Securing A Mortgage For The Couple With A Low Credit Score

With Clever Mortgages they were able to:

Use 100% of their Universal credit and child benefit alongside their income Take out a first-time buyer mortgage with a high street bank Secure a fixed rate of 2.18% even though they had a poor credit history Ensure financial stability with a good rate and low payments for two years Start rebuilding their credit score

Mr and Mrs D were a couple of first-time buyers struggling to find a mortgage as they had low credit scores and previous defaults. Theyd already been declined by a high street bank and werent sure if theyd be able to get onto the property ladder.

Mr and Mrs D needed a lender which would accept 100% of the Universal Credit along with Mr Ds income, which they were finding difficult.

We helped them by securing them a first-time buyer mortgage with another high street bank, which is helping them rebuild their credit scores. They now have an affordable mortgage with a fixed-term which is covered by their income and benefits. This has provided them with the security of a new home with low payments for two years.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

The Role Your Credit Score Plays In Getting A Mortgage

Whats the most important piece of information about you when it comes to getting a mortgage? Is it your age? Your income? Your debt load? Your taste in architecture? All are important , but theres one thing that rules them all: your credit score.

Lenders use your credit score to gauge what kind of risk you pose as a borrower. The higher your score, the lower the risk you present to lenders, and the likelier it is youll be offered a mortgage with an attractive interest rate. And a low interest rate matters a difference of only 0.5% in your interest rate can add up to thousands of dollars over the term of your mortgage, so it pays to have a high score!

While there are other methods for calculating credit scores, FICO is the method used by most financial institutions and credit bureaus. According to myfico.com, 90% of top lenders use FICO scores to make decisions about credit approvals, terms, and interest rates, so thats what well be focusing on. You can learn more about how your FICO score is calculated here.

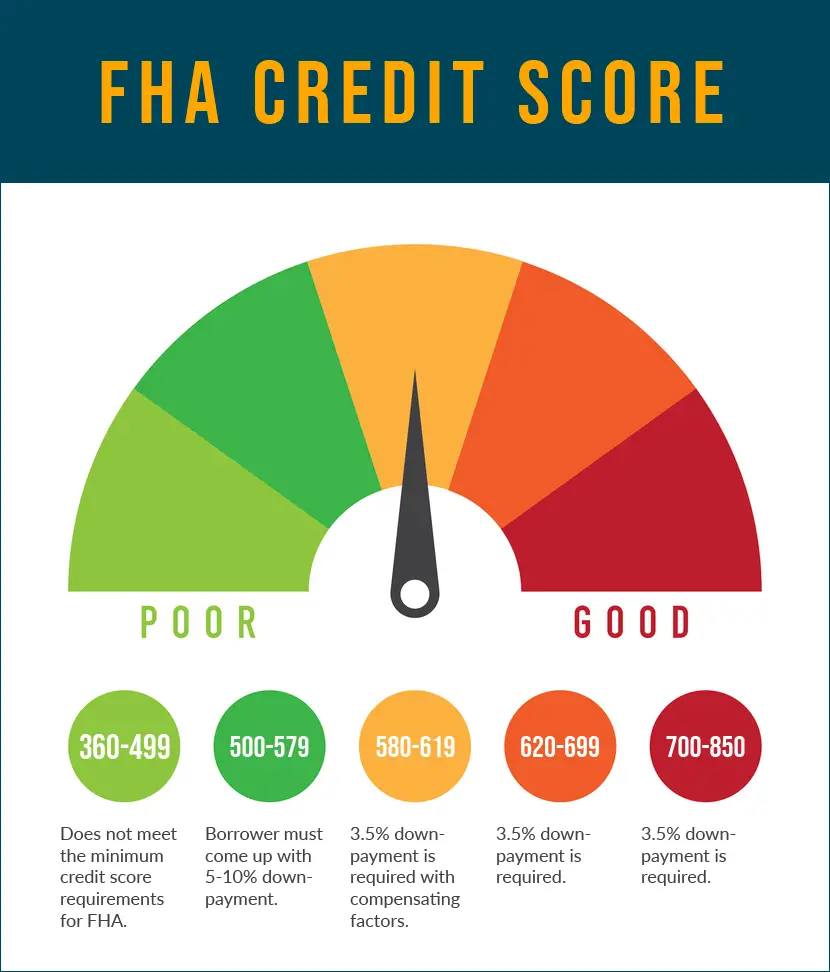

When its time to get a mortgage, there will be different credit score requirements depending on the type of mortgage you can get. Lets take a look at the different requirements.

Don’t Miss: Does Chase Allow Mortgage Recast

Other Credit Improvement Options To Consider

Some credit reporting agencies will consider alternative information, such as payments for utilities and streaming services, and include them in your credit report. As long as youve paid these items on time and havent skipped a payment, they can provide a boost to your score.

You can also consider consolidating your debts into one single loan, which can help reduce your monthly payments and save on interest. If you rent your home and have been consistently making your payments, you can have that information included in your report as well. Demonstrating the ability and willingness to pay your monthly expenses on time will improve your score as well.

If you have bad credit and need help sprucing it up, consider using a company. For a fee, these companies will go through your credit report, identify errors that could be pulling your score down, and take action to have them removed. Note, however, that credit repair companies cannot remove negative information that is accurate from your report.

How Does Bad Credit Affect A Mortgage

A bad credit score means that you are riskier to a lender compared to a person with a good credit score. A poor credit score might mean that your mortgage rate will be higher, you might qualify for a lower mortgage amount, or you might not qualify for a mortgage at all.

Having an insured mortgage will also let you make adown paymenton your home for as little as 5%. Uninsured mortgages require a down payment of at least 20%. Since you wont be able to qualify for an insured mortgage if your credit score is less than 600, you will need to make a larger down payment on your home.

It might be very difficult to be able to save up a 20% down payment, let alone a 5% down payment, which is why some provinces offer down payment assistance programs forfirst-time homebuyers. Even so, higher bad credit mortgage rates will mean that you will be paying more if you have a low credit score. Being forced to use private lenders can mean that your rate can be multiple times higher than one from a major bank.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Home Loans For Borrowers With Bad Credit

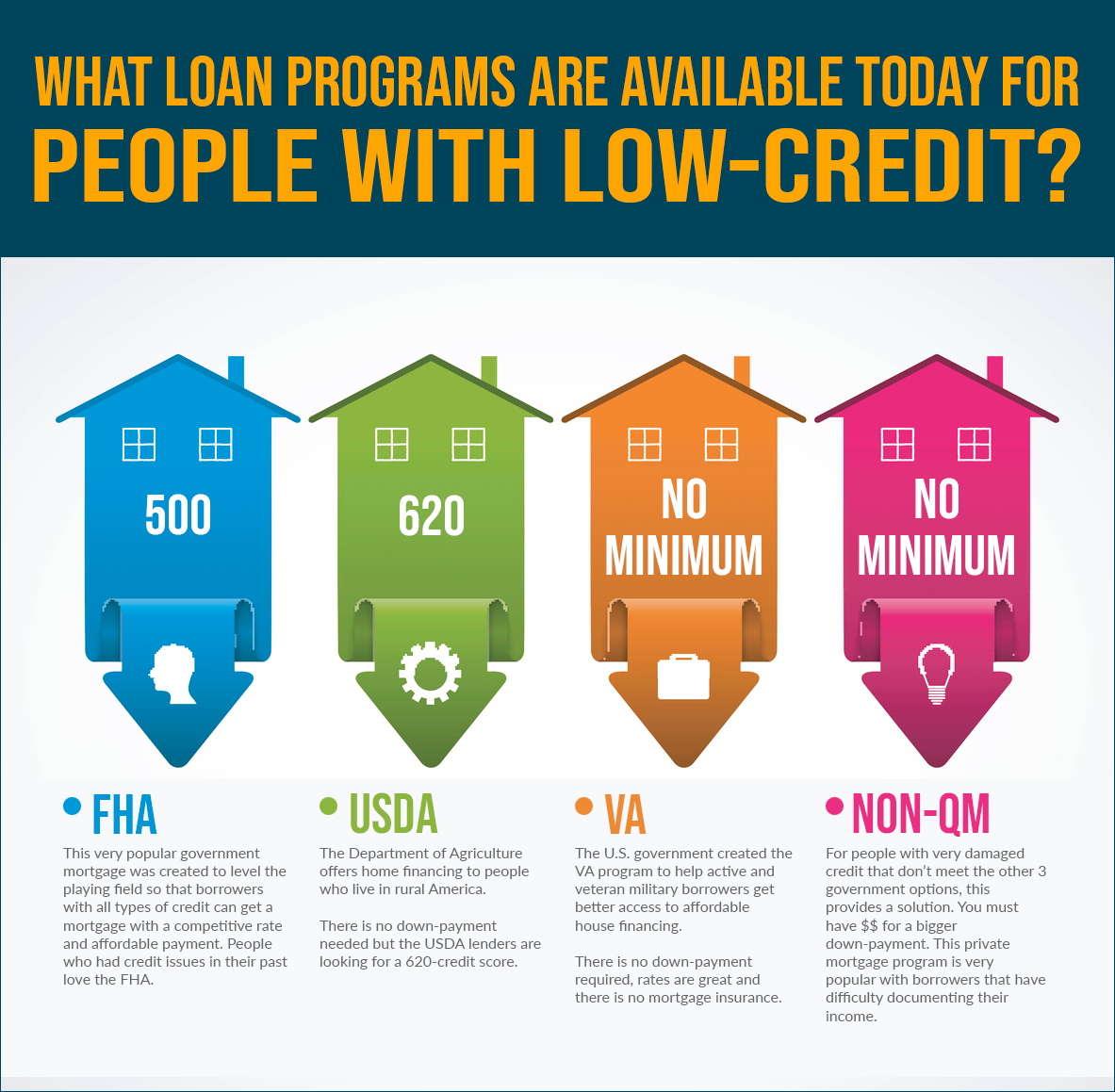

- Conventional non-conforming loan Even with bad credit, you might be able to qualify for a conventional loan thats non-conforming, or falls outside of Fannie Mae and Freddie Mac requirements for factors like credit score. This can be an option if youve declared bankruptcy or are otherwise credit-challenged.

- FHA loanFHA loans are insured by the Federal Housing Administration and allow lenders to accept a credit score as low as 580 with a 3.5 percent down payment, or as low as 500 with a 10 percent down payment. The drawback here is that youll pay mortgage insurance.

- VA loan If youre a member of the military, a veteran or married to someone who has served in the armed forces, one of your benefits is the VA loan program backed by the U.S. Department of Veterans Affairs. You dont have to come up with a down payment for this type of loan, and there are no minimum credit score requirements, although lenders do have their own credit standards.

- USDA loan If you meet certain qualifications earn less than a certain amount each year and want to buy a property in a certain area the U.S. Department of Agriculture-backed lending program can help you become a homeowner with subpar credit.

Experts’ Advice On Choosing A Mortgage Lender

We consulted mortgage and financial experts to inform these picks and provide their insights about mortgage lenders. Our experts have also provided advice about how to know whether you’re ready to get a mortgage, and how to decide which type of mortgage is best for you.

- , mortgage broker, founder of Aragon Lending Team

- Laura Grace Tarpley, certified educator in personal finance, editor of banking and mortgage at Personal Finance Insider

Here’s what they had to say about mortgages.

Recommended Reading: Does Chase Allow Mortgage Recast

Pay Your Bills On Time

Payment history is the most important factor that determines your credit score, making up about 35% of it.

Make sure all your credit card, auto loan, and other debt payments post to your account by the due date to boost this part of your score.

Find Out: 700 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

Can I Get A Bad Credit Mortgage If My Partner Has Good Credit

Yes, its possible to get a bad credit mortgage if your partner has good credit as there are lenders who specialise in joint applications involving only one bad credit applicant. In this scenario, your bad credit will still be factored in when the overall strength of the application is being assessed, and it might mean the deals you qualify for are fewer.

That said, mortgage approval and favourable rates could still be possible if you apply through a specialist broker who knows exactly which lenders to approach.

Read Also: Can You Get A Reverse Mortgage On A Condo

Learn More About Mortgages In The Uk

How do mortgages work in the UK?

Buying a home or land is expensive. A mortgage is a financial product that helps people purchase their own home or land.This is especially true for a first time buyer, as it might be the only route onto the property ladder.

The minimum credit score for a mortgage

ou can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

fixed term Contract Mortgages

A fixed term contract is a way of describing certain types of employment. If your current employment contract is due to end after a certain period of time, or after a specific piece of work is complete, you are likely on a fixed term contract.

how long does a mortgage application take?

After sending off the final application waiting for the decision can be frustrating. Many prospective homeowners ask how long does it take? but the truth is the mortgage approval process is always different for each customer.

how long does conveyancing take?

The entire conveyancing process will normally take anywhere between 8-12 weeks, however you should be prepared for this to take much longer depending on your circumstances and wider factors. This articles explores what the timescale involves.

Mortgages if You are bankrupt

what stops you getting a mortgage?

IVA Mortgage

How Can Someone Know Whether They’re Financially Ready To Buy A Home

Lauryn Williams, CFP:

“You should have funds left over after everything is said and done as it pertains to purchasing the home. So if you don’t have an emergency fundplus a down payment, you’re probably not ready to purchase a home. Another thing I think about is credit card debt. While you can be approved for a mortgage with credit card debt and student loans and very little cash on hand, you put yourself in a very risky situation.”

Laura Grace Tarpley, Personal Finance Insider:

“You should be able to afford the extra costs that come with owning a home, like home repairs or lawn care. You didn’t have to budget for those things when you rented, because the landlord was responsible for maintenance.”

You May Like: Can You Do A Reverse Mortgage On A Condo

Accept Help From Family

If saving that larger deposit is a struggle, most lenders will accept a deposit if it’s ‘gifted’ from a family member. This can’t be a loan and you must be under no obligation to repay the money.

In the future you might find youre in a position to repay the money. There’s nothing stopping you from ‘gifting’ the money back to them then.

Disadvantages Of The New Us Funding:

- Not available to Hawaii or New York residents

Minimum credit score and down payment listed for FHA home loans only.

Bottom line: Rocket Mortgage is a good choice if you want a smooth online experience and prioritize customer support. However, it is the only lender on this list that does not accept alternative credit statements.

Read Also: How Much Is Mortgage On 1 Million

Can I Get A Mortgage With Bad Credit

When you apply for a mortgage, lenders will check your credit history to understand how well you manage your finances. Theyâll also need to see your income, monthly outgoings and savings – what you earn and what you spend. This is to ensure you can afford the monthly repayments, especially if things change – like interest rates going up, or your income going down.

Itâs possible to get a mortgage with poor credit, but it helps to show yourself in the best possible light. That means taking care of your credit history and budgeting sensibly.

Remember, youâll also need a decent deposit in place â at least 10-20% of the property price.

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

You May Like: Reverse Mortgage For Condominiums

Should I Buy A House With Bad Credit Or Wait To Improve My Score

While it may be technically possible for you to get a mortgage when you have a poor credit history, you also have the option of trying to improve your credit score first, in order to increase your chances of getting accepted for a ‘normal’ mortgage. Here are some of the pros and cons of getting a bad credit mortgage:

How To Make Your House More Affordable With A Mortgage

A bad credit score can be a major hassle when trying to re-finance your mortgage. If you have an FICO score over 500, your maximum borrowing power will be about 90% of what it was before. A low credit score can significantly reduce the amount of loan youre able to get.

If you are looking to re-finance your mortgage, you might find it difficult with a low credit score. However, there are still many options that can make your house more affordable and make it easier for you to qualify for those loans. You could try negotiating the terms of your mortgage or change the loan type. If nothing else, try refinancing into a fixed or adjustable rate.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Home Loans For Low Credit Score Get Mortgage For Bad Credit

Lets elaborate on this term Home Loans for Low Credit Score, a home loan is a contract between a borrower and lender that allows a person to borrow money to buy a house or other living property. Typically, a home loan is paid back more than a term of 10, 15, or 30 years. In current days, it could be hard to get a home loan during a pandemic. This is because lenders have raised credit score requirements because of challenges regarding the economy. Be prepared for your credit to come under additional scrutiny if you are getting a home loan. Lenders use your credit score anduse other details that are related to your financial history. By this, they can determine whether you qualify for a home loan.

The answer to what credit score do you need to get a home loan depends on the type of home loan you want. In this blog, I will talk about how much Minimum Credit Score Needed for Home Loan? Can you get a home loan without a credit score?

As per the recent report of 2020, around 34% of home loans were expected to be nonprime obligations, up to 1% from 2019. Nonprime obligations are the same as subprime loans in that both are loan products, available for those with low credit scores. However, the average credit score needed for the nonprime loan in 2020 was 80 points more than the average score required for the subprime loan in 2008. Income documentation is important to get non-prime credit while noting was required for subprime loans in 2008.

When You Should Rent Vs Buy

Your credit score can offer insight into whether you should rent or buy. Lenders use your credit score as a crystal ball to predict how likely you are to repay a mortgage. But they dont actually know you. What do you think about your credit score? Does it say more about the type of borrower you are today or the type of borrower you were in the past?

If you have a bad score because you didnt understand how to manage credit, but youve learned since then because you went through a rough patch, but youre fine now or because a divorce or identity theft trashed your credit, you might be comfortable buying a home now if you can get a loan despite your credit score.

If you have a bad credit score because youre not good at making payments on time or you tend to overspend, renting while you improve your habits is probably the wiser option.

Don’t Miss: Requirements For Mortgage Approval