In most cases, with a 620 FICO score,you will be allowed to refinance up to 100% of your homes value.

VA Cash Out Refinance Guidelines

- Have your certificate of eligibility

- You need at least a 640 FICO score

- The home you are refinancing must be your primary residence

- You can cash out up to 100% of the appraised value

- Your debt to income ratio cannot exceed 45%

- No monthly payments for mortgage insurance is required

How Does A Cash Out Refinance Work

With any home mortgage refinance, youre essentially replacing the entire current mortgage on your house or apartment with a brand-new mortgage, ideally one that has a lower interest rate. In simple terms, if the balance on your current mortgage is $200,000, a refinance replaces it with a completely new $200,000 mortgage.

But in a cash out refinance, youre increasing the balance of your new mortgage and taking the extra money in cash. So if your current mortgage has $200,000 left on it, but you get a new mortgage for $250,000, that extra $50,000 is yours to keep .

Not just anyone can get a cash out refinance. As with any new mortgage, you need to be able to show you have enough income to cover the monthly payments, as well as a . The lower your credit score, the harder it is to qualify for a refinance and the more youll pay in interest with higher rates.

You also cant take every last penny out of your home in a cash out refinance. Most lenders require at least 20% equity right now to approve a cash out loan, says Julian Hebron, founder of The Basis Point, a consultancy to banks and fintech companies. Equity is the amount of your home that you own yourself, as opposed to the part you owe your lender. This means the new loan balance that includes the cash out must not exceed 80% of your homes value, explains Hebron.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Pay Off A Second Mortgage Or Equity Line

It would be nice to have just one mortgage to pay each month. You’ve been paying your second mortgage and/or your equity line of credit payments along with your original mortgage. By getting a cash-out refinance to pay those other mortgages off, you might have better cash flow, depending on what interest rate you receive and how much you need to take out in cash from your refinance. But remember that on a cash-out refinance, you must pay closing costs. Those costs can add up into the thousands depending on your mortgage. Even if the closing costs can be rolled into your cash-out refi, you will have to pay it â just for a longer period of time. Another thing to consider is how close you are to paying off your original mortgage. If it is a new loan and the interest rate is less than what the refinance interest rate will be , then a cash-out refinance could be the answer.

What Is Cash Credit With Example

Cash credit is a type of short-term working capital loan extended by financial institutions, which allows the borrowers to utilise money without holding a credit balance in an account. Here, a borrower can withdraw funds up to a limit predetermined by the financial institution as per prior agreements.

Recommended Reading: Chase Mortgage Recast

Cashout Refi Vs Reverse Mortgage

Similar to a traditional mortgage loan, a reverse mortgage loan allows homeowners who are 62 or older and have considerable home equity to borrow money by using their homes to secure the loan.Unlike a mortgage, though, a reverse mortgage has no monthly payments. Instead, you borrow from your equity and the loan is only repaid when the homeowner sells the property or passes away.If youre considering a reverse mortgage loan, its best to talk with an HUDapproved counselor about your options.

Your Loan Terms May Change

When you get a cash-out refinance, you pay off your original mortgage and replace it with a new loan. This means your new loan may take longer to pay off, your monthly payments may be different or your interest rate may change. Be sure to look at the Closing Disclosure from your lender and analyze your new loan terms.

Read Also: Mortgage Rates Based On 10 Year Treasury

Conventional Cash Out Refinance

Homeowners can refinance a cash-out whenever they wish to tap into the equity of their home. A borrower can refinance a cash-out loan in Fannie Mae and Freddie Mac. These loans can be used to access much needed cash for any reason listed throughout this article.

Conventional Cash-Out Guidelines

- Up to 80% of the loan to value amount of your primary residence

- Up to 75% of the loan to value amount of your vacation home

- You need at least a 640 FICO score

- Your debt to income ratio cannot exceed 45%

Home | Mortgage Products | Cash Out Refinance

Dont Forget To Factor In Closing Costs Taxes And Lost Equity

Refinancing your mortgage isnt a free process. Lenders charge money to execute a refinance, including an origination fee, appraisals, inspections and other expenses. Refinance closing costs can range from $2,000 to $5,000 depending on where you live and the price of your home, says Hebron.

Some of these costs may be negotiable, or you can request a refinance with no closing costs, which reduces your upfront expenses but comes with a higher interest rate.

Also, if youre refinancing your primary residence and use the extra money from a cash out refinance on non-home expenses , that portion of your interest is not tax deductible. Youll need to consult with a tax professional to determine how a cash out refinance will affect your tax liability.

Even if you use the extra cash for home improvements or other related costs, in some cases, you might actually find that your overall mortgage deduction ends up lower after a refinance. Thats because even if you increase your mortgage balance with a cash out refinance, a lower interest rate may mean lower monthly interest payments and a smaller tax write-off.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

How Much Cash Can A Cash

For typically cash-out refis, you can take a new loan out for as much as 80-percent of your overall home value. Lenders call this percentage your LTV, which stands for loan-to-value ratio.Keep in mind that you need to subtract any amount which you owe currently on your mortgage in order to ascertain how much cash you get to withdraw.

The following example shows you how that math can work out:

Consider a home value of $400,000The maximum refinance loan amount, which would be 80-percent of the home value, is $320,000The current mortgage balance is $250,000The maximum possible cash-out would be $70,000

In the above example, a homeowner would start out with $150,000 in actual home equity. This is the home value of $400,000 minus the current loan balance of $250,000.

However, since a homeowner has to leave 20-percent of their home equity untouched, they can only withdraw $70,000 at the maximum.

If a homeowner already had taken out a second mortgage that used the homes equity, for instance, a home equity-specific line of credit, then the lender would need to subtract that loan amount from the potential cash-out.Lenders limit how much equity you get to withdraw since it gives them protection from losses incurred due to default.

Simple Steps To Refinance Your Home

If you are planning to refinance this is a must read guide. It will walk you step-by-step through the process and let you know what to expect along the way.

Whether you choose an FHA cash-out, VA cash-out, or conventional cash-out refinance, the odds are good that you can make your home equity work hard for you while still landing a good interest rate.

You May Like: Does Rocket Mortgage Service Their Own Loans

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

About the author:

Read More

Types Of Cashout Refinance Loans

There are three main cashout refinance options homeowners can pursue:

- Conventional loans: A conventional cashout refinance allows you to borrow up to 80% of your homes value with a minimum credit score of 620

- FHA loans: An FHA cashout refinance allows you to borrow up to 80% of your homes value. Youll have to pay upfront fees that are financed into the loan, as well as an annual mortgage insurance fee just like you would on any other new FHA mortgage. A credit score of at least 600 is typically required

- VA loans: A VA cashout refinance lets you borrow up to 100% of the homes value, though many lenders cap the LTV at 90%. VA cashout refinance loans charge upfront fees that are financed into the loan, unless you are a veteran with a servicerelated disability

The right type of cashout refinance loan for you will depend on your current mortgage and what youre able to qualify for.

You May Like: 70000 Mortgage Over 30 Years

What Is Cash Out

Any home loan which has the funds released to you directly is considered to be cash out by the banks. Some banks will decline your application due to the amount of equity being released and what your intentions are.

Some examples are:

- Releasing equity to use as a deposit on your next property.

- Buying a business or for investment in your business.

Whereas other types of loans arent considered to be cash out, and so are not subject to restrictions:

- Construction loans.

- Funds to purchase a specific property with a signed contract as evidence.

- Refinancing an existing home loan.